It has been a number of years since I’ve gone through the home buying process, so it’s easy to forget how involved it was.

The average homeowner moves every eight years, and, honestly, I’d love to move more often if it wasn’t so complicated.

First, you have to get pre-approved for a mortgage and make sure you have the down payment. You’ll then have to find a real estate agent and deal with gathering the many documents for your official loan. Only then are you ready to start shopping for a home.

Better Mortgage streamlines the process to make your move a little less exhausting.

What is Better?

After having a tough time going through the home buying process in 2012, Vishal Garg founded Better. The goal was to streamline the home buying process, making it easy for a new homebuyer to navigate the multiple steps required.

With Better, you get a platform that can help you locate a real estate agent, get a pre-approval letter, complete your mortgage application, and go all the way to closing. Best of all, the process is 100% fee-free.

How does Better work?

Whether you want to get pre-approved for a new mortgage or want to refinance an existing one, you’ll start at the Better landing page. Enter your ZIP code and choose “Buy a home” or “Start refinance” to get started.

I chose “Buy a home.” Here, you have three choices: “Get pre-approved,” “See today’s rates,” or “Use our calculator.”

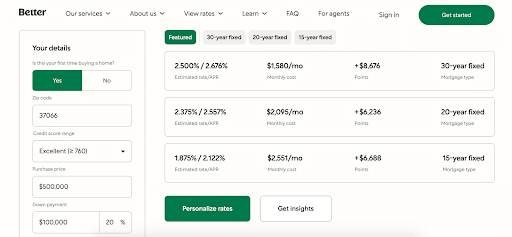

“See today’s rates” will take you to a screen that shows featured rates. You can also look at current interest rates for a 30-year fixed, 20-year fixed, or 15-year fixed mortgage loan. As you adjust your credit score, purchase price, and down payment amount on the left, you’ll see the list of rates change to fit those criteria.

