When I was looking for car insurance, I sought out companies that would provide me personalized quotes based on how I drive, as opposed to blanket quotes for all types of drivers. I didn’t think it was fair to charge everyone the same price since all of us drive differently.

That’s when I found Root Insurance, a company that tracks your driving habits for a specified amount of time and then decides whether or not they’ll insure you. Root won’t cover risky drivers, but I wasn’t worried, because I always drive carefully.

For safe drivers who are looking for better insurance rates based on their everyday driving habits, then Root is going to be a solid option.

What is Root Insurance?

Root is pretty new when it comes to the insurance space. They’re based out of Columbus, Ohio and they claim to offer auto insurance based on how you drive. They do this through UBI – or usage-based insurance.

Basically what this means is Root will collect information on your driving habits through what’s called telematics devices. Based on the data they collect and how you drive, they’ll price their premiums from there. It’s nice because it’s a more accurate depiction of you, instead of simply relying on your demographics and historical data.

Root also offers the standard auto insurance coverage options that most other insurers do. Things like bodily injury and property damage liability, collision and comprehensive, and uninsured/underinsured coverage are all available through Root.

They’re also able to offer coverage to those who live in states with specific auto insurance requirements (i.e., medical payment coverage, personal injury coverage) should you need it. Finally, Root gives you roadside assistance with every policy, which is a huge perk.

How does Root Insurance work?

Today, nearly all insurance companies will depend on things like your driving history, demographics, car, and credit score (among other factors) to determine your insurance rate. Root Insurance looks at these factors but to a much lesser degree. That way your quote is based more on how you drive during the Test Drive (usually two to four weeks).

Here’s a little more information on how exactly this works:

You can get started by either downloading the Root app or going onto Root’s site and simply opting into their quote process. Root will use your phone’s GPS (so you’ll need to enable it for the app) to look at your driving behaviors during their Test Drive period.

They’ll look at things like your speeds, the time of day you tend to drive, how fast you take turns, how smooth your rides are, and how hard your braking is. What’s really cool is Root uses machine learning, so they can actually tell if you’re driving or if you’re a passenger. This way you won’t get crushed for your spouse’s terrible road habits.

Once the Test Drive period is over, Root either gives you a quote for insurance or declines to cover you. Root makes it a habit to not cover high-risk drivers, so if you’ve got a bad driving history or you’re just a reckless driver, I’d look for another option because you’ll probably get declined.

But, if you’re a pretty good driver, you should be able to get a quote from Root. And the fact that they weed out bad drivers allows you to take advantage of lower rates.

Pricing for Root Insurance

While pricing will vary, if you do the Test Drive and qualify for a quote, odds are you’ll find the pricing to be pretty low-cost compared to some of the other bigger insurers.

But remember, if you drive poorly during your Test Drive you may not qualify for a quote at all. And when you do qualify and the price is low, you can pretty much expect basic coverage options – nothing too elaborate.

You may also find that you need some specific add-ons to your insurance policy. For example, if you have a new car, you might want to look at getting gap insurance. But gap insurance isn’t offered by Root, so you’ll have to go elsewhere for that.

Root does claim to save their customers up to 52% on their car insurance coverage, though. And they put their customer reviews right on their site for you to see – most of them being incredibly positive.

So to put it simply, pricing tends to be low-cost if you qualify, but not incredibly comprehensive. Your best bet is to get the app and do the Test Drive to see what kind of rate you’d receive (if you qualify that is).

Root Insurance features

Root has a complete cadre of basic insurance options, as well as several add-ons. What this means is that if you’re looking for things like pet coverage or rideshare insurance, you’re better off looking elsewhere (like Allstate, which I’ve outlined below).

That being said, here are the features Root Insurance does offer.

Liability coverage

- Bodily injury – Covers injuries to others when you cause an accident.

- Property damage – Covers damage to other vehicles or property when you cause an accident.

- Liability (Bodily injury & property damage) + collision & comprehensive – Also known as “full coverage,” Root can provide this as optional.

Car coverage

- Roadside assistance – Root Insurance includes roadside assistance for services like towing and battery jump starts, with each of its policies at no extra cost. Roadside assistance is delivered through Blink in most cases – a partnership Root has – but customers can request services from any company they want. The roadside assistance benefit is covered for up to three incidents during the six months of your policy’s term. Each incident is covered for up to $100.

- Collision coverage – Pays for covered damage to your vehicle when you cause an accident.

