Want to do one thing to ensure the money you’re saving today in your 401k or IRA will be around tomorrow?

Diversify.

Too many Americans have watched their retirement dreams disappear because they invested solely in the company stock of their employer.

It’s never a good idea to put all your eggs in one basket. No matter how big, stable, or fast-growing a company you work for, it can fail. And if it does, not only will you be out of a job, but that company stock (and your 401k) will be worthless.

So if you don’t read any further and your 401k provides the option to invest in your employer’s stock, make sure that’s not the only investment you hold. Can you buy some? Sure! And if you can buy shares at a discount, all the better. Just make sure it doesn’t represent more than 10% of your total investment holdings.

Today’s post is a lesson in 401k asset allocation (or, simply put: diversification). We’ll move from simple to slightly more advanced.

The easy way to diversify

If you want nothing to do with managing your investments, no problem: Choose a target-date mutual fund.

Most 401ks are beginning to offer these from a variety of companies. You simply figure out the date you will begin to withdraw money (for example, if you’re 25 in 2024 and want to retire when you’re 65—in 2089—you would choose a 2085 or 2090 target-date fund).

The upside to these funds is that they continually rebalance as you get older. They start out aggressive (and more risky) and become less risky with time.

The downside to these funds is some have higher-than-average expense ratios and, obviously, they take control away from the investor.

Choosing the right allocation

If you want more control over your asset allocation or your 401(k) does not offer target-date funds, choose:

- One stock mutual fund

- One bond mutual fund

Or

- One domestic stock mutual fund

- One international stock mutual fund

- One bond mutual fund

Mike Piper provides good examples of simple portfolios that use low-cost Vanguard index funds. (This, by the way, is how I’ve invested most of my own retirement funds—in just four Vanguard index funds.)

So how do you choose the right allocation? As you can see, the guidelines recommend buying more bonds and fewer stocks as you get older. This is because bonds are less volatile and less likely to lose large amounts of money in a year or two. They’re also less likely to deliver huge returns.

The old rule was to subtract your age from 100 to get the target allocation of stocks. So if you’re 25, 100-25 is 75 and you would have 75% stocks in your portfolio. As we’re living longer, however, we need to earn bigger returns to make our money last in a longer retirement, so that rule could be subtract your age from 110 or even 120.

Here are very rough guidelines for 401k asset allocation:

| Decade | Domestic Stocks | Foreign Stocks | Bonds |

|---|---|---|---|

| 20s | 60% | 40% | 0% |

| 30s | 60% | 30% | 10% |

| 40s | 55% | 25% | 20% |

| 50s | 50% | 10% | 40% |

| 60s | 35% | 5% | 60% |

| 70s | 30% | 0% | 70% |

An example retirement portfolio for a young investor

Your 401k asset allocation

How you allocate your 401k should depend on your age, but also your tolerance for risk. If a big stock market crash like we had in 2008 were to wipe out a third or your portfolio’s value, would you?

- A: Sell your stocks as fast as you could.

- B: Do nothing.

- C: Buy more stocks at a discount.

If you answered A, you should probably stick with a conservative portfolio of more bonds and fewer foreign stocks.

If you answered B, the above guidelines are good for you.

If you answered C, you may want a more aggressive approach and hold even more stocks even as you age.

As an example, right now, my allocation is 80% stocks, 12% bonds, and 8% alternatives (some real estate through a real estate index ETF). I’m staying a little bit on the aggressive side because:

- I don’t have a ton of money invested yet.

- I’m optimistic about economic growth over my lifetime.

- I still have got a long way before I retire.

Adding alternatives

Not all 401k plans will have alternative investment options. These include ETFs or mutual funds that invest in things like:

- Real estate

- Commodities like Gold or Silver

- Debt obligations

For the average investor, I think alternatives should make up less than 10% or your portfolio. I like alternatives because they provide further diversification, and some can serve as a hedge. For example, the price of gold and silver typically moves opposite the stock market. So owning some ETFs that invest in metals can mitigate losses when the markets have a bad year.

Beyond your 401(k)

Although 401ks are great, you will hopefully have other investment accounts, too (like a Roth IRA). So the diversity of investments within your 401(k) is only part of the picture.

Ah, this sounds like it’s going to get complicated! Deep breath.

The easiest way to ensure you’re allocating your assets correctly s to diversify within each account. Remember I’ve said before that a 401k or IRA is like an empty bucket into which you place eggs (your investments). So if you have three buckets—a 401k, a Roth IRA, and a taxable investment account, you can place different eggs in each.

You might have 80% stocks and 20% bonds in your 401k, the same ratio in your Roth IRA, and 50% bonds and 50% stocks in your taxable account (a more conservative allocation because you may use the money much sooner than retirement).

The more sophisticated way to accomplish this is to look at your entire retirement portfolio at once. For example, if your 401k is entirely invested in stocks and is worth $80,000 and you have $20k in a Roth IRA, you could put that money in bonds to achieve an 80/20 stock bond allocation. Some brokers have tools that allow you to look at the compensation of your entire portfolio whether or not the assets are with that company.

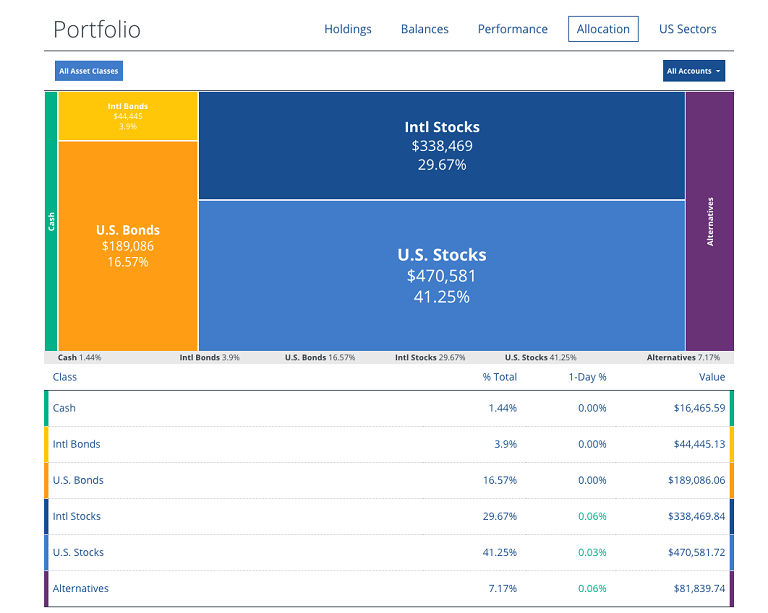

Emerging tools like Empower, formerly known as Personal Capital, make this easier by aggregating your investments and giving you an x-ray of your portfolio’s contents by asset class, sector, and more. Above, a screenshot of Empower’s investment screen shows the asset allocation of all your investment accounts in one place.

What’s most important

This post scratches the surface of asset allocation, but what 99% of investors need to remember is that diversification is good. Diversification protects you. So owning a mutual fund that holds 25 different stocks is good. Owning three mutual funds that hold 100 different stocks and bonds is better. And, some argue: owning three index funds that track thousands of stocks and bonds is better yet.

To be simpler still, just remember these three secrets to successful 401k investing:

- Get the money in.

- Invest broadly.

- Let it be.

Need 1-on-1 advice? Check out How to find the best financial advisors.