And this is where the Current Visa Debit Card comes into play. This card has a huge level of diversity as well as dynamic parental controls. This card, and the associated account, can help you teach your teenagers about managing money well. And it may even teach you a thing or two also!

What is the Current Visa Debit Card?

Current is one of the newer players on the market when it comes to teaching teenagers about finances. Since our teenagers are growing up in an almost completely digital age, their banking has to follow suit if we are going to get them on board. Luckily, Current has come up with a great solution.

Current offers so many different options with their accounts that they are an actual one-stop-shop. But, on top of that, they also gear their Current Teen Banking account towards more intuitive parental controls and the teaching of financial responsibility for your teen.

How does the Current Visa Debit Card work?

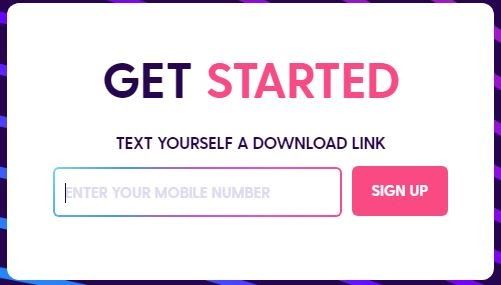

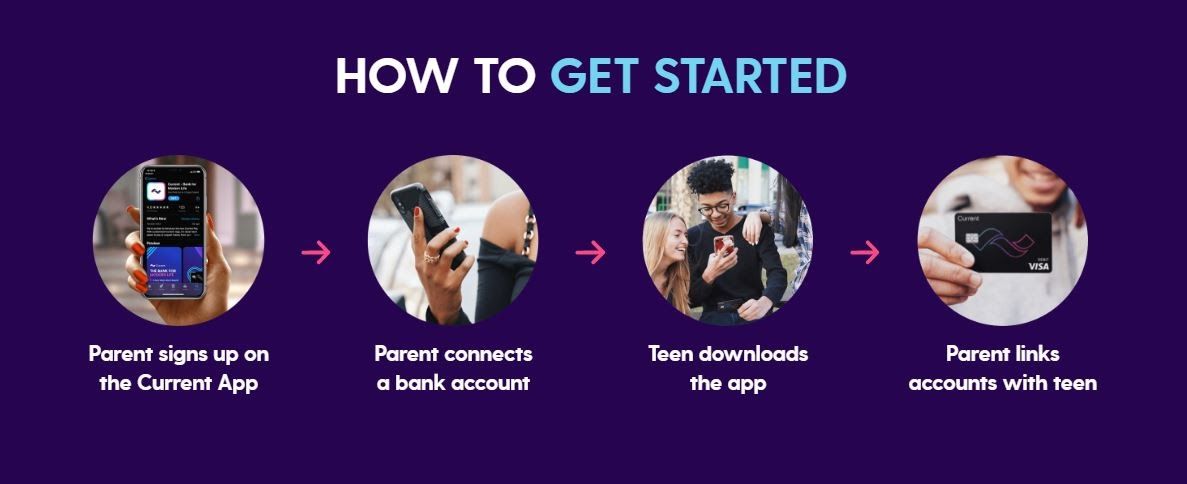

When it comes to signing up for a bank account, Current has made the process so much simpler. No matter which page you go to on their website, you will run across the bright pink “Sign Up” button to click on.

![]()

Once I clicked on that button, I was asked to enter a cell phone number.

I then got a link texted to me to sign up and download the app from my phone.

