You can get loans from anywhere between $500 and $35,000. And, since we like things done quickly these days, you’ll be happy to know that, after you’re approved, you can get your loan as soon as the next business day! There are also no fees when applying through LoansUnder36.

But those are just a few key reasons you might consider LoansUnder36. As one of my favorite comedians, Seth Myers says: it’s time for a closer look.

What is LoansUnder36?

LoansUnder36 is an aggregator that searches multiple lenders to find the best rates. No rates are higher than 36% APR, so even if your credit score is on the lower side, you know the interest you’ll pay won’t be too unreasonable.

Founded in 2014, LoansUnder36 is designed to give borrowers a quick injection of cash. Loan amounts are limited to $35,000, but it’s best for lenders looking for smaller loans.

How does LoansUnder36 work?

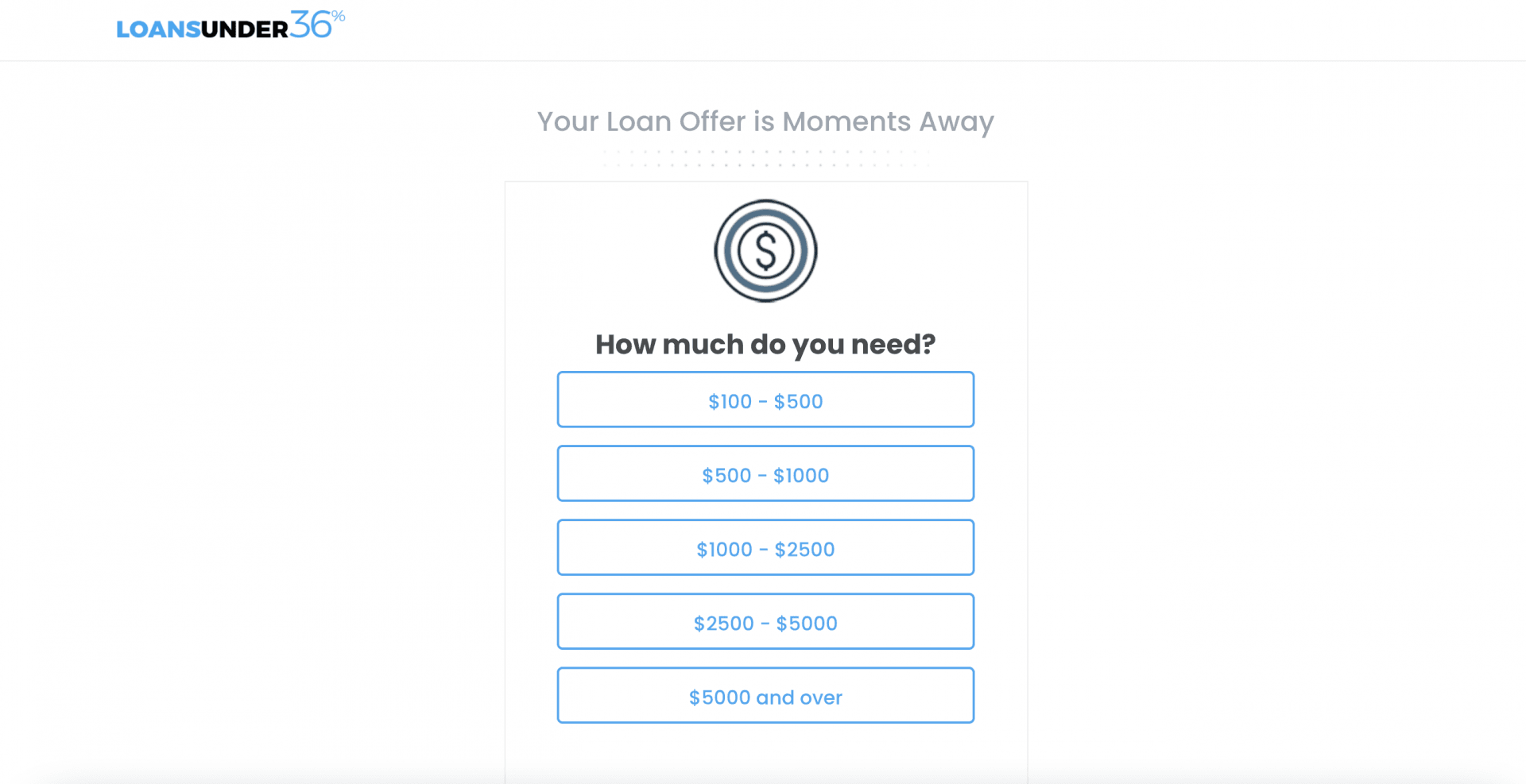

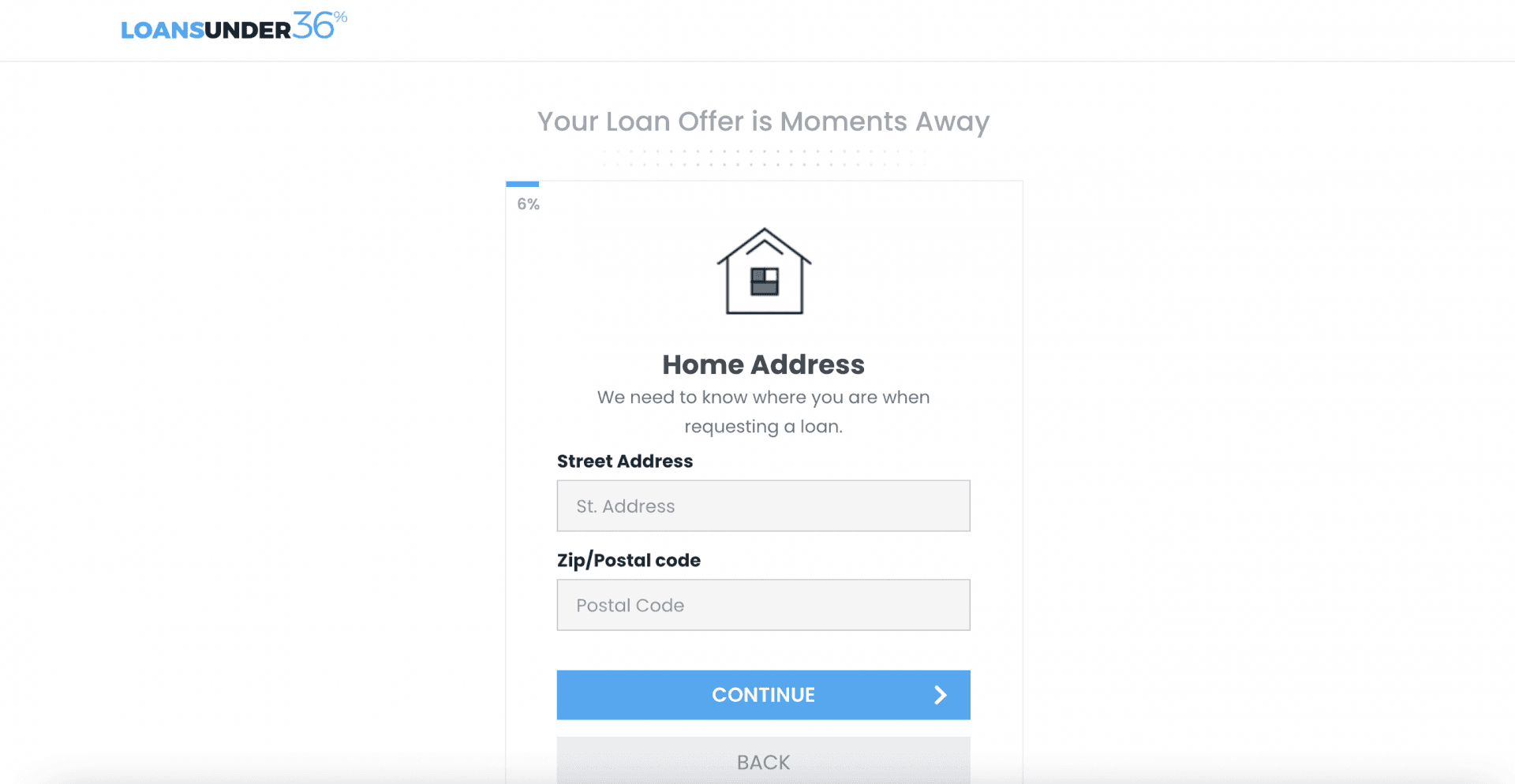

For the most part, the application is very simple, and like many other lender-matching services, takes just a few minutes.

I only ran into one problem. My cell number is the same as my employer’s number, as I’m self-employed—but the application requires two separate numbers. But that’s a very specific issue that most shouldn’t have a problem with.

As the application continues, things get a little more personal. You’ll need to add your driver’s license number and bank account information. This is because your loan will be directly deposited into your bank account.

Don’t worry – all your information is secure through LoansUnder36 and is only used to provide you with the best loan possible. That being said, they do collect data from customers, including some sensitive details. However, the company doesn’t share this without consent from the user.

