Small business owners and freelancers have unique financial needs. You have business expenses to track and need to account for taxes while keeping your business transactions separate from ones of personal nature and keeping costs down.

Enter an all-in-one banking solution in the Lili Business Checking account, offering no minimum online business banking, expense management, tax prep, a debit card and fee-free access to the MoneyPass network of ATMs. There’s a free Lili Basic account or paid plans to choose from that include additional features like dedicated support.

When evaluating top business checking accounts, we compare balance and account requirements, the reasonability and transparency of fees, ease of account use, pricing, and perks like interest on your balance. We evaluate these and more in our Lili Business Checking account review.

Lili is an all-in-one online banking solution for small business owners and freelancers. You’ll get all the tools you need to manage your expenses and for tax prep, as well as the debit card and fee-free ATM access.

Accounts are FDIC insured with no hidden fees on four plans to choose. Plus, the paid plans with Lili offer a high-yield savings account that earns a competitive interest rate.

- No minimum deposit or balance requirement

- Fee-free MoneyPass ATM network

- Early payment feature

- Expense management tools and tax prep

- No paper checkbooks

- Out-of-network ATM fees

- Some useful features require paid plans

What is Lili?

Lili is a technology company with a leading business finance platform that’s designed for small businesses seeking banking services. The platform for the Lili Business Checking account offers combination of business banking, accounting, invoices and tax preparation software with no hidden fees and no minimum balance requirement.

Tools like instant transaction categorization, smart bookkeeping and invoicing can streamline operations and help businesses visualize their financial picture with Lili. The single platform functionality lets you manage all aspects of your business’ finances seamlessly so you can focus on business growth.

Lili was founded in 2019 as a banking solution for a growing (but underserved) sector of the working population: freelancers. Co-founders Liran Zelkha and Lilac Bar David came to understand the necessity of keeping personal and professional expenses separate. Today, Lili boasts more than half a million users with increased availability to a wide range of business types for its business checking accounts.

Pros & cons

Pros

- No hidden fees — Lili’s transparency means there’s no hidden fees resulting in an unwelcome surprise. There’s no overdraft fees, and no deposit or minimum balance required.

- No fees on MoneyPass ATMs — There are no transaction fees for using an ATM in the MoneyPass network with all Lili account types.

- Integrated tax tools — Avoid the headache during tax prep season with tax planning that’s seamlessly blended with Lili’s business operations, including auto-generated expense reports and pre-filled tax forms.

- Early payment feature — Get your paycheck up to two days earlier than a traditional bank account when you have direct deposit.

Cons

- Fees may apply for out-of-network ATMs — Domestic and international ATMs outside the MoneyPass network are subject to fees, including ATM owner fees.

- No checkbook for paper checks — Lili also does not provide you with a physical checkbook since it’s a digital product.

How to open a Lili Business Checking account

Lili works quickly; in just a few minutes, you follow a few steps to sign up for a Lili Business Checking account online or via mobile app and wait for a near-instant approval.

- Fill our some basic personal information (name, date of birth, Social Security number, etc.)

- Share a few details including business type, EIN and industry.

- Choose the account plan that best fits your business.

During this process you may be asked to share some details including your business type, EIN and industry, with documents they might request including:

- Single-Member LLC – IRS EIN letter & Articles of Organization

- Multi-member LLC – IRS EIN letter & Articles of Organization

- General Partnership / Limited Liability Partnership – IRS EIN letter & Partnership Agreement

- S-Corp – IRS EIN letter & Articles of Incorporation

Then simply fund your account when you’re ready using ACH transfers, direct deposit and/or mobile check deposit. There’s no minimum account balance or deposit, so you can transfer as much or as little as you would like to your new business checking account.

Lili Business Checking account plans

There are no fees to use Lili’s basic account, whether you have $10,000 in your account or $10. Lili Basic with a business checking account is free. The Lili Pro, Smart, and Premium accounts offer premium features for a fixed monthly fee of either $15, $35, or $55 per month.

All plans, including the basic free plan, have a $0 minimum deposit, fee-free ATM withdrawals at 38,000+ MoneyPass locations, can receive domestic wire transfers and payment up to 2 days early.

Lili Basic ($0/month)

Lili Basic provides the essentials of business banking for free. Get a business checking account, debit card and automatic savings.

» Get a 30-day free trial and 40% off for 3 months on Lili paid plans

Lili Pro ($15/month)

For $15, Lili Pro provides an advanced business checking account with a debit card that provides cash back rewards. There’s fee-free overdraft up to $200 with enrollment, automatic tax savings, and a high-yield savings account that earns 4.15% APY, which the basic account doesn’t provide.

