Buying a new home or car can be a fun milestone in life, but in doing so, you’re unavoidably made aware of your credit history. myFico helps you avoid any unpleasant surprises, giving you ongoing access to your credit scores from all three reporting bureaus.

What is myFICO?

myFICO is the consumer division of FICO, the most-used scoring model by lenders across the U.S; 90% of lenders use FICO Scores and myFICO gives you the specific versions that are most used by lenders for home, auto, and credit cards, so you can prepare for your credit goals. For a monthly fee, myFICO gives you around-the-clock access to the information lenders are most likely to see when they research you. You can even see how your score prepares you for specific goals, such as requesting a credit card or taking out a mortgage on a new home. Checking this information will have no impact on your score. In addition to giving you access to your score, myFICO alerts you so that you’ll know when there’s activity on your credit report. You can also use a built-in tool to see how certain activities will push your score up or down. Overall, myFICO gives you the tools you need to take charge of your credit history.

How does myFICO work?

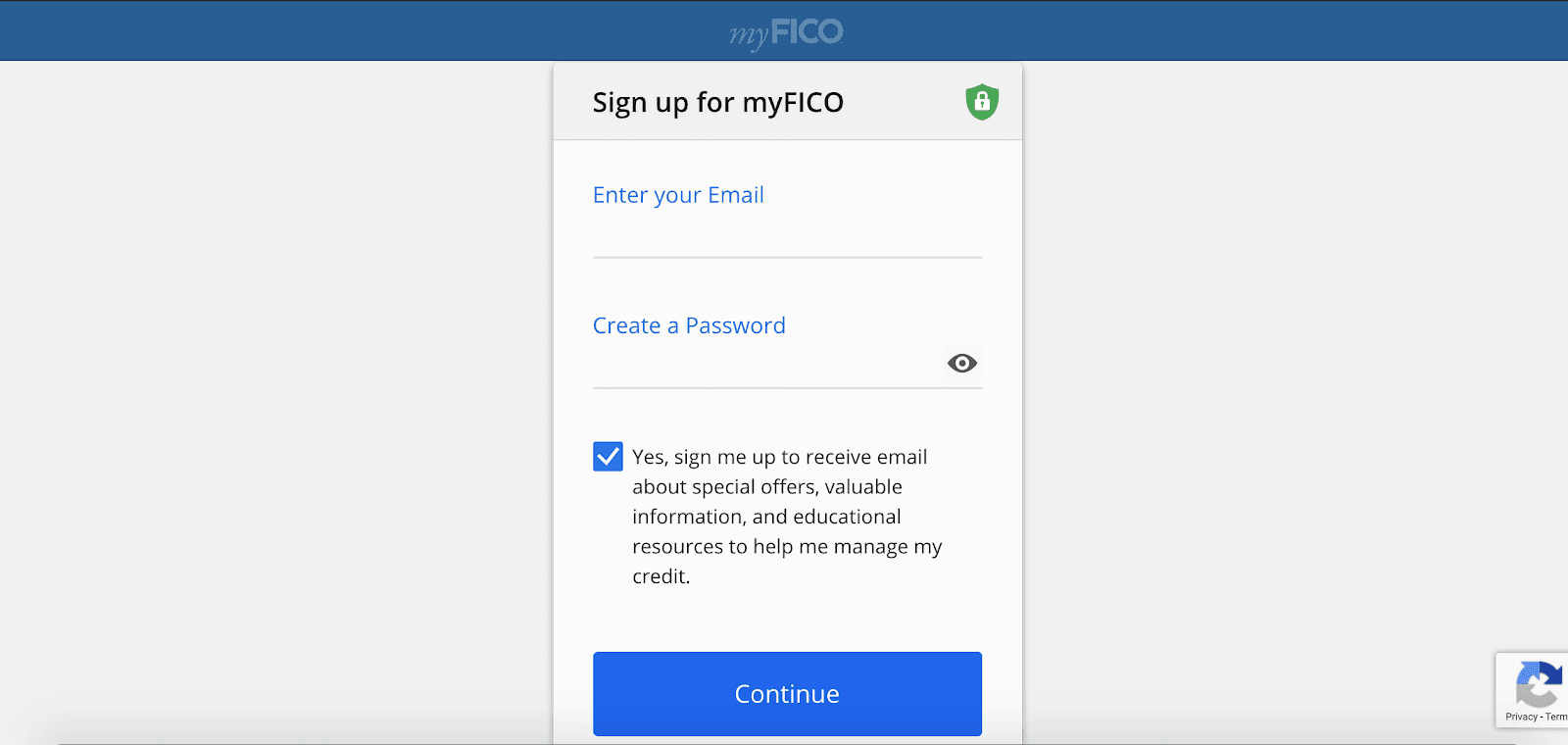

Signing up for myFICO is just a matter of choosing a plan and inputting your billing and contact information. To get started, you’ll pick one of three options. One of the biggest differences between the three is the number of bureaus your coverage will include. With the basic plan, you’ll have access to your Experian score, but with either the advanced or premier version, you’ll get your credit score from all three. Identity monitoring is also only included with the advanced and premier plans.  You’ll then need to input your email address and choose a password. You can also opt-out of receiving promotional emails, although these emails include educational resources.

