Browsing through thousands of investment options can be exhausting.

You obviously want to put your money somewhere that coincides with your values and financial goals.

Enter Magnifi.

Magnifi is made up of a simple interface to give investors access to all possibilities. The platform will help you find the right fit by going over the options that best suit your needs.

Keep reading to learn more about what this platform offers. Then, you can decide if this online marketplace is right for you.

What is Magnifi?

Magnifi is an online investment marketplace designed to help regular investors (aka, those without millions to invest), financial advisors, and portfolio managers. Here, you can compare thousands of investment options straight from Magnifi’s website. Their connection to the NYSE paired with their interactive, language-based search technology, streamlines the process.

This platform is more than just another place to trade stocks. The goal is to help investors make more intelligent decisions regarding their investment choices. Advisors and portfolio managers also find a place on this platform to support average investors and build their portfolios.

Read more: How To Determine Your Investing Risk Tolerance

And, if you’re new to the investment process, Magnifi offers helpful information to start researching investments. However, using this platform may be overwhelming for someone who has just begun to learn the basic concepts of investing.

How does Magnifi work?

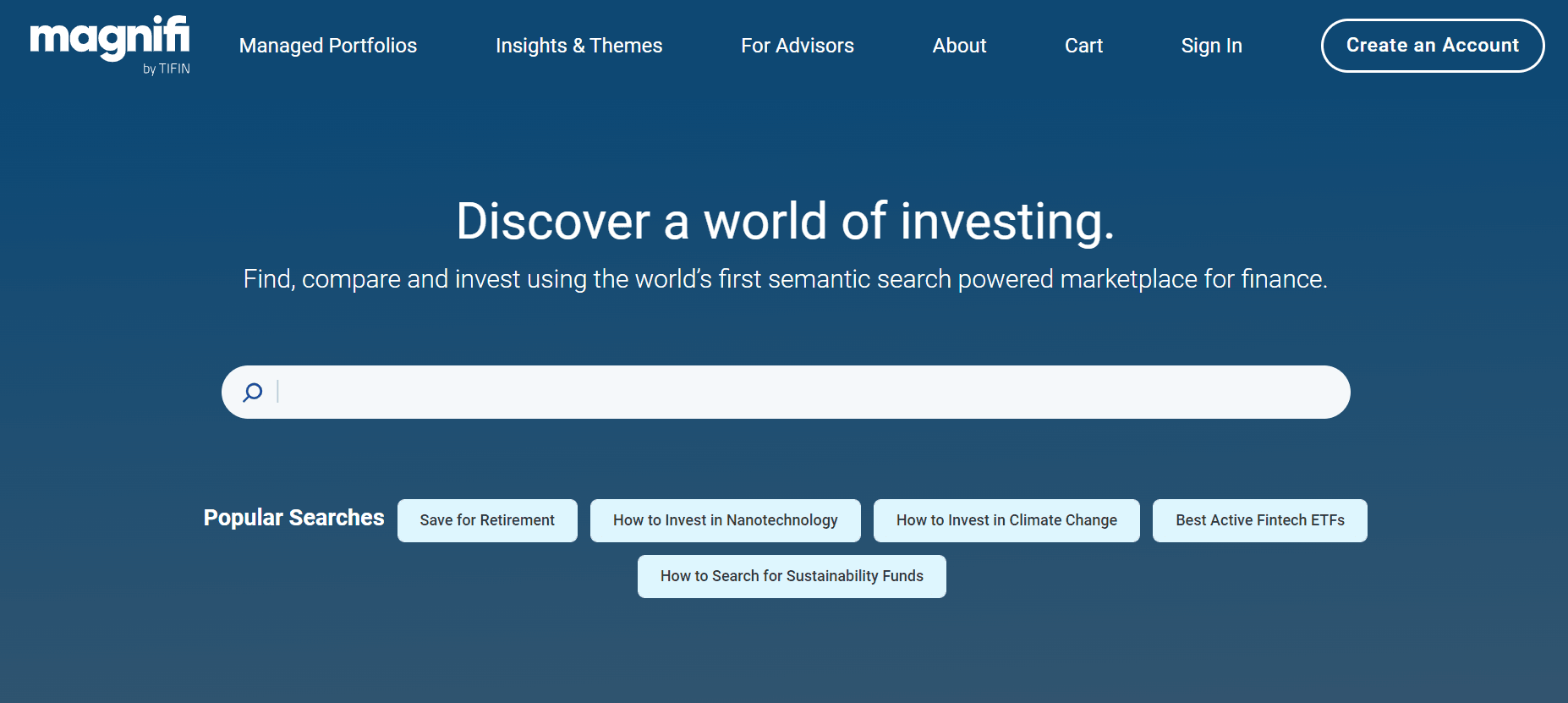

You want to start at the website homepage and select “Create an Account” in the far left corner.