After you fill out the form, it takes about two minutes to process and you’ll be directed to a page with your loan offers. Which leads us to the loan lenders.

Pricing for LoansUnder36

There are no fees for using LoansUnder36. However, once you choose a lender, that lender may charge some fees. You could be charged a loan origination fee, prepayment penalties, late payment penalties, and/or a returned payment fee. Make sure you read any terms before you close the loan.

Interest rates range from 5.99% to 35.99% APR. You’ll be able to see the interest rate before choosing a lender.

LoansUnder36 features

More than 100 lenders

LoansUnder36 partners with over 100 lenders to offer the best loan for you.

Instead of having to apply to each lender individually, you fill out just one application through LoansUnder36, and you’ll be given the best APR (based on creditworthiness, of course).

In addition to the LoansUnder36 application, you’ll be required to fill out the application specific to the lender you choose. So there may be additional personal questions you’ll have to answer.

Guaranteed rate ceiling

No loan on LoansUnder36 exceeds 35.99%. That means even if you’re credit-challenged, you’ll know that the rates you’re being quoted have a cap. You can then choose from offers and choose the loan with the lowest rates and best terms.

No application fees

Your quotes through LoansUnder36 are free, and there’s no obligation to choose a lender through them. You may be charged fees by the lender you choose, but it’s free to get quotes through LoansUnder36.

