With so many deposits happening electronically, you no longer need to visit a physical branch to manage your money. But there’s still a need for ATMs, and fees can add up if you withdraw cash very often. Betterment Checking from robo-advisor Betterment will reimburse you for all the fees you’re charged at those ATMs, even if you’re outside the country.

Not only will you save money on fees, but you’ll earn money, as well. Betterment Checking also offers cash back rewards, so you can earn automatic cash back on your purchases.

With Betterment Checking’s mobile app, you can see, at a glance, how much money you have.

How does Betterment Checking work?

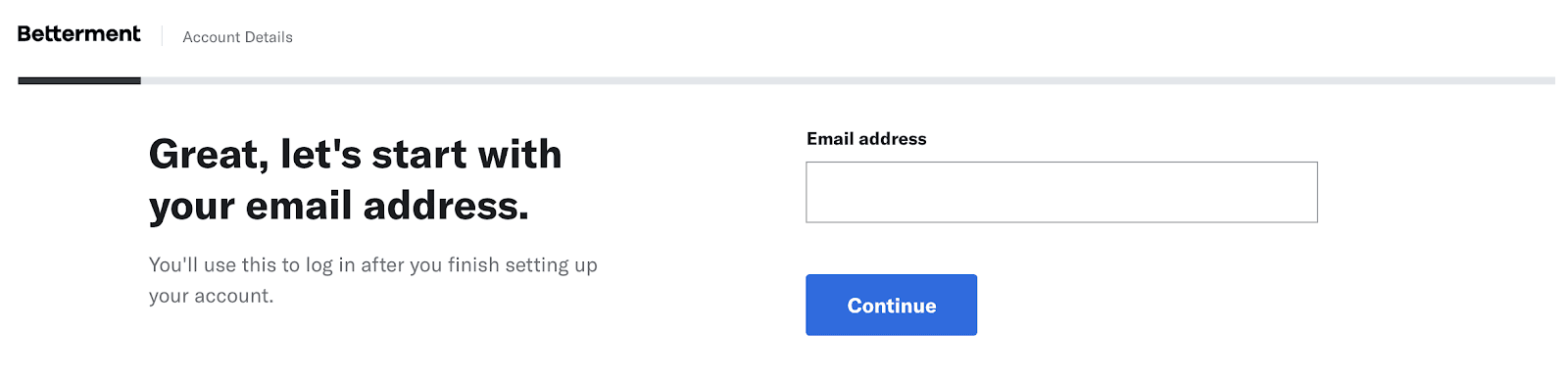

Betterment makes signing up for a checking account easy. To get started, you’ll just need to provide an email address that can be used as your login.