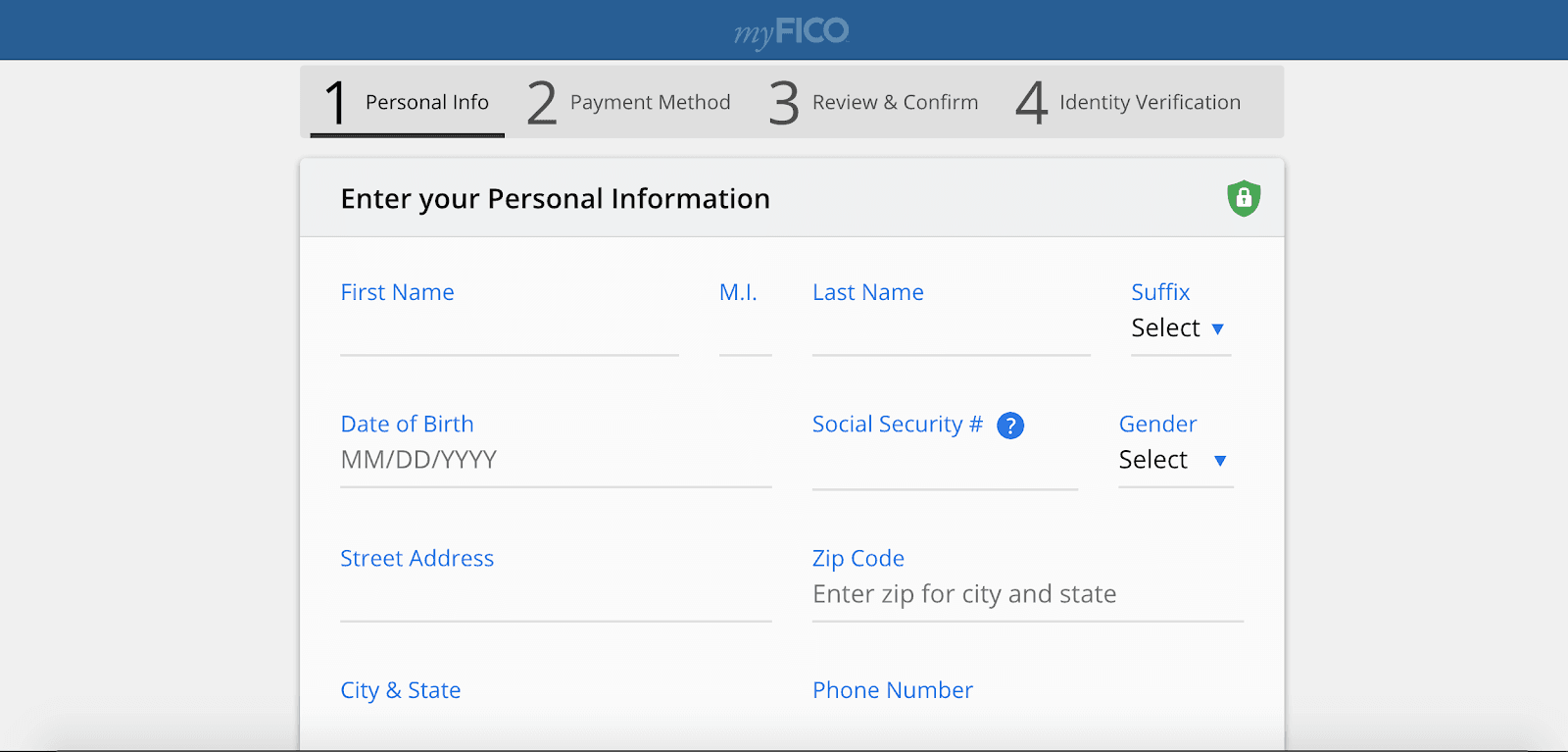

You’ll then need to input your email address and choose a password. You can also opt-out of receiving promotional emails, although these emails include educational resources.  Now it’s time to input your personal information. You’ll have to give your Social Security number and date of birth here.