You will be prompted to verify whether you are an individual investor or a financial professional. Investors are taken to make a free account, and advisors can select from the free account or one of two paid subscriptions.

All users can filter their searches to learn about new investment options before shopping and comparing them in the comparison grid. Advisors can then advise and manage financial portfolios if they sign up for one of the paid subscriptions.

After creating an account, you will have access to thousands of investment options from your screen. Their website is designed in a way that allows investors to easily search, discover, and invest in the ideas that best match their values and goals.

Users can find the perfect investments within minutes and use their accounts to purchase funds commission-free. You can easily monitor the performance of all your investments over time with tabbed comparison and performance grids.

How much does Magnifi cost?

The Discovery tier for Magnifi is free, and this is the only one available for regular investors. Users can make an account to explore what the platform has to offer and take advantage of the basic features that allow you to analyze and compare investments from thousands of ETFs and mutual funds.

The next tier is the Selector tier, which allows you to compare funds, SMAs, and models based on customizable portfolios for $150/month. The next two tiers, Enhancer and Accounts Dashboard, are also $150/month. They allow advisors to optimize client portfolios and better manage them. All three are designed exclusively for advisors.

The feature of scheduling a demo to try out the features is unfortunately only available for advisors. Still, the website has free access to get an overview of the services for the free Discovery tier to get a good idea of what you can do before you commit to making an account.

Magnifi features

Now that we’ve covered Magnifi’s background, we’re going to take a closer look at some of the features that make this company unique.

Language-based searching

The language-based search engine is designed on the foundation of semantics. This makes it possible to search for items based on themes and goals without needing the exact words to find what you’re looking for.

The sematic-based search helps users search through themes to connect them with investments that suit their goals more quickly. Next to the search function are categories for trending searches that might pique your interests when deciding what to look for. This also gives users insight into what is doing well in the market.