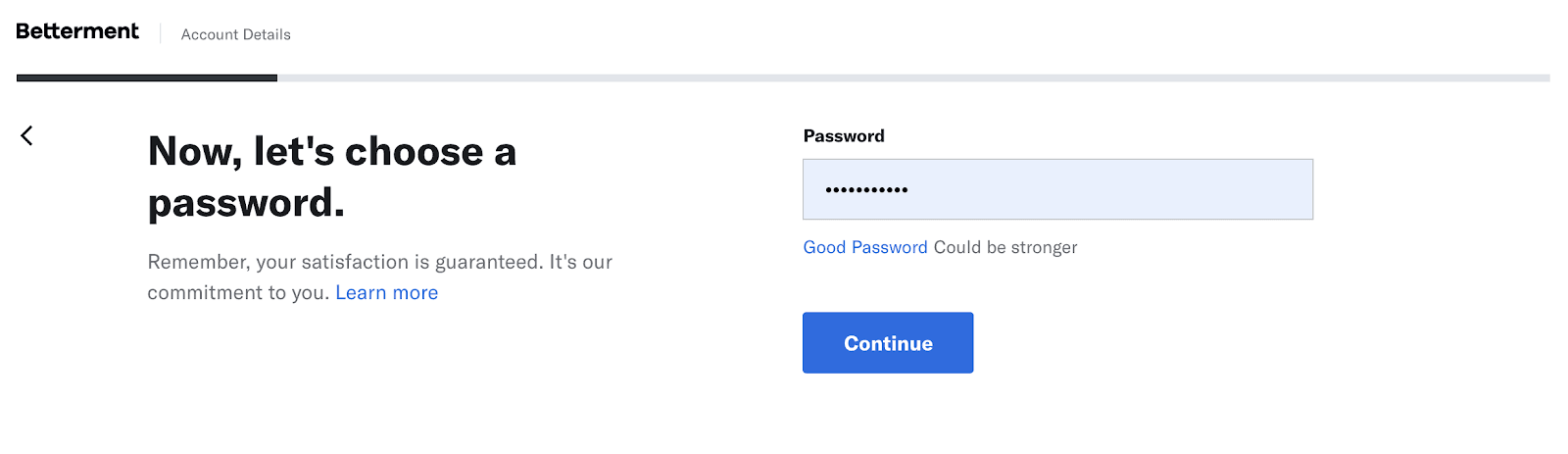

Then you’ll choose a password. As with most financial accounts, you’ll probably want to choose a password that’s tough to crack.