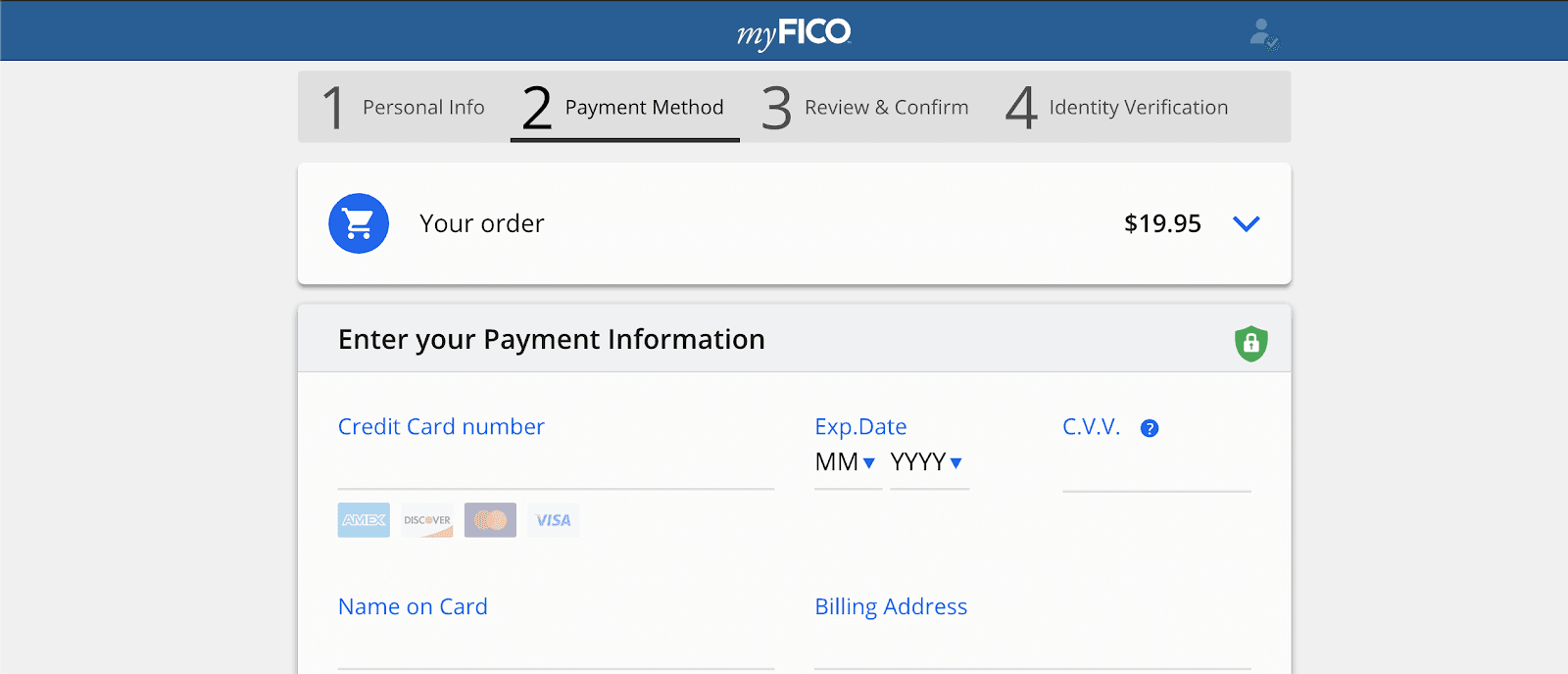

Now it’s time to input your personal information. You’ll have to give your Social Security number and date of birth here.  The final step before your identity is verified is to provide payment information. Once that’s complete and your identity is verified, your account will be official.

The final step before your identity is verified is to provide payment information. Once that’s complete and your identity is verified, your account will be official.

