Identity theft is something everyone should take seriously. It can be a costly event that takes up a significant amount of your time. Unfortunately, I’ve experienced this first hand.

What started as a criminal making a fraudulent charge on my credit card turned into full-blown identity theft. The criminal knew my Social Security Number. They started a balance transfer to my credit card, which I just had reissued.

Thankfully, I caught it before the balance transfer went through, and my bank was able to stop it. They added additional security to my account and I haven’t had a problem since.

Identity Guard is a service that can help you deal with identity theft issues. But should you purchase a service like Identity Guard? It depends. Here’s what you need to know.

What is Identity Guard?

Identity Guard is a U.S.-based service located in Virginia, with corporate locations in Virginia and Massachusetts, that focuses on helping people protect themselves against identity theft. It was created by a company called Intersections Inc., which was founded in 1996. In 2019, Intersections Inc. launched Aura Company, which owns Identity Guard.

The process of using Identity Guard takes about five steps. First, you sign up for the service. Next, you set up a watch list so Identity Guard can monitor activity. Then, you learn best practices to help you avoid identity theft.

Over time, you’ll get alerts. You’ll need to review them to make sure identity theft isn’t taking place. Finally, Identity Guard will help you recover your identity and restore funds if you become a victim of identity theft.

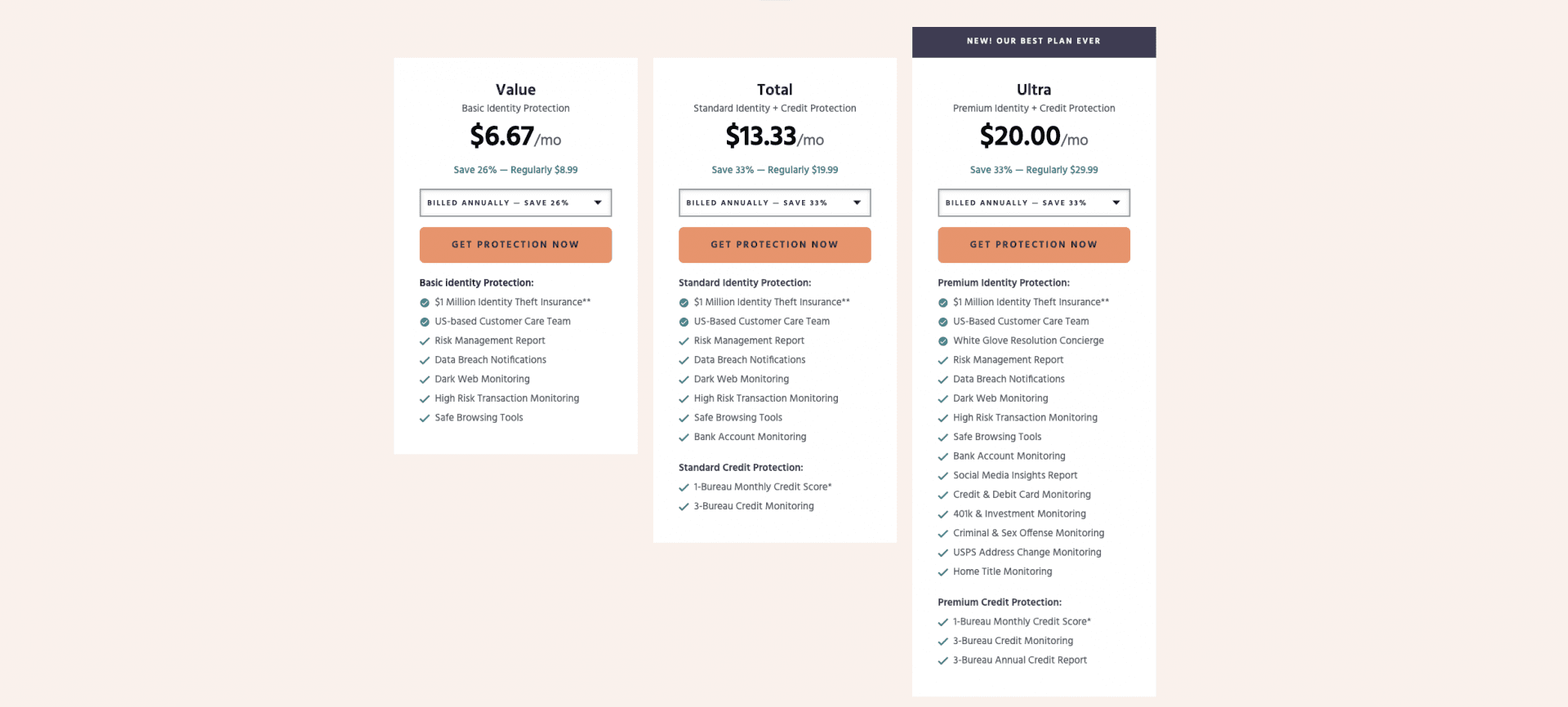

Identity Guard offers three plans at different price points. Each provides varying levels of service to help prevent and monitor for identity theft.

How does Identity Guard work?

Signing up with Identity Guard is a super simple process.

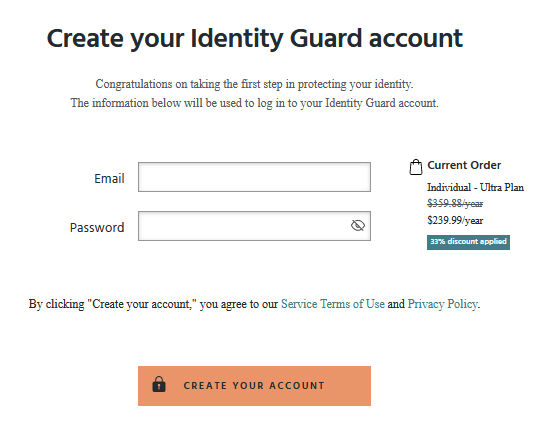

After clicking “Start My Membership” in the top right corner of the website, you’ll be taken to a page where you select your plan.

On this page, you can toggle between individual or family options depending on the number of people you want to cover. Under each plan, you can toggle between getting billed annually, which is cheaper, or getting billed monthly.

Next, you create your Identity Guard account by providing your email address and creating a password. Click Create Your Account to continue.

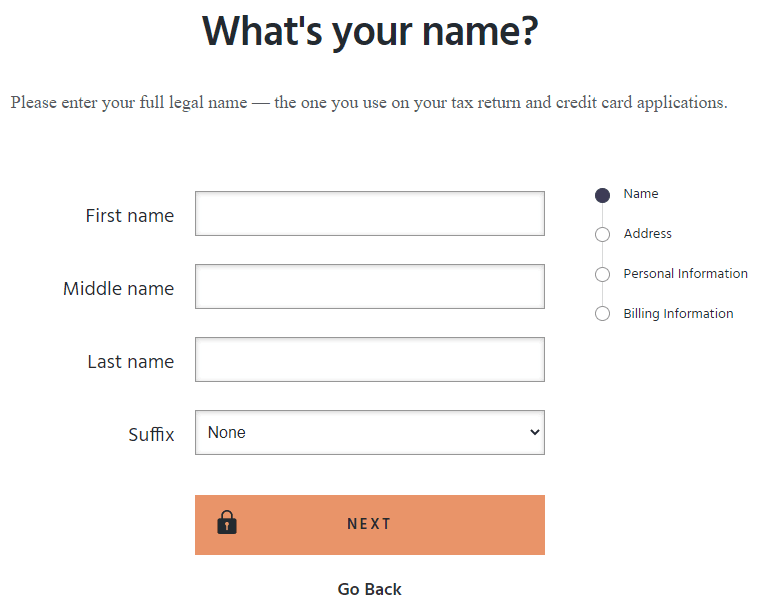

You must fill out your first, middle, and last names as well as a suffix, if applicable. Click Next to continue.

