Have you ever wondered how to save $1 million?

Now you can wonder no more because there’s a magic monthly savings number out there for you, and I’ll show you how to discover it!

Once you uncover your magic monthly savings number, all you’ll need to do is set up a recurring, automatic monthly savings plan and you’ll be well on your way to building your million-dollar nest egg.

First, decide when you want to reach $1 million

Whether you want to save $1 million early, late, or by the typical retirement age of 65, the number of years you have left will determine how much you need to save each month to reach a million dollars.

The good news? The math is simple and it will only take a few seconds to figure out.

Just take your desired millionaire age (when you want to have saved $1 million) and subtract your current age.

So, if you want to reach $1 million at age 65 and you’re currently 30, you have 35 years to save.

Next, decide how much you expect your investments to earn

This one’s a bit trickier, I know. It requires you to think about how risk-averse you are (i.e., how much would you freak out if you lost a little, some, or a boatload of your investment portfolio) and to consider the types of investments that are likely to help you get to the investment return you’re comfortable with.

Before we start talking about how much different investments have returned over time, though, you should know this: how an investment performed in the past does not necessarily mean it will perform that way in the future.

Even so, the longer your investment horizon (the amount of time you’ll have your money invested), the greater your chances of receiving an overall return that’s closer to the historical long-term average.

Let’s take a look at how a few different investments performed over the past 20 years (which includes the so-called “lost decade,” the first recorded 10-year period when stock returns were flat).

Stocks

For the past 20 years, the average annual return of the stock market, as measured by the S&P 500 and reported by the NYU Stern School of Business, was 7.60%. To be clear, there were years when the market was down (a devastating -36.55% in 2008) but there were also years when it was up (a whopping 32.15% in 2013).

It’s also worth mentioning that average stock market performance is historically low for the past 20 years (that “lost decade” was quite a curveball). The average annual return for the past 50 years was 11.23%.

Bonds

Bonds are typically considered safer investments, because their returns don’t fluctuate as much. In other words, bond highs aren’t as high, but their lows aren’t as low either.

Using the 10-Year Treasury Bond as a proxy, and again using figures reported by the NYU Stern School of Business, the average annual return over the past 20 years was 5.31%. For the past 50 years, it was 7.11%.

Cash

While the money in your wallet definitely qualifies as cash, so do investments like your money market account, which are typically made up of short-term investments like three-month Treasury Bills.

These are the safest investments with the lowest volatility (the amount an investment’s price fluctuates, over time). At the same time, they also offer the lowest return.

While it’s very unlikely that you’ll lose money with your capital parked in a cash investment, there’s also a high likelihood that your investment won’t outpace inflation, which, over time, essentially means your money will slowly lose value.

That said, over the past 20 years, three-month Treasury Bills have averaged 1.44% (again using figures reported by the NYU Stern School of Business). Over the past 50 years, they’ve averaged 5.04%.

Most investment portfolios include a combination of investments from these three buckets. Those willing to accept more risk, with the hope of higher returns, create a portfolio with a higher stock concentration. Those more risk-averse load up on bonds and cash investments.

Finally, find your magic monthly savings number

As you’ll see in the charts below, you’ll likely want to take on some investment risk to increase your chances of earning a higher return over time. Otherwise, you’ll be tasked with finding a way to save a whole lotta dough each month.