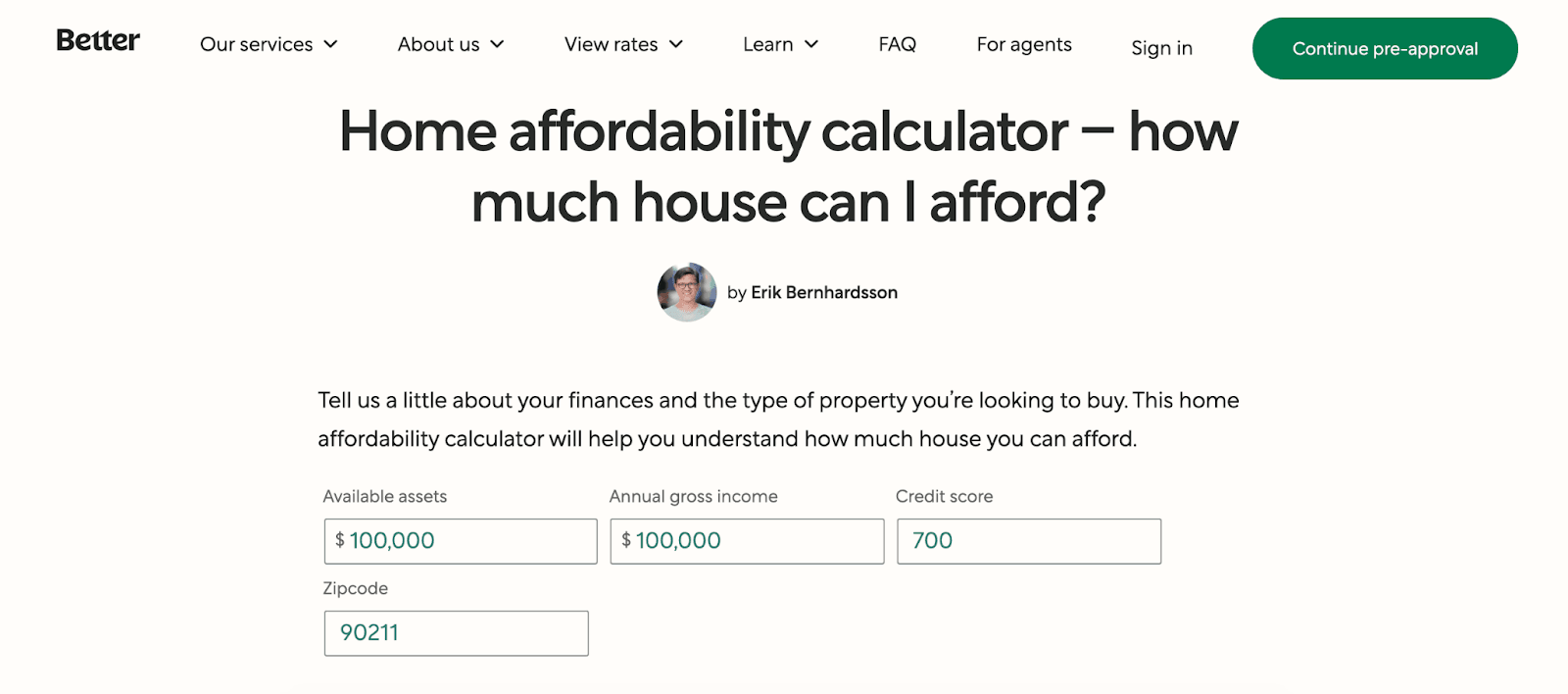

From the main screen, you can also choose the affordability calculator. This will help you determine exactly how much of a home you can afford without going through the official pre-approval process. It’s a great way to determine whether you’re really ready to buy a house. This can come in especially handy if you’re thinking about refinancing but aren’t sure how much it will save you.