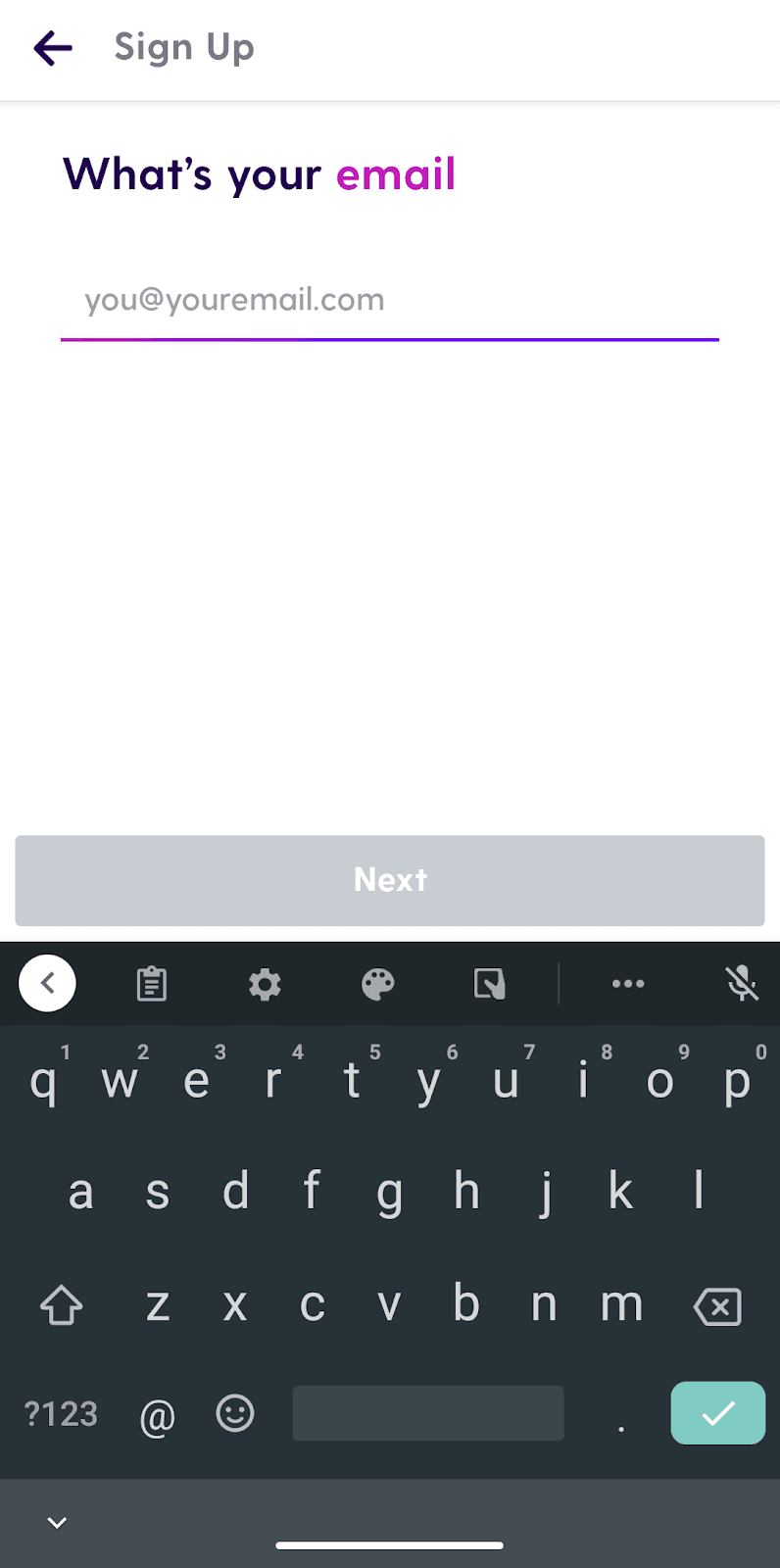

I downloaded the app and opened it and was then asked to verify my phone number. It sent me a verification code and then asked me to sign up with my email.

