There’s a reason why an identical tank top is $6 on Amazon and $15 at Old Navy. The price you pay at Old Navy helps offset brick-and-mortar overhead like physical space, clerk salaries, licensed music, and more.

Similarly, direct-to-consumer insurance providers have emerged with a simple strategy: less is more. Fewer human employees and physical addresses empower them to move lean and mean, offering highly competitive rates and innovating faster than the hulking behemoths of the industry.

Elephant is a direct-to-consumer provider backed by a British insurance giant aimed squarely at capturing the young American market. How are their rates? What innovations do they offer?

Let’s investigate Elephant.

Pros & Cons

Pros

- Sleek and modern online quote wizard — The company did an excellent job honoring the covetous domain of “www.elephant.com” — the site is among the most optimized and usable in the industry.

- High-value, innovative features — I personally could have saved nearly $1,000 with Elephant’s windshield insurance, and legal assistance coverage is a no-brainer for VA residents with strict and unforgiving law enforcement.

- Gap and Rideshare insurance — These are two oft-forgotten but vitally important types of insurance.

- Competitive overall — Many insurance companies don’t make an effort; they just put a worm on a hook and wait. Elephant offers truly competitive rates in the brutal direct-to-consumer arena.

Cons

- Questionable customer service record — Elephant receives a higher-than-average number of consumer complaints than insurance providers of its size, though the sample size is small.

- Only available in some states — At the time of this writing Elephant is only available in eight states: GA, IL, IN, MD, OH, TN, TX, and VA.

What Is Elephant Insurance?

Founded in 2009, Elephant is an innovative direct-to-consumer insurance provider with no independent agents. It operates in eight states.

Who Owns Elephant Insurance?

Elephant is a subsidiary of Admiral Group plc, one of the U.K.’s leading insurance providers.

How Does Insuring with Elephant Work?

While many insurance websites appear to be polished antiques, with quote wizards flanked by cringe-worthy copy from the 1990s (“live your ideal life”), elephant.com is simple, crisp, and modern. As an aside, I’m amazed that the domain elephant.com was free until 2009.

Anyhow, first impressions are stellar. Its minimalist style, along with the friendly, colloquial tone of its “About Us” page, reveal that Elephant probably understands its young buyers.

Because I don’t live in a state covered by Elephant, I solicited a quote for Marty McFly, a 29-year-old who drives a 2022 Infiniti Q50 (because DeLoreans are challenging to insure).

Elephant’s online quote wizard stood out to me in two ways:

Annual Mileage

Not all providers even ask about annual mileage, and when they do, it’s usually something along the lines of “above or below 15,000.” Elephant gets curiously granular, with options every 2,000 miles. If you drive fewer than 9,000 miles per year, consider securing quotes from both Elephant and a pay-per-mile insurer like Metromile.