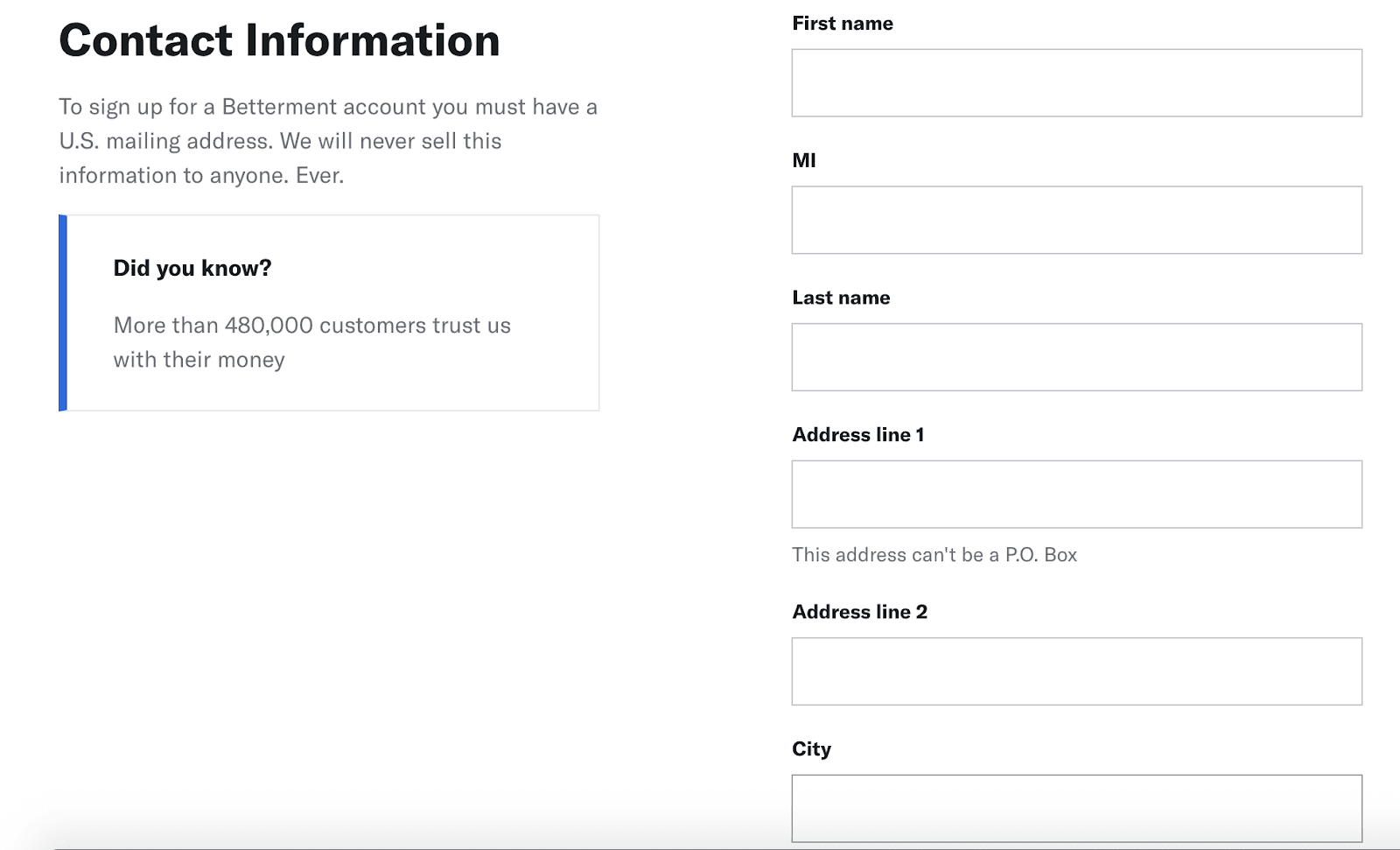

You’ll need a U.S. mailing address to sign up for an account with Betterment. No P.O. boxes are allowed. Input your name and address, then continue to the next screen.

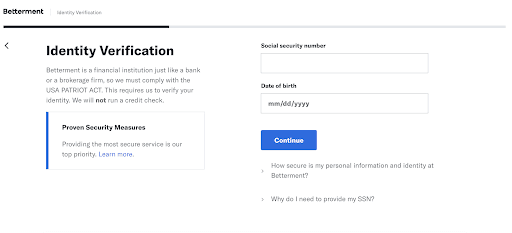

Lastly, Betterment will need your Social Security number and date of birth. This is not used to run a credit check. The U.S.A. Patriot Act requires that financial institutions collect Social Security numbers on accountholders for counterterrorism purposes.

Once Betterment has collected that basic information, you should be approved. You can then transfer some money into your account to get things set up.