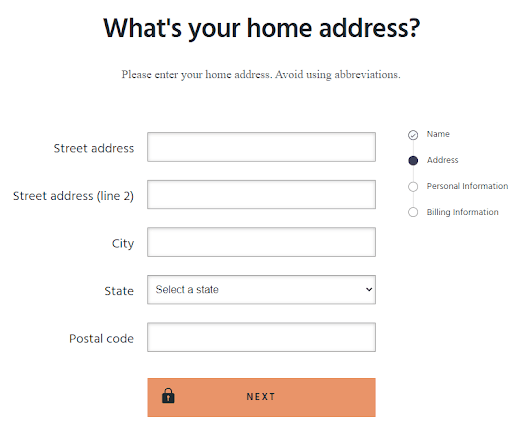

Identity Guard asks for your home address without including any abbreviations. Click Next to continue.

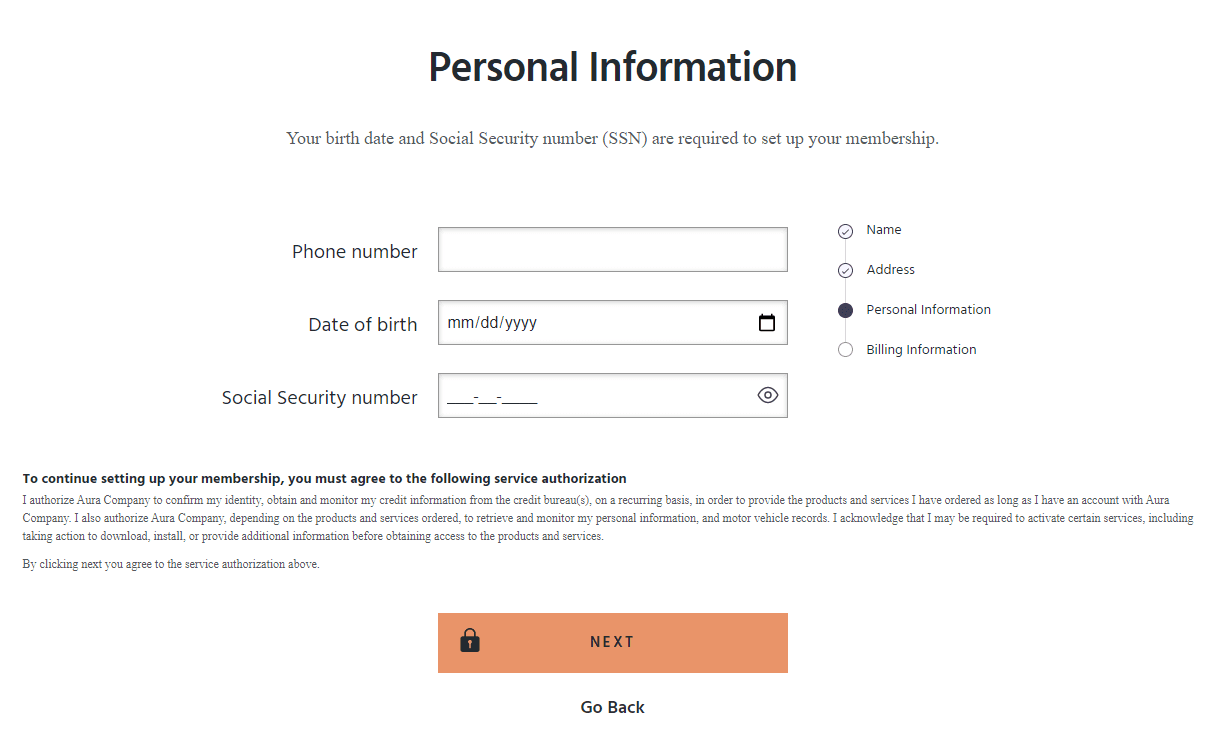

You will have to fill out personal information, including your phone number, date of birth, and Social Security number. By clicking Next, you also give Identity Guard permission to obtain information about you from the credit bureaus so you can use the service as well as monitor personal information and public records.