- Comprehensive coverage – Pays for covered damage to your vehicle caused by anything other than an accident.

- Rental coverage – As I previously mentioned, most car insurance companies will give you rental reimbursement coverage – meaning they’ll pay for a rental car while yours is getting repaired after an accident. Root does this but alternatively provides you with the option to get reimbursed for rideshares from services like Lyft. Every time you make a claim, you get to choose which option you want. Root Insurance can also help you determine which option is right for you.

- Uninsured motorist property damage – Covers your property when it is damaged by an uninsured driver.

Medical coverage

- Personal injury protection – Covers medical expenses and lost wages for you and your family members, no matter who causes the accident.

- Medical payments – Helps pay for injuries to you or your family members, no matter who causes the accident.

- Uninsured and underinsured motorist bodily injury – Covers your medical expenses when you are injured by an uninsured or underinsured driver.

Other

- Rental reimbursement – Rental reimbursement is optional with Root. If you add it, though, it gives you the option to rent a car and be reimbursed for the cost – if yours is in an accident and being repaired. You’ll find this included with most other auto insurers, so Root actually offers credits for Lyft rides in lieu of this being standard.

- SR-22 access – You can obtain an SR-22 form from Root, which is an official document you file with your state that proves coverage. It just requires a few taps via the Root app (like most other things using this provider).

Discounts

Since Root is so different in how they price your car insurance, it tends not to offer many traditional discounts that you’d see with most other insurance providers. That being said, Root offers the following:

- No phone usage discount – You can get up to a 10% discount on your insurance if you don’t use your phone while you drive.

- Tesla automated driving discount – If you have a Tesla equipped with autopilot, you can get a discount from Root when you use automated steering.

Who is Root Insurance for?

Root isn’t for everyone. That said, here are a few groups that should love the company:

People who have good driving routines as well as an excellent driving record

If you have a great driving history and you maintain solid driving habits (i.e., you don’t speed, brake too hard, or take turns like a crazy person), you’ll most likely get a quote and find that it’s affordable.

People searching for cheap car insurance

If you’re okay with more basic insurance coverage and you qualify for a quote from Root, odds are you’ll end up saving a pretty good chunk of change.

People interested in customized car insurance quotes

If you want to have a quote tailored specifically to YOU and how you drive, you’re going to like Root. They don’t see you like a list of demographics and other data; they actually quote you on how you drive, which makes it far more personalized.

Students looking for an inexpensive car insurance plan

If you’re currently a student and you want to save money (especially if you drive well and don’t drive often), you’ll probably LOVE Root.

Technology-wise customers who don’t mind a mobile experience

If you’re used to using for phone for pretty much everything and don’t mind managing your car insurance through an app, then Root will speak to you. It definitely caters to those mobile crowd.

Who shouldn’t use Root

Those with questionable driving records

If you’ve had tickets, accidents, or any kind of poor driving record, it’s likely that Root won’t be able to offer you insurance, since they do not take on risky drivers.

Those looking for discounts

If you want an abundance of discounts (Good Student, Good Driver, etc.) Root won’t be right for you. You’re better off going with a big-name company like Geico or Allstate.

My experience using Root Insurance

Note – I did not decide to do the Test Drive with Root Insurance, as the coverage options are too limited for what my family needs right now. That said, I did sign up for the app and walk through the process, so I can share my experience with you.

First off, I have to say that the whole idea of Root Insurance is awesome. Whether I like to admit it or not, I’m pretty much glued to my phone. It carries my whole life in it these days. So it only makes sense to look at insurance that would come directly from an app on my phone.

After I downloaded the app, I opened it up and was greeted with a bright orange screen.