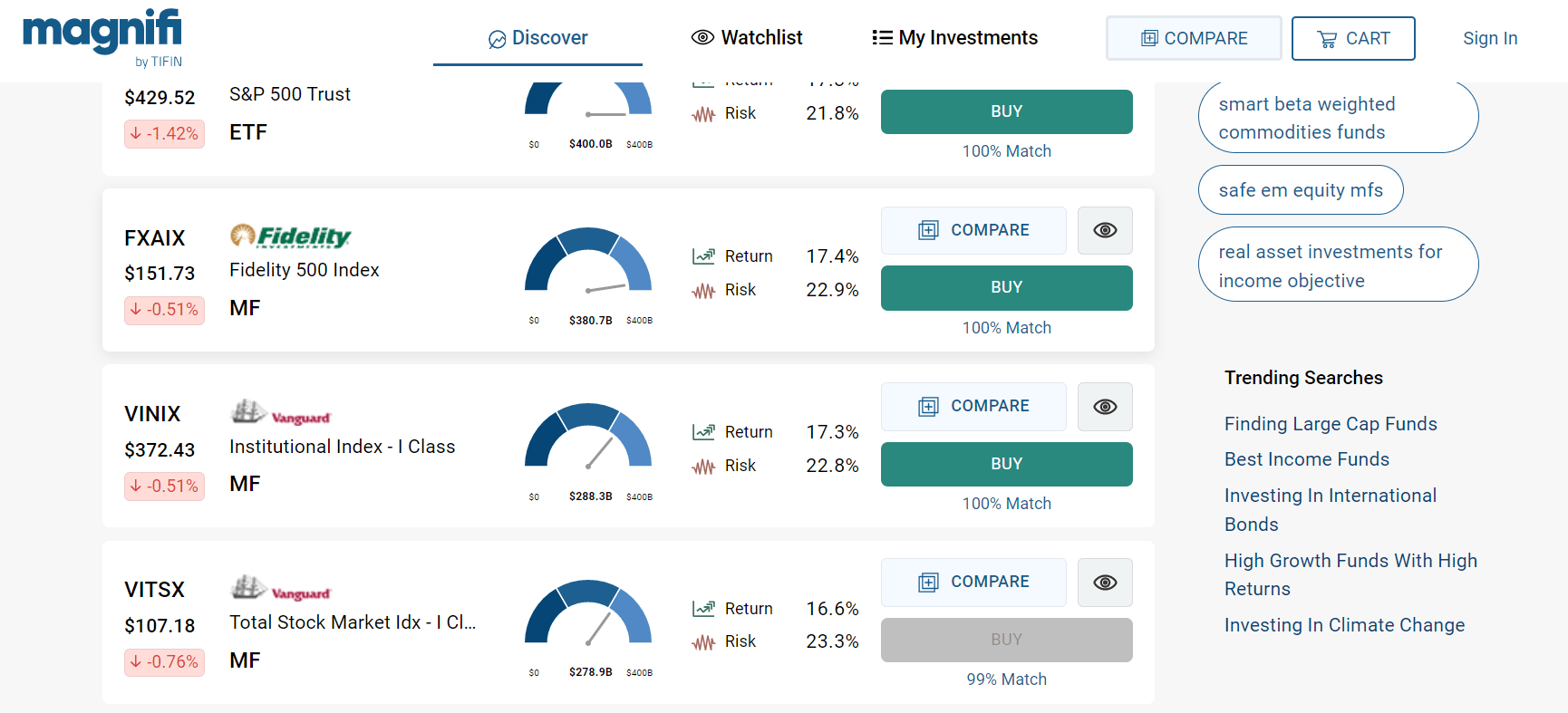

Comparison grid

Using the search engine to find investments that suit your values and goals is the first step in building your portfolio. Once you have selected a few options, you can use the grid to compare the performance, holding, and other essential information about your funds with just a few clicks on the screen.

This streamlined interface allows you to analyze how your investments are performing all in one place. The main window further breaks down into four tabs: Compare, Combine, Act, and Funds. This keeps all your options in one place while retaining an organized view while switching between functions.

AI-powered investing

Once users have created an account, they can begin making purchases commission-free without any additional or surprise costs. The metrics and insight system will monitor all transactions and performances, so you can easily manage your financial assets online.