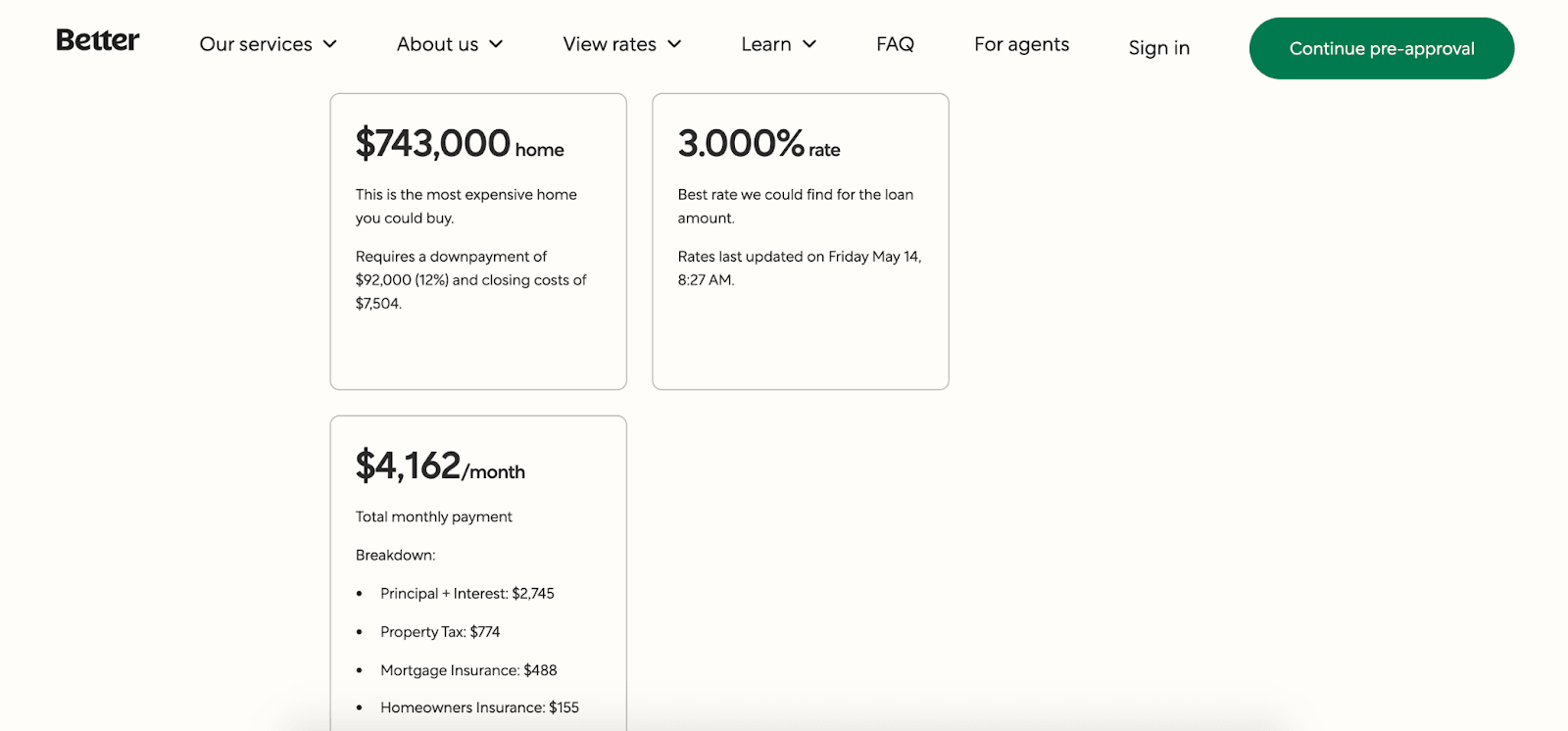

The calculator will display figures for the most expensive home you could buy. Using the above parameters, I’d be able to buy a house as expensive as $743,000. My interest rate would be 3.0% and my monthly mortgage payment would be $4,162 a month. I would also need to provide a down payment of $92,000, and my closing costs would be $7,504.

