You’ve probably heard of “sustainable investing,” i.e. investing in companies that treat their employees, customers, and Mother Earth, with respect. These are also known as ESG stocks, an acronym I’ll pull apart later.

But did you know there’s an opposite investment strategy on the market? A Sauron to ESG’s Gandalf? It’s called “sin stock” investing, and it involves, quite literally, companies that engage in “sinful” behavior.

I know – sounds made up, but it’s real. There’s a lot of hype surrounding ESG investing, but sin stock investments are shooting up as well.

As always, an educated investor considers all options.

Let’s compare and contrast ESG vs sin stock investing!

What is ESG investing?

ESG stands for Environmental, Social, and Governance. ESG synonyms include sustainable investing, socially responsible investing, and impact investing.

Investors prefer the acronym ESG, however, because it literally spells out the three criteria that they’re looking for in an investment:

- Environmental – the company is eco-friendly.

- Social – the company treats its stakeholders and employees well.

- Governance – the company has morally upright leadership.

Not all ESG companies exude all three qualities, however. In fact, the ESG label itself is entirely subjective. There are no universally agreed-upon standards for what constitutes ESG, so it’s really up to the investor.

For example: a cigar company may check a mutual fund’s ESG boxes because the company’s eco-friendly processes and treatment of employees outweigh its impact on public health.

The point is, ESG companies aren’t perfect, but they’re generally considered the progressive, forward-thinking, wholesome good guys.

How do I spot an ESG stock?

The easiest way to find ESG companies is to ask Google. There are dozens of curated lists out there highlighting the top 50 or 100 ESG stocks, with common mentions of:

- Nvidia (NVDA).

- Microsoft (MSFT).

- Texas Instruments (TXN).

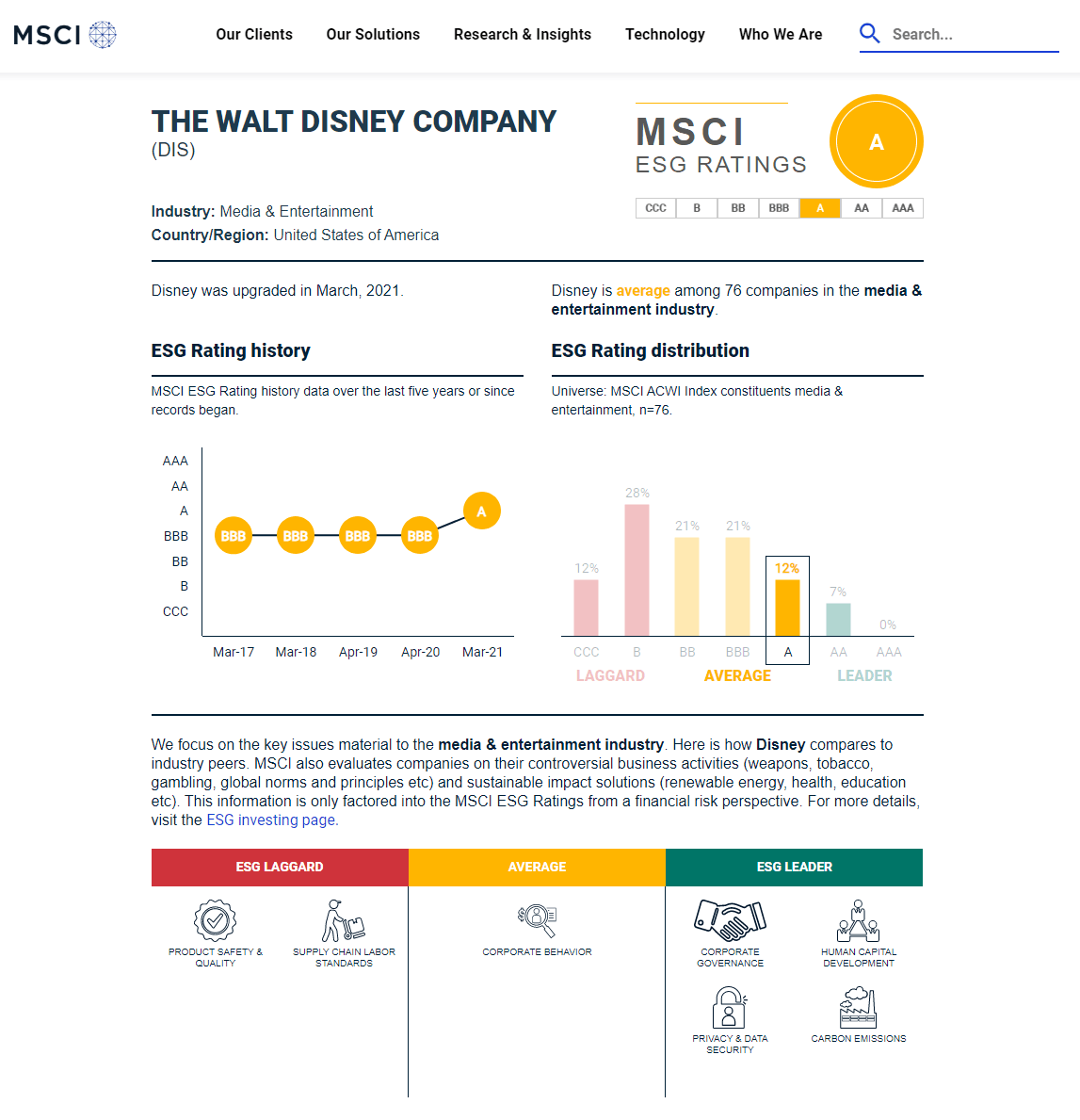

You can also tinker with MSCI’s ESG Ratings Corporate Search Tool, which has cataloged MSCI’s own ESG ratings of over 2,800 companies.