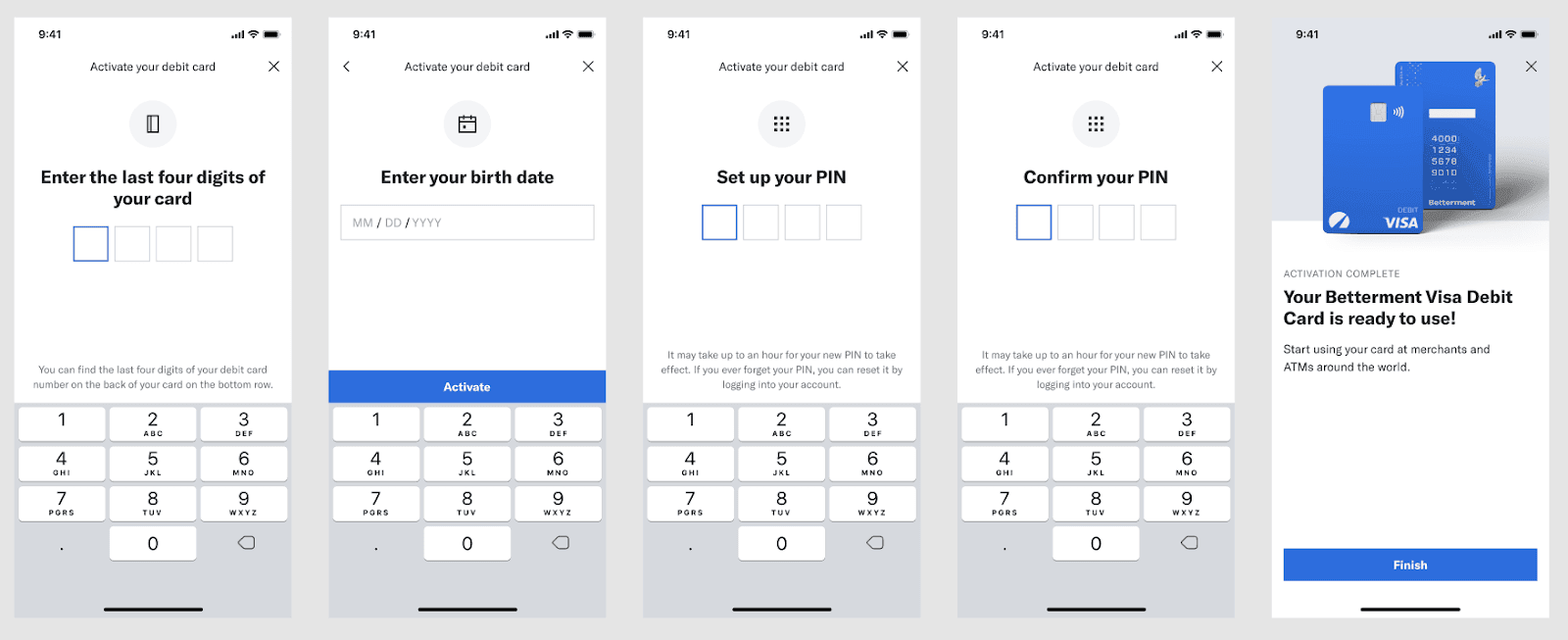

Once you receive your debit card in the mail, you can activate it in the app. After you’ve received your card in the mail, you can either use the physical card or pay using your phone at locations where contactless payment is available.

Pricing for Betterment Checking

You’ll pay no fees for a checking account with Betterment, even if you have an overdraft. If you don’t have the funds in your account to cover an incoming transaction, Betterment notifies the vendor and reverses the transaction. There’s also no opening deposit requirement, and you won’t have to maintain a minimum monthly balance.

But one of the biggest cost savers with Betterment is its fee refund policy. Yes, it’s an online bank, but you can use your ATM card at any machine around the world, and Betterment will refund any charges incurred.

If you use your Betterment Visa® Debit Card while traveling internationally, the 1% fee will also be refunded, but you’ll need to let Betterment know in advance that you’re leaving the country.

Betterment Checking features

You have plenty of choices when it comes to online checking. Here are a few things that make Betterment Checking stand out.

Easy account setup

Setting up your new checking account is easy, thanks to the app. Once you have an account, you’ll even get a checklist that walks you through the setup process. You can even request a debit card through the app.

No fees

While many checking accounts come without fees, Betterment goes a step further by eliminating fees for account overdrafts. If you ever do overdraw your account, Betterment will simply reverse the transaction.

