With inflation continuing to rise, you might be looking at savings bonds as a way to protect your cash — specifically bonds with inflation-adjusted interest rates.

Savings bonds are generally considered to be a safe investment. While they won’t go to the moon anytime soon, they can be used to protect what you already have.

What is a savings bond?

A savings bond is basically a loan issued by the government. Think of it like an IOU, but with interest. It’s a way the government raises money for big capital projects like building broadband access in rural communities or funding the military in times of war.

The Treasury Department is responsible for issuing savings bonds. They are backed by full faith in the U.S. government.

While savings bonds are a safe investment option, they aren’t the most lucrative. Bond interest rates historically range in value from around 0% to 5%. Interest accrues every six months, which compounds over time.

Interest is paid out when you redeem your savings bond. You’ll have to keep your money locked up in the bond for years — sometimes decades — if you want to benefit from interest payments.

After a bond reaches its maturity date it stops accruing interest. When you’re ready to cash out you’ll be paid back for your initial investment. You can keep the money or use it to buy a new bond.

I bonds vs. EE bonds

There are two different types of savings bonds you can choose from. They differ in their maturity dates, upfront costs, and how interest rates are applied.

Series I bonds are adjusted for inflation. They have two rates: One is fixed and one changes. The fixed rate is set at zero and is guaranteed to never drop below that. That means the bond will never lose its value.

The other rate is an inflation-adjusted rate. Every May and November the Treasury Department announces new rates. I bonds can earn a lot of interest in times of high inflation.

Series I bonds mature after 30 years, at which point they no longer earn interest. These bonds are sold at face value. If you buy a Series I bond for $100 you can cash it out for $100.

There are some penalties for cashing out I bonds early. If they’re liquidated before the five-year mark, you’ll forfeit some of the interest earned on it. After five years though, you’re free to cash it out without any penalties.

Series EE bonds have a fixed rate and also earn interest. These bonds appreciate differently than I bonds. Like I bonds, Series EE bonds also mature after 30 years. But if a Series EE bond is kept for 20 years it is guaranteed to double in value. For example, after 20 years a $25 Series EE bond is actually worth $50. Plus interest.

These bonds have to be held for at least one year. Like I bonds, if you cash out Series EE bonds before five years you forfeit some of the accrued interest. The big difference between the two is that if you cash out a Series EE bond before 20 years you only collect the interest and what you originally paid for the bond — not the increase in its value.

How do savings bonds work?

Savings bonds work like an IOU with interest. In exchange for lending money to the government, the Treasury Department agrees to pay you back with interest.

Bonds are similar to investing in stocks, but because they are backed by the government they come with less risk. Interest accrues until the bond reaches maturity and is then paid out, along with the value of the bond.

How to buy savings bonds

The best way to buy savings bonds is online. This can be done via the Treasury’s website at TreasuryDirect.gov.

Series I bonds can also be purchased as a physical piece of paper from a brokerage firm or commercial bank. Series EE bonds can only be purchased online.

The minimum purchase amount is $25 and the maximum is $10,000. Paper Series I bonds are slightly different. The maximum purchase amount for these is $5,000 and they come in denominations of $50. Note: if you go the paper route you’ll have to use your tax refund.

Gift savings bonds

An easy way to give a savings bond as a gift is to opt for paper Series I bonds. When you file your taxes you can designate how much of your refund you’d like to receive in the form of a savings bond. You don’t need any information from the recipient and you can gift the paper bond just like cash.

Waiting until tax season can be inconvenient though, so you can also give electronic bonds if you prefer. To do that, you’ll need to know the recipient’s:

- Full name

- Social Security number (or Taxpayer Identification Number)

- TreasuryDirect account number

Buying a savings bond as a gift is pretty similar to buying one for yourself. The main thing you’ll need to keep in mind is that an electronic bond is attributed to the recipient’s Social Security number. It can’t be exchanged or traded once it’s gifted to them.

Savings bonds interest rates

The inflation-adjusted rate for Series I bonds is currently at 6.89% as of November 1, 2022.

Series EE bonds currently earn 2.10% interest. This is a fixed rate and isn’t adjusted for inflation.

When do savings bonds mature?

Savings bonds mature at the 30-year mark. Once they’ve reached that point they no longer earn interest for bondholders.

You can cash out a savings bond penalty-free after five years. Doing so forfeits the accrual of more interest but you won’t lose the face value of your initial investment.

Do savings bonds increase in value?

Yes and no. The face value of a Series I bond doesn’t change. A $100 bond purchased today will still be worth $100 tomorrow. The increase in value comes in the form of interest which accrues during the life of the bond until it reaches maturity.

Series EE bonds, however, do increase in value. These can double in value from their original purchase price. There’s a caveat though: You’ll have to hold onto the bond for at least 20 years to see that kind of ROI.