Itemized Quote Breakdown

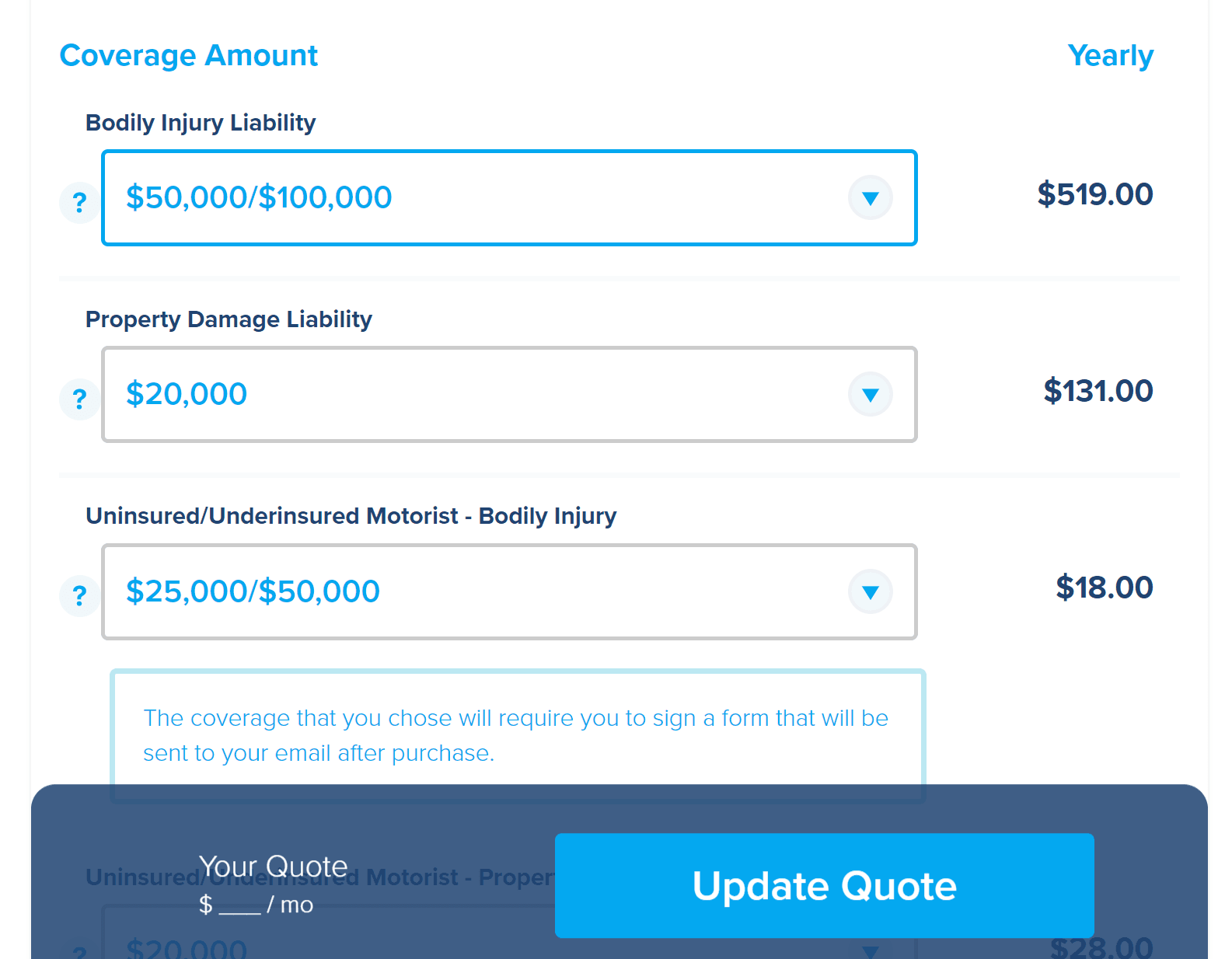

Unlike Game of Thrones Season 8, Elephant’s online quote process ended quickly and on a high note. I was pleasantly surprised to see an itemized breakdown of my quote, so I could tinker with my coverage and quickly see updated numbers.

Elephant Features

Elephant offers a few innovative, high-value features that make you wonder why more competitors don’t offer the same.

Direct to Consumer

I mentioned this earlier; so what does it mean? Elephant has no independent agents. You are buying insurance from a computer.

Companies choose a direct-to-consumer model to save money, and depending on who you are, this might just be a good thing. You may want to purchase car insurance the same way you buy stuff off of Amazon Prime — you just want to buy online, with no human interaction involved, and have it delivered quickly.

If you prefer having a live agent help you navigate coverage and the claims process, you may want to consider a provider with a network of live agents, like Liberty Mutual.

Windshield Replacement

Regardless of your coverage level, Elephant has an Express Glass Service, i.e., a dedicated claims team to help you repair or replace your windshield ASAP.

It actually makes good sense, and I don’t know why other providers don’t copy this model. If I ran an insurance provider, I’d do everything in my power to make sure my members could see out of their moving vehicle

Diminishing Deductible

Another innovative feature Elephant offers you is a diminishing deductible. For each year that you’re accident-free while insured with them, they’ll reduce your collision deductible by $100.

Elephant Insurance Roadside Assistance

Many insurance providers offer roadside assistance to simply check a box in their offerings. The actual quality of said roadside assistance…varies.

Elephant induces greater confidence by partnering with Urgent.ly, a roadside assistance app that enables you to easily communicate with and track your roadside savior.