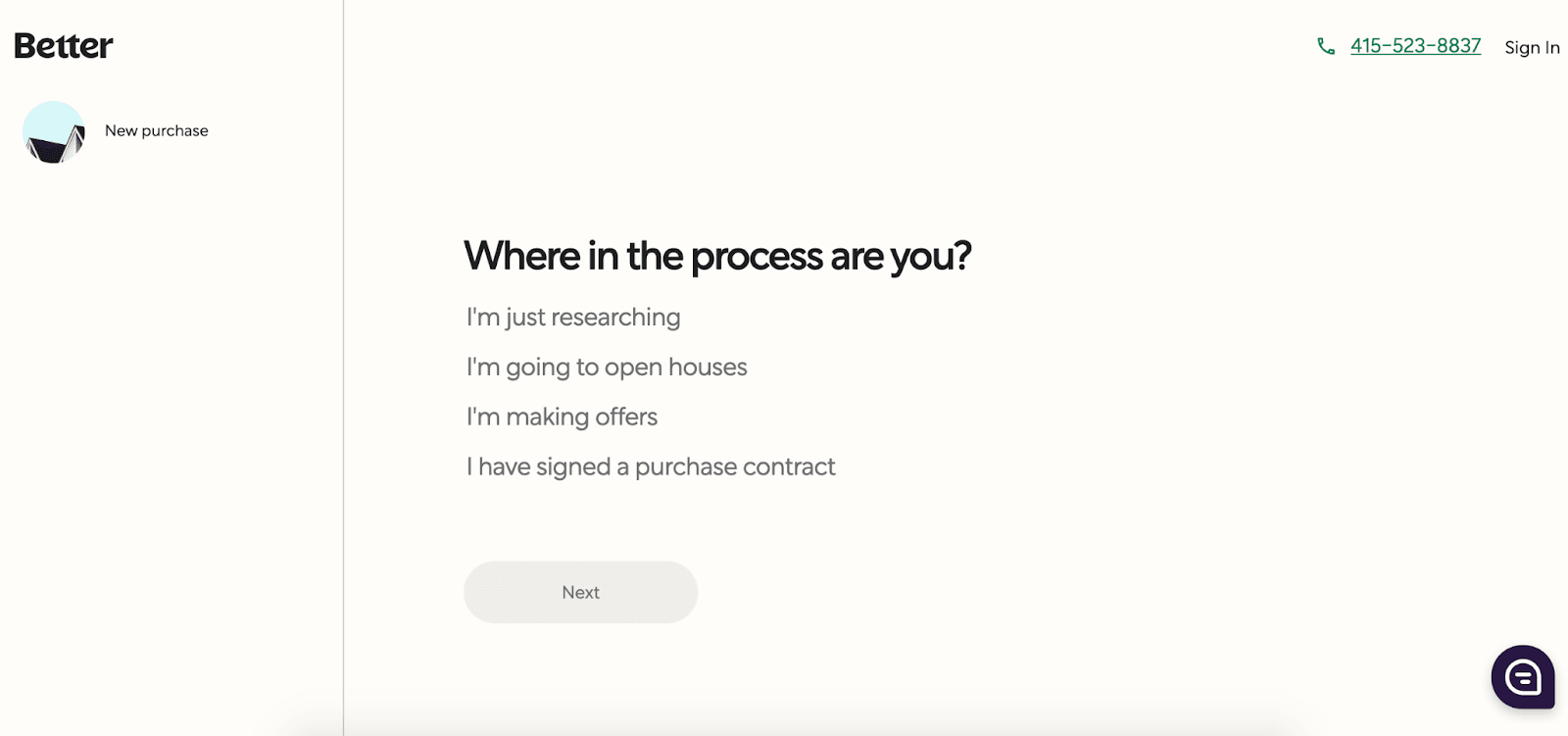

If you like the numbers you get from that rate peek, you can click the button in the top-right corner of your screen to start the pre-approval process. Better will begin by asking you some questions.

