When you buy a car on finance, you don’t own the car. At least, not yet. That’s because until you pay off the full cost of the vehicle, your lender is the legal owner of the car.

But what if you decide you don’t want your car, or that you want a new car, before you’ve paid off the value of the vehicle? Are you stuck with a vehicle you don’t want?

Not at all. You just need to make sure you follow the right steps.

Here’s how to sell a car on finance.

1. Find out the fair value of your car

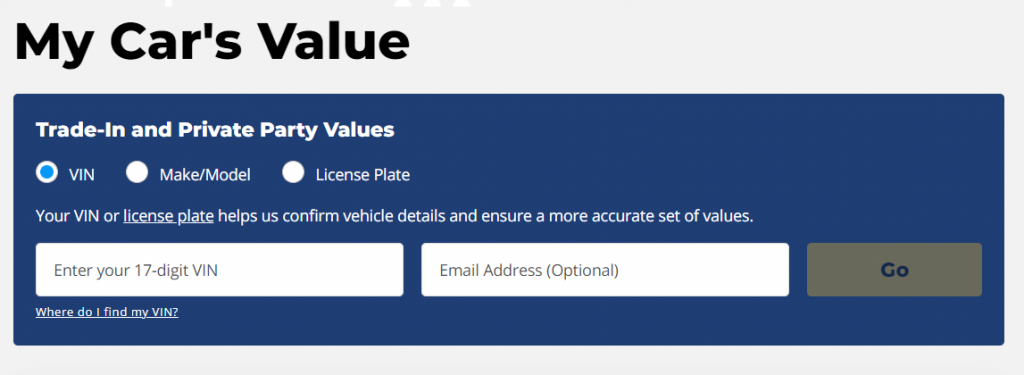

The sale of any vehicle should start by getting a reasonable estimate of its value. Kelly Blue Book and Edmunds.com are two trusted sources for car valuations. In fact, you should get estimates from both sites.

Enter as much detail as you can about the car to get the most accurate value. You should focus on “private party,” since this is the sales route that you will be taking. They also provide “trade-in,” in case you want to go down that path, and “dealer retail,” which won’t apply since you aren’t an auto dealer.

2. Get your loan payoff balance

Contact the lender who holds your car loan, and ask for the payoff balance, or settlement figure. (Note: This will be slightly different than the balance on your last statement, as interest accrues daily.)

Then compare the loan balance to the estimated value of the car. That will tell you whether the car has sufficient value to pay off the loan, and allow you to walk away with some cash, or if you will need to write a check upon the sale of the car in order to pay off the loan.

This is an important step — if you determine that the likely sale price of the car will not be sufficient to pay off the loan and/or provide you with enough cash for a down payment on the next car you want to buy, you will have to come up with that cash or you won’t be able to sell the car. But you want to know that before accepting an offer from a buyer.

Read more: How much should your down payment on a car be?

3. Enlist your lender in the sale

Once you know the payoff on the car loan and have decided to go ahead with the sale, you should get the lender involved in the sales process. They hold the title to the vehicle, and you can’t sell the car without it.

Ask your car lender the best way to proceed so that you can pay off the loan and deliver the title to the buyer in the shortest time possible. This is not an uncommon occurrence, so the lender should have procedures in place.

Read more: Can you pay off a car loan early?

4. If you can, hold the sale at the bank that holds your loan

The easiest way to handle the sale of a car that has a loan on it is to hold the sale at the physical address of the lender. This will provide you with the ability to collect the funds from the buyer, pay off the loan to the bank, and transfer the title to the new owner.

Holding the sale at the lending institution also has other advantages:

- It represents a neutral site to hold the sale.

- It gives the sale a more formal tone than if you were to complete it in your driveway.

- Any documents that you may need from the lender will be immediately available.

- You may be able to have the lender’s staff make copies or notarize any documents necessary.

This is the best way to go if your loan is from a local bank or credit union. Unfortunately, many loans written at car dealerships come from big national banks like Chase, Capital One, or the financing arms of car manufacturers (Toyota Motor Credit, for example). This makes selling your car with an outstanding loan balance a bit more difficult — but not impossible.

How to deal with an out-of-state lender

If the lender is not local, you’ll need to bring the bill of sale on the car to your state Department of Motor Vehicles. You’ll want to obtain a temporary operating permit for the buyer. This will allow you to transfer the vehicle to the buyer, and then deliver a clear title to the buyer once the loan has been paid.

Obviously, you will not have the title until the loan is paid off in full, so there will be a delay of several days while that process is completed. You may have to pay a fee to your lender to expedite the title, a process that ordinarily takes several weeks.

The risk of this delay will be a problem primarily for the buyer, since they will have a vehicle without having the legal title. However, there is no easier way to complete the sale, unless you have the personal funds to pay off the car loan prior to the sale of the car.

5. Accept only cash or an official bank check

Never accept a personal check from the buyer whether for full or partial payment of the sale price. A personal check can bounce, in which case the buyer will have both the cash and your car in their possession.

For that reason, you should accept only cash or a bank check for payment. A bank check or cashier’s check is issued by the bank itself. To be extra careful, insist on going to the bank with the buyer to get the official check so you know it’s legit — there are Craigslist scams in which buyers pass counterfeit bank checks that are impossible to detect until they bounce.

Wrapping up legal matters

Remember that you can’t legally sell something you don’t own, which means you need to notify your lender before you can sell your financed car, and you’ll need to ensure the settlement figure is paid off. If you don’t, your lender could take you to court for breaking your contract.

But beyond that, there are other legal considerations for selling your car. I recommend getting a list of the specific requirements in your state from the Department of Motor Vehicles. And be sure to follow those requirements to the letter.

Some of the documents you should have prepared include (but are not limited to) the following:

- Bill of sale. This is a simple document that will spell out the parties to the transaction, as well as the specific details, including date, price, and a description of the property being transferred. It should include the vehicle identification number of the car being sold, as well as the odometer reading as of the date of sale.

- Release of liability. You can usually download these forms from the DMV website in your state. It will confirm the transfer of the vehicle, and release you, the seller, from future liability. The form should include the odometer reading, and be filed with the DMV immediately so there is an official record of the transfer.

- Cancel your insurance coverage on the car. And while you’re at it, require that the buyer provide proof of insurance coverage on the car as well. This will make it clear that the buyer is assuming responsibility for the vehicle.

- Remove and keep the license plates. Not only will this reduce your liability after the sale, but you may be able to save some money by transferring the plates to the next vehicle that you purchase.

- Pay any fees associated with the sale. Your state DMV will be able to tell you what fees are required in connection with the sale of your vehicle. There can be a variety of fees, including sales tax, which you will have to collect over and above the final sale price of the car.

Finally, be certain that the registration on the vehicle is current. If it isn’t, it can lead to problems after the sale, including the payment of late fees.

The bottom line

Selling a car that you still owe money on is possible, but it does require some extra steps to keep it legal. Be sure to notify your lender of your intent to sell, and get the payoff amount in writing. Once you have that figure, you can advertise the car for sale, and screen potential buyers.