Plus, Urgent.ly wins my award for Best Millennial Stock Photo:

Legal Assistance

Echoing the kindness and wisdom of its namesake, Elephant will help you contest one minor traffic violation per driver per year. They’ll cover the cost of a consultation and representation by a lawyer.

This could be a $1,000+ perk if you live in Virginia, as Virginia residents face some of the strictest and most expensive driving penalties in the nation.

Gap Insurance

How do you make “underwater car” sound way less exciting? Add the word loans to the end.

Your car loan becomes “underwater” when the value of the car is less than the remaining balance on the loan. Underwater is a bad place to be, because even if you sell the asset, you still owe gobs of money on your loan.

Gap insurance protects you from that scenario. Elephant requires you to have comprehensive and collision and that your loan is held by a bank to qualify, but it’s still worth mentioning nonetheless.

Multi-Car Discount

This isn’t an uncommon feature among auto insurers, but Elephant’s multi-car discount is really good — up to 40%.

Elephant Insurance Reviews for Customer Service

Elephant claims they chose their name because the world’s largest land animal “is kind, caring, and looks out for the herd.” Do the numbers support their claims?

A.M. Best gave Elephant an “A+” rating, basically meaning they can, and do, pay out their claims to “the herd.” According to the National Association of Insurance Commissioners (NAIC), in 2018 Elephant received complaints at 2.76 times the national median. However, that number was based upon fewer than 60 complaints.

Given Elephant is a small provider with a small sample size of data, it’s hard to say unequivocally whether they treat customers well or not. The common thread among frustrated customers is an arduous and stingy claims process, which stands in stark contrast to how customer-forward everything else is.

Getting payout for claims can be a smoother process when human agents are involved, but that of course isn’t the case for Elephant.

Elephant vs. Competitors

A mixed customer service record can be ameliorated by rock-bottom rates. So how does Elephant stack up?

I checked the rates offered by Elephant for the below two driver profiles. Rates are listed as a six-month policy with typical discounts applied.

- Marty McFly. 29-year-old male. Drives a 2022 Infiniti Q50. No violations. Rate: $1,719.

- Danny Targaryen. 23-year-old female. Drives a 2020 Kia Soul. One at-fault accident. Rate: $1,037

I also looked at features and perks offered by Elephant’s competitors as well.

I came away from my competitive analysis with a greater admiration for Elephant. So many small insurance companies don’t even make an effort; they simply prey upon ill-informed consumers and bank on decades worth of lazy loyalty. Many even punish long-time policyholders by jacking up rates.

Elephant, by contrast, seems self-aware of its major shortcomings and is making a sincere effort to earn its policyholders. Elephant’s greatest disadvantage is only being available in eight states (GA, IL, IN, MD, OH, TN, TX, and VA) but if you do live in one of those states, Elephant makes a compelling case for your business.

But, to give you a sense of how Elephant compares to some bigger-name competitors, here are a few other options to consider:

Metromile

- Advantage: Cheap for low-mileage drivers

- Disadvantage: No gap insurance

- Sample Rate 1: $1,486.8

- Sample Rate 2: $983.46

If you live in Illinois or Virginia, you have the option of insuring with Elephant or Metromile. While Elephant takes steps to discount low mileage drivers, they likely can’t beat Metromile at their own game.

Where Elephant might hold the advantage is in features; Metromile doesn’t offer gap insurance, for instance.

Learn more by reading our full Metromile review or get a Metromile quote now.

Liberty Mutual is an insurance company that has been around for over 100 years and has consistently marketed themselves as an insurer that really cares. In fact, one of their main slogans is: “we believe insurance should ease your concerns, not cause them.”

Liberty Mutual offers a big selection of policies, including home, renters, auto, life (term and whole life), flood, business, accident, and pet insurance.

- Lots and lots of discounts

- Make a claim in minutes

- Fast quotes

- Pay-per-mile option

- A company who cares

- Not the best customer service reviews

- Not all coverage is available in every state

- Advantage: Backed by human agents

- Disadvantage: Less forgiving of at-fault accidents

- Sample Rate 1: $1,539

- Sample Rate 2: Driver profile uninsurable

The battle of Elephant vs. Liberty Mutual is one of coverage versus customer service. Liberty Mutual has more agents to take your call and help you navigate the claims process, but Elephant has better overall coverage options and will likely pay out more by the end.

Between court fees and rate spikes, having an at-fault accident can cost you tens of thousands in the long run. But Elephant alleviates both of those through their legal assistance coverage and greater accident forgiveness. Liberty Mutual couldn’t provide a quote for my imaginary driver, Danny Targaryen, who has one at-fault accident on her record.

Learn more by reading our full Liberty Mutual review or get a Liberty Mutual quote now.

Progressive

- Advantage: National availability

- Disadvantage: No legal assistance coverage

- Sample Rate 1: $1,347

- Sample Rate 2: $1,076

Elephant and Progressive are neck and neck rivals; they’re both direct-to-consumer providers offering solid technology and low premiums.

Facing down Progressive — a Fortune 500 insurance provider with customers in every state — Elephant knew they had to come prepared, and they did. Elephant’s secret weapon is its legal assistance coverage.

For as little as $5 per month, this coverage is like having a $350/hour attorney in your back pocket. As stated on Elephant’s website, the coverage can help you contest $1,000+ tickets and fees, but you don’t have to be in trouble to use it. Consult a high-quality attorney, file a claim, and you’re covered. It’s an incredibly generous no-brainer with no equal at Progressive.

Learn more by reading our full Progressive review or get a Progressive quote now.

My Experience with Elephant

I’d be more nervous to insure with Elephant if it were just another faceless insurance startup. But the fact that it’s backed by one of the U.K.’s largest insurance providers, Admiral, is slightly more comforting.

I typically use this section to also share my experience with live agents, but that of course doesn’t apply here.

Overall, Elephant strikes me as a provider with a lot of potential. Its site is fast and sleek. Its About Us page is endearing and honest, like they’re trying to be efficient, but human. Their perks and benefits, like Urgent.ly and diminishing deductibles, are fresh and innovative, and clearly geared toward long-term customer retention.

Because their rates aren’t particularly competitive, I’m worried they may struggle to expand out of the few states they operate in. I hope they do. In fact, I’m cheering for them. The auto insurance industry could always use a new disruptor to keep the incumbents on their toes.

Who Is Elephant Best For?

Virginia Drivers

Virginia has some of the strictest driving laws in the country. Driving over 80mph anywhere in the state can lead to a $2,500 fine and jail time, as this one Jalopnik writer discovered.

It’s no coincidence that Elephant, headquartered in Richmond, offers perks tailored to defend against these draconian driving laws. Legal assistance insurance starts at around $5 per month and can save you thousands. Plus, their rates don’t seem to spike following an at-fault accident.

Winter Drivers

I remember living in Madison, Wisconsin when half of the city’s windshields cracked overnight due to the plummeting temperature. Chaos ensued as many residents couldn’t get to work and garages were overwhelmed.

For that reason, for Elephant to have a hotline dedicated to windshield replacement is pure genius. It further illustrates how Elephant understands and is looking to meet the needs of the customers in the territories they cover.

Who Is Elephant Not Ideal For?

Drivers Who Value a Connection to a Live Agent

Elephant has 417 employees on LinkedIn. By contrast, Progressive has tens of thousands. Elephant’s small team is not in the traditional business of building in-person relationships with policyholders.

They keep you covered for low rates and innovate new features and discounts, but if you value that long conversation with your insurer every six months, you might want to consider a more traditional provider.

Drivers Who’ll Pay a Premium for A++ Service

As mentioned throughout this review, Elephant’s customer service record is unproven at best. Elephant scores below the industry average for complaints by size, but the sample is so small that it feels a little unfair to ding them.

Still, if you’re looking for a direct-to-consumer provider with a proven track record of customer service, consider GEICO instead.

Summary: Is Elephant Insurance Good?

Elephant is a fresh, innovative insurance provider with an honest message and reasonable rates. Being unable to judge their overall customer service is slightly disconcerting, but being backed by one of the U.K.’s largest insurers reinvigorates confidence. Their generous multi-car discount and innovative perks like diminishing deductibles make them a provider to watch.

Read more:

- How to Compare Car Insurance Quotes

- Find Out the Average Cost of Car Insurance Per Month