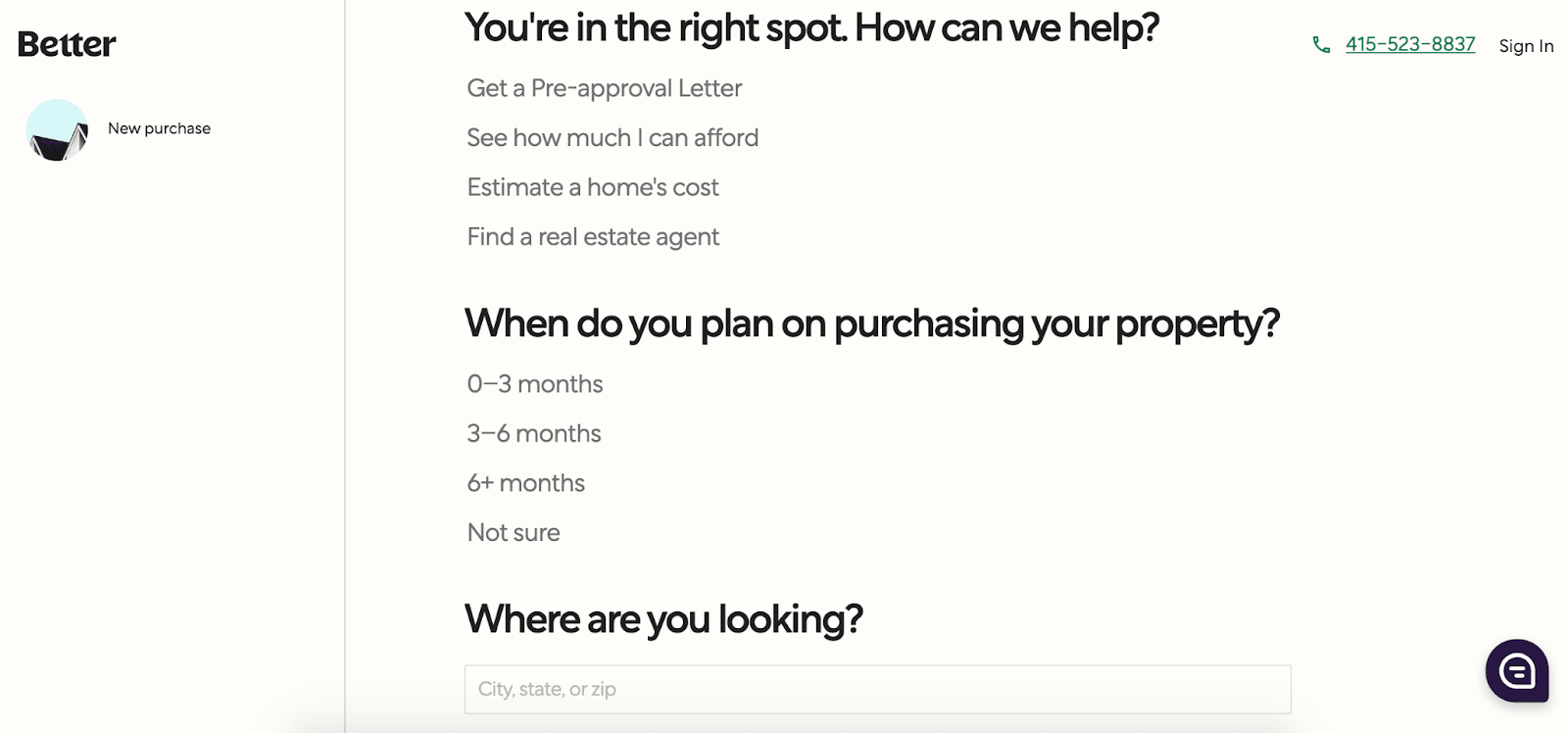

I chose that I’m just researching. Since I’m only researching, I wanted to see how much I could afford. But you can also start the process of getting a pre-approval letter, estimate a specific home’s cost to you, or find a real estate agent through Better. You’ll also need to specify how many months away you are from buying a property and enter the city, state, or ZIP code of your desired location.