Pricing for myFICO

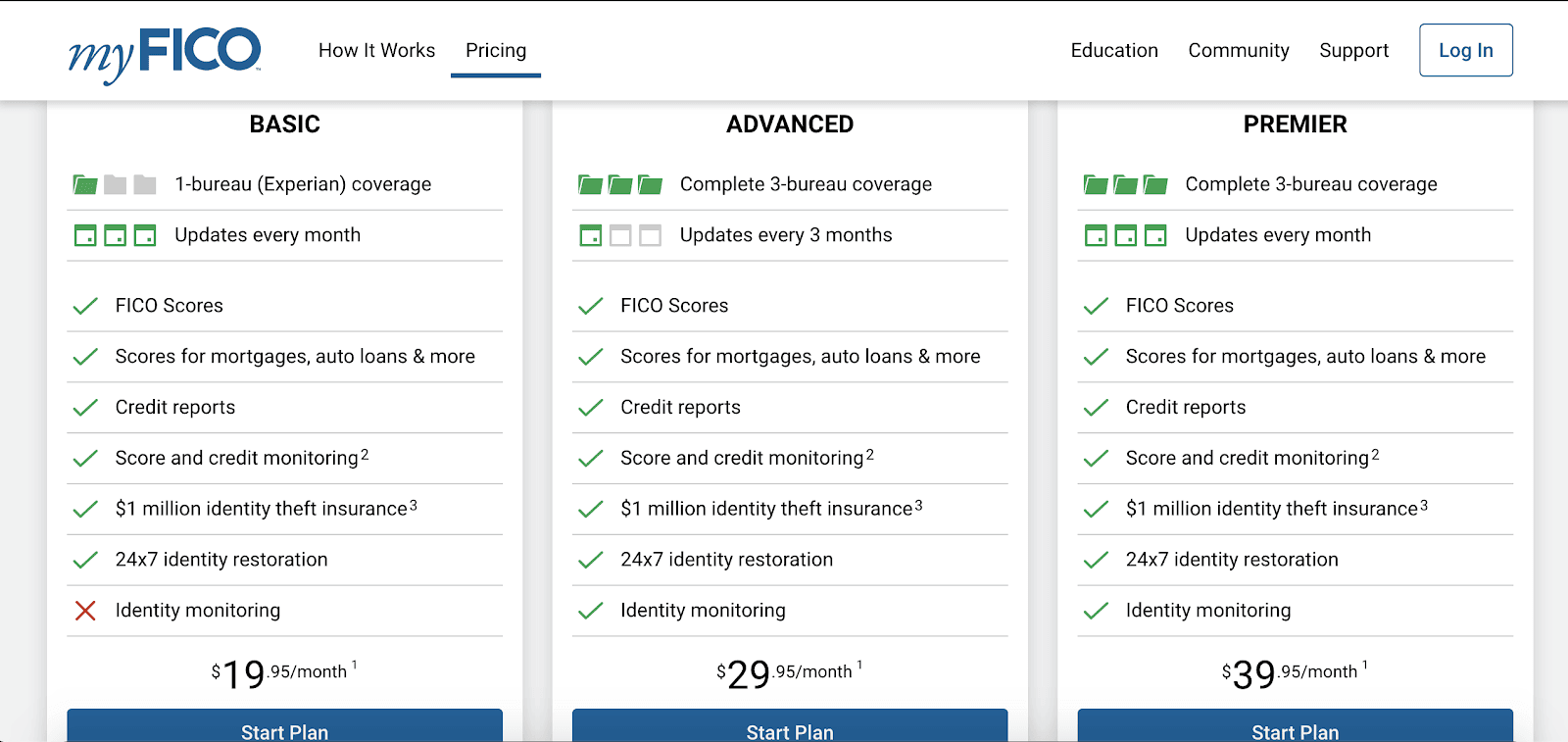

myFICO is structured in three tiers: basic, advanced, and premier. Here’s how it breaks down:

| Basic: $19.95/month | Advanced: $29.95/month | Premier: $39.95/month | |

|---|---|---|---|

| Bureau coverage | Experian only | All three credit bureaus | All three credit bureaus |

| Update frequency | Every month | Every three months | Every month |

| Identity monitoring | Not provided | Provided | Provided |

With all three plans, you’ll get your FICO score, credit reports, score and credit monitoring, $1 million in identity theft insurance, and 24/7 identity restoration. myFICO provides the score you’re most likely to show when applying for a mortgage, auto loans, and more.

myFICO features

There are many tools for monitoring your credit score. Here are a few features that make myFICO stand out.

Official consumer division FICO

myFICO is the official consumer division of FICO, which creates and oversees the FICO score used by the majority of lenders. If you’re interested in keeping an eye on your credit score, myFICO will be one of the best resources you’ll find.

Scores customized to your goals

Creditors use different criteria to determine whether you’re eligible for a home loan than they do for a car loan. myFICO customizes the information you receive to your own goals. With myFICO, you get access to up to 28 FICO score versions, which boosts the accuracy of the score you’re seeing based on the loan you want.

Pull credit reports

Your credit score is only one part of the picture. myFICO also gives you access to your credit report, allowing you to see, at a glance, factors that are affecting your credit. This helps you quickly spot errors so that you can dispute them.

Credit score and fraud alerts

If your score changes, you won’t know unless you’re watching your credit report on a regular basis. myFICO makes it easy to stay on top of your financial health, notifying you if anything changes. If you choose a plan that includes identity monitoring, you’ll also be alerted if suspicious activity is detected.