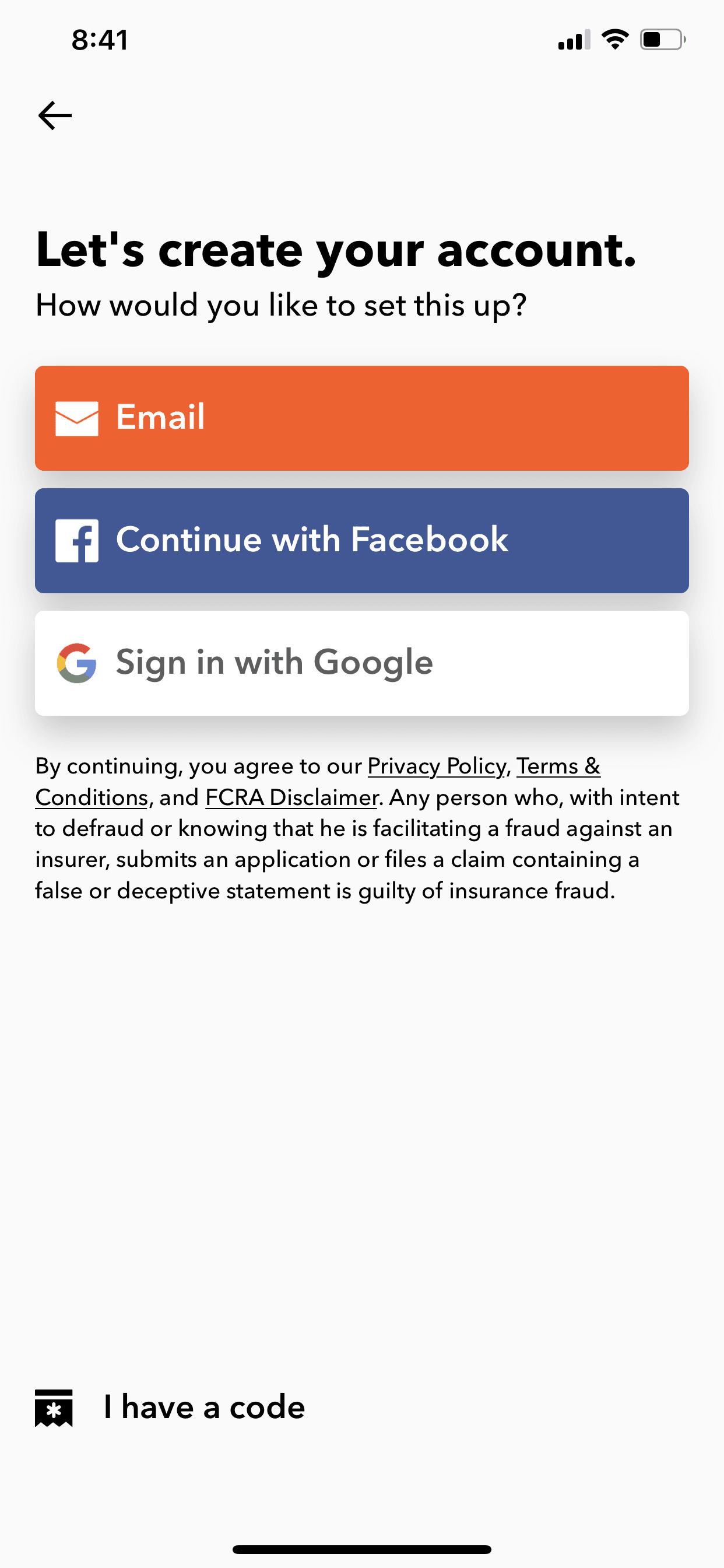

Once I clicked “Get started,” I was taken to a screen where I could enter my email to sign up (you can also sign up with Facebook or Google):

After that, I had to enable location, motion, and notifications (note: if you don’t do this, they won’t be able to accurately evaluate your Test Drive).