Lili Pro provides tools to organize your expense transactions, the option to attach receipts and notes to expenses, and software to generate monthly expense reports.

Lili Smart ($35/month)

Lili Smart is the most recommended option at $35/month and builds upon what Lili Pro offers, including high-yield savings account with a 4.15% APY. There’s additional accounting and tax prep software that can make the management of your business less of a hassle with this plan.

Start by being able to easily create and send unlimited invoices and accept payments with payment reminders so you’re not sitting there waiting to get paid. The organization of your income and expenses is aided by bookkeeping automation powered by Lili AI and the enhanced reporting includes statements for profit, loss and cash flow. Bill management with Lili Smart lets you auto-scan your bills and pay them instantly.

Tax forms 1065/1120-S/Schedule C are pre-filled with this option, transactions can be instantly sorted for deductions and you can choose to have funds automatically allocated towards tax payments so you’re prepared when Uncle Sam needs his cut.

Lili Premium ($55/month)

Lili Premium at $55 month is the most expensive plan that comes with everything Lili Smart offers and with a exclusive, metal debit card. You’re provided with a dedicated account specialist and priority customer support with this Lili Premium account plan. This provided direct point of contact assigned can answer questions and assist with any issues.

If you’re not in need of this you might want to go with Lili’s most recommended option of Lili Smart for $35/month, which includes many of the comprehensive features you may be looking for.

Lili features

These features stand out among Lili’s business checking account plan offerings.

No minimum balance, no hidden fees

It can be hard to find to a business checking account with no minimum balance requirement or deposit required that competes with Lili’s vast array of features and transparency on fees for small business owners and freelancers. The basic account has no monthly fee and, while there are some fees, Lili doesn’t charge for returned items or stop payments as a traditional brick-and-mortar would.

Fee-free ATMs

You can use your debit card to get cash out at over 38,000 MoneyPass ATMs locations fee-free across the United States and Puerto Rico.

If you ATMs outside of these, Lili will charge you $2.50 per transaction in addition to any other relevant ATM fees. Outside the U.S., that fee goes up to $5 per transaction. So just be aware of where you’re taking money out in order to avoid getting hit with fees.

Includes a debit card

Your basic Lili checking account includes a Lili Visa® business debit card. You’ll be able to use it for business expenses, with all money coming directly from your Lili account. Plus, Lili supports joint account access and provides a debit card for each owner, letting you get the shared financial control to track spending and control with each card.

- Lili Basic: Visa® Business debit card

- Lili Pro: Visa® Business Pro debit card with Cash Back Rewards

- Lili Smart: Visa® Business Pro debit card with Cash Back Rewards

- Lili Premium: Metal Visa® Business Pro debit card

There’s eligibility for fee-free overdraft protection (BalanceUp) associated with debit cards on paid plans with no interest charged. This limit starts at $20 and can go up to $200 based on your account activity and history with updates from time to time.

Cash back rewards

Debit cards on paid account plans with Lili are automatically enrolled in the Visa SavingsEdge cash back program features offers from select merchants on eligible purchases. Cash back rewards will automatically be credited to your Lili account.

4.15% APY on savings

With Lili Pro, Lili Smart, and Lili Premium accounts you get 4.15% APY on up to and including $100,000 of savings. This competitive rate means you won’t have to shuffle funds on idle cash between this and a personal savings account to boost your savings.

By setting up this high-yield savings account with Lili, you’ll be able to choose the fixed amount that you want to set aside weekly. Those funds will be transferred from your checking account.

Easy mobile check deposit

With Lili, you can easily deposit checks from the comfort of your home or office using the Lili mobile app. Simply sign the check and write “For Lili mobile deposit only” on the back of it, enter the amount into the Lili app, and snap a photo of the front and the back. Checks are generally reviewed on the same business day if submitted by 4pm EST with funds available within 1-5 business days.

Cash deposit

You can deposit cash in your Lili account at over 90,000 partnered cash deposit retail locations, including Walmart, CVS, and 7-Eleven. You go to the register and tell the cashier that you want to make a cash deposit with your debit card, swipe the card, hand the cashier the hash, pay the fee, and you’re finished. The money will be available usually within an hour. The fee varies with this depending on the retailer (max $4.95).

The maximum cash deposit with Lili is up to $1,000 per 24-hour period and $9,000 per month, though certain retailers may have lower limits.

Move money faster

Lili offers Standard or Express ACH, wire transfers, and expedited check deposits. You can safely link payment apps and external bank accounts to move money more conveniently.