Identity restoration

One of the worst things about identity theft is the work it takes to repair all the damage. myFICO provides $1 million in identity theft insurance, as well as helping you restore your identity if a criminal damages your credit.

Predictive analytics

myFICO also offers a tool that shows you how various activities affect your credit score. If you take out a mortgage loan, for instance, what will your score be? You can use the tool to try out various scenarios and boost your knowledge of how credit scoring works.

My experience using myFICO

I went all-in on my membership, choosing the premier plan to ensure I had all the benefits. I think you could get away with the advanced plan, though. You’ll get all three credit scores and identity monitoring. The biggest downside to the advanced plan is that you get updates every three months rather than monthly. What I liked best about myFICO was that your three credit scores are displayed on the main dashboard. The date of the last update is below each graphic, and you’ll also see the number of points your score has risen or dropped since the last report. Just below that report, you can see your estimated score if you’re looking for a mortgage, auto loan, credit card, or another type of loan. But the numbers themselves aren’t much help. I wanted to know what my score meant. For that, I just had to click on a score to bring up a page telling me where my score falls in relation to the rest of the U.S. population. Turns out, my score is above average. But myFICO doesn’t stop there. I could also click on a link to find out factors that are hurting my score so that I can take active measures to improve it. From that same main dashboard, I could click on Insights to find out, at a glance, how many late payments and collections I’ve had over the past 30 and 60 days. In addition to actively checking the app, I now receive alerts for more than 30 different types of activities, including inquiries against my credit, changes in credit limits, and newly opened accounts in my name.