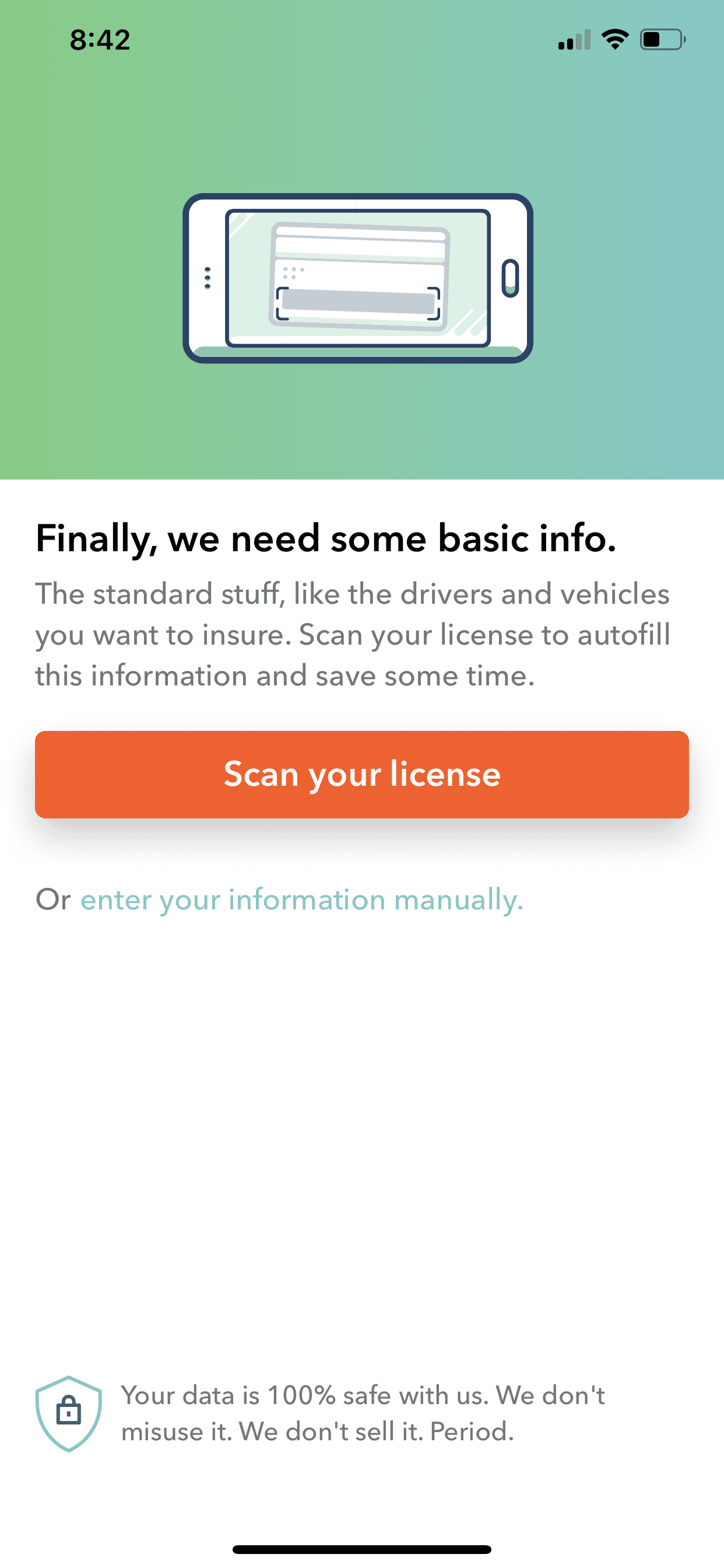

As a final step, I had to take a snapshot of my driver’s license (you can also enter the information manually). The app scans the barcode on the back of your license.

