If that’s the case and you’re ready to build it back up, the OpenSky® Secured Visa® Credit Card can help. Make regular, on-time payments on this credit card to see your credit score improve month after month.

Never had a credit card before? That’s OK, too. OpenSky® Secured Visa® Credit Card allows you to prove you can handle credit responsibly.

Overview of the OpenSky® Secured Visa® Credit Card

- Best for– Those who want to better their credit and people with limited credit history.

- Annual fee– $35

- Credit check– None to apply.

- Minimum security deposit– $200.

- Credit reporting– Reports to all three major credit bureaus.

OpenSky® Secured Visa® Credit Card

Annual Fee

Intro APR, Purchases

Intro APR, Balance Transfers

Regular APR

Credit Needed

$35

N/A

N/A

25.64% Variable

Poor/Limited/No Credit

In-depth OpenSky® Credit Card review

The OpenSky® Secured Visa® Credit Card is a secured card, meaning you’ll need to put down a security deposit (in this case, $200 – $3,000) to secure (hence the term secured) your credit limit. While that may seem like a pain, it’s only fair, considering you don’t have much of a credit history, and OpenSky wants to guarantee that they’ll get paid back if you don’t pay down your bill.

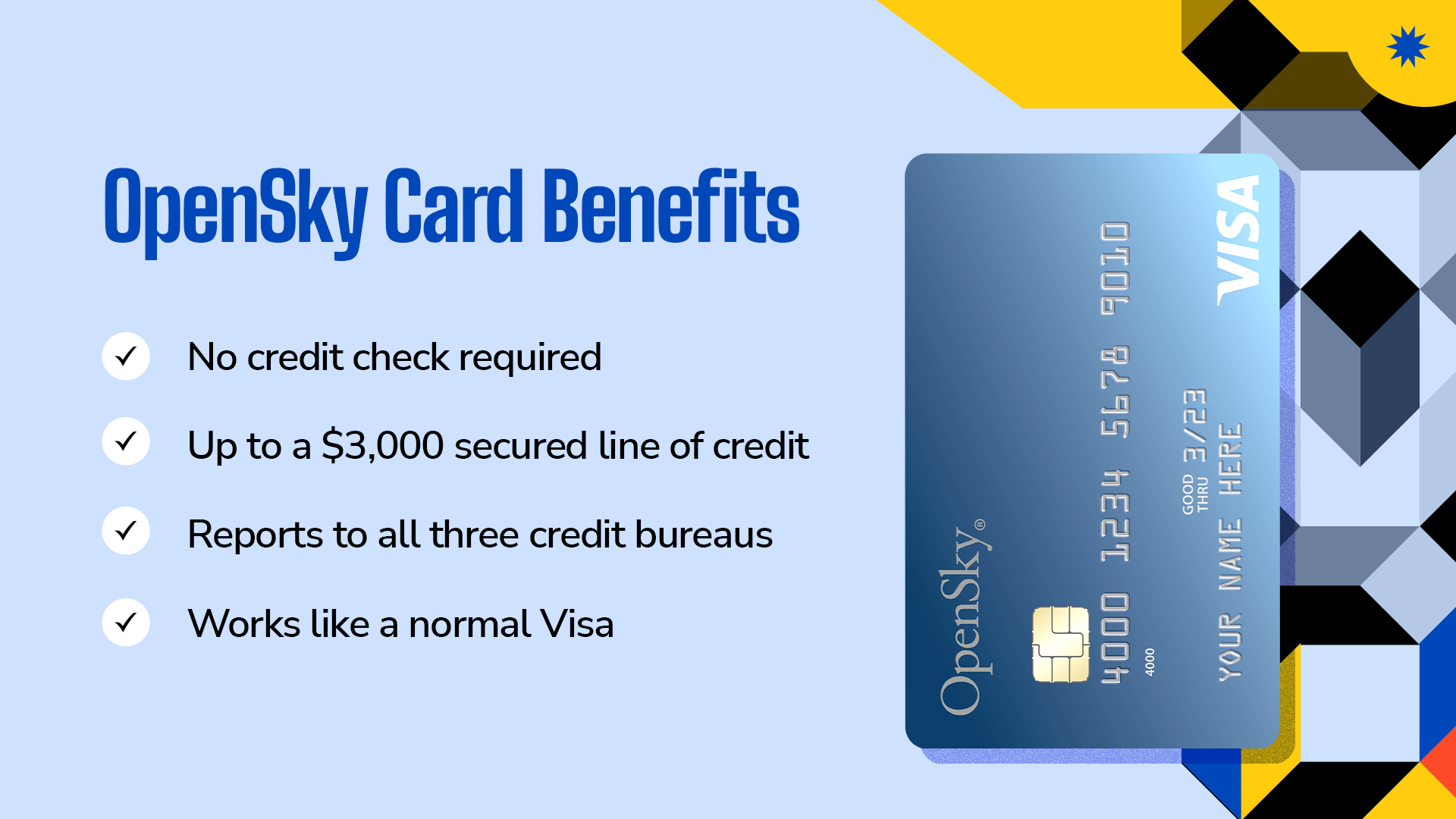

Plus, the OpenSky® Secured Visa® Credit Card has plenty of useful features, including:

No credit check

The OpenSky® Secured Visa® Credit Card doesn’t require a credit check. They don’t run a “hard pull” on your credit like other credit cards. Anyone has the chance to get the OpenSky® Secured Visa® Credit Card, no matter what their credit score is.

