Streitwise is a real estate investment platform focusing on commercial real estate. As an investor, you can get started with just $5,000 and be a part of large-scale real estate projects.

Streitwise has a very straightforward structure for their pricing, and I’ve seen them rated as not only one of the lowest in pricing but one of the best-rated companies overall in this field.

In addition, both accredited and nonaccredited investors are able to participate – something many of its competitors shy away from. With an easy-to-use iOS app and cryptocurrency funding available, Streitwise stands out as a top-notch real estate investment platform.

Streitwise is a real estate investment platform focusing on commercial real estate. As an investor, you can get started with just $5,000 and be a part of large-scale real estate projects. Both accredited and nonaccredited investors are able to participate – something many of its competitors shy away from. .

- Anyone can invest

- Low initial investment

- Generous lockout period

- Limited options, usually one REIT

- Upfront fee is high

What is Streitwise?

Streitwise opened up shop in 2017, so they’re a relatively new company. They’re based out of Los Angeles and focus solely on REITs (hence the funny spelling of their company name). Streitwise is geared toward individual accredited and nonaccredited investors.

Streitwise is NOT a crowdfunding site

One of the major differences with Streitwise is that it’s a REIT (real estate investment trust), not a crowdfunding platform like many other online real estate investment brokers.

To put it simply, a REIT is like an ETF or mutual fund full of a variety of real estate investments – in this case, commercial real estate projects.

Crowdfunding, on the other hand, is when you’re directly contributing to a single or small group of real estate projects and are tied directly to their success or failure.

There are obviously pros and cons to this, and it’s up to you as the investor to decide which option is best.

REITs let you earn two ways

In addition, this REIT is what’s considered an equity REIT. This means that you’ll not only get dividends from the investments (through cash flow by way of rent payments on commercial property), but you’ll also benefit from any appreciation in the underlying value of the commercial real estate itself.

They have great accreditation

Finally, Streitwise has a BBB (Better Business Bureau) rating of A+, which is the highest rating you can have as a company.

How does Streitwise work?

Getting started with Streitwise is pretty easy. From the Streitwise homepage, just click “Start Investing” in the upper right corner:

On the next page, click “Get Started”.