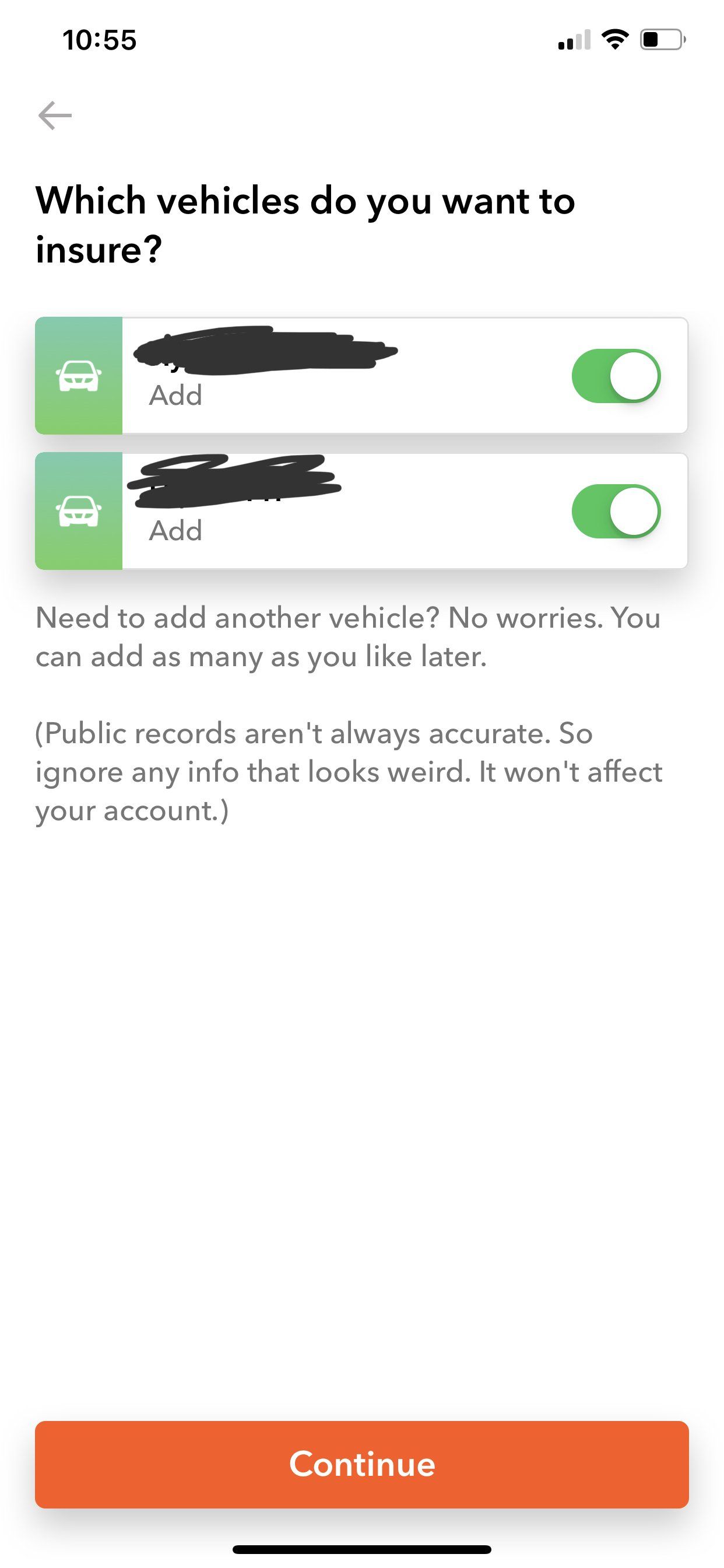

It then finds your address (based on the barcode) which you have to then verify, or enter a new address if you’ve moved. It’ll then ask if you own or rent your marital status, who will be covered, and which vehicles you want to insure.

After that, you confirm all your information is correct and you’ll get started with your test drive. At that point, you simply keep your phone on you while you drive, and Root will do the rest.

Pros & cons

Pros

- Ultra low cost — By giving you a Test Drive and weeding out bad drivers, Root is able to offer some of the lowest-priced quotes in the market.

- 24/7 claims support — This might not seem that awesome, but when you do pretty much all your business through a mobile app, you might expect to not have a live person available for things like claims at 2:00 in the morning. Root does.

- Very fast claim payment — Root will typically pay your claim within 10 business days. Most auto insurers these days are going to take several weeks to process and pay a claim, so this is an excellent benefit for those who want to get their money faster.

Cons

- The coverage area is sparse — You can only get Root Insurance in one of 20 different states today. Root claims they will be expanding to more states in the future, but for now, you’re out of luck if they don’t cover your area.

- Lack of history — Root is only about five years old, which can make some new customers a little nervous, especially when some of the major insurers have been around since the early 1900s. Being so young can also be a challenge because there isn’t a substantial history to show that they’re able to pay out all of the claims they receive. Also, Root hasn’t been evaluated by organizations such as J.D. Power, which provides annual ratings on car insurance companies.

Root Insurance vs. competitors

| Root | Allstate | |

|---|---|---|

| Best for | Student drivers | A wide array of discounts |

| Discounts | No phone usage Tesla automated driving |

Good student Save driver Bundling and more |

| Types of insurance offered | Car insurance | Car insurance Life insurance Homeowners insurance Renters insurance and more |

Allstate

Allstate is a completely different type of insurance provider. They take the traditional route of giving you a quote, versus having you Test Drive on an app for a few weeks.

Allstate is a completely different type of insurance provider. They take the traditional route of giving you a quote, versus having you Test Drive on an app for a few weeks.

They offer all types of insurance, too (not just auto insurance), including homeowners, renters, life, and a lot more. They have an easy to use mobile app that lets you file claims right on the spot, and their J.D. Power ratings are pretty good.

Summary

Root Insurance provides a unique value proposition. If you’re someone who drives really well and doesn’t need a bunch of complex coverage types, this might be a really good option for you. For me, with a family and higher insurance needs, it didn’t fit. But if I were a single person without kids, I’d already be signed up by now.

While the “quote” process isn’t instant – it will only be a matter of weeks doing what you normally do (driving around with your phone). At that point, you’ll see if you qualify and if so, what rate you’ll receive, all before committing. If you’re looking to save money, I would definitely check this one out.