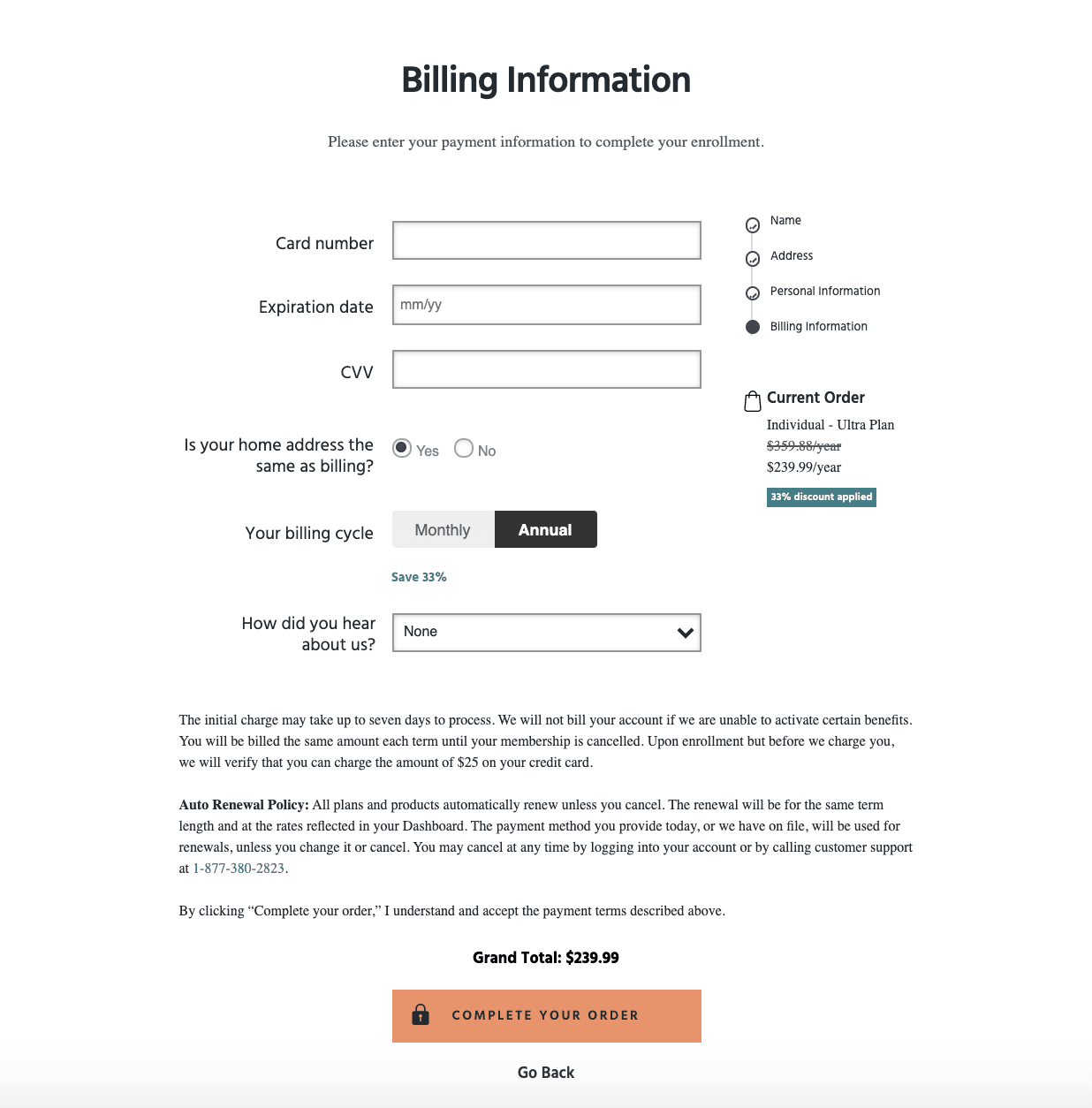

Finally, input your credit card information and select a billing cycle to complete your order. Take special note of the auto-renewal policy that states your subscription will be renewed automatically unless you cancel.

