A few years ago, after a college speaking gig in Michigan, I caught a red-eye to Miami. After passing baggage claim, I relaxed on a bench with my luggage at my feet.

Before I knew it, I’d passed out. And when I awoke, my backpack was noticeably lighter.

The thief had taken my laptop, wallet, even my charger — and strangely — left my backpack. I gave the police my laptop’s serial number and immediately canceled all my cards. Sigh.

Thankfully, Miami’s Finest actually used my laptop’s serial number to track it, rescue it, and arrest the thief.

But since I’d canceled my credit cards, my troubles were just getting started.

Netflix, Amazon, and countless other services started banging at my virtual door. I must’ve read the phrase “There’s a problem with your payment method” two dozen times.

Crappy situations like this are why card lock is a revelation.

And it’s not just for use against criminals, either. Card locks have tons of everyday uses that can save you massive headaches.

What is card lock?

Card lock is a feature that lets you freeze your credit card without canceling it.

That may sound like a semantic difference, but it’s actually a pretty big deal, for one very specific reason: card lock lets you keep your old credit card number.

Locking instead of canceling totally changes the game.

With your card on lock, you no longer have to worry about someone racking up charges on your lost or stolen credit card. With the card lock on, the card will get declined for every new transaction, so any possible thief will assume it’s been canceled and toss it in the trash.

Even if it’s just sitting behind the bar, you don’t even have to go back to the bar to get it. You can order a new, identical card with the same account number to arrive ASAP (one that probably swipes better than your old one, too) and ask the bar to cut up your old one.

How does locking your credit card work?

Credit card companies want you to use card lock, because a lost or stolen card is an even bigger liability for them than it is for you.

Chase was the original pioneer of card lock, having introduced it in September of 2018. For that, I’ll let them do the honors of showing how it usually works.

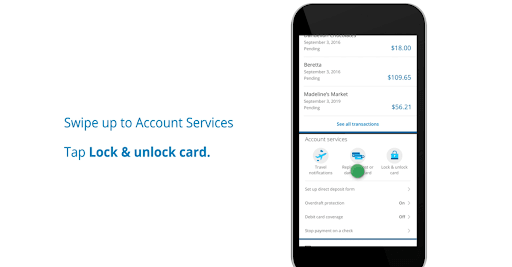

From the Chase Mobile® app, all you have to do is scroll down to your card, tap on it to see recent activity, and scroll down from there to see Account Services.

Then, tap the big ol’ padlock on the right, and Bob’s your uncle.

Locking your card doesn’t block all transactions — just new ones. That’s a critical distinction because it means that your recurring payments to your utilities providers, landlord, etc., won’t be interrupted.

It basically just prevents bad guys from going on a shopping spree until you can either find or destroy your card.

Does card lock work for debit cards, too?

Yup! Most debit cards offer a card lock feature. You will want to refer to your bank for specific details.

Are there still times you’d want to cancel your card?

Yes. Here are three cases when freezing may not be enough to save your card info:

- Your credit card info has leaked online. If your credit card information has been leaked online, it’s possible that thieves will attempt to use it multiple times before it expires. That’s a good time to cut your losses and get a totally new card number.

- Your card is in the hands of someone you distrust. Similarly, if your sketchy landlord or seedy ex still has your card info, and especially if they know you froze it, they may just be waiting for it to unfreeze. Time to cancel.

- You’re still getting fraudulent charges after you unfreeze. This ties into bullets one and two, but if you unfreeze your card and still get peppered with fraudulent charges, that’s definitely a sign that your card info is compromised.

When would I want to lock my credit card?

Card lock is helpful for more than just preventing criminal activity.

Here are five practical use-cases for card lock that can help you save time, stress, and money:

When your card is stolen

As we’ve covered extensively, the main use-case for card lock is to prevent new spending on a lost or stolen card.

Remember, you can always cancel a locked card. Locking is just something you can do to secure your card until you can figure out what happened to it. If your card is locked, you don’t have to rush to the bar to retrieve it. And if your card never manifests, you’re safe to wait and investigate a little further before canceling it.

When you can’t find your card, but you’re not sure if it’s stolen yet

Similarly, if you can’t find your card or wallet, locking your card from your smartphone is an instant no-brainer. Even if you find it within the next 90 seconds, you can instantly unlock it from your phone.

Plus, locking your card down takes most of the stress and urgency out of finding it — giving you a clearer head to retrace your steps and find it faster!

To curb your own impulse spending

Even if you know exactly where your card is — sitting safely in your wallet on your desk — you may still want to lock it down.

That’s because card lock also prevents you from making new purchases, and that makes it a helpful anti-spending or budgeting tool.

For example, when I returned from my globetrotting adventures in 2017, I wasn’t too flush with cash. “That’s it — no more travel,” I said, as I buckled down. Freezing my travel credit card would’ve been a good, practical way to keep myself to my word.

Granted, some card issuers still let you make purchases with locked cards from your digital wallet, but some barriers are better than none!

To disable a card when you’re not actively using it

I have friends who freeze their credit by default, and only unfreeze it when they apply for a loan. It may be slightly inconvenient when you forget it’s frozen, but it’s still a smart way to prevent identity theft.

You can view card lock the same way. If you have a credit card that you only use for certain expenses, such as booking flights or overseas spending, you can take 15 seconds to lock it down until you actually need it.

Heck, if you have a card that you only use for recurring expenses, you can lock it indefinitely!

Freezing spending by a secondary cardholder

Finally, if you have an authorized secondary user on your credit card, you may want to lock them out for the same reasons you’d lock yourself out; to help them with budgeting, curb impulse spending, etc.

I can’t think of a better example than Jack Black, whose son spent $3,000 on a “free” app clearly designed to trick kids into spending their parents’ money.

Mr. Black became more vocal about the predatory practice back in late 2018, right as Chase introduced the original Card Lock.

Coincidence? Or perhaps just good timing for modern parents everywhere.

Who offers card lock?

Here’s a non-exhaustive list of major card issuers that offer card lock:

- Chase

- Citi

- Capital One

- Wells Fargo

- Discover

- American Express

It’s worth noting that not all card locks are made the same. Some expire and unlock after a limited time period. Others will still authorize new charges made from digital wallets.

So be sure to study your particular bank’s card lock terms so there are no surprises, unpleasant or otherwise!

Summary

As someone who’s gone through the drudgery of canceling multiple cards at once, I’m super grateful that card lock exists. It takes 90% of the stress out of losing your card, provides an instant layer of security, and can even help you manage your finances — all with a simple toggle.