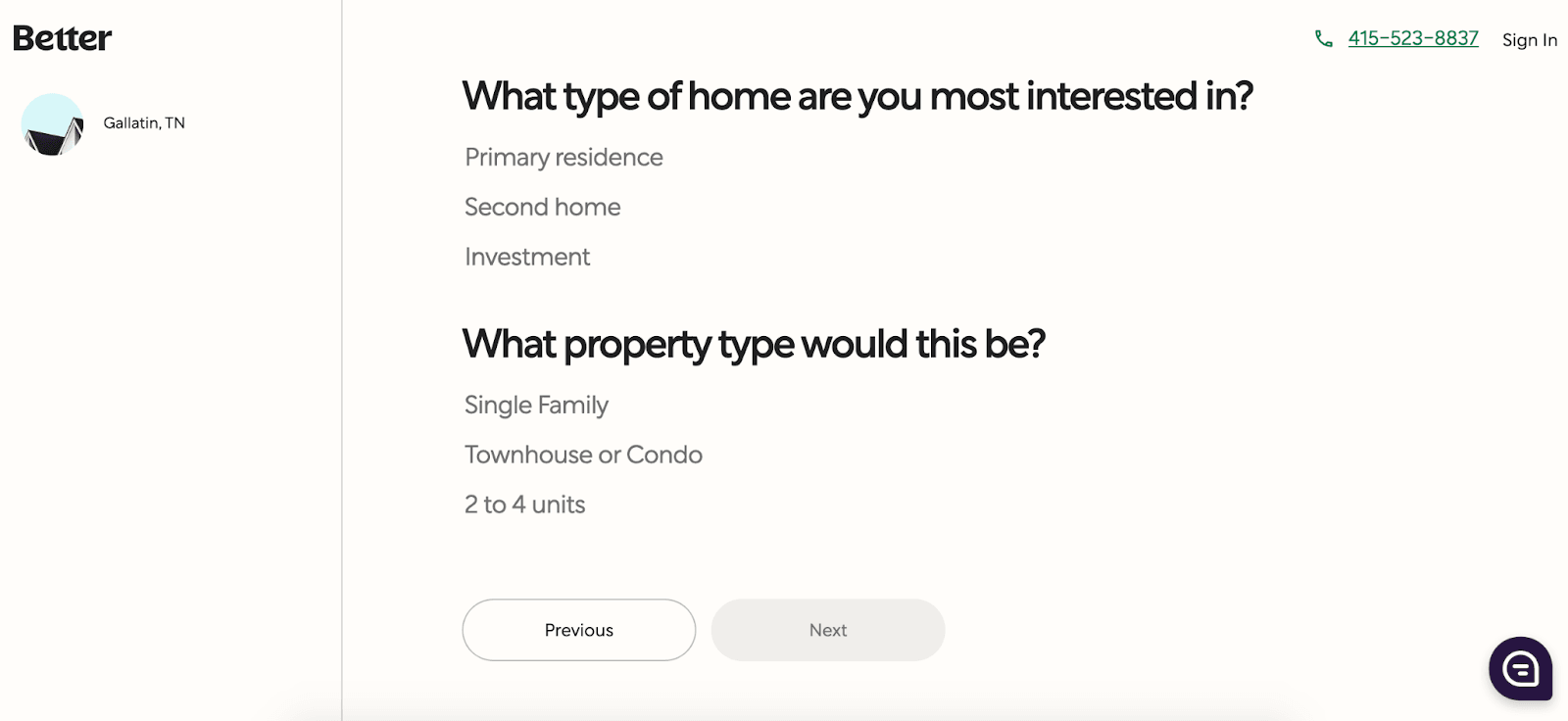

Better also needs to know if you’re looking for a primary residence, a second home, or an investment property. Also, check the property type you’re planning to buy.

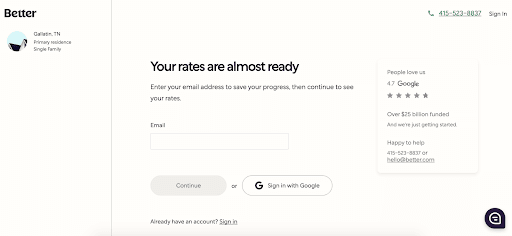

At this point, you’ll have to enter your email address.