Who is myFICO best for?

Aspiring home purchasers

If you’ve been saving your dollars and cents for a downpayment on a mortgage, myFICO is a great tool to have on hand. While you’re preparing for your future home purchase, you can make sure your credit score is in the range lenders want it to be.

Credit-challenged consumers

For those who have a score that’s lower than they want it to be, myFICO can help. You can see, at a glance, what your score is and how much it changes from month to month. You can also pinpoint the activities hurting your score and make adjustments as needed.

Those concerned with identity theft

The value of identity theft protection can’t be understated. myFICO not only monitors your score, but you’ll also get insurance and help with restoring your identity if you ever have an incident.

Who shouldn’t use myFICO?

Budget-challenged consumers

The monthly fee to use myFICO may make it less than budget-friendly for some consumers. If you’re trying to save money, it may be a wise idea to table myFICO until you’ve strengthened your budget, then begin working on improving your credit score.

Cash payers

You may not have plans to borrow money anytime in the future. You may even have an aversion to credit of all types. Monitoring your credit score might not be necessary if you never plan to use that score for anything. However, consider whether you may buy a home in the future. Unless you have the cash for it, you’ll need fairly good credit to get a mortgage.

Pros & cons

Pros

- Reliable data — The FICO score is the one used by the majority of creditors, so you’ll know the information you’re getting is the most relevant

- Customizability — You can get information about your score as it relates to your particular goals, whether it’s buying a house or qualifying for a credit card

- Tips and training — One of the most unexpected byproducts of using this app is that I now have a better understanding of how my activities impact my credit score

Cons

- Cost — Even the lowest-priced plan is $19.95 a month, which can be out of the price range of some consumers

- Slow reporting — Scores aren’t in real-time, but you will see the last time the information was updated

The competition

myFICO is one of several services that provide credit monitoring and reporting category services. Here are a few others to consider.

myFICO vs SoFi’s Financial Insights Tools

SoFi is a free financial app providing credit score monitoring, account aggregation and budgeting, and tools to help you manage the repayment of your student loans and other debts.

SoFi is loaded with free features that track your credit score and help you budget. See all your accounts in one place, get weekly credit score updates, and manage student loan and other debt repayment.

- Free credit monitoring and budgeting in one

- One-of-a-kind student loan management tools

- No affect on your score score

- Uses VantageScore, not FICO

SoFi gives you a complete picture of your finances and credit score. It’s accessible via web browser or the SoFi mobile app.

Activating credit score monitoring with SoFi and exploring SoFi’s financial insights tools is completely free. You do not need to be an existing SoFi member to enroll. After you sign up, you’ll have immediate access to your VantageScore 3.0 credit score, provided by the credit bureau TransUnion. Your score will automatically update each week so you can see how it changes over time. You can also learn to manage your finances in a way that will gradually improve your credit.

» MORE: Learn more or create a free credit score monitoring account with SoFi now or read our review of SoFi’s Financial Insights Tools

myFICO vs Experian

With Experian, you can pull your credit report and FICO score at any time for free.

Experian Boost™ is a credit-building tool that lets you count bill payments in your credit history for a chance to improve your FICO credit score. It’s free to use and ideal for people with limited histories and those newer to credit.

- You choose your bills

- FICO® score tracking

- Ongoing updates

- No guarantees

- Credit requirements

- Must link a bank account

- Only affects your Experian® score

For ongoing service, you’ll need to sign up for the company’s free credit monitoring service. You’ll get real-time alerts to any changes that occur to your credit score, as well as a tracker that helps you monitor your progress in improving your score. Unlike myFICO, though, Experian only gives you access to your Experian credit report and scoring, although your FICO score is also included. It’s a great free tool that can help you monitor your credit, though.

» MORE: Try Experian Boost™ or read our full Experian Boost™ review.

Summary

Whether you’re trying to improve your credit score or you just want to keep an eye on things, myFICO can help. With tools that help you improve your score, you’ll learn more about how your daily activities impact where you fall on the risk spectrum for lenders.