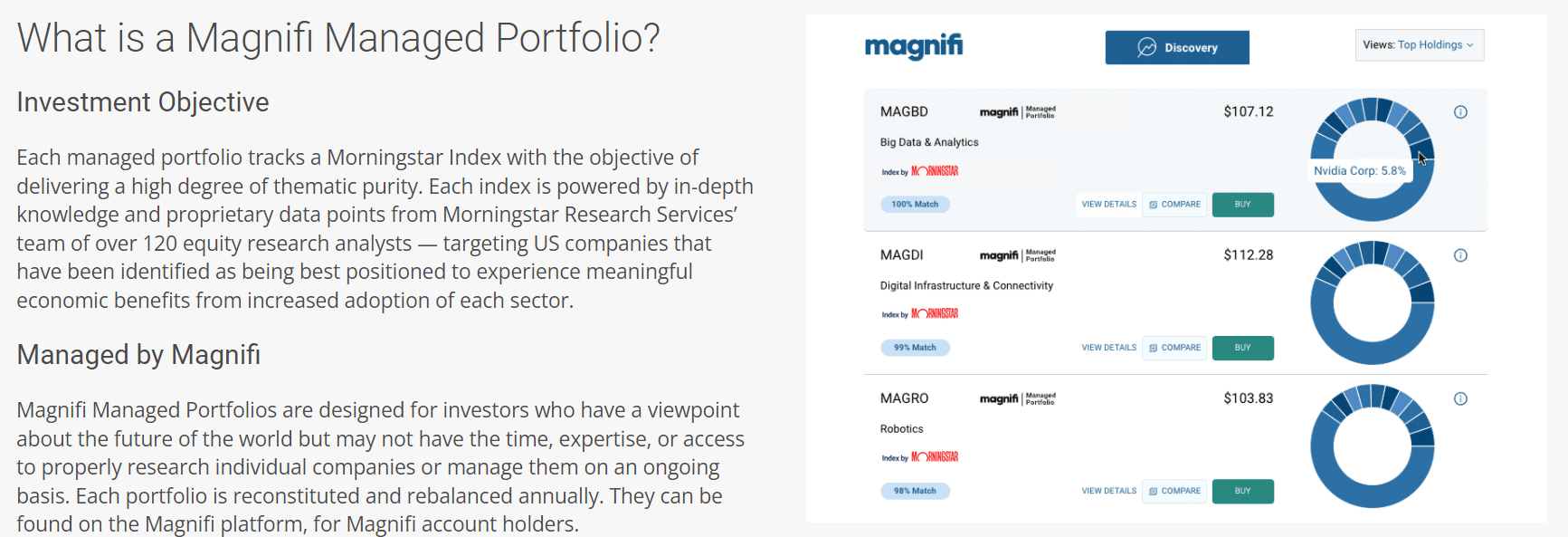

Magnifi managed portfolio

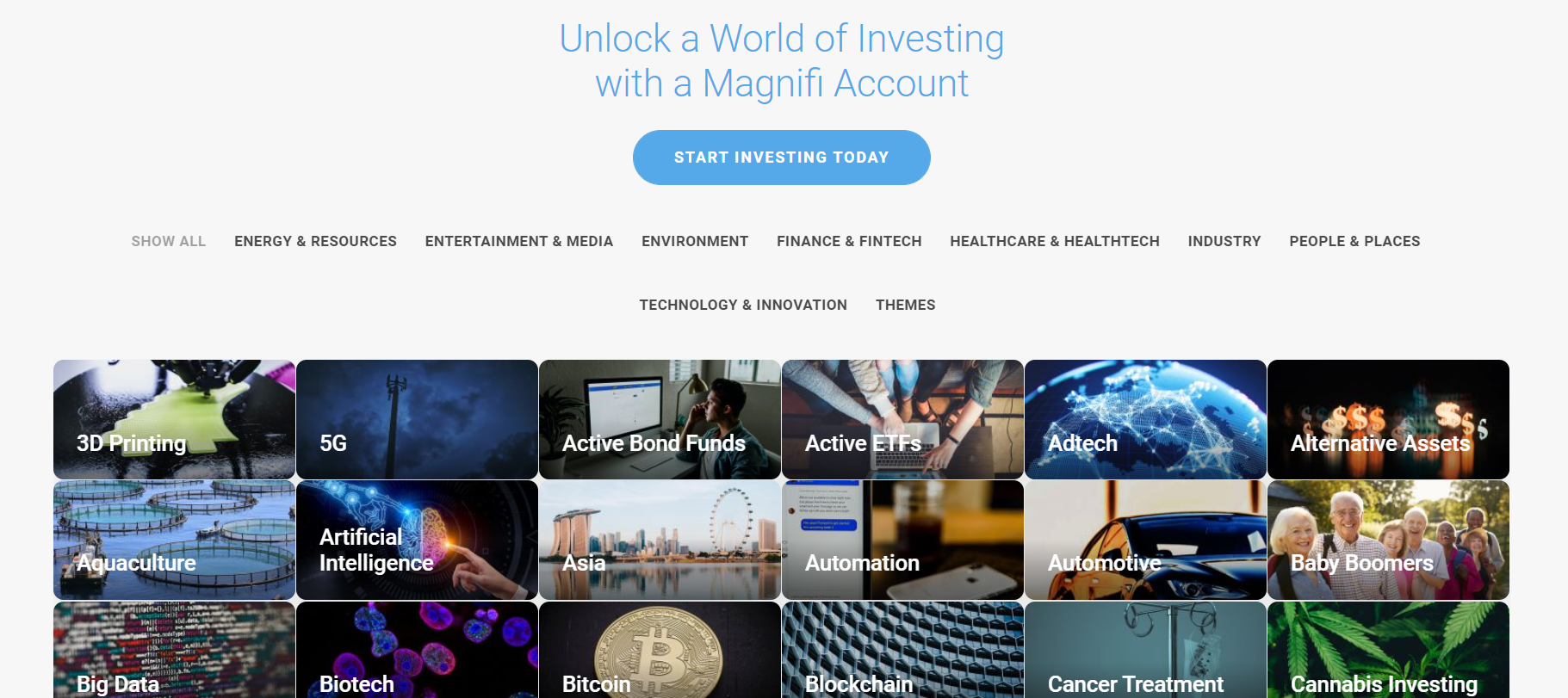

The company provides seven different managed portfolio types based on Morningstar indexes, using thematic strategies that highlight specific themes based on worldwide innovation.