Early payment up to 2 days sooner

The early payment feature with Lili on all account plans means you may receive funds up to 2 days sooner than a traditional bank if you’re paid via ACH Transfer. Freelancers especially may enjoy this faster option when you get paid for direct deposit by just providing your bank routing and Lili account number to the payer.

Free overdraft protection (BalanceUp)

All Lili paid plans starting with Lili Pro and above can qualify for up to $200 in free overdraft protection for debit purchases through the BalanceUp program with Lili. There’s eligibility requirements for this with enrollment required, but once you’re enrolled the overdraft limits range from $20-$200.

Accounting software and expense management

Lili provides accounting software with select paid Lili plans (Premium/Smart) and expense management tools, including being able to easily generate expense reports, on all paid plans. These can provide insight and be save you time as a busy business owner.

The accounting software can be very useful. There’s automated smart bookkeeping powered by Lili AI, receipt capture to add receipts and notes to expense, and enhanced reporting. This include reports on demand covering cash flow and profits/losses. You can also have bills auto-scanned for instant payment.

Professional invoicing software

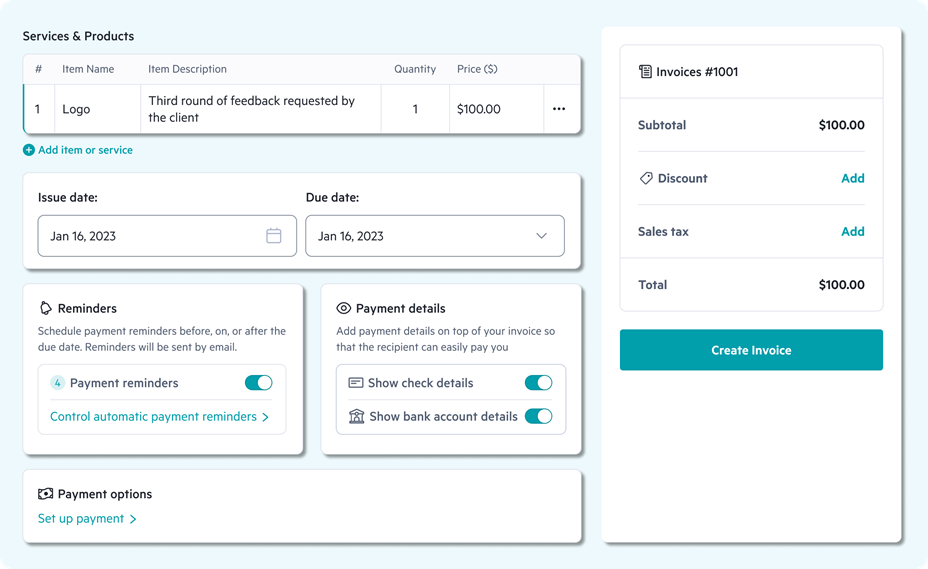

The invoice and payments that come with Lili Premium and Lili Smart allow you create and send unlimited customized invoices as well as track their status. Payments are accepted instantly and, in the event you’re noticing an invoice go unpaid, you can send a reminder to help make sure you’re collecting as intended. You can also re-use invoices as needed.

Clients can pay their preferred way based on your pre-defined payment methods: debit, credit card (Visa, Amex, Mastercard), ACH, Venmo, Cash App, PayPal and checks. There’s also of course cash, which leads to the cash deposit feature we went over above.

Hassle-free integrated tax prep software

For freelancers and small businesses, tax time can be stressful, but it doesn’t have to be with the right business management tools in place. Lili helps you simplify your tax preparation with a streamlined process.

You’re first provided with the ability to automatically save for taxes with a tax savings bucket throughout the year for your estimated taxes in April, June, September, and January to ensure your taxes are paid in full and on-time. There’s a write-off tracker to help maximize tax deductions, quarterly and yearly expense reports whenever you need them, and pre-filled IRS tax forms based on prior transaction categorization. These include Form 1065, Form 1120-S, and Schedule C.

You’ll still need to retain your receipts, but you’ll also have a detailed log of your expenses if you need to provide it. These are available with select paid plans beyond the basic level so make sure the plan you choose has what you need.

Savings buckets

In addition to tax buckets, you can create other savings buckets with Lili. Create an emergency savings bucket, for example, to hold your emergency fund. Set a little aside each month, even if it’s just a few dollars, and have that money waiting for you. Instead of relying on your credit card or personal savings in time of need, this will give you a cushion you can rely on during those inevitable lean months your business may face.

Lili mobile app

Lili customers can access their account online or through the dedicated Lili mobile app, available for iOS and Android. The App Store rating for Apple users is 4.6/5 across over 6,000 ratings while the Lili App in the Google Play store is 4.3/5 across over 10,000 users on over half a million downloads.