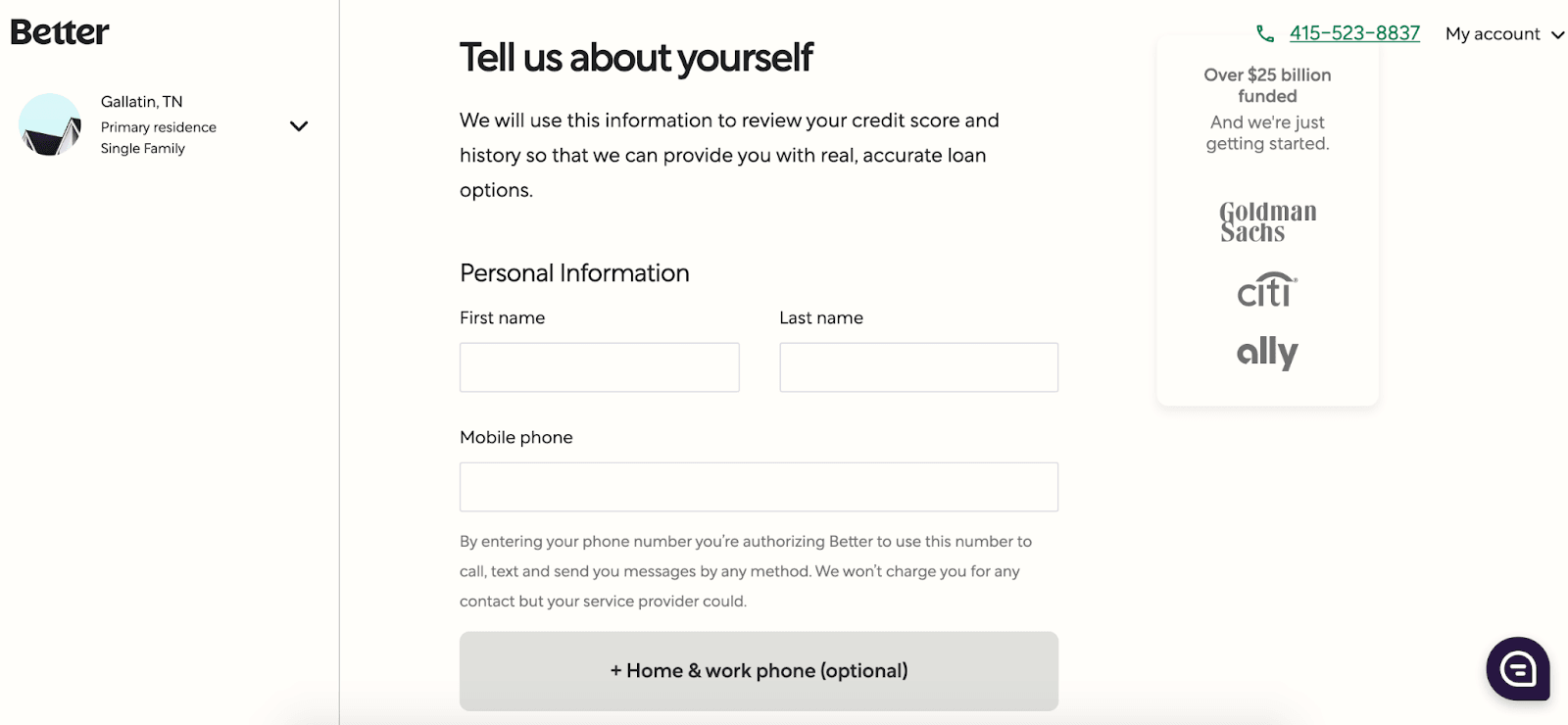

To give you a quote, Better needs to do a soft credit check. This won’t affect your credit score. You’ll need to provide your contact information and your Social Security number to run this.

Pricing for Better

Unlike many other mortgage lenders, Better charges no fees at all. With other lenders, there can be origination, application, processing, and underwriting fees. You won’t pay any of that with Better.

As is standard practice, Better sells off its loans on the secondary market. To optimize its success at this, they match their loans with companies who pay top rates for them, which allows them to skip charging fees to borrowers. It also allows them to offer lower rates than some competitors.

Better features

Finding a mortgage means weighing all the options and finding the best fit for you. Here are some features that set Better apart from the rest.

One-stop mortgage shopping

If you’re looking for a home, you’ll typically deal with multiple service providers to kick off the process. Better saves you time, lining you up with a real estate agent, quotes and pre-approval letters, and even homeowners insurance. This saves time and helps keep everything in one place.

Rate transparency

It’s pretty easy to find out how much you can expect to pay if you get a mortgage through Better. You can glimpse current rates for various mortgage types. If you decide to get a personalized quote, you’ll just need to give a few pieces of information for a soft credit check.

No fees or commissions

Usually, when you apply for a mortgage, the lender will charge a commission for managing the process. This amount is typically around 1%, which would be $5,000 on a $500,000 loan. Better saves you that fee, letting you put more toward paying the loan.

Fast turnaround

When you’re ready to get started, Better’s approach can be refreshing. Whether you’re looking for a pre-approval letter or just trying to get a quick loan estimate, you’ll be saved the frustration of waiting days for a response.

Real estate agent matching

Finding a real estate agent can be challenging. Better makes the process easier by helping you locate partner real estate agents in your area. In addition to helping you find an agent who is familiar with your area, you’ll get $2,000 off closing costs for going with a suggested agent.

Better price guarantee

It’s always wise to shop around if you’re looking for a mortgage. But Better guarantees their pricing. They’ll beat any competitor, plus credit you $100 on your loan. If they can’t match the price, you’ll get $100 anyway. To take advantage of this, just send a competitor’s offer within one business day of receiving it.

Insurance handling

Your homeowners and title insurance both go through your mortgage lender. Better lines all this up for you. Of course, you can still bring your own homeowners insurance, but if you don’t have it, Better can get quotes from multiple providers and bring you the best rate.

My experience researching Better

Do you know what mortgage rates are today? I don’t. But with a couple of clicks on Better’s website, I could see current rates for my ZIP code. Best of all, I could adjust them for my target house price, my own income, and the type of mortgage I want – a 30-year loan.

But what I really like is the transparency of Better’s process. Normally, you put in your mortgage application and wait. That wait is a real nail-biter. Better lets you take a peek at your likely approval amount and interest rate based on your credit score, income, and assets, among other features. If you like what you see, you can progress to a soft credit check, which will take a more detailed look and approve you.

I also like the affordability of Better. Not only are there no fees, but you’ll also get $2,000 off closing costs if you go with one of their real estate agents and $100 if you use their price-matching guarantee. Buying a house comes with so many costs, even a little savings can make a big difference.

Who is Better best for?