Cash back rewards

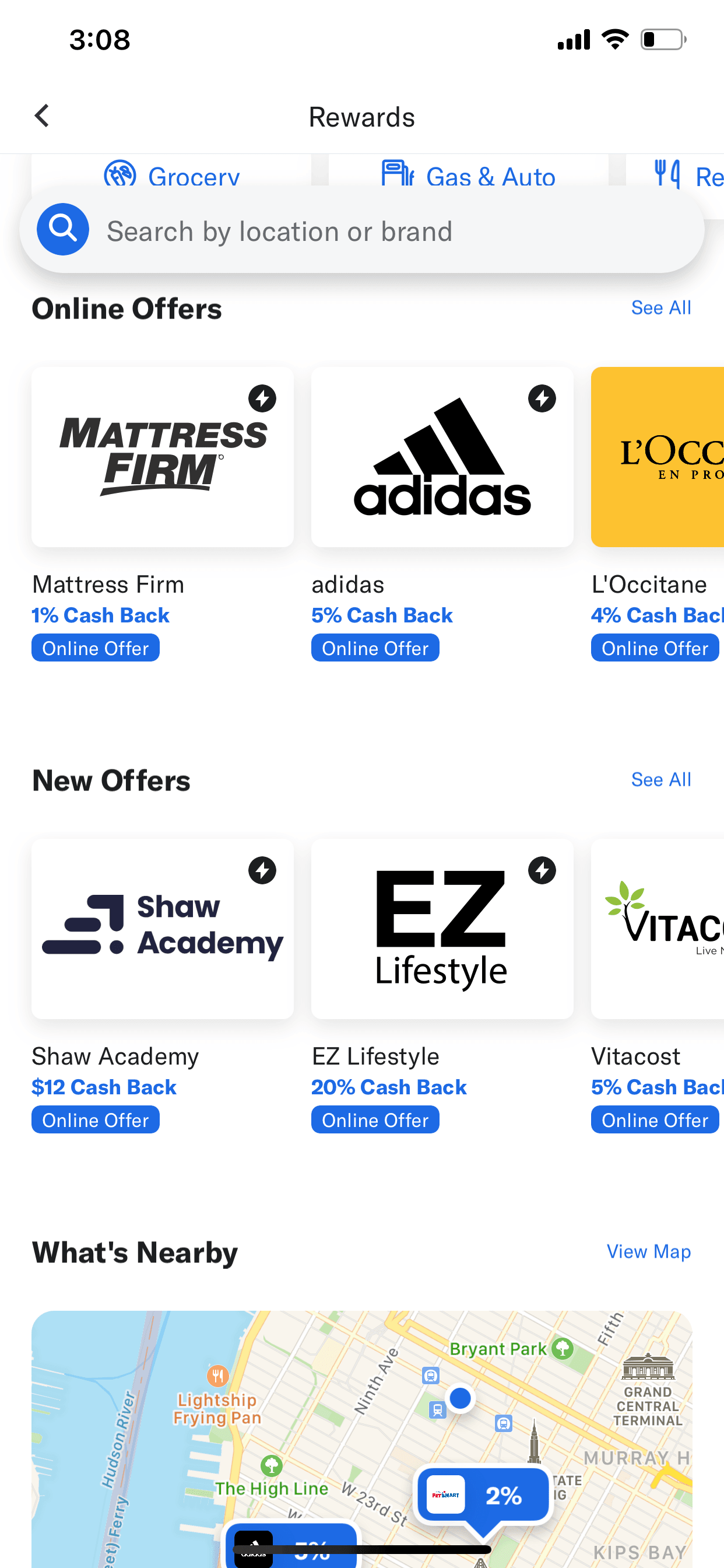

With the Betterment Visa® Debit Card, you’ll get cash back when you spend at more than 10,000 merchants across the globe. That includes both online and in-store purchases (for online purchases you will need to make purchases through Betterment’s “Earn Rewards” section on the site or app).

Best of all, Betterment uses your own purchasing history to show you the offers most relevant to you. The more you spend, the more Betterment gets to know the retailers and restaurants you like best. There’s even a locator built into the app that will help you find reward-earning opportunities near you.

Earning cash back is only one part of a rewards program, however. You’ll also get an immediate notification every time you make a purchase that earns you a reward. From there, you don’t have to do anything extra. Your rewards will automatically be applied to your account as Betterment approves them, with cash going into your account sometimes multiple times per day (note, however, that it can take up to 90 days depending on the merchant).

Reimbursed international fees

When traveling internationally, transaction fees can quickly add up. Betterment refunds all fees, whether you’re using your card overseas or getting cash out of an ATM locally.

Powerful mobile app

Betterment’s mobile experience is strong; it’s easy to see, at a glance, what’s going on with your account – translating to excellent oversight of your finances.

