Prosper is a personal loan marketplace that offers personal loans for debt consolidation, home improvement, medical or dental expenses, and more.

Prosper began as an innovative peer-to-peer lending platform on which individual investors could pool money to fund other member’s loans. (In 2006, I actually got an $11,000 Prosper loan to refinance credit card debt). Today, Prosper has made over 1 million loans totaling $25 billion!

What is Prosper?

Prosper is an investor-backed lender offering unsecured personal loans for between $2,000 and $50,000 with a term of three or five years. Personal loans from Prosper can be used for nearly any purpose outside of education-related expenses.

Prosper was founded in 2005 and operates out of a San Francisco-based headquarters. They are commonly used for debt consolidation, home improvement, medical expenses, new vehicles, big purchases, and other uses.

How does Prosper work?

Signing up for a loan with Prosper is quick and easy. You can get your rate instantly after completing a short online form. According to the Prosper website, it uses TransUnion to obtain your credit score and requires the following minimum criteria:

- A debt-to-income ratio below 50%.

- Income greater than $0.

- No bankruptcies in the last 12 months.

- Fewer than five credit inquiries in the last six months.

- Minimum of three open credit lines on a credit report.

If that sounds like you, here’s a step-by-step look at what it’s like applying for a loan from Prosper:

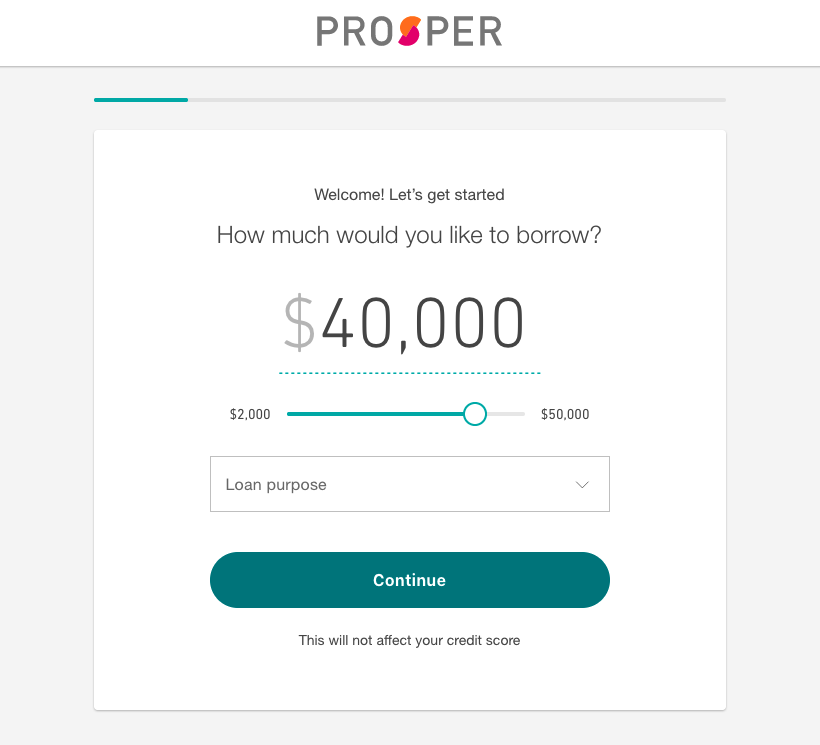

After clicking any of the “Check Your Rate” buttons, you’ll start by entering your desired loan amount.

Next, Prosper asks how you plan to use the loan. If you choose “other,” you’ll see a note that you cannot use your loan for post-secondary education expenses. That includes tuition, fees, books, or room and board at a college, university, or vocational school

On the next page, you will choose between getting a loan by yourself or if you’re planning to add a cosigner. Cosigners can help you get a lower interest rate if they have better credit, but they’re also obligated to repay the loan just like you.

Once you finish entering information about the loan, you’ll start adding information about you.

The next pages ask for your contact information and details about your income. Prosper uses this information to help determine if you are able to repay the loan.

After entering your annual income and monthly rent or mortgage payment, the last steps ask you to enter your phone number and choose a password. You’ll get your rate in just a few moments.

How much does Prosper product cost?