Curious shoppers

With very minimal information, you can get an idea of the rates and terms available with your credit score and desired home purchase price. Being able to view rates in advance gives you a way to see what you can afford before you start shopping.

Buyers without an agent

If you don’t yet have a favorite real estate agent, Better can set that up for you. You’ll get a phone call where you discuss your own needs and preferences, and from that, Better will match you with a local real estate agent. That agent will help with your search and your closing. Best of all, you’ll get $2,000 off closing costs if you choose that agent.

Those in a hurry

Closing typically takes at least a few weeks, and that’s after you’ve put the offer in. If you’re looking to compress things, Better’s process helps you expedite them. You can get a pre-approval letter and track down a real estate agent all in one place.

Who shouldn’t use Better?

Those needing government-backed loans

While Better can help homebuyers at all levels, FHA, VA, and USDA loans aren’t supported. That could be a problem for the many homebuyers who don’t quite have the credit score or down payment requirements necessary for a conventional loan.

Buyers in prohibited states

Better is currently only available in 46 states and Washington, D.C. If you live in one of the following four states, you can’t use Better right now.

- Hawaii.

- Massachusetts.

- Nevada.

- New Hampshire.

Pros & cons

Pros

- No fees — You won’t pay an origination fee with your loan.

- Low rate guarantee — Better promises the lowest rates available, offering to meet any competitor’s offer, plus $100.

- Quick turnaround — You can get a quote and a pre-approval letter in a matter of hours.

- They’ll find a real estate agent for you — You can take care of the entire home buying process through Better, including the first step of finding a real estate agent.

Cons

- No government-backed loans — Better doesn’t support FHA, VA, or government-backed loans.

- No physical presence — Those who want the brick-and-mortar experience might not find an online-only lender ideal.

- Limited availability — Although Better has expanded its reach in recent years, it’s still unavailable in Hawaii, Massachusetts, Nevada, and New Hampshire.

The competition

| Better Mortgage | Reali Loans | Credible | |

|---|---|---|---|

| Initial application process | Can be completed in seconds | Can be completed in seconds | Can be completed in three minutes |

| Loan fees | None | None | Varies by lender |

| Mortgage types offered | Purchase, refinance, jumbo, fixed, adjustable | Purchase, refinance, fixed | Purchase, refinance |

| Availability | 46 states and the District of Columbia | Varies by lender | Varies by lender |

| Unique features | Low price guarantee, real estate agent matching | Easy rate lock-in, shop multiple lenders at once | Start-to-finish loan shopping, multiple competitive lenders |

Better Mortgage vs Reali Loans

If you want to shop multiple lenders at once, Reali Loans is a great option. Reali Loans works with multiple partners to help you compare rates and choose the lender you like best. You’ll just answer a few questions and get a list of rate quotes. If you choose one, you can proceed with the application.

One benefit to Reali Loans is that you can lock in your interest rate without submitting documentation. That means you can easily ensure you’ll get the low rate you’ve been quoted. Although you can’t get a real estate agent through Reali, the site does walk you through the steps of getting your loan in place.

Better Mortgage vs Credible

If you are on the hunt for a mortgage, it is important to compare multiple different lenders in order to get the best rate. Credible makes doing so incredibly easy.

In only three minutes, you can get instant prequalified rates for a mortgage refinance with Credible. During that process, Credible delivers personalized prequalified rates from multiple lenders without affecting your credit score.

The entire process is entirely online for a seamless application.

- Cash-out refinancing

- Personal information is not shared

- Transparency

- Limited lending opportunities

- Lender fees may apply

First, you will prequalify for a loan (this only takes three minutes), then you will compare some of today’s most competitive lenders. Once you find the best loan for your financial situation, Credible will allow you to submit all needed documents and wrap up your loan directly through their site.

Using Credible isn’t just easy, but it doesn’t cost you a dime and has no impact on your credit score, making it the perfect starting point when shopping for a mortgage.

Summary

If you’re in the market for a home loan, Better Mortgage is a great place to start. With a low-rate guarantee and no fees, you’ll be able to get into a home for less than with competitors. You don’t have to track down a real estate agent through Better, but being able to do everything in one place is a huge perk.