In the past, we asked: 401k or IRA? So the obvious follow-up is: Roth or traditional?

If you read that and say, “huh?” Don’t feel bad. Despite hundreds of articles I’ve read on the topic, I have yet to find one that explains the differences between Roth and traditional accounts in a way that non financial nerds can understand it.

Today I’ll do my best.

Note: Not everybody has the option to do a Roth 401(k). Only some employers offer this, although it’s becoming more common. In this series we’re discussing 401(k)s, but the differences between Roth and traditional accounts we discuss today apply to individual retirement accounts (IRAs) as well.

Traditional vs. Roth

Very quickly, retirement accounts come in two flavors—traditional and Roth.

- With traditional accounts, you don’t have to pay taxes on the money you put in now, but you have to pay taxes on the money when you withdraw it later.

- With Roth accounts, you can only put money in after you’ve paid taxes on it, but when you withdraw it in retirement, you don’t have to pay taxes on the money.

| Traditional Accounts | Roth Accounts |

|---|---|

| Contributions made with pre-tax dollars | Contributions made with after-tax dollars |

| Withdrawals (principle & interest) are taxed | Withdrawals (principle & interest) are tax-free |

| 10% early withdrawal penalty applies to entire balance | 10% early withdrawal penalty only applies to gains, not deposits |

For quick trivia: The Roth accounts are named for this guy, the Delaware Senator who created the Roth IRA in 1997.

Roth 401(k)s vs. Roth IRAs

We’re focusing on comparing Roth 401(k)s and traditional 401(k)s, but how does the Roth 401k differ from the Roth IRA, every blogger’s favorite retirement account? The big points are highlighted on the chart below—contribution limits, income limits, and mandatory retirement age.

But if you have a Roth 401(k) at work, is there any reason to still contribute to a Roth IRA?

The simple answer is yes.

The main reason is Roth IRAs can double as emergency funds. With a Roth IRA, you can withdraw your deposits tax- and penalty-free at any time. (You just can’t touch the gains.) Not that you should do this, but if you ever had a big emergency and needed money, tapping a Roth IRA is better than tapping a 401k or traditional IRA and paying a 10% penalty. It’s probably better than taking a 401(k) loan, too.

| Roth 401k | Roth IRA | Trad. 401k | Trad. IRA | |

|---|---|---|---|---|

| Tax deductible | No | No | Yes | Yes |

| Taxed at withdrawal | No | No | Yes | Yes |

| Early withdrawal penalty | On earnings only (before age 59 1/2) | On earnings only (before age 59 1/2) | Yes, before 59 1/2 | Yes, before 59 1/2 |

| Mandatory withdrawal age | 70.5 | No | 70.5 | 70.5 |

| 2023 contribution limit** | 22,500 | 6,500 | 22,500 | 6,500 |

| Loans allowed | Yes | No | Yes | No |

| Income limits | No | Yes | Yes | On deductions |

Other differences

As you can see, there are a lot of subtle differences between these account types, and all the acronyms and contingencies start to make your head ache like a bad hangover. Just a couple more things to mention:

Rollovers

When you leave a job, you can rollover your 401k into an IRA at the investment account of your choosing. If you have a traditional 401k it becomes a traditional IRA; a Roth 401k becomes a Roth IRA.

Roth conversions

You can convert a traditional IRA into a Roth IRA by doing a Roth conversion. You pay taxes this year on the balance of the IRA so you won’t have to pay them in retirement. This can be a way to diversify the tax basis of your retirement savings or for high earners to get around the income limits on Roth IRA contributions.

Choosing between a Roth 401(k) and a Traditional 401(k)

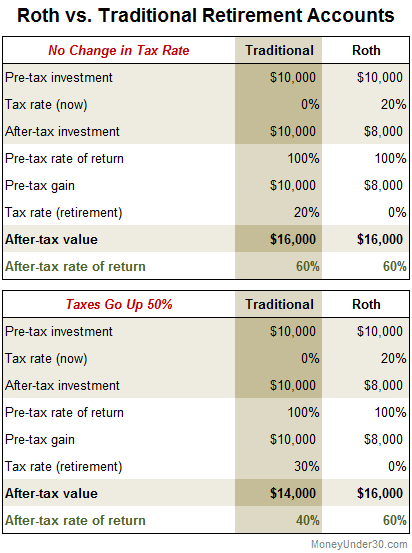

Here’s the thing about this decision: If the tax rate you pay stays exactly the same between now and when you retire, there will be NO DIFFERENCE in your returns between a Roth and Traditional account invested in the same stocks. So:

- Roth 401(k)s are better if you believe you will be paying a higher tax rate in retirement than you pay now.

- Traditional 401(k)s are better if you believe you will pay a lower tax rate in retirement than you pay now.

Here’s how this looks. The table on top compares a traditional 401k with a Roth 401k if tax rates stay the same; the bottom table compares the accounts if the investor’s tax rate goes up 50%.

Of course, no one knows for sure what taxes will be in the future, but most people assume taxes won’t go down.

If you’re young and professionally ambitious, it’s a good assumption that you’ll be in a higher tax bracket as a successful retiree than you are now on an entry-level salary.

This is why most advice geared towards young investors heavily favors Roth accounts.

That said, some people hedge by using both traditional and Roth accounts so they get some benefits whether taxes go up or down. Before Roth 401(k)s became available, many investors had a traditional 401(k) at work and a Roth IRA too. If you can’t do a Roth 401(k) at work, this is what I recommend.

Summary

- Roth 401(k)s are good because if your tax rate goes up, your savings will be worth more in retirement.

- But because nobody knows what tax rates will do, it’s not a bad thing to have both Roth and traditional accounts.

- The less you earn now, the better it is to contribute to a Roth.

- The more you earn, the more you want to transition to traditional accounts.

If you make a lot of money, you cannot contribute to a Roth IRA because of income limits. You can still do a Roth 401(k) if you have one at work, but that doesn’t mean you should. Unfortunately, there’s no clear dividing line because nobody knows how their tax rate in retirement will compare to their tax rate now. If you want to make sure you get it right, regular visits with a financial planner or tax expert are a must.

To make it simple as possible, however, know that saving for retirement is more important than whether you use a Roth or traditional account. But as a rule, follow this automatic investing flowchart: Start with your 401k—traditional or Roth—and contribute enough to get your employer’s match (if there is one). Then contribute up to the max to a Roth IRA. Then go back an max out your 401k.