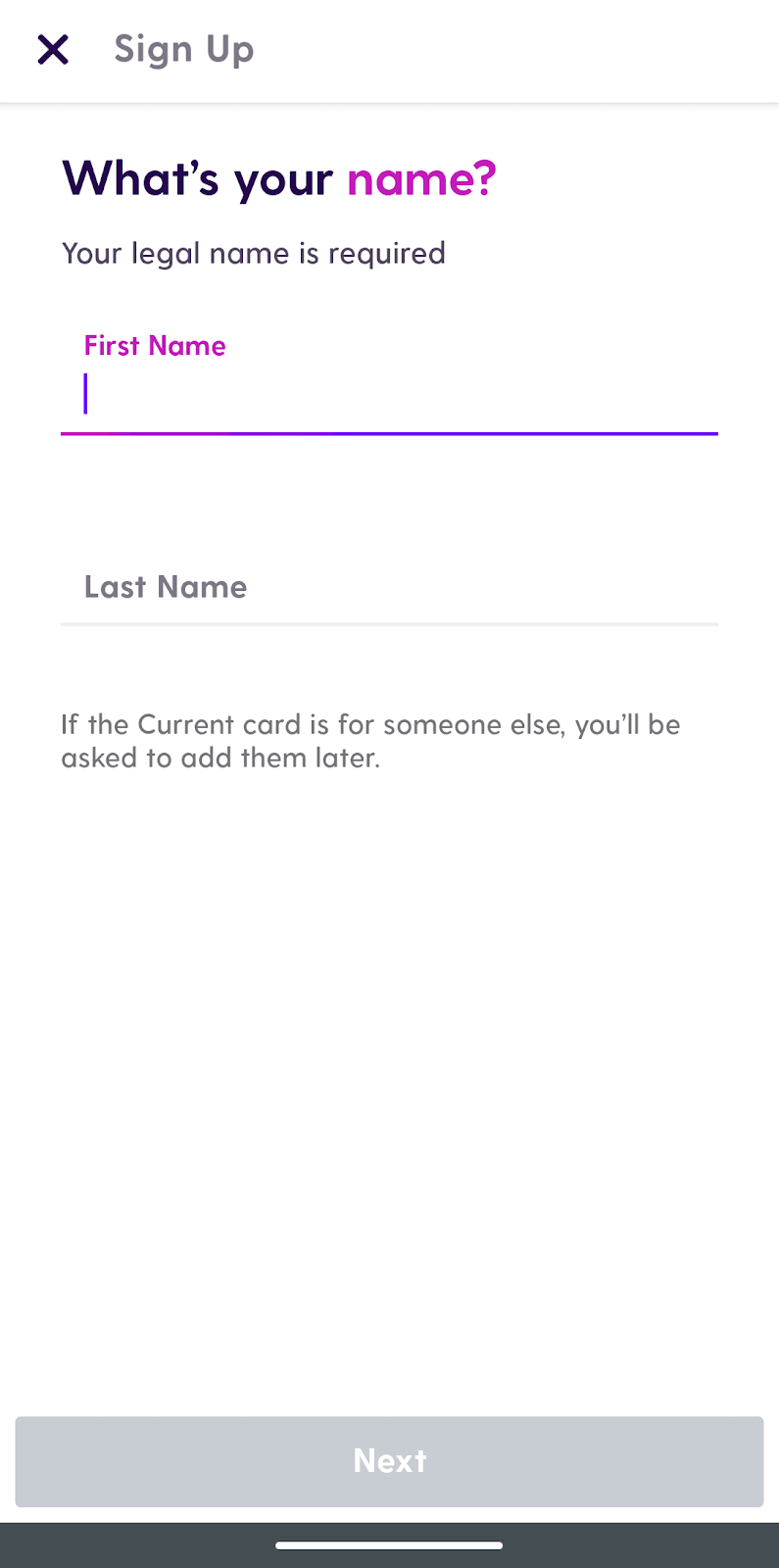

Next, I had to enter my first and last legal name and my date of birth.

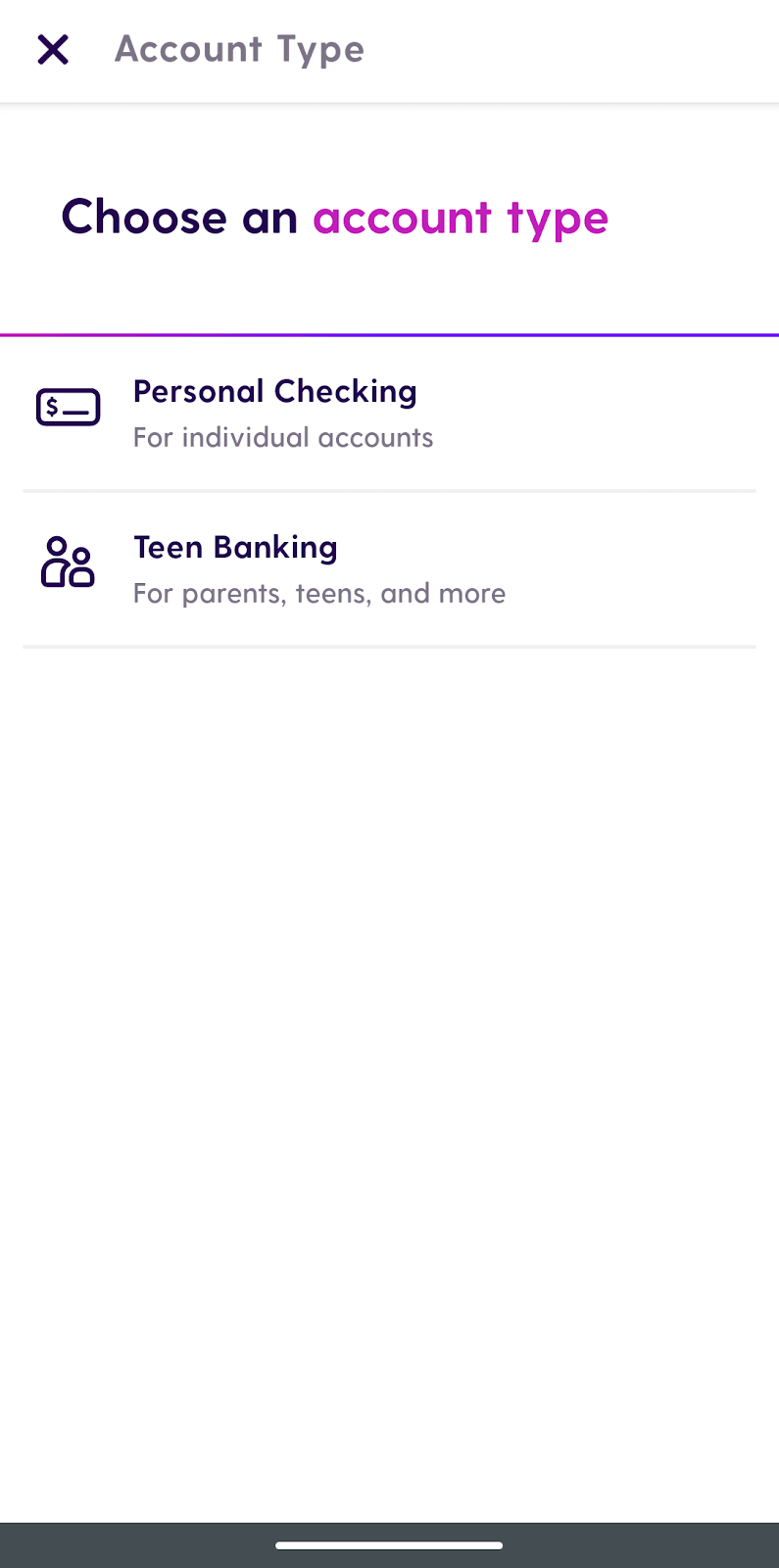

After that, I had to enter my legal street address. Please note that they do not accept P.O. boxes. Once I got to the next screen, it gave me the option to choose between a Personal Checking account or a Teen Banking account. I chose the Teen Banking account.