Customers can make mobile check deposits through the app and do everything they would on desktop for the finances of their small business with the versatile mobile app.

Deposits are FDIC insured

The money in your Lili account will be FDIC insured by their sponsor bank, Choice Financial Group for up to standard maximum of $250,000. Your funds will be protected with Lili even as your business grows.

» Get a 30-day free trial and 40% off for 3 months on Lili paid plans

Who is Lili best for?

Freelancers

Lili began by aiming to serve freelancers and it still serves them well today. Whether you’re just starting out or you’ve been freelancing for years, Lili can help with tools and insights. You likely won’t need a separate business management solution with the various expense tracking and reporting Lili’s business checking account provides. You can also set money aside for taxes and emergencies to ensure your freelancing is covered from all angles.

Small business owners

Small business owners from the features Lili offers. There’s a number of reasons why you need a bank account for your business. The business management tools are best for those early days of building and growing a business while keeping transactions separate from personal ones. Once you start hiring employees or managing an inventory, you’ll likely need some of the robust bookkeeping tools Lili can provide.

Digital-savvy businesses

Lili offers an abundance of powerful features and tools for those looking for an all-in-one online banking solution. Use your Lili account online with your desktop or through the useful mobile app. The less tech-savvy who don’t need a physical bank may be content with a Lili Basic account with no monthly fee while those who can take advantage of all the useful tools, like those for expense management and invoicing, may like a paid account plan.

Who shouldn’t use Lili?

Those who prefer to bank in-person

If you prefer to walk into a bank, Lili won’t be the service for you as it’s online only. Lili does not provide you with a physical checkbook since it’s a digital product and any paper checks will need to be deposited electronically.

Those traveling internationally

If you have frequent international transactions or move out of the United States, Lili may contact you for verification. Temporary stays can be coordinated with Lili but a permanent move or an extended stay abroad (without notification) may lead to account closure. You also will be charged $5 fee per transaction at ATMs outside the U.S., along with any fees the other bank’s ATM charges you.

Those with large cash deposits

Lili has a cap of $1,000 per 24-hour period and $9,000 per month on cash deposits at 90,000 partnered cash deposit retail locations. This may not be an issue if you’re only deposits cash on occasion, but it may be a hurdle if you need to make frequent cash deposits and pay the relevant retailer fee that ranges up to $4.95.

My personal thoughts after researching Lili

I’m a freelancer myself so I can see the benefits of having a separate checking account just for work. What really stands out about Lili, though, is its expense-tracking features. I know that tracking expenses can be one of the most complicated aspects of running a freelance operation. Since everything is automatically categorized, it’s easy to both see where my money’s going and pull reports at tax time.

But for freelancers and small businesses, one of the best things about Lili is that there are no hidden fees and no minimum balance or deposit requirements. That means I can start separating my business and personal finances without having to move a bunch of money out of my personal account. Requirements and fear of fees have been a big obstacle to setting up a dedicated business account during my years as a freelancer.

One feature I really like is the early-pay option. Several of my clients pay me via direct deposit, so being able to have access to those funds within two business days of the deposit is a huge bonus. With my current bank, those pending transactions can linger out there for several days at times.

The only thing that caused initial hesitation was the limitation on ATMs. I wasn’t sure if there would be enough MoneyPass locations nearby to make it easy enough for me to get money out. I rarely use the ATM, but what if there was an exception? I took one quick look with the MoneyPass ATM locator and it was clear I’d never have trouble finding an ATM nearby if I did happen to need one.

All in all, my takeaway is that Lili has plenty of features that make it a great fit for a number of different business types. With no hidden fees, a free basic account or reasonable paid account plans and such an easy signup process, Lili provides a great solution to split business and personal finances to make taxes and accounting far easier.

The competition: Other business checking accounts

See how Lili Business Checking compares against some other best business checking accounts for small businesses, startups and freelancers.

The battle of popular online business accounts include Axos, LendingClub, Novo, Chase, Mercury, NorthOne and Bluevine with a few of these briefly covered stacked up against Lili below.

Lili vs Novo Business Checking

Novo Business Checking is an online-only platform that offers small business owners, startups and freelancers a fee-free business checking account with no minimum balance requirement and no monthly fees.

Novo is an online business platform geared towards small business owners, startups, entrepreneurs, and freelancers. When you start your own business, you’ll quickly find that using your personal bank account can get overwhelming.

That's where Novo comes in with an easy to set up free checking account dedicated to separate business expenses.