Like all loans, you should plan on paying interest while paying down your balance. Borrowers get a rating based on their credit. Prosper assigns interest rates based on that rating and other factors from your application, like your current income. Borrowers are rated from AA (best) to HR (first-time borrowers).

Prosper personal loan APRs range from 8.99% to 35.99%, with the lowest rates for the most creditworthy borrowers. In addition to interest, loans require an origination fee of 1% to 7.99%, based on your credit and loan details. The origination fee is deducted from the loan proceeds automatically. Although its possible to get a very good APR with Prosper if you have good credit, the origination fee adds to the cost of the loan. It’s worth comparing personal loan options because you may be able to find a loan without such a fee.

When it comes to loan payments, be prepared for them to be set to autopay by default. Failed payments require a $15 fee. Late fees are charged for payments 15 days late or more.

Prosper features

Personal loans

Loans from Prosper are personal loans. Personal loans are unsecured, which means that you don’t need any collateral. If you stop paying, the lender can’t try to seize a specific asset. Instead, the damage comes in the form of fees and harm to your credit score.

Instant rate check

The Prosper application took me less than five minutes to complete. You can get your interest rate instantly. Unlike some loans, checking your rate at Prosper won’t affect your credit score. They just use a soft credit inquiry, which is visible to you but not other lenders.

Loans for people with less than excellent credit

While applicants with top credit scores will get the best interest rates, you don’t need perfect credit to get a loan from Prosper. Loans are available to borrowers with credit scores as low as 640 in some cases.

Prosper requires that your credit report is free of bankruptcies in the last 12 months, has less than five credit inquiries in the last six months, and contains at least three prior credit lines.

Fixed-rate loans

Loans have a fixed interest rate for the life of the loan. Three-year loans get slightly lower rates than five-year loans. No other terms are available.

No prepayment penalty

You can pay off your loan early with no added fees. Paying off your full balance before the due date, or paying a little extra each month, also helps you save on interest over the life of the loan.

HELOC loans

In addition to personal loans, detailed above, Prosper recently added the home equity lines of credit (HELOCs). A HELOC is secured by your home, which means the lender can go after your home if you stop paying. HELOCs work kind of like a credit card attached to your home.

Prosper HELOCs are issued through a partnership with BBVA.

Peer-to-peer investing

Prosper isn’t just for borrowers. If you have money to invest, Prosper allows you to pick and choose your own loans and they will build a portfolio for you automatically!

According to Prosper.com, historic returns average 5.1%. Your results may vary widely, however, based on the portfolio of loans you choose.

My experience using Prosper

I started out with Prosper as an investor way back in September 2012. I had an overall good experience picking loans and earning a return on my money. I ultimately decided the average return for Prosper investors wasn’t worth the risk in my own portfolio, but it is a great product for people looking to diversify their investments and make money with alternatives.

I gave the loan side of Prosper a try while preparing for this review. Like the investing side of the house, I found the experience to be intuitive and easy-to-follow. Everything worked as advertised with no surprises along the way.

The entire signup process took me less than five minutes from start to finish.

Who is Prosper best for?

Debt consolidation

The best use of Prosper may be debt consolidation loans. If you have high credit card balances on one or more cards, you may be able to consolidate with a lower interest rate at Prosper. If your rate is below what you pay on your cards, you should save money and may even be able to pay off your loan faster.

High-credit borrowers

If you have good to excellent credit, you may qualify for the very best Prosper rates. If you get the best rate, the 6.95% APR interest rate may be competitive for nearly any borrowing need outside of a home loan.

Alternative investors

Investors who want to diversify outside of the stock and bond markets often look to investments known as alternatives. Peer-to-peer loans are a popular form of alternative investment.

Who should not use Prosper?

Borrowers with bad credit

If you have a history of bankruptcy, missed payments, or late payments, you may not qualify for a loan from Prosper at all. If you do qualify, your rates could be more than you would pay with a credit card.

Borrowers who don’t want to pay origination fees

The biggest downside of Prosper is its origination fee. Many personal loan sources don’t charge any fees at the start of the loan. This fee is not very competitive and could be a reason to shop elsewhere for a personal loan.