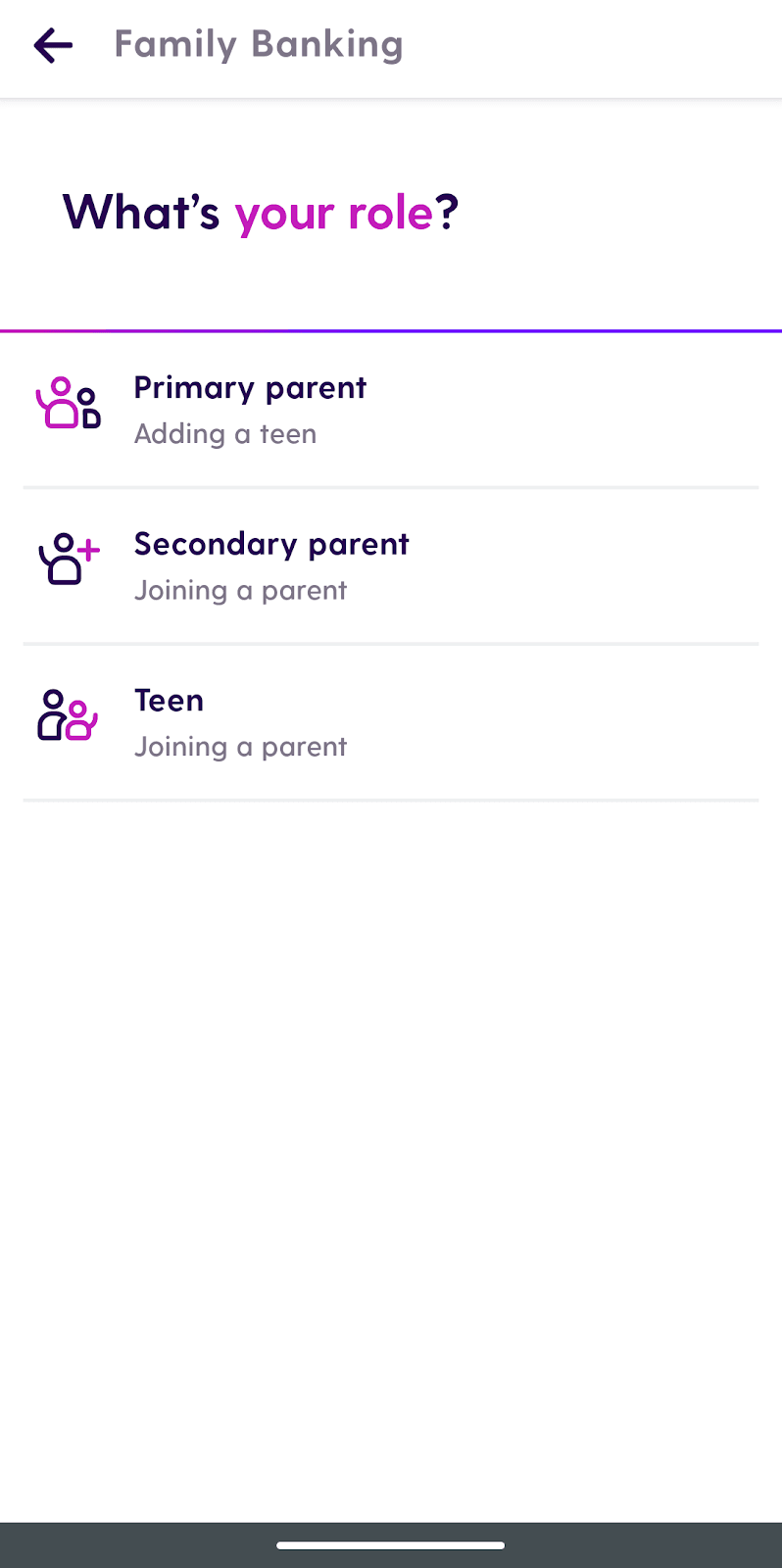

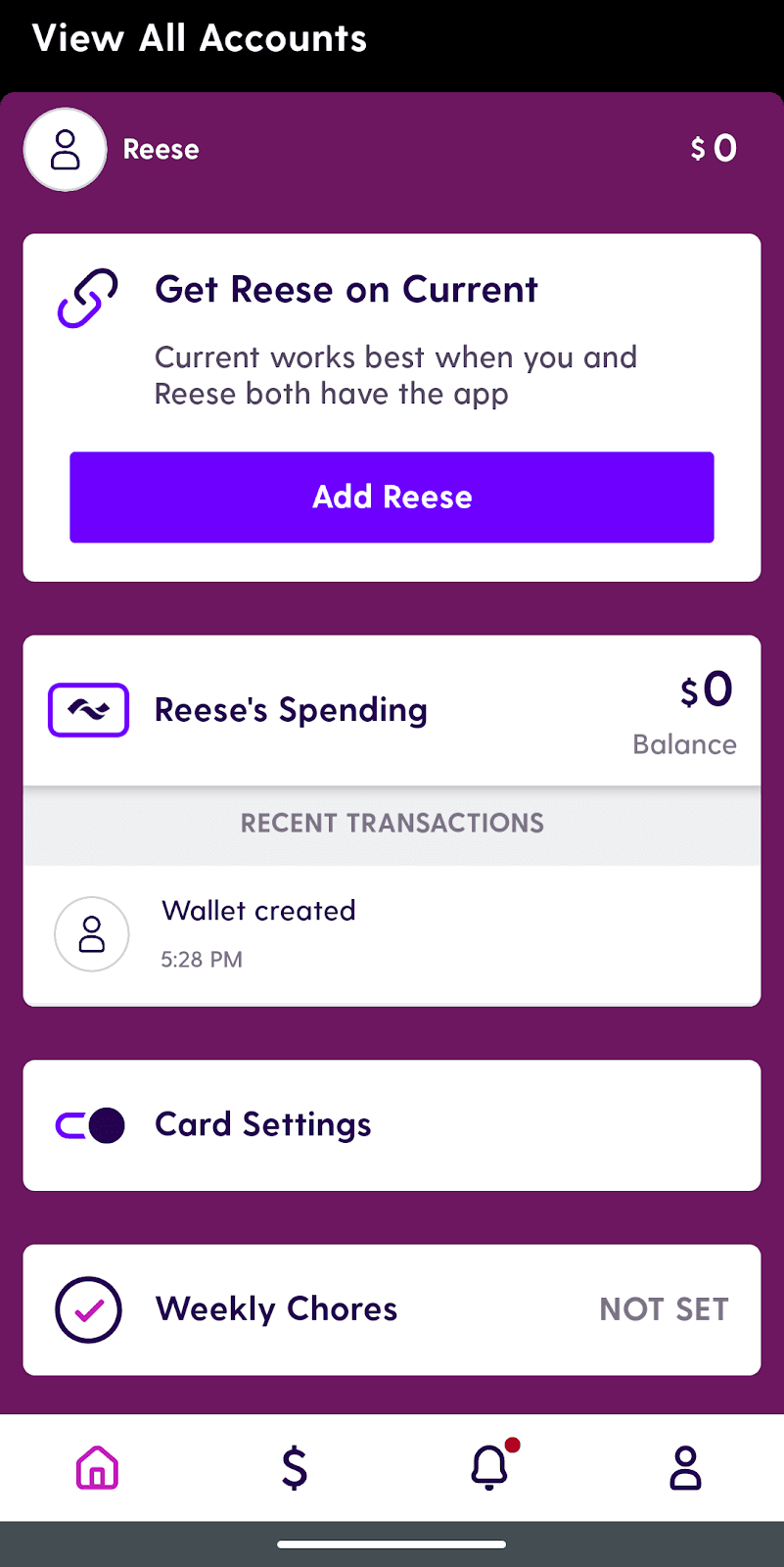

Then I was taken to a screen to choose my role. I chose the Primary Parent role since I am the one setting up the account for my teenager. I had to enter my teenager’s first and last name on this screen.

And then answer a question about what my son calls me. Next, I had to enter my teenager’s birthdate.