With these portfolios, investors have access to rebalancing oversight when they invest in things like big data, health tech, and other themes without ETFs or mutual funds. These portfolios track an index with 30-50 companies that cover themes contributing to changes around the world.

Read more: Are Robo-Advisors Worth It? A Complete Guide

My experience researching Magnifi

At the most basic level, Magnifi is an online investment marketplace that streamlines investment research by using language-based technology and grouping options into easily recognizable themes. You could do the research yourself, but having it all in one place will reduce your research time significantly.

I enjoy how anyone can learn more about the investment themes and insights offered through the platform before making an account. Having this preview before committing to their services allows users to decide what they are interested in before making new investments.

The accessibility to thousands of options for investors and advisors makes it easier for individuals to make decisions that best benefit them and the issues they care about.

Who is Magnifi best for?

Investors

The website’s design makes it easy for seasoned investors to find what they’re looking for or learn more about new options. Creating an account is free, and you have access to thousands of options to choose from, all with informative slides to give you more background about your potential investments.

Financial advisors

Their advisor services allow financial advisors to become AI-Powered financial advisors. All you have to do is schedule a 30-minute demo meeting at a time that works for you. Advisors then have access to intelligence-powered research of high-impact portfolios to recommend highly-personalized recommendations to clients.

Portfolio managers

Magnifi offers seven portfolio types, each with an index to track 30-50 companies looking for exposure to certain categories (i.e. sustainable investments, etc.). All three of the paid tiers give managers access to better manage and make personalized recommendations to their clients looking to improve their assets.

Who shouldn’t use Magnifi?

New investors

Someone who is entirely new to the world of investing should do some additional research before making a Magnifi account.

Although the website is packed with helpful information and offers a variety of options, it can be overwhelming for someone who is still learning about the basic concepts of investing.

Advisors who don’t want to pay a subscription

The standard tier for all users is free to use, but the two higher-level tiers exclusively for financial advisors require a monthly subscription that can get pricey over time. You can try out the demo or cancel your subscription any time, but if you aren’t sold on paying a subscription, it isn’t for you.

Pros & cons

Pros

- All themes and insights come with information — When browsing through the themes and insights menu in search of the right investment category, each category comes with detailed information, including reputable sources, to help you decide what investments are meaningful to you.

- Free to use for investors — With all the information and possibilities, this platform has a lot to offer, and its standard level tier is free to everyday investors. Simply make an account. Other platforms would keep this level of information behind a paywall as well.

- Easily connects financial advisors to clients — Financial advisors and portfolio managers are easily connected to clients and have opportunities to use more resources when they pay for one of the other two tiers. This can help users to boost their assets and helps advisors build their own professional portfolios.

Cons

- Overwhelming number of options — The insights and themes tab on the website opens up to a page of endless investment opportunities. Each option then leads you to available investment options and an explanation of that topic. This could turn into an information rabbit hole for those who are indecisive or new to investing.

- Only the base level account is for regular investors — There are four account levels total, but the paid levels are for financial advisors only. This means investors don’t have access to the same additional resources. The subscription levels can also be a bit pricey for newer advisors.

Magnifi vs. competitors

Magnifi has some competitors in the market, but it’s hard to tell where they stand in comparison. They are a relatively new company with only a few reviews.

However, Magnifi’s search engine is uniquely designed to appeal to more people around the globe, using language as an asset rather than a hindrance when it comes to finding new investments. More companies will most likely take advantage of similar software in the future, tightening competition.

Similar platforms are streamlined with similar compassion grids for users who have already begun to invest in using the platform. Magnifi takes a universal concept for displays and makes it their own by incorporating tabs to match their unique functions.

Summary

Magnifi makes it easier for investors and consumers to find things they care about without having to learn another language. It’s free to use, easily connects investors to clients, and users are made known of meaningful investment opportunities.