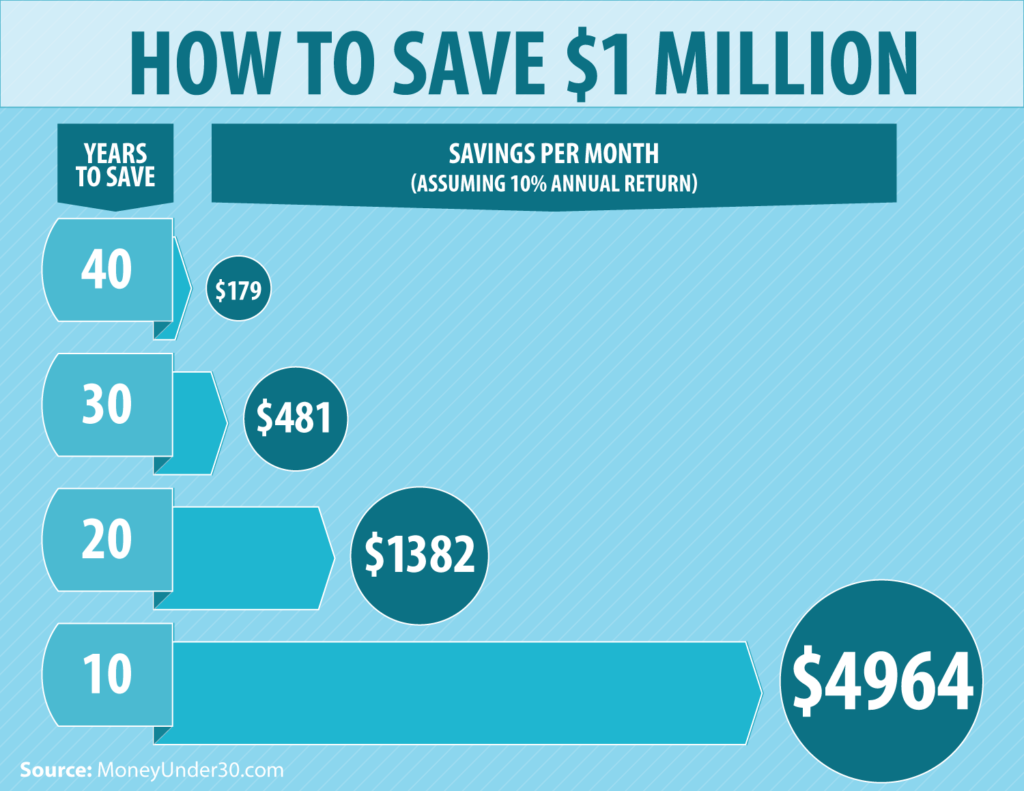

You check out the summary in the graphic at the start of this article.

If you have 40 years until retirement

Those with the longest investment horizon are in the best shape, thanks to the magic of compound interest.

If you start early and retire late, you could retire a millionaire by saving just $179 per month, assuming a 10% rate of return. Using a more conservative 6% rate of return, you will need to save $522 per month.

If you have 30 years until retirement

Waiting just 10 years has a huge effect on the amount you’ll have to save to reach your goal. Even with an average annual return of 10%, you’ll have to save $481 per month to get to $1 million before you retire. At 6%, you would need to save $1,021 per month.

If you have 20 years until retirement

The longer you wait to start saving, the more cash you’ll have to put aside each month to reach your goal. If you wait until retirement is 20 years away, you will need to save $1,382 per month to hit the million-dollar mark, assuming a 10% return. At 6% you will need to save $2,195 per month!

If you have 10 years until retirement

As you can see, waiting until the last 10 years before retirement is a dicey strategy. At 10% returns, you would have to save $4,964 per month to reach a million dollars. That’s pretty tough to do, especially if you haven’t built up the habit of saving consistently over your lifetime.

If the returns were lower, it seems even more impossible: at 6%, you would need to put away $6,125 per month to get to a million.

For those of you somewhere in between the numbers listed below, use MU30’s calculator to find your own numbers.

The bottom line is, the longer you have left and the higher your average annual return, the greater your chances of reaching your goal.

The good news for savers and investors is that if you’re saving through a 401(k) or another employer-sponsored retirement plan, your employer may be matching a percentage of your savings. Those matches can make a huge impact on a retirement portfolio, no matter where in the savings cycle you are.

Summary

No matter if you’re 10 years or 40 years away from retirement, saving as much as you can now help boost your financial security in the future.

Because of the power of compound interest, the more time you let your money grow, the more you can transform small savings into a huge nest egg.

Start as soon as you can, and make sure to calculate the time you have before retirement so you can better decide how much to save each month.