Automatic deposit

Once you’ve chosen a lender, your funds can be directly deposited into your bank account. No waiting for a check to arrive or dealing with funds on a payment card. Your money will be in your account where you can start using it.

My experience researching LoansUnder36

LoansUnder36 is completely transparent, putting all the information you need directly on the main page of its website. Questions like, “Are there any fees?” and, “What if I need to make a late payment?” are all there, complete with answers.

But what I like best about LoansUnder36 is that you can get a quote directly from its main page. The form walks you through the questions you need to answer to get you to your quotes as quickly as possible.

The great thing about LoansUnder36 is that it’s quick and convenient. Once your application is approved, you can get the funds deposited into your bank account as soon as within one business day.

LoansUnder36 does caution that your information will be shared with partner lenders in order to give you an accurate rate quote. This is standard for loan aggregators, but I appreciate that LoansUnder36 is upfront about it.

Who is LoansUnder36 best for?

Those with lower credit scores

LoansUnder36 doesn’t have a credit score limit, so someone with low credit, excellent credit, and everything in between can apply for a loan.

Those with lower credit will likely qualify for the higher end of the 36%—which is a high APR, there’s no doubt about that. However, anyone with excellent credit may get an APR as low as 5.99%.

Those looking for smaller loans

$35,000 is a hefty loan for some but is relatively small compared to other loan matching sites.