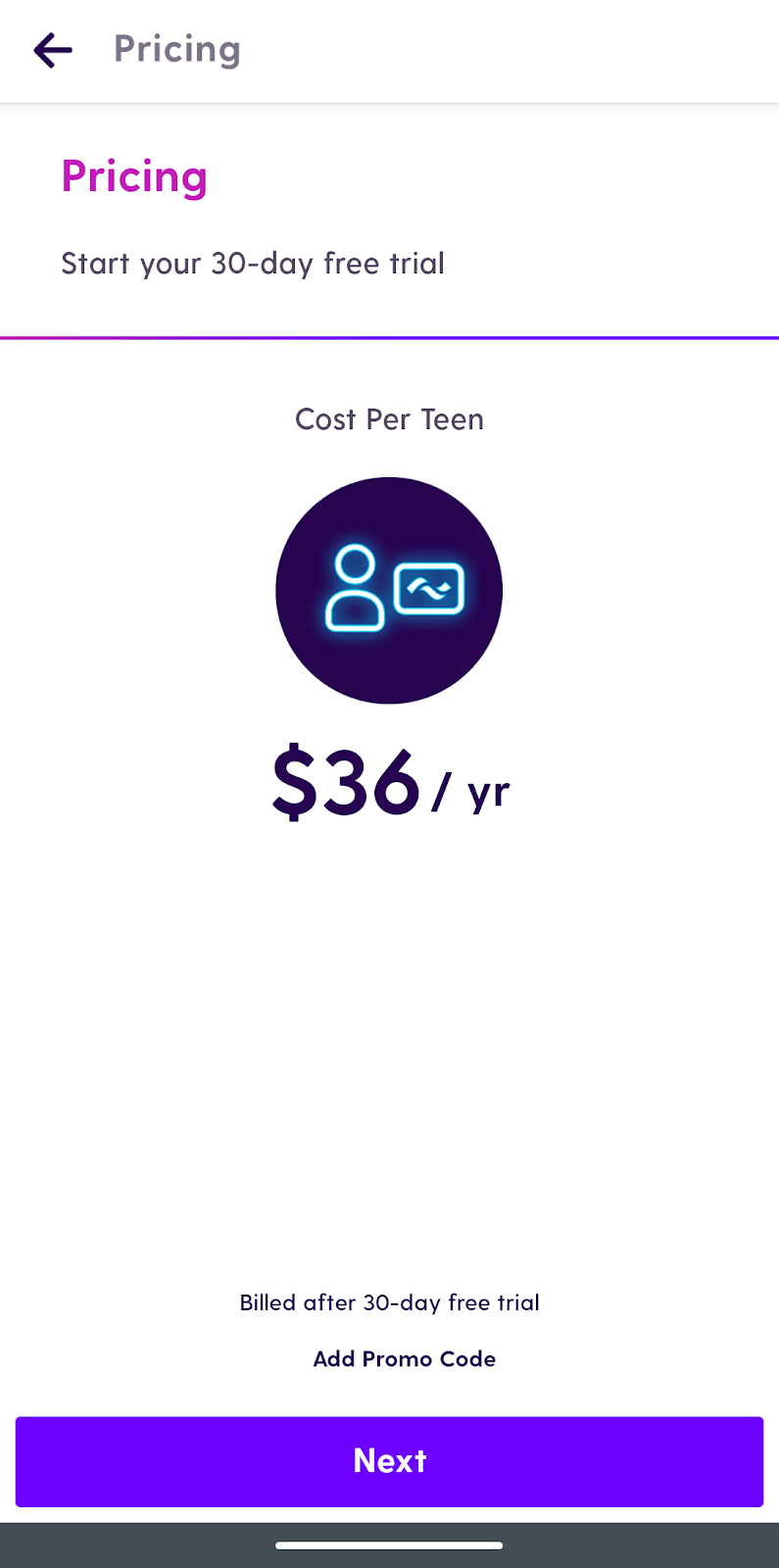

On the next screen, I got to choose whether I wanted him to have a black or white card or if he had one already. The last step was the pricing screen where I could start my 30-day free trial. And then I was told that I could expect my teenager’s card to be here in one to two weeks.

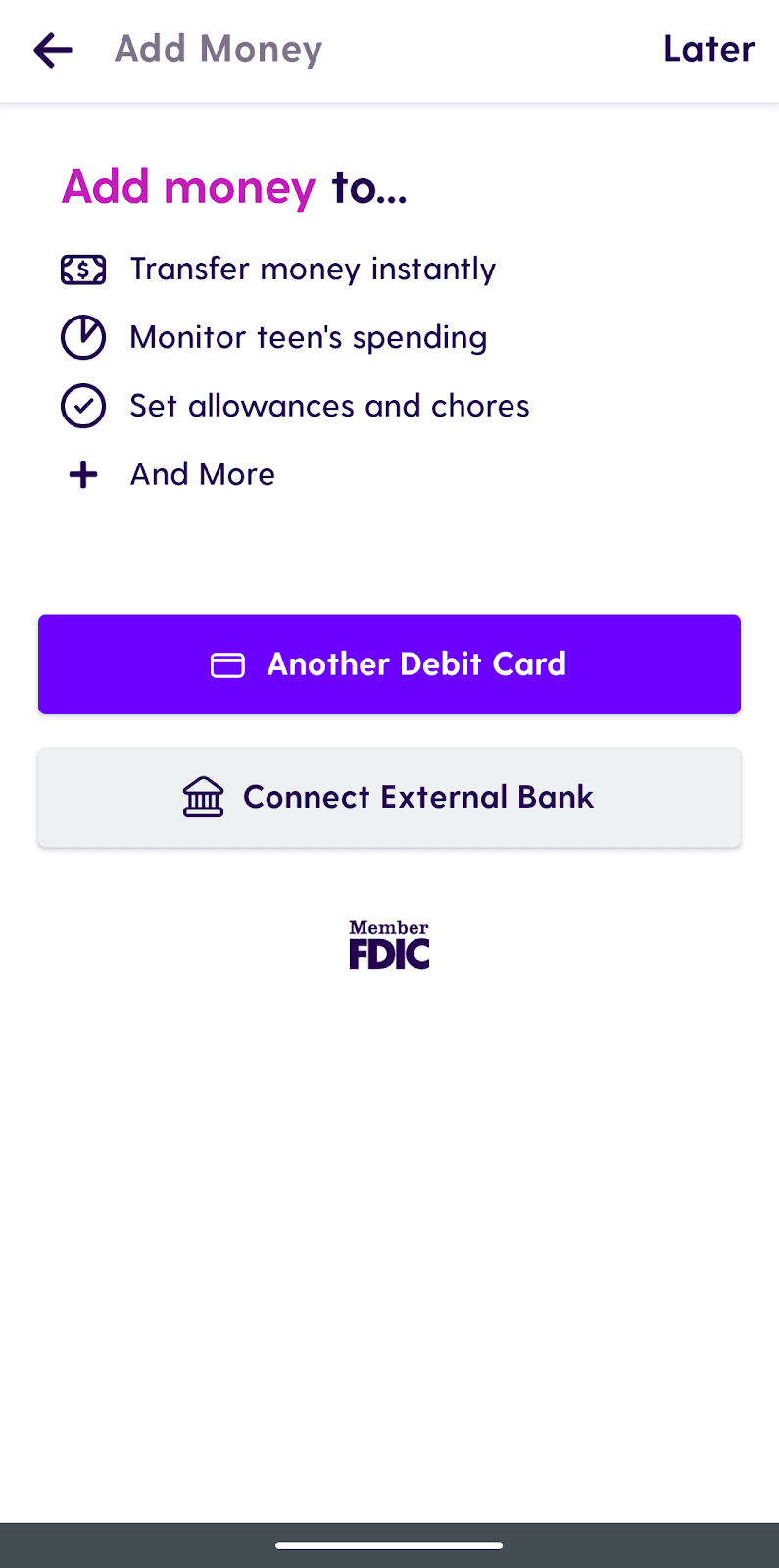

Next, I was sent to a screen to connect my external bank account. The option to go back and do this later was there as well. But if I didn’t connect a bank account, then the account wouldn’t be activated until I did that step.

After that, I was asked to choose a photo to use on my account and personalize my current account ~tag so people could find me. This is similar to how Venmo works.

Finally, I was taken to the home screen of the app and asked to add my son so that he could get the app also. Once he downloads the app, then he will connect his banking information and the two of us will be ready to go!

How much does the Current Visa Debit Card cost?

A lot of bank accounts still charge an annual fee, and Current falls into that category. While a lot of us might balk at the idea of paying an annual fee, hear me out. Current offers a 30-day free trial period before they charge anything. That way it gives you and your teenager time to try out all of the features before you fully commit.

If you do decide that the plethora of features are worth it on the path to teaching your teenager financial savviness, then it’s only a $36 annual fee to keep going. The fee comes out automatically after the trial period and then will come out every year after that unless you cancel.

If you decide to get paper statements or your teenager loses their debit card, then there are fees associated with those items, but that is pretty standard across the board. The only other fees they charge are a 3% international transaction fee and a $3 ATM fee for international ATMs. But throughout the United States, there are over 55,000 free ATMs at your disposal. These are easy to find with the Current ATM Finder, should your teen need to withdraw any money.

Current Visa Debit Card features

The features offered by the Current Visa Debit Card are some of the best on the market today, which makes teaching your teenagers about finances just that much easier.

Cash back rewards

When you use the Current app, there is a section to find participating merchants near you. Shopping with these merchants can earn you up to 15x points back. The rewards can then be redeemed for cash directly into your Current account – which is awesome!

You also have the option to block your teen from spending at certain merchants, giving you complete control of how your teen spends their (or, more realistically, your) money.

Notifications

You can easily set up parental notifications and spending limits within your account. That way you can see exactly what your teenager is spending when and where. And if they have been getting a bit carried away with their purchases, you can put the kibosh on that and set a spending limit. As much as they may not like this, these options help you keep the dialogue open regarding smart spending.

Savings goals

Current has an option for your teenager to create a Savings Pod also. This savings account can be controlled through the app. And what’s even better is that they offer the option to create round-ups, similar to how Acorns works. This makes for a big, or small, goal super easy.

Every time your teenager swipes their Current Visa Debit Card, a little bit of money can be moved to their Savings Pod account, funding their savings goal. Personally, I love this feature!

Enhanced security

Each Current account has a different login, which begins their higher level of security. This way, your teenager can’t get access to, or even see, your banking information. Plus, all of their debit cards come with the standard EMV chip and bank-level encryption. This is something we take for granted because we presume these options are standard practice everywhere now, even when they aren’t.

And since this is a Visa Debit Card, you will have access to Visa’s fraud liability protection department should you suspect foul play. Which, for me, has come in handy a few times throughout the years. Lastly, you can lock the Current Visa Debit Card if it has been stolen so it can’t be used anymore. But, if it returns as mysteriously as it disappeared, you can unlock it to begin using it again.

Deposits

One of the biggest issues we have run across with some of the smaller banking institutions has to do with deposits. Luckily, Current isn’t one of those banks that still requires you to make physical deposits. Because who is doing that anymore? With Current, you can deposit your checks directly through the app without ever having to go to a physical location.

And if you get funds direct deposited, you can get those faster than at a traditional bank or . Current can disperse your teenager’s direct deposit to them two days earlier than normal. Which is a great way to help them learn about budgeting and cash advances.