If you choose the annual or monthly option, set a reminder on your calendar a few days before renewal to make a conscious decision of whether you want to renew. Click Complete Your Order to finish the process.

How much does Identity Guard cost?

Identity Guard has three tiers of service with pricing options for monthly or annual subscriptions. You can also choose an individual or family subscription. Here is the pricing information and included features for both individual and family packages billed monthly or annually.

| Value | Total | Ultra | |

|---|---|---|---|

| Individual – Annual | $6.67 per month | $13.33 per month | $20.00 per month |

| Individual – Monthly | $7.20 per month | $15.99 per month | $23.99 per month |

| Family – Annual | $10.00 per month | $20.00 per month | $26.67 per month |

| Family – Monthly | $11.99 per month | $23.99 per month | $31.99 per month |

Each pricing level comes with a set of included services as detailed in the image above and reiterated below.

Services included with Value package

The following are included in the Value package:

- $1,000,000 of identity theft insurance.

- U.S.-based customer care team.

- Risk management report.

- Data breach notifications.

- Dark web monitoring.

- High-risk transaction monitoring.

- Safe browsing tool.

Services included with Total package

In addition to items in the Value package, the Total package also includes:

- Bank account monitoring.

- One bureau monthly credit score.*

- Three bureau credit monitoring.

Services included with Ultra package

The Ultra package includes the following services above and beyond the Total package:

- White glove resolution concierge.

- Social media insights report.

- Credit and debit card monitoring.

- 401(k) and investment account monitoring.

- Criminal and sex offense monitoring.

- USPS address change monitoring.

- Home title monitoring.

- Three-bureau annual credit report.

Identity Guard features

Here’s an in-depth dive into some key Identity Guard features that have protected over 47,000,000 individuals over more than 20 years.

Advanced identity theft protection

Identity Guard uses IBM® Watson™ artificial intelligence to provide advanced identity theft protection. It works by constantly scanning with the goal to detect more threats. The more detectable threats, the more action you need to help safeguard your identity before the damage gets worse.

24/7 monitoring with alerts

Identity Guard reads through the vast amount of data it scans to look for items that could potentially result in identity theft for you. When it finds any relevant information, it sends alerts no matter the time of the day. It’s always working 24 hours a day, seven days per week.

They work to send you the fastest alerts by using mobile app notifications and by sending you an email. As soon as you see these notifications, you can take action to help safeguard your identity.

Examples of alerts include:

- Activity alerts, which let you know about changes that could be fraudulent.

- Dark web alerts, which could expose sensitive information such as your credit card number.

- Threat alerts, from things like data breaches that may have exposed your data.

Dedicated case agent and U.S.-based customer support

If Identity Guard detects a threat, your dedicated case agent and their U.S.-based customer service can help you take action. Identity Guard’s expert guidance will share what you can do to help mitigate any risks.

$1,000,000 identity theft insurance with stolen funds reimbursement

Identity theft can be a costly event. Sometimes, criminals are successful and manage to drain your bank accounts. Identity Guard service includes $1,000,000 in identity theft insurance. This policy includes stolen funds reimbursement. These benefits can help give you peace of mind that identity theft won’t ruin your financial life.

Monthly credit score and three-bureau credit report

Identity Guard’s Total and Ultra account comes with a one bureau monthly credit score update using data from TransUnion credit file. The score is an educational score and may not be the same type of credit score used by lenders. They also include three-bureau credit monitoring to watch out for items that could signal identity theft.

The Ultra account offers a three-bureau annual credit report, as well.

My experience researching Identity Guard

After carefully reviewing Identity Guard’s offerings, here are some standout features.