How much is my savings bond worth?

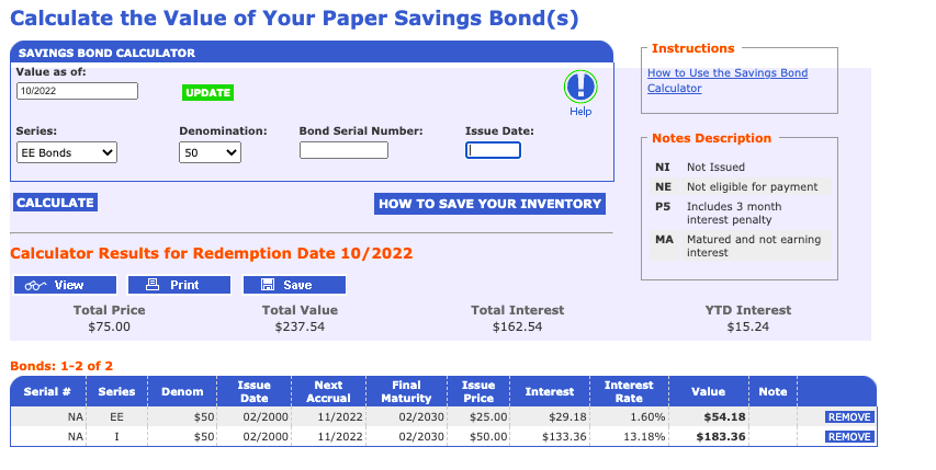

You can check the value of a savings bond using the Treasury Department’s bond calculator.

If you were gifted a $50 Series I bond in 2000, for example, it would be worth $183.36 today. A $25 Series EE bond would be worth $54.18.

The savings bond calculator also tells you the next interest accrual date, as well as the date on which your bond will reach maturity.

How to find savings bonds in my name

You could already have a savings bond and you might not know it (thanks grandma). To see if you have any matured bonds in your name you can use the Treasury Department’s search tool, Treasury Hunt. All you will need is your SSN and state of residence.

How to cash in savings bonds

When you’re ready to cash in a savings bond just log into your TreasuryDirect account and follow the instructions. Make sure you have a bank account linked to it so you can receive your money. It takes a couple of business days for the deposit to hit your bank.

If you have a paper bond, you can go to your local bank. A bank may limit how much you can cash out at once, depending on the value of your bond(s). Check out the Treasury Direct website for more information on cashing out paper bonds.

Are savings bonds a good investment?

Savings bonds can be a good investment. But be forewarned: They usually aren’t big money-makers.

One of the benefits of investing in savings bonds is that they provide stability. They won’t lose face value and won’t earn an interest rate below zero. Inflation-adjusted savings bonds can also help you protect the value of your money during periods of high inflation.

Another reason why savings bonds might be considered a good investment is because of their tax benefits. While the interest they earn is taxable income on the federal level, they are not subject to state or local taxes. Depending on how much money you make or where you live, savings bonds can be a good component of a tax optimization strategy.

Plus if a savings bond is used to pursue higher education, the interest might be exempt from federal taxes too.

Other types of bonds

Savings bonds are a secure investment option, but they aren’t the only bond you can choose from.

Treasury Bonds

In addition to savings bonds, the Treasury Department also issues Treasury Bonds. These are known as Treasury Bills (T-bills), Treasury Notes (T-notes), and Treasury Bonds.

The difference between these different types of loans is that they mature at different times. T-bills can mature within a few weeks while Treasury Bonds can mature after a couple of decades.

Municipal bonds

State, county, and city governments also issue bonds. Like the bonds issued by the federal government, these bonds are sold to raise money for capital projects like building new roads.

These bonds can sometimes be exempt from federal taxes, as well as state and local taxes. Depending on the bond, they can also mature quicker, e.g., in just a couple of years.

Corporate bonds

It might come as a surprise, but you can purchase bonds from companies in addition to stocks. The big difference is that a stock is equity in the company; the bond is just debt.

Corporate bonds are a less risky alternative to stocks, but come with none of the perks of being a shareholder. Like government bonds, corporations issue bonds to raise capital. Interest on the bond is either paid at a fixed or variable rate. When the bond reaches maturity, it stops earning interest payments and the initial investment is returned to the bondholder.

Bond index fund

A passive investment option to consider is investing in an index fund. Instead of owning a specific T-bill or bond, an index fund owns a bunch of different ones. Investors purchase a share of the index fund just like they would a share of stock in the company. Popular brokerage firms like Charles Schwab and Vanguard offer their own bond index funds.

Summary

Savings bonds don’t lose their initial face value, which makes them a low-risk investment option. During times of inflation, they can be used to protect the value of your money, and there are even some tax benefits to holding savings bonds too.

Featured image: Jonathan Weiss/Shutterstock.com