So, while you can use your personal loan for anything, the loans you get from LoansUnder36 are best suited for smaller needs—like paying back some medical debt, doing a home improvement project, etc.

Those who need flexibility in their loans

After you fill out the application, you’ll see your loan options. You’ll be offered a range of loans with different repayment periods. You can choose between short-term repayment periods or a multi-year plan. That way, you can have a longer chunk of time to pay off your loan if you can’t repay it quickly—but be warned, you’ll be paying more in interest.

Anyone tired of searching for personal loans

If you’re tired of applying directly through lenders only to get denied, LoansUnder36 is best for you. Since they don’t promise stellar APRs for everyone—just one under 36%—they’ll find you a loan through a lender you’re sure to be approved for.

Who shouldn’t use LoansUnder36?

Those with excellent credit

There’s no reason someone with good to excellent credit can’t give LoansUnder36 a try. But the site’s promise that low-credit borrowers can get approved means you might fare better with another loan aggregator.

Sporadically employed borrowers

Although LoansUnder36 is flexible with credit scores, they do prioritize steady income. If you don’t have a regular paycheck, you may have a tougher time qualifying for one of their loans.

Pros & cons

Pros

- No fees — Its fee-free matching service makes LoansUnder36’s no-obligation quotes a can’t-lose proposition.

- Flexible credit requirements — LoansUnder36 accepts borrowers with lower credit scores.

- Quick access to funds — Once approved, LoansUnder36 deposits the funds as early as the next business day.

Cons

- Income requirements — Those without steady income may have a tougher time getting approved.

- Uncertain fees — Since fees may be charged by individual lenders, you’ll need to read your loan contract carefully to see what you’ll pay.

- Higher rates — Although the rates cap at 36%, that’s still high, but for those with low credit scores, it may be better than other offerings.

LoansUnder36 vs. competitors

| LoansUnder36 | Marcus by Goldman Sachs | Monevo | Fiona | |

|---|---|---|---|---|

| Loan amounts | $500-$35,000 | $3,500-$40,000 | $500-$100,000 | Varies by lender |

| Terms | 2-72 months | 36-72 months | 12 months to 144 months | 6-144 months |

| APR | 5.99%-35.99% | 6.99% – 24.99% | 1.99% – 35.99% APR | 2.49%-29.95% |

| Application process | Online | Online | Online | Online |

| Other features | Variety of terms | No loan fees | Large loan options and terms | Varies by lender |

Marcus by Goldman Sachs

Marcus by Goldman Sachs is a direct lender of personal loans, not a connection service like LoansUnder36. At Marcus, you can get a loan amount between $3,500 and $40,000, and the interest rate ranges from 6.99% – 24.99%.

Marcus by Goldman Sachs is a direct lender of personal loans, not a connection service like LoansUnder36. At Marcus, you can get a loan amount between $3,500 and $40,000, and the interest rate ranges from 6.99% – 24.99%.

Marcus promises no fees on its personal loans, which is a perk; other lenders typically charge sign-up fees, origination fees, late fees, and other kinds of fees. Marcus offers autopay, which keeps your payments timely, and provides a 0.25% rate discount for signing up for that service.

However, to snag a Marcus loan, you’ll need good to excellent credit.

Fiona

Fiona is another aggregator to consider if your score is 580 or better. Whether you’re looking for a debt consolidation loan or to refinance your student loans, Fiona shops multiple lenders to help you get the best rate.

is another aggregator to consider if your score is 580 or better. Whether you’re looking for a debt consolidation loan or to refinance your student loans, Fiona shops multiple lenders to help you get the best rate.

With Fiona, you’ll get a few quotes to choose from. The service is free of charge and takes only minutes. In addition to personal loans, you can also get credit card offers through Fiona.

Summary

LoansUnder36 offers to find loans for any credit, promising an APR under 36%. With their large lender directory, you won’t need to go anywhere else to find a loan that suits your needs.