Good range for deposit

The OpenSky® Secured Visa® Credit Card gives up to $3,000 of a secured credit line via a refundable* security deposit that you provide. But you can also get the card with a credit line as low as $200. So no matter how much you’d like to put toward this account, OpenSky® can work with you.

Reports to all three credit bureaus

The OpenSky® Secured Visa® Credit Card also reports monthly to Equifax, TransUnion, and Experian. This is an excellent feature of the card because this reporting helps you build your credit.

When you make a purchase and then pay off your card (or at least pay the minimum), it’s reported to the credit bureaus. This would establish a habit of responsible credit card usage, even if you had bad or no credit.

It works like a normal Visa

While the OpenSky® Secured Visa® Credit Card is a secured card, it isn’t flagged as “secured” in your reports. But your card usage is still reported like any standard credit card. So use it anywhere you would use a regular Visa card: the grocery store, online, or even rent a car with it.

Pros & cons

Pros

- No credit check — It doesn’t matter what your current score is, or if you even have one at all.

- Easy to apply — Apply in minutes online at the OpenSky website.

- Helps rebuild your credit fast — Responsible use of your OpenSky® Secured Visa® Credit Card could give your credit score a boost in just a few months.

Cons

- Annual fee — The annual fee might be unattractive to some people.

- Deposit is held until you close the account — You have to completely close the account and pay the balance in full to get your deposit back.