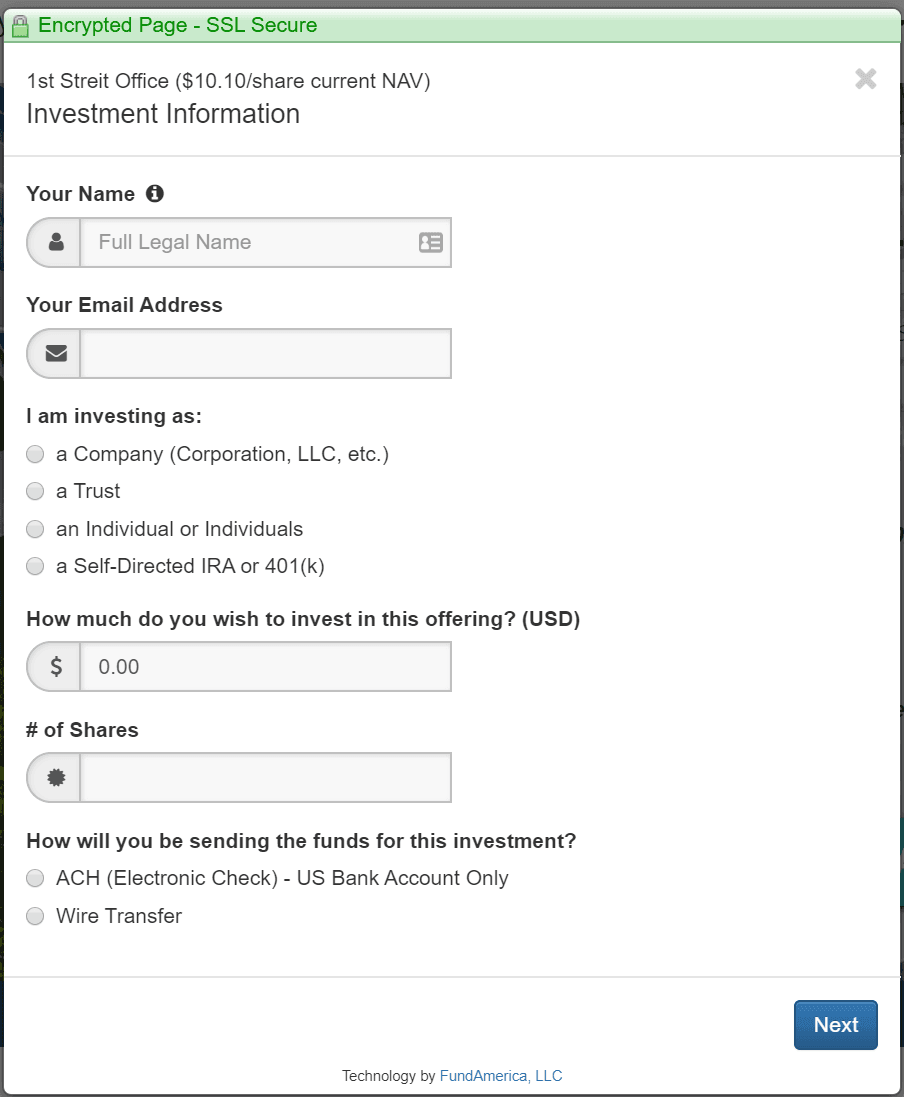

You’ll then get a popup that asks you to enter some basic information about your investment, as well as yourself:

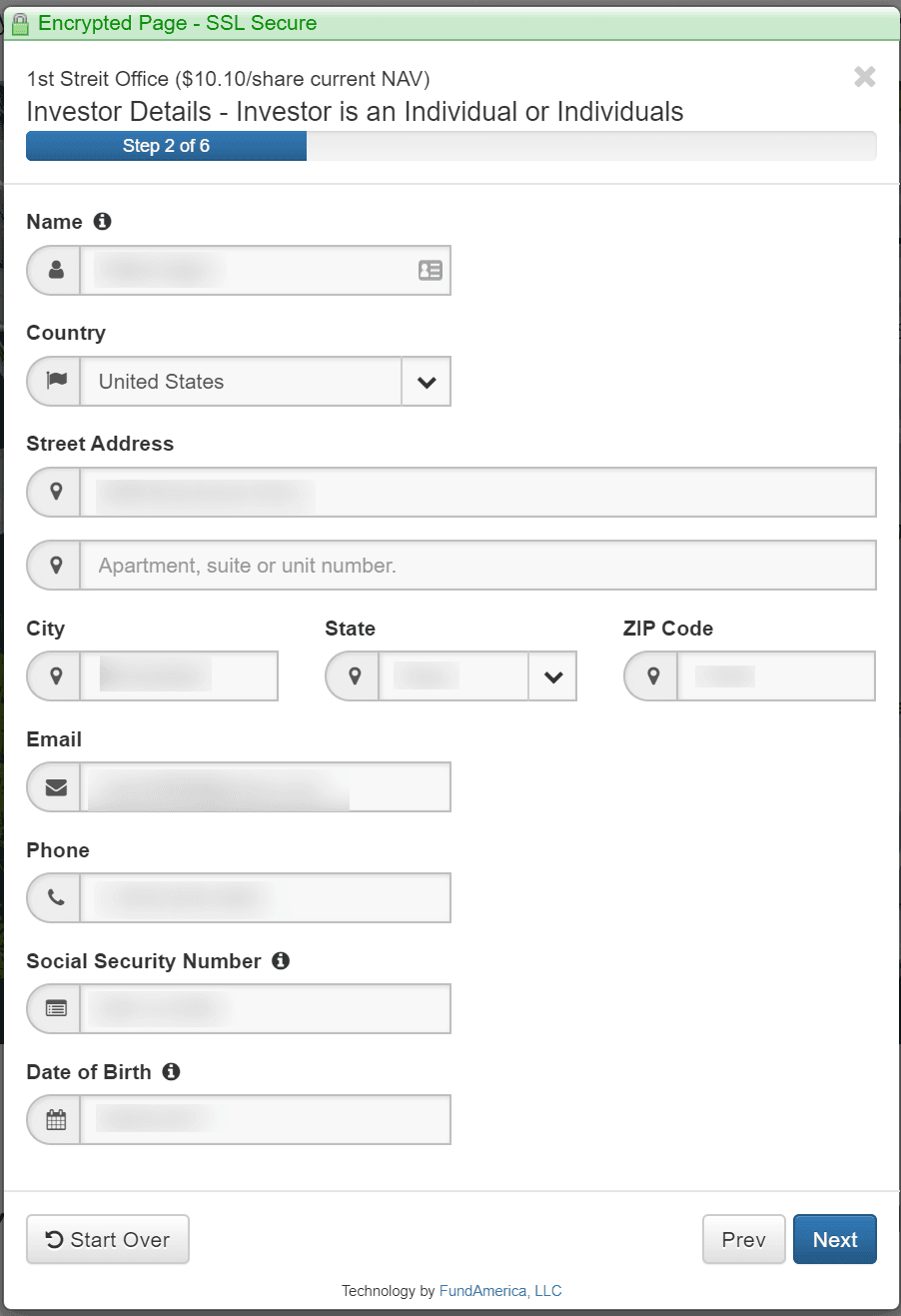

In the next step, you’ll be asked to enter some more information about yourself, including your address, phone number, and Social Security number:

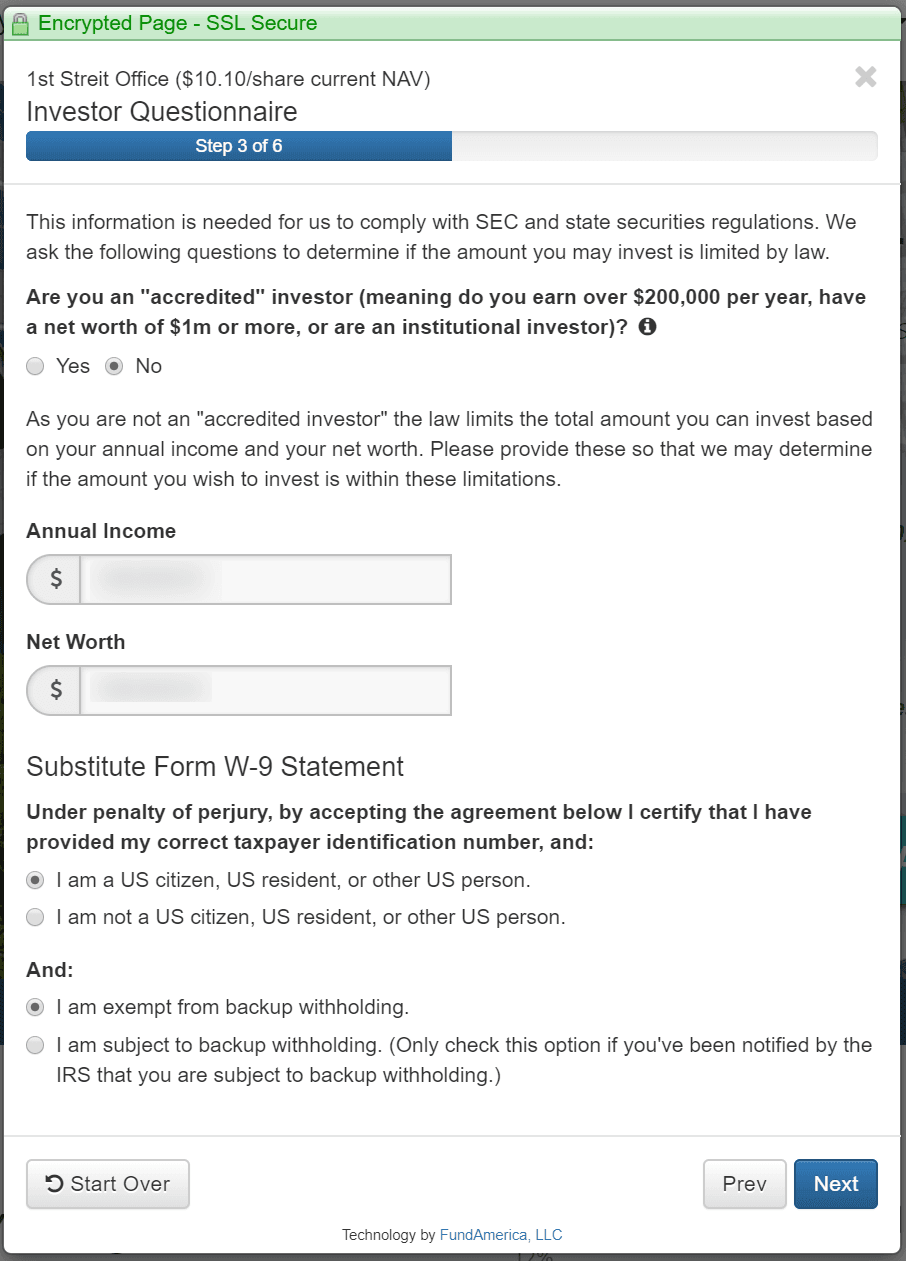

After, you’ll need to do a brief questionnaire where you’ll let Streitwise know if you’re an accredited investor or not, based on your income and net worth:

