Imagine this common scenario:

You’re in an auto accident. Both cars are pretty banged up, and the other driver is clearly at fault. You call up your insurance company to report the accident and to prove the other driver’s liability. You send photos and a copy of the accident report provided by the police.

Thanks to your diligent info-gathering, your insurance company is able to file a third-party claim with the at-fault driver’s insurance. Their insurance cuts you a check to cover repairs, and everyone moves on with their lives.

You did everything right…right?

Most drivers don’t realize that in a scenario like this, they’ve actually left money on the table: potentially thousands of dollars.

You see, once your car has been in a collision, it permanently loses between 15% and 40% of its resale value, according to YourMechanic. This is because your car’s history report (Carfax, etc.) now has a permanent stamp that scares buyers: ONE ACCIDENT REPORTED

Your future buyer, whether they’re a dealer or a private party, will see that and wonder: “were the repairs done well? Were they comprehensive? Is there hidden frame damage, effectively totaling the car?”

So even if you got your Toyota Camry hand repaired by Akio Toyoda himself, your car has still lost hundreds, even thousands in resale value.

And the only way to recoup that money is through a diminished value claim.

What is a diminished value claim?

A diminished value claim is a claim you or your insurance provider files with an at-fault driver’s insurance company to recoup the lost value of your car after an accident.

When you get hit by another driver, your car suffers two types of value-loss:

- Damage. Your car has taken physical damage and needs repairs.

- Diminished value. Your car now has an accident permanently reported on its vehicle history, and has instantly lost up to 40% of its value.

Let’s say you got t-boned at a four-way stop by a distracted driver. Here’s the breakdown of the true value loss to your car.

- Damage. Your passenger side door is smashed in. A replacement door and paint costs $1,131.

- Diminished value. Your car has a passenger-side collision reported on its vehicle history. Buyers might be concerned that there’s underlying frame damage. The market value of your car has dropped from $8,000 to $6,300.

So even though your car has a shiny new door with no miles on it, buyers are worried about what else might be wrong with your car.

It’s totally fair for buyers to be cautious around cars that have one or more accidents reported. Here’s why.

If my car got repaired, why has its resale value still plummeted?

To see why cars with accidents in their history permanently lose so much value, let’s imagine for a bit that you’re the buyer.

You’ve started your research process where all informed car buyers start: Edmunds. You’ve narrowed down your choices by body type, read reviews from Edmunds staff and real owners, and finally, let the True Cost to Own tool be the tiebreaker.

After some test drives, you’ve decided on a Mazda3 (good choice). The next step is to browse used listings for cars in your area. A car pops up in the color you like. It’s well-equipped with low miles, and an excitingly low price.

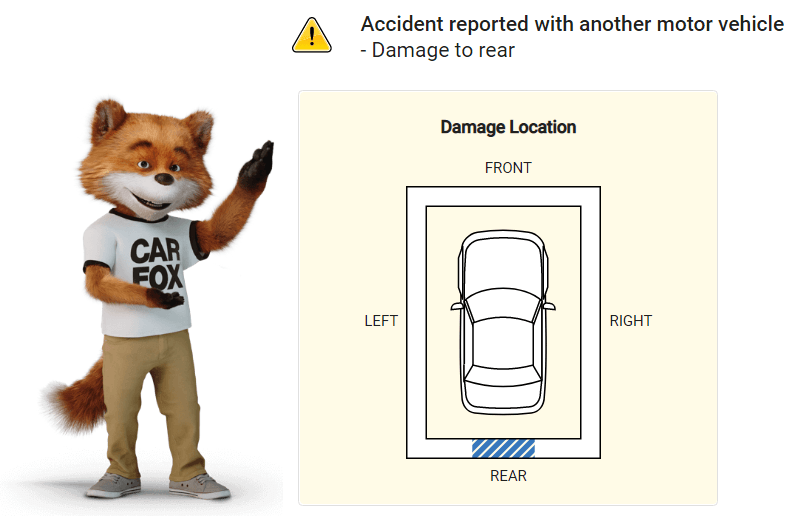

Time to look at the vehicle’s history. Crack open the Carfax and what do you see?

Well, that explains the suspiciously low price. Maybe it was just a minor accident? To find out, you click on the Carfax accident report to learn more.

Yeah, doesn’t say much, does it? And it’s not Carfax’s fault; they can only report the information they receive from owners, shops, and dealers. They’re a database, not a detective agency.

So in summary, as a potential buyer, here’s what you do know about this car:

- It was in an accident.

- It was damaged in the rump.

Here are just a few things that you don’t know about this car:

- Was the car even repaired?

- Were the repairs performed by a professional?

- Were the repairs made with OEM parts, or cheap third-party parts?

- Were the repairs comprehensive? Or was the bare minimum done to make it look good?

- Is there frame damage to the car, effectively totaling it?

- Is the car safe to drive?

- Did the collision affect any other areas that weren’t assessed?

- Did the impact of the collision shake other parts loose?

- Do all of the car’s electronics still work?

I could go on, but you get the point. This car could be worth its full value or totally worthless; you have no idea.

Now, as a potential buyer, you could do more research to answer some of these questions. You could research its VIN, track down the shop that did the repairs, and interrogate them about the quality and thoroughness of the repair.

But even after all that, you and your hired experts still may not be able to fully assess the damage this car is hiding.

Let’s say you still move forward and buy the thing. Good luck selling it one day, because it’s still a one-accident vehicle with poor resale value!

Alright, let’s go back in time to the first time you saw this:

Are you really going to bother doing weeks of research to get a Ph.D. in this car’s repair history? Or just skip it and find one without an accident on record?

In short, cars with one or more accidents reported lose so much value because buyers don’t want them. And buyers don’t want them because

- It’s extremely difficult to verify the quality and comprehensiveness of the repairs.

- Why bother? There are plenty of used cars without accidents reported.

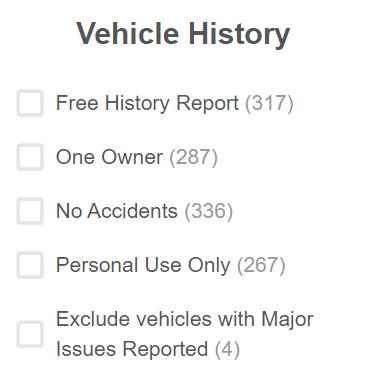

Buyers are so wary of cars with accidents in their vehicle history that Edmunds even lets you filter them out:

In summary, that’s why your car loses so much value after an accident; forgive the bluntness, but nobody wants it.

Therefore, the only way to recoup the lost value is to file a diminished value claim after every accident.

Why should every driver know about diminished value claims?

Successfully filing a diminished value claim is the only way to recoup your car’s depreciated value after an accident. Every driver should know about them because a little paperwork could quickly result in a check for $500 to $2,500.

Let’s calculate how much a diminished value claim could be worth for your vehicle.

Insurance providers use a formula called 17c to calculate a vehicle’s diminished value and write you a check. It’s actually a pretty simple formula.

Value of vehicle x 10% cap x damage multiplier x mileage multiplier = diminished value

Let’s do your car!

- Grab the value of your car from the National Automobile Dealers Association site.

- Multiply your car’s value by 10%

- Apply a damage multiplier. Here’s the whole list, but let’s use 0.75:

- 1.00 – Severe structural damage.

- 0.75 – Major damage to structure and panels.

- 0.50 – Moderate damage to structure and panels.

- 0.25 – Minor damage to structure and panels.

- 0.00 – No structural damage or replaced panels.

- Apply an age multiplier. Here’s the whole list again, but let’s use .80:

- 1.00 – 0-19,999 miles.

- 0.80 – 20,000-39,999 miles.

- 0.60 – 40,000-59,999 miles.

- 0.40 – 60,000-79,999 miles.

- 0.20 – 80,000-99,999 miles.

- 0.00 – 100,000 miles or more.

Let’s say you have a newer Toyota Camry XLE worth $25,000.

- 10% is $2,500.

- You sustained major damage: 0.75 x $2,500 = $1,875.

- Your car has 23,000 miles on it: .80 x $1,875 = $1,500.

The potential value of a diminished value claim after a big accident is $1,500. That’s in addition to the check you receive to cover repairs.

Even if your car is an old beater worth $6,000, your diminished value claim could easily be worth a few hundred bucks, so it’s worth the paperwork.

You might be thinking that $1,500 is ridiculously low and won’t cover the depreciated value of your car. I agree. Formula 17c is controversial, arbitrary, and not endorsed by the Insurance Commissioner’s Office. In short, it’s miserly. The notion that a car can’t lose more than 10% of its value after a major accident is insane.

17c was created in the wake of Mabry vs. State Farm (2001), in which plaintiffs essentially forced the auto insurance industry to recognize the reality of DV (diminished value). 17c, therefore, became providers’ way of throwing DV filers a bone.

Many private appraisers and law groups believe they can get you more than 10%, but more on that later.

Now, before taking the steps to file a diminished value claim (listed below), you’ll probably want to verify that the other driver’s insurance will accept your claim and you’re not fighting in vain.

Do all auto insurance providers accept diminished value claims?

Yes and no.

As a result of Mabry vs. State Farm, the following states now allow drivers to submit diminished value claims to at-fault drivers’ insurance companies:

- Arizona.

- Colorado.

- Florida.

- Georgia.

- Illinois.

- Indiana.

- Iowa.

- Kansas.

- Louisiana.

- Maryland.

- New Mexico.

- New York.

- Oregon.

- South Carolina.

- Virginia.

In Georgia, where Mabry vs. State Farm took place, providers are required to pay out for diminished value, even if the other driver wasn’t at fault (but only if they receive a claim!).

In short, if your situation meets ALL five of these criteria:

- You were involved in an auto accident where the other driver was found at-fault.

- You sustained damage to your car.

- You have substantial proof of your damage through photo evidence.

- You have proof of the other driver’s fault through a copy of the police report.

- You have proof of the other driver’s insurance and relevant information.

You have a good shot at getting a diminished value claim accepted and getting a check.

How should you file a diminished value claim?

To file a diminished value claim, you’ll have to collect and provide the following information to your insurance provider:

- The other driver’s insurance information.

- Proof of the other driver’s liability through a copy of the police report.

- Lots and lots and lots of photos of the accident.

Your insurance provider can usually take it from there.

But even the largest, most customer-centric providers may still ask for a bit more due diligence from you. They may recommend or even require you to secure a diminished value report from an independent appraiser.

This is common, and even if they don’t require it, I recommend it since it greatly improves both the chances that your diminished value claim will be accepted and the amount of money you’ll receive.

Read more: What To Do Immediately After A Car Accident

How do I hire an independent appraiser?

Your insurance provider may have a recommendation for a local independent appraiser to assess the diminished value of your vehicle.

If not, ask Google. Here are signs of a good, trustworthy diminished value appraiser:

- They have good customer reviews.

- They’re referred to by insurance companies.

- They’ve performed 1,000+ diminished value inspections/appraisals.

How much does an independent appraiser cost?

The cost of hiring an independent appraiser to produce a diminished value report varies depending on the severity of the accident.

If your car looks like this and the damage is pretty isolated, an appraiser can probably assess the damage pretty quickly, charging you as little as $150.

However, if your car looks more like this, and the accident has impacted tons of tiny, sensitive components, your appraiser may need an hour or two and will charge you up to $350.

In either case, however, it’s worth it. Insurance companies will have a much harder time rejecting your diminished value claim if it comes with a professional third-party report. They’ll have to concede that you did your homework.

If they reject your diminished value claim now, they risk seeing you lawyer up, and rightfully so. Insurance providers will do anything to stay out of court, so they’ll cut you a check for a few thousand bucks to make you go away, and you’ll do a well-deserved happy dance.

Summary

When your car gets hit by another driver, it loses between 10 and 40% of its value instantaneously. Buyers simply don’t want a car with an accident on its record, regardless of the quality of the repair.

Luckily, you can recoup around 10% of its lost value by filing a diminished value claim. As long as you take lots of photos of the accident and have a copy of the police report illustrating the other driver’s liability, you have a good shot. At that point, call up your insurance provider, let them know you’d like to file a diminished value claim, and they’ll help you take it from there.

You may have to hire an independent appraiser to write up a diminished value report for ~$150 to $300, but it’s worth it. Including a diminished value report in your claim can mean the difference in getting your claim accepted or rejected, and increase your payout by factors more than the cost of the appraisal.

Diminished value claims are a right that all drivers should know about. Without them, you could be leaving thousands of dollars on the table that you’re entitled to. Tell your friends, and drive safe!