- No monthly fees or balance requirements

- Unlimited fee-free transactions

- Smart Insights for your business

- No cash deposits (money order required)

The invoicing product stands out, letting you send unlimited free and professional invoices from the Novo app and have your customers pay you directly via integrated payments, like Stripe, Square and Paypal. Novo also integrates with some of the most popular business apps, provides a debit card and lets you create internal ‘Reserves’ for budgeting.

Novo and Lili match up well and if you’re looking for a more affordable option over a paid plan with Lili, Novo may be the top alternative.

» MORE: Read our full Novo Business Checking review

Lili vs Bluevine Business Checking

The Bluevine Business Checking account is another alternative to Lili that comes with a debit card and fee-free access to the MoneyPass network of ATMs. Fees are pretty straightforward with no minimum balance requirements or limits on most transactions.

The Bluevine Business Checking account offers no monthly maintenance fees, unlimited transactions and easy-to-use digital banking tools on an account that can be opened in minutes.

There's a free standard plan that earns 2.00% APY on account balances up to and including $250,000 with a monthly activity goal or a Premier plan with a 4.25% APY. Terms apply.

- No monthly fees, minimum deposit or minimum balance required

- No overdraft fees, plus fee-free ACH transfers

- Earns a competitive APY

- FDIC-insured up to $3 million

- Fees apply on cash deposits

- Out-of-network ATM fees

- No in-person banking services

There’s increased FDIC insurance of up to $3M per depositor as Bluevine, a financial technology company, has banking services provided through Coastal Community Bank, Member FDIC and sweeps to program banks in partnership.

The Bluevine Business Checking account is also an interest-bearing account. Earn 2.00% APY on balances up to $250,000 if you meet one of two monthly activity goals with a free account. One option is to spend $500 with your provided debit card. An upgrade to Bluevine Premier comes with interest of 4.25% APY that’s earned automatically up to a much higher cap. Terms apply.

Lili vs Chase Business Complete Banking®

Chase’s small business banking offering, the Chase Business Complete Banking®, is geared toward businesses that accept credit cards. With the built-in QuickAccept® feature, you’ll get a mobile card reader for in-person swipes, as well as the ability to accept credit card payments through the Chase Mobile app.

Chase Business Complete Banking® is a small business checking account that offers a competitive suite of benefits for business owners providing you what you need to start or grow your business and keep it going.

- Convenient physical bank access

- Wide range of additional banking services

- QuickAccept℠ payment processing feature

- Monthly fee may apply

- There's a limit to free transactions

A Chase Business Complete Banking® account comes with a $15 monthly service fee, but there’s multiple ways to waive the monthly fee, including maintaining a daily minimum balance of at least $2,000. This account blends various tools of the other popular online business checking accounts with the large bank footprint of a brick-and-mortar.

» MORE: Read our full Chase Bank review

Summary

Lili is a useful business banking option for small business owners and freelancers who can benefit from a business checking account with no minimum balance or deposit requirement. You can potentially save on fees while also getting powerful features that can help you with accounting, taxes and the overall management of your business.

» Get a 30-day free trial and 40% off for 3 months on Lili paid plans

FAQs about Lili

Is Lili a real bank?

Lili is a business banking platform that’s a financial technology company, not a bank, with banking services provided by partner bank, Choice Financial Group, Member FDIC. Choice Financial provides your account and is the issuer of your Lili Card while Lili is the program manager that provides access to those products for users.

Is Lili safe to use?

Lili is a legitimate and trustworthy financial technology company that’s safe to use. All Lili accounts are FDIC insured by their sponsor bank and your data and account are protected with multiple layers of security. User reviews for Lili are pretty favorable as it holds a 4.7/5 Excellent score on TrustAdvisor for its financial services on over 2,900 reviews.

What account types does Lili support?

Lili supports the following account types: Sole Proprietor, Sole Proprietor with DBA, Single-member LLCs, Multi-member LLCs, S-Corps, General Partnerships, and Limited Liability Partnerships.

How do you add money to your Lili account?

Options to add money to your Lili account include: Instant pay, direct deposit, ACH Transfer, linking to another bank account, scanning checks with the mobile app, and incoming domestic wire transfers.

Does Lili charge any fees?

Lili offers several account types, including a Lili Basic account with no monthly fee. There are three paid plans that charge monthly fees: Lili Pro, Lili Smart and Lili Premium. All Lili account plans have no minimum deposit required and offer fee-free access to the MoneyPass network of ATMs.

Can I use Quickbooks with Lili?

You can integrate Quickbooks with your Lili account and automatically send transactions to QuickBooks on a daily basis.