Who should get the OpenSky® Secured Visa® Credit Card

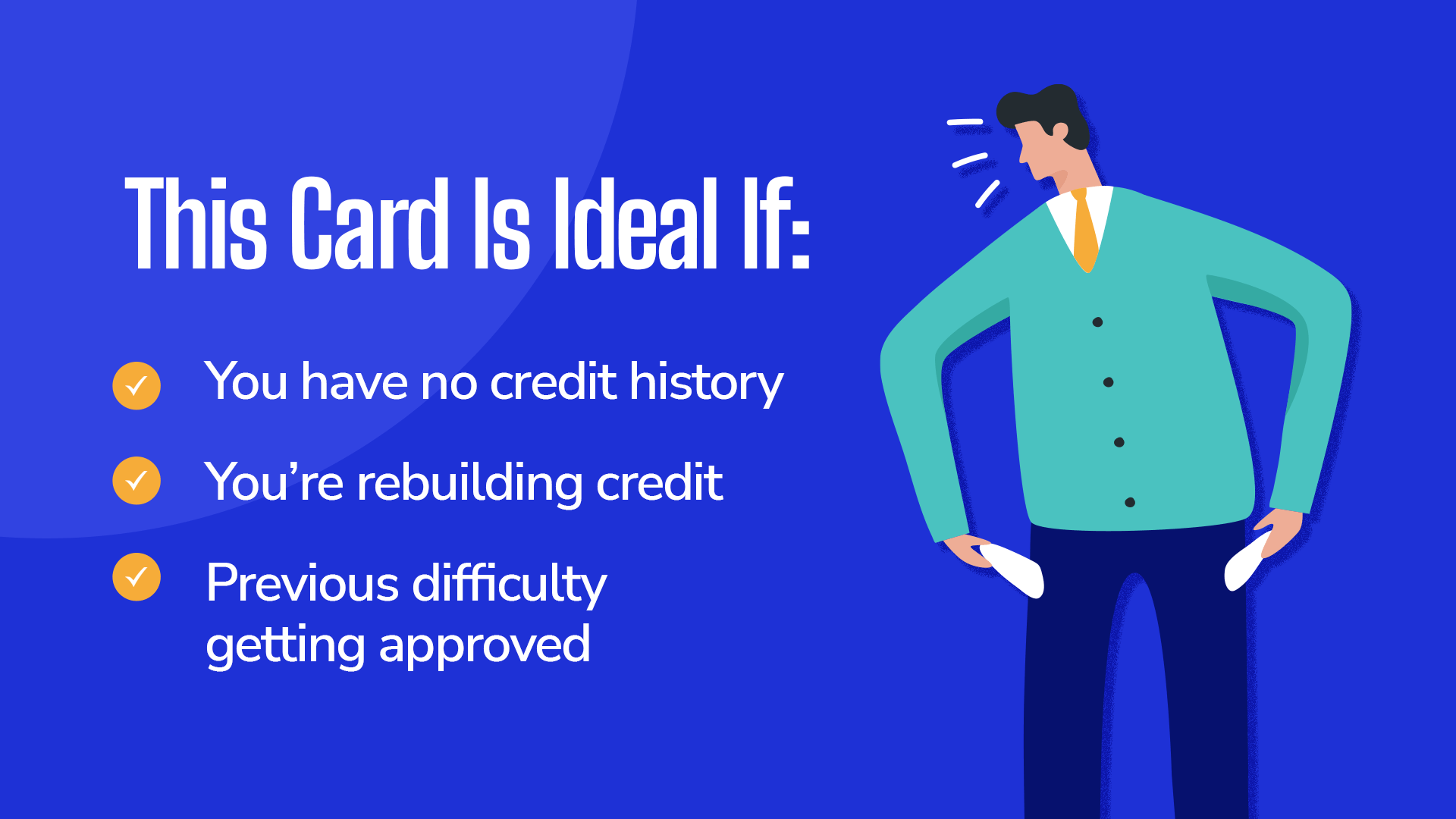

Those with no credit history

The OpenSky® Secured Visa® Credit Card is a good option for someone with no credit history, such as students or people just starting their financial journey. It’s also a good choice for people who want to improve their credit from a low credit score to something higher.

Those rebuilding credit

You may have had some financial trouble and took a hit on your credit score. The OpenSky® Secured Visa® Credit Card is an option that lets you focus on rebuilding that score, which will open the door for more opportunities down the road. They won’t look at your credit score, so you can focus on improving.

Those who have previously had difficulty getting approved

If you’ve never had a credit card before and have trouble getting approved for a credit account, the OpenSky® Secured Visa® Credit Card can help you prove your creditworthiness. It doesn’t matter if you don’t have an existing credit score because OpenSky® doesn’t consider that in the application process.

How to apply for the OpenSky® Secured Visa® Credit Card?

You can sign up for the OpenSky® Secured Visa® Credit Card from their website. All you need is some personal information, so OpenSky can verify your identity:

- Name.

- Email.

- Address.

- Phone number.

Then, you’ll provide some information about your finances:

- Total annual income.

- Monthly housing payment.

- Housing payment type (rent, mortgage, other).

- Social security number.

- Date of birth.

This is very private information, but they need this data from you to ensure you are who you say you are; verifying identity for financial accounts is a law under the USA Patriot Act.

Next, OpenSky® will share some disclosures with you. These are the terms of your financial agreement, and you’ll see details about the OpenSky® Secured Visa® Credit Card, such as the annual percentage rate (APR).

Alternatives to the OpenSky® Secured Visa®

The OpenSky® Secured Visa® card is great if you have poor credit. But other secured credit cards are worth considering as well. You may even qualify for a card that doesn’t require a security deposit.

Here are some alternatives to take a look at:

Capital One Platinum Secured Credit Card

The Capital One Platinum Secured Credit Card has no annual fee or foreign transaction fees. See Rates & Fees.

You can put down a refundable security deposit of as little as $49 to access a $200 credit line.

One perk of this card over the OpenSky® Secured Visa® card is that you’ll be automatically considered for a higher line of credit in as little as six months, with no extra deposit required.

Like most secured cards, the Capital One Platinum Secured card doesn’t come with rewards or cash back. It also doesn’t offer an intro rate on purchases, so you’ll want to be sure you pay off your balance every month to not only avoid paying high fees but also start improving your credit score.

Revvi Visa® Credit Card

The Revvi Visa® Credit Card is a good option for anyone with a credit score of 620 or lower, including those with no previous credit history or anyone who has poor credit in need of improvement.

This card has an annual fee of $75 the first year, which then gets reduced to $48 each year after. There is a one-time $95 program fee, but the good news is this card requires no security deposit and offers 1% cash back on all purchases (See Revvi Rewards Program Terms & Conditions for details).

The pre-qualification process for the Revvi Visa® card is easy, and most applicants receive a response in seconds. They also report to all three major credit bureaus, allowing you to build credit with on-time payments. Speaking of on-time payments, cardholders will be eligible for a credit line increase after just 12 months of on-time payments. So if you’re interested, consider applying for this card before resorting to a secured card instead.

Milestone® Mastercard®

Lastly, I’d recommend the Milestone® Mastercard® as an alternative to the OpenSky® Secured Visa® card.

The annual fee for this card is a bit different: it comes with an elevated annual fee the first year then it drops for all following years. But the higher fee may be a sacrifice you’re willing to make for an unsecured card that doesn’t require a security deposit.

You can get approved for this card even if your credit score is below 600, so it can be a solid way to start building or rebuilding your credit.

Your Milestone® Mastercard® comes with the ability to access your account on your phone or online 24/7. In addition, you can set up payment alerts so that you never risk missing a payment and paying a late fee or taking a hit on your credit score as you try to rebuild it.

Summary

For people looking to improve their credit history right away, the OpenSky® Secured Visa® Credit Card is a great option because it requires no credit check. Use it to fund small purchases, pay the minimum payment on time every month, and watch your credit score improve as OpenSky® notifies each credit reporting bureau of your timely payments.

It is possible to improve your credit score and get closer to better interest rates, even a home or car loan, with a secured card like the OpenSky® Secured Visa® Credit Card.