If you are unsure, ask yourself these questions

To help you assess smaller companies, and further illustrate what defines ESG, consider these nine sample questions an ESG investor might ask before anointing a stock with the designation:

Environmental

- What are the company’s climate change policies?

- How dedicated are they to the development and implementation of renewable energy?

- Do they encourage, equip, and empower their employees to be more “green” at work and at home?

Social

- How happy are the company’s employees? What do they have to say on Glassdoor?

- Does the company have satisfied customers? How have they responded to critical consumer feedback?

- What social or political issues does the company tangibly support?

Governance

- Does the company have a diverse board of leaders?

- Are shareholders happy? Why or why not?

- Is there a large discrepancy between executive pay and worker pay?

Do ESG stocks outperform non-ESG stocks?

There was a time when sustainable investing was considered a bit of a sacrifice.

After all, every dollar these companies spent trying to make a more eco-friendly shoe, or finding ethically sourced ingredients, meant slimmer profit margins. Smaller margins meant worse quarterly performance, lowering share prices.

Therefore, “sustainable investing” was considered something you’d do to appease your fund’s more progressive clientele.

Oh, how times have changed.

Today, investor perception of ESG companies is that they’re future-proof, well operated, and better suited to attract top Millennial and Gen Z talent.

ESG isn’t just ethical – it’s practical. ESG CEOs aren’t just granola-crunching idealists – they’re highly effective leaders who can afford to implement ESG practices because the rest of their business is so well-run. According to BlackRock’s 2021 Letter to CEOs:

“companies with better ESG profiles are performing better than their peers.” The infamous investment firm calls the extra cash you’ll pocket investing in ESG the “sustainability premium.”

To summarize, ESG companies score highly in Environmental, Social, and Governance factors. Their raw performance – and rising investor perception – are leading them to outperform the S&P 500.

Let’s look now at the other side of the spectrum.

What is sin stock investing?

Sin stocks are shares of companies that are involved in immoral, unethical, or generally “naughty” behavior. I like to call them Grand Theft Auto stocks because they typically involve some combo of sex, alcohol, gambling, guns, drugs, and prison.

Generally speaking, a company is considered a “sin stock” if they indulge in at least one of the “seven deadly sins” from Christian teachings:

- Pride.

- Greed.

- Lust.

- Envy.

- Gluttony.

- Wrath.

- Sloth.

For example, weapons manufacturers could fall under “wrath,” adult entertainment under “lust,” and beer and weed under “gluttony.”

Samples of sin stocks include, but aren’t limited to, the following:

- Craft Brew Alliance (BREW).

- Smith & Wesson Holding Corp (SWHC).

- CoreCivic (CXW) (formerly Corrections Corporation of American).

- Caesars Entertainment (CZR).

- Northrup Gruman (NOC).

- British American Tobacco (BTAFF).

- Aurora Cannabis (ACB).

How do I spot a sin stock?

As you’ve probably surmised, sin stocks are much easier to spot than ESG stocks. When surveying a company for your sin portfolio, you can ask yourself:

Does this company provide something used in Grand Theft Auto?

If you don’t play GTA, you can use the seven deadly sins as a sin-o-meter, or simply check your own moral compass.

Generally, if the company feels “naughty” or “sketchy”, it’s probably a sin stock.

Do sin stocks outperform non-sin stocks?

Like ESG stocks, sin stocks also tend to outperform regular companies. The unique makeup and perception of ESG stocks and sin stocks give them both a small performance boost in the overall market.

However, the nature of that boost is a little different.

- ESG stocks get a small push upwards from good management, good perception, etc.

- Sin stocks get a large push upwards due to company performance and a medium push back down due to mixed perception, among other factors. The combined forces net in a small push upwards.

To illustrate what I mean, here are the two main forces giving sin stock performance a large boost upwards:

Sin stocks are more recession-proof

Pop quiz: which stocks exploded during the Great Depression?

Yep, booze and tobacco.

Even if the economy tanks, people don’t suddenly stop wanting sinful products.

If anything, they want them more.

As a result, sin stocks outperform the S&P 500 during recessions, lending to their other classification: “defensive stocks.”

Sin stocks are “protected” by regulations

Companies selling “sinful” products have typically had to survive decades of regulatory scrutiny. Having emerged on the other side, they’re now extremely hard to catch. Even if a new competitor emerges and survives the regulatory gauntlet, they may never make up for the lost time and resources, allowing the existing sin stock to keep its crown.

So those are the two main factors driving sin stock performance up.

Let’s now talk about the two primary forces keeping them in check.

- Many investors avoid them. Religious, conservative, and ESG investors tend to avoid sin stocks for obvious reasons. Even institutional investors who otherwise have no problem with sin stocks will still refrain from adding them to the portfolio, lest they upset their more conservative or green-minded investors.

- Government scrutiny will always be a threat. While government regulations do help out sin stocks by keeping competitors at bay, that’s just a happy byproduct of their true purpose: punishing sin. Volkswagen Group stock (VWAGY) plunged 50% after news broke of the emissions scandal in 2015, and with their latest “emission cartel” becoming public, sin stock investors may want to brace for another unexpected loss.

To summarize, sin stocks are companies engaging in sinful behavior or selling sinful products. Overall, sin stocks tend to outperform the S&P 500, but there are forces both positively and negatively impacting their share prices.

Which type of stock will make you more money?

I wish I could pick a definitive winner between the two so I could send you off to make some trades. In reality, the answer is a bit more complicated than just X outperforms Y.

I say that because performance-wise, ESG and sin stocks are neck in neck.

Despite pointing in opposite directions on the moral compass, both types of stocks tend to outperform the S&P 500 by the same amount – between 5 to 20 percentage points.

Thus, the pair stand on opposing ends of the same scale, providing a Thanos-approved, perfect balance in the markets.

Therefore, which you choose to invest in will come down to two things:

- Qualitative factors, like your personal preferences and moral code.

- Which type of stock you think has greater long-term potential.

ESG vs. sin stock investing: pros and cons

From a purely moral standpoint, ESG stocks pretty clearly take the cake.

But if you’re looking for the right investment from a financial perspective, the division between good and bad becomes muddier than a season of Game of Thrones.

Let’s start with the good and bad of ESG:

ESG investing pros

- Moral victory. Investing in ESG companies should give you the warm-and-fuzzies, knowing that you’re a part-owner in a company that treats employees well, honors its mission, and/or leaves an earth-friendly impact.

- Institutional support. There are entire networks, firms, and ETFs dedicated to ESG investing, with more arriving every day. Needless to say, you’ll be part of a growing trend of conscious capitalism with plenty of advisors and fellow investors to lean upon.

- Next-gen support. Trends indicate that Millennials and Gen Z prefer to work for, purchase from, and even invest in ESG companies versus sin stocks – a small difference that could propel ESG companies well past sin stocks over time.

ESG investing cons

- Short track record of performance. Depending on who you ask, ESG investing as a recognized market strategy has only been around for a few years. That’s not a lot of data to pull from to definitively say it’s the way of the future, or will even last as a trend.

- Fuzzy metrics. Because there are no universally agreed-upon standards for ESG, unsavory funds may start using it to mislead investors, watering down the term’s meaning in the marketplace.

- The government doesn’t understand ESG. In late 2020, the Department of Labor issued a confusing statement that sounded like they were banning ESG investments from retirement plans. Following the backlash, they later stated that they needed to “revisit the rules.” When a big investor like the U.S. government doesn’t “get” something, it’s not good for business.

Sin stock investing pros

- Proven performance. Sin stocks have been outperforming the general market by at least a few percentage points since the Great Depression.

- Long-term reliability. Two main reasons why sin stocks are so perennial and recession-proof are that government regulations keep competitors at bay, and people always need the “sinful” stuff they’re selling – regardless of a tanking economy.

- Potentially undervalued. Because many institutional investors won’t touch sin stocks, many smaller investors see them as massively undervalued. For example, if a sin stock ousts its morally bankrupt CEO, big firms may suddenly reclassify the stock and buy-in, creating massive gains for investors who bought in during the “sinful years.”

Sin stock investing cons

- Moral questions. Depending on your stance on certain topics, investing in sin stocks may give you the opposite of the warm-and-fuzzies (cold and scratchies?). You may face little hesitation investing in beer, but overpriced pharmaceuticals and for-profit prisons may be a step too far.

- Limited institutional support. Unlike ESG investing, there are very few firms or institutional investors who will proudly proclaim that they focus on sin stocks. Your choices for advisory support and ETFs may be limited.

- Moral bankruptcy can lead to literal bankruptcy. Sin stocks are more likely than ESG stocks to prop up scumbag CEOs and cultivate toxic cultures, leading to 10-figure fines and plummeting share prices. See: Nissan, Enron, VW.

Where to invest in ESG and/or sin stocks

You can buy ESG and sin stocks (and ETFs for both types) from your favorite online broker.

Here are two that I would consider:

- Robinhood is a better landing pad for beginners, with an intuitive design, clean interface, and a robust, rewarding learning center.

- Webull is a bit more advanced, with more of the tickers and charts you’d expect to see on a Wall Street trader’s monitor. Despite the extra tools and analytics, however, it’s just as free to use as Robinhood.

Summary

ESG and sin stocks are fascinating if you ask me. Despite representing polar opposite ends of the moral investing compass, they perform about the same financially and offer endless fodder for debate with your fellow investors.

And don’t judge yourself too harshly for investing in a sin stock; everyone needs a beer once in a while.