Risk-averse investors

For investors at Prosper, it’s important to understand that your returns are driven by individual borrowers. If someone doesn’t pay their loan, and you invested in that loan, you could lose money. Investing in more loans helps you diversify your risk, but there’s always a risk that a borrower will stop paying.

Pros & cons

Pros

- Instant rate check with no impact to credit — Find out if you are approved, as well as your interest rate, without a hard hit on your credit.

- Peer-to-peer funding eliminates banks — Prosper connects lenders and borrowers. Because it isn’t a bank looking to profit, some loans may come with more competitive rates or be available to lenders that can’t find a loan elsewhere.

- Borrow up to $40,000 — Loans are available from $2,000 to $40,000. Big loans can help you tackle big debt consolidation efforts. Just keep in mind that you have to pay back anything you borrow, plus interest.

- No prepayment penalty — If you have the cash to make extra payments each month or pay off the loan in full before the due date, you won’t pay any penalties.

Cons

- Origination fee — Arguably the biggest downside of Prosper, all loans start with an origination fee. The fee of 2.41% to 5% is deducted from your loan proceeds.

- Some borrowers get a high APR — Unless you have excellent credit, interest rates can be on the high side.

Prosper vs. competitors

| Prosper | Upstart | Credible | |

|---|---|---|---|

| Interest rates | 6.95% to 35.99% APR | 7.8% – 35.99% APR | starting at 7.49% fixed APR (with autopay), See Terms* |

| Pre-payment penalty | No | No | Varies by lender, but mostly no |

| Time to receive funds (average) | In as little as 1-2 days | 1 day (for most customers) | Varies by lender |

| Can you check your rate with no hard credit inquiry? | Yes | Yes | Yes |

Prosper vs Upstart

Upstart is similar to Prosper in a lot of ways, but they do offer slightly larger loans than Prosper – ranging from $1,000 – $50,000. You’ll only be offered a three or five-year term (with no prepayment penalty) when taking out loans, and interest rates are somewhat similar to Prosper.

Upstart is similar to Prosper in a lot of ways, but they do offer slightly larger loans than Prosper – ranging from $1,000 – $50,000. You’ll only be offered a three or five-year term (with no prepayment penalty) when taking out loans, and interest rates are somewhat similar to Prosper.

What’s especially great about Upstart, however, is that 99% of borrowers will get their money the next business day after applying – it doesn’t get much faster than that!

Prosper vs Credible

Credible is actually a loan marketplace where you can compare loan rates from a variety of companies. Using a marketplace like Credible can help you ensure that you’re getting the best rate you possibly can – so it never hurts to check them out before going with a direct lender.

Credible is one of the most popular loan portals online today. It is a free tool that specializes in finding borrowers personal loans for the most competitive rates.

Loan amounts range from $600-$100,000 and offer interest rates starting at 7.49% fixed APR (with autopay) See Terms*.

- Single application form

- 100% free to use

- Close with a better rate than you prequalify for on Credible and get a $200 gift card. Terms Apply.

- Limited lending opportunities

- Lender fees may apply

Credible’s application process takes just a few minutes and is easy to understand. Plus, Credible shows you quotes from companies that offer loans all the way up to $200,000. So if you’re looking for a large loan, Credible may be right for you.

Can individual investors still invest in Prosper loans?

Yes. Investors can create an account and invest money that Prosper will use to fund personal loans. You can start with as little as $25 and choose to have your funds automatically invested or to pick and choose which loans you want to fund based upon interest rate and credit quality. The interest you earn can either be automatically reinvested or deposited into your bank account monthly.

Summary

Personal loans have the potential to be a useful financial tool when managed well. Prosper loans, like all personal loans, are best for borrowers who will save money paying off other debt. They are also useful for many other purposes, just be aware that you’ll have to pay interest and fees. Don’t take out a loan of any kind unless you are okay with the costs.

If you are in the market for a personal loan, Prosper can be a great place to find one. It is best for people who qualify for low rates thanks to their good credit, but other borrowers may find Prosper to be the best deal around for their needs. Because there’s no obligation or cost to apply, it can’t hurt to check your rate at Prosper when shopping around for a personal loan.