Easy investing

Since Betterment specializes in investing, a checking account with them makes it easy to save for the future. The Cash Reserves feature lets you know when you have an excess amount of money in checking and lets you transfer funds to help you earn interest on those funds.

Card management

If you ever lose your debit card, no problem. Just go into the app and lock the card until you find it again. You can then unlock it when you find it or, if you don’t, call Betterment to get a new card and cancel the old one.

Contactless payment

At participating locations, you can use your Betterment debit card without even removing it from your wallet. Simply unlock your phone, hold it near the terminal, and wait for checkout to complete.

Who is Betterment Checking best for?

Investors

Whether you’re thinking about getting started as an investor or well established as one, Betterment is a great option.

Those who travel light

It isn’t always easy to carry a card around with you. Betterment’s Visa includes contactless payment, which means you’ll only need your phone to pay. It’s important to note that not all merchants are set up to accept contactless payment, so you’ll need to check before leaving home without your card.

Your cash back rewards will be applied whether you use your card or the app, and having the app handy will make it easy to look up which nearby merchants will earn you rewards.

International travelers

Globetrotters will love that Betterment refunds all fees. That means if you use your debit card at ATM machines anywhere, Betterment will reimburse fees associated with that. When you leave the country with your Visa debit card, Betterment also refunds the 1% fee for international purchases.

Who shouldn’t use Betterment Checking?

Local bankers

Some consumers simply love the in-person banking experience. If you enjoy visiting your local branch and chatting up the employees, a mobile banking option like Betterment won’t be for you.

Those who like to separate checking

If you prefer to keep your checking separate from your investments and savings, you may not get the most out of Betterment’s all-in-one approach. You can still enjoy its many other benefits, though.

Advanced investors

Betterment’s investment options make its checking account a winner. But for expert investors, Betterment’s robo-advisor approach to investing may not give you the control you need.

Pros & cons

Pros

- No fees — You won’t pay any fees with Betterment, including for overdrafts.

- Cash back rewards — You’ll earn automatic cash back from thousands of big-name retailers on purchases with your Visa® debit card.

- Fee reimbursement — If you use an ATM, Betterment will refund any fees you’re charged.

- Money management — Using the app, you can easily move money to other accounts, including your investments.

Cons

- Fully online — You won’t have a local branch to visit.

- Limited investment options — Those using Betterment Checking for its connected investment platform might find investment options lacking.

Betterment Checking vs. competitors

| Account | Fees | Minimum balance requirement | Cash back rewards |

|---|---|---|---|

| Betterment Checking | None‡ | None | Yes, when you use your debit card at select merchants (there are thousands to choose from) |

| Chase Total Checking® account | $12 or $0 (when waived) | $1,500 (as one of waivers for monthly fee) | None |

Chase Total Checking® account

If your employer pays by direct deposit ($500 or more), the Chase Total Checking® account is another free option. If not, keep your balance at least $1,500 every day in this account or $5,000 among qualified deposits/investments for fee-free checking. Otherwise, you’ll pay $12 a month for this checking account.

Offering one of the largest branch networks in the country, the Chase Total Checking® account gives customer easy access to managing their funds.

Plus, there's responsive customer support, a versatile mobile app and customer-friendly features like Chase Overdraft Assist℠. There is a monthly service fee but there's multiple waiver options to avoid it.

- 15,000 ATMs and more than 4,700 branches

- Easy to earn welcome bonus

- Powerful Chase Mobile® app

- Monthly service fee applies if qualifications not met to waive

- No interest on balance

What’s also nice about Chase is that if you prefer an in-person experience, Chase has plenty to offer with access to over 15,000 ATMs and 4,700 bank branches.

Summary

Mobile banking provides plenty of perks, including the convenience of managing your money from your phone. With Betterment Checking, you combine that convenience with the ability to withdraw cash from ATMs located around the world.

This fee-free checking account option helps you save money while also earning cash back. You’ll earn while you spend, with the money going directly into your account automatically, no waiting required.