Gas hold refunds

Current does another thing differently than almost every other bank out there when it comes to gas holds. Usually, when you go to the pump and swipe your card, the gas station will put a hold on your account. This is why a lot of people prefer to purchase gas with a credit card instead of a debit card.

But, with Current, you don’t have to worry about using your debit card when you purchase gas. This is due to the fact that they automatically refund the gas hold to your account as soon as you finish filling up, which keeps more of your teen’s money in their account.

Free transfers

Current clearly keeps up with the times, which becomes abundantly clear with their transfer feature. Through, what Current calls their ~tag, you and your teen can instantly send or receive money between Current accounts without any fees. This is similar to how many payment apps (think PayPal and Venmo) work, but Current makes it available all through one convenient banking app.

Overdraft protection

Current offers Overdrive™, which is their overdraft protection option. This feature gives qualified premium members up to $100 in free overdrafts with no fees.

This is perfect if your teen tends to spend a little bit more than they should and you are worried about receiving a hefty .

My experience researching the Current Visa Debit Card

Ultimately, I was extremely pleased with the whole process. All of the features they offer for teens are above and beyond other products that I have found so far. Even though my kids have joint checking accounts where I bank, they don’t offer anything close to the features that Current does.

For starters, I loved how simple and easy the instructions are on their website to sign up.

And on top of that, they have a ton of drop-down links for all of the different features tied to their accounts, which include:

- Faster direct deposit.

- Free overdraft.

- No hidden fees.

- Earn points get cash back.

- Mobile banking.

- Free ATM withdrawals.

- Cash deposits.

- Gas hold refunds.

- Mobile check deposit.

- Money management.

- Automated savings.

- Current ~tags.

- Teen banking.

This made it really easy to sift through the noise and get down to the nitty-gritty, which also made it easier for my teenager to understand all the perks of the Current Visa Debit Card, too!

Who is the Current Visa Debit Card best for?

Teen banking

The Current Visa Debit Card is a great option for a lot of people. However, it is the best option for those of us with teenagers that don’t otherwise have access to a joint account with them. Since Current offers so many features geared directly towards teaching teenagers about money, this is really a one-stop-shop.

Those looking for robust features

Current has nearly every feature you can think of, from mobile deposit to early payday options when you use direct deposit to very few fees or minimum requirements. Since they’re clearly built for today’s fast-paced, technological world, Current is perfect for most of us.

Who shouldn’t use the Current Visa Debit Card?

Those who don’t want to pay an annual fee

If you have the option at your current bank to have a joint account with your teenager, then you may want to check there first. The $36 annual fee can be a determining factor for some people. So, if you want a no-fee account, there may be better options.

Folks without teens

While Current offers plenty of perks, one of the biggest is their Teen Banking account. If you don’t have teenagers, there are credit cards and debit cards out there that offer many of the same features, plus some that are more geared towards adults.

Pros & cons

Pros

- Parental controls — You can set up automatic notifications, spending limits, and block certain merchants.

- Many options — Current has checking and round-up savings accounts, as well as instant payments between accounts. Multiple family members can send funds, allowance payments can be sent, and chores can even be assigned for a set amount.

- Mobile app — The mobile app is extremely robust and everything can be done from within the app, so no need for physical locations. You can deposit checks easily, manage the money in your account, and more.

- Gas hold refunds — Current instantly refunds holds when you use your card at gas stations. This ensures that all account funds are fully available right away.

- Many ATMs available — Current offers 55,000 ATMs your teen can use for free.

- Great customer service — With Current, you’ll get access to 24/7 support, 365 days a year. You can contact customer service by phone, email, or live chat in the app.

Cons

- Fees — While the $36 ($3 per month) fee may not seem like a huge cost, it is still a lot more than many banks charge.

Current Visa debit card vs. Netspend® All-Access® Account

| Current Visa Debit Card | Netspend® All-Access® Account | |

|---|---|---|

| Digital platform | Yes | Yes |

| Savings account options | Yes | Yes, high yield savings with average 6% APY |

| Fees | $3 per month | Varies, $5 per month minimum |

Netspend® All-Access® Account

Netspend® All-Access® Account has a lot of similar features to the Current Visa Debit Card. They are geared more towards the younger generations in that they run on a digital platform and have a lot of options.

They offer two-day early paydays for direct deposits and free ATMs all over the United States, just like Current. However, the Netspend monthly fees are certainly higher than Current. The minimum monthly fee you will get is $5 per month, but you must have at least $500 direct deposited each month for that to occur. A lot of teenagers aren’t making that kind of money yet, so that could be a dealbreaker.

However, their savings account option might sway you back in their direction. They offer a high yield savings account with an APY of 6%, which is pretty darn good!

Summary

The Current Visa Debit Card is a great option for anyone who wants to teach their teens more about money management. The low annual fee and powerful parental controls make this account a no brainer. And with a vast expanse of offerings to help them learn how to save, spend, and budget, it’s hard to go wrong.

Read more:

- Banking 101 – A Guide For Teenagers (And Anyone Who Needs A Refresher)

- Credit Card Basics – A Guide For Teens