A one-stop-shop for those who want an easier process

The real benefit of Identity Guard is it is a one-stop identity theft protection shop for a fee. You’d have to spend time logging into several accounts to get the same tasks done. With Identity Guard, you pay for a service you can rely on to provide service consistently.

Monitoring for things you can’t easily get elsewhere

Some of Identity Guard’s features in their more expensive tiers are harder to find elsewhere. Bank account, debit card, 401(k), investment, criminal offense, sex offense, USPS address change, and title monitoring aren’t common services you’ll find anywhere else.

These services can provide you peace of mind that unauthorized activity isn’t occurring within these accounts.

Proven identity theft insurance

Identity Guard states the insurance is underwritten by American International Group, Inc, better known as AIG – a company with a long history.

Who is Identity Guard best for?

Identity Guard is an excellent fit for the following types of people.

Those that want identity theft insurance

If you want identity theft and stolen funds reimbursement coverage, Identity Guard’s $1,000,000 policy offered on all packages is a great option. This is especially true if it gives you peace of mind, which is more important than ever in this day and age when identity theft is becoming more common – practically, if I might add, commonplace at this point.

Those that don’t mind paying for a one-stop-shop

People that value having multiple services in one place are also a good fit for Identity Guard. This way, you don’t give out your information to as many services. You also don’t have to remember many usernames and passwords to log in to several free accounts.

Who shouldn’t use Identity Guard?

If you already use other free services to monitor your credit and you check your financial accounts regularly, you may not need to use Identity Guard and purchase identity theft insurance elsewhere. Alternatively, you could get it as part of the coverage on another insurance policy you already have.

But again, it’s all about convenience and peace of mind. If that’s truly what you’re looking for, Identity Guard is well worth the cost.

Pros & cons

Pros

- $1,000,000 of identity theft protection coverage — This coverage with Identity Guard will give you peace of mind.

- U.S.-based customer service — You don’t have to worry about dealing with outsourced customer service that can’t easily understand your situation.

- Several types of monitoring — Identity Guard provides more than just credit report monitoring by including other options such as USPS address change monitoring as well as 401(k) and investment monitoring.

Cons

- Can’t stop all identity theft — Identity Guard plainly states that no one can stop all identity theft. They can only alert you to risks and help you fix damage after it is done.

- $1,000,000 policy isn’t shared — Identity Guard doesn’t show you the policy and exclusions it has before signing up for service.

Identity Guard vs. Experian Identity Theft Protection

Identity Guard is not the only identity theft product on the market (although, they are one of the better ones). Let’s compare Identity Guard to another popular identity protection plan – Experian’s Identity Theft Protection.

| Identity Guard | Experian Identity Theft Protection | |

|---|---|---|

| Cost | $6.67 – $31.99 per month | $9.99 to $29.99 per month |

| Coverage amount | $1,000,000 of identity theft insurance | Up to $1,000,000 in ID theft insurance |

| Features | Several types of credit and other financial account monitoring depending on the package level you choose and advanced identity | Identity Theft Monitoring, alerts, and dark web surveillance |

Experian Identity Theft Protection

Experian Identity Theft Protection offers some basic features, including identity theft monitoring, alerts, and dark web surveillance. So you’ll be alerted if your social security number or email is being used on the dark web.

They also offer a three-bureau FICO® Score and credit monitoring. Finally, they also offer the same $1 million in ID theft protection insurance as Identity Guard.

Where Experian falls flat against Identity Guard, however, is in their pricing. You’ll notice that Experian runs a little higher for most of their plans.

Summary

Identity Guard offers several levels of identity theft protection. These can help you mitigate the risk of identity theft. The service also helps you clean up any messes that result from it.

You can save money by paying annually or using a family plan rather than separate individual subscriptions.

If you’re the type of person that likes to pay for the convenience of having several services under one roof and peace of mind, one of Identity Guard’s three different plans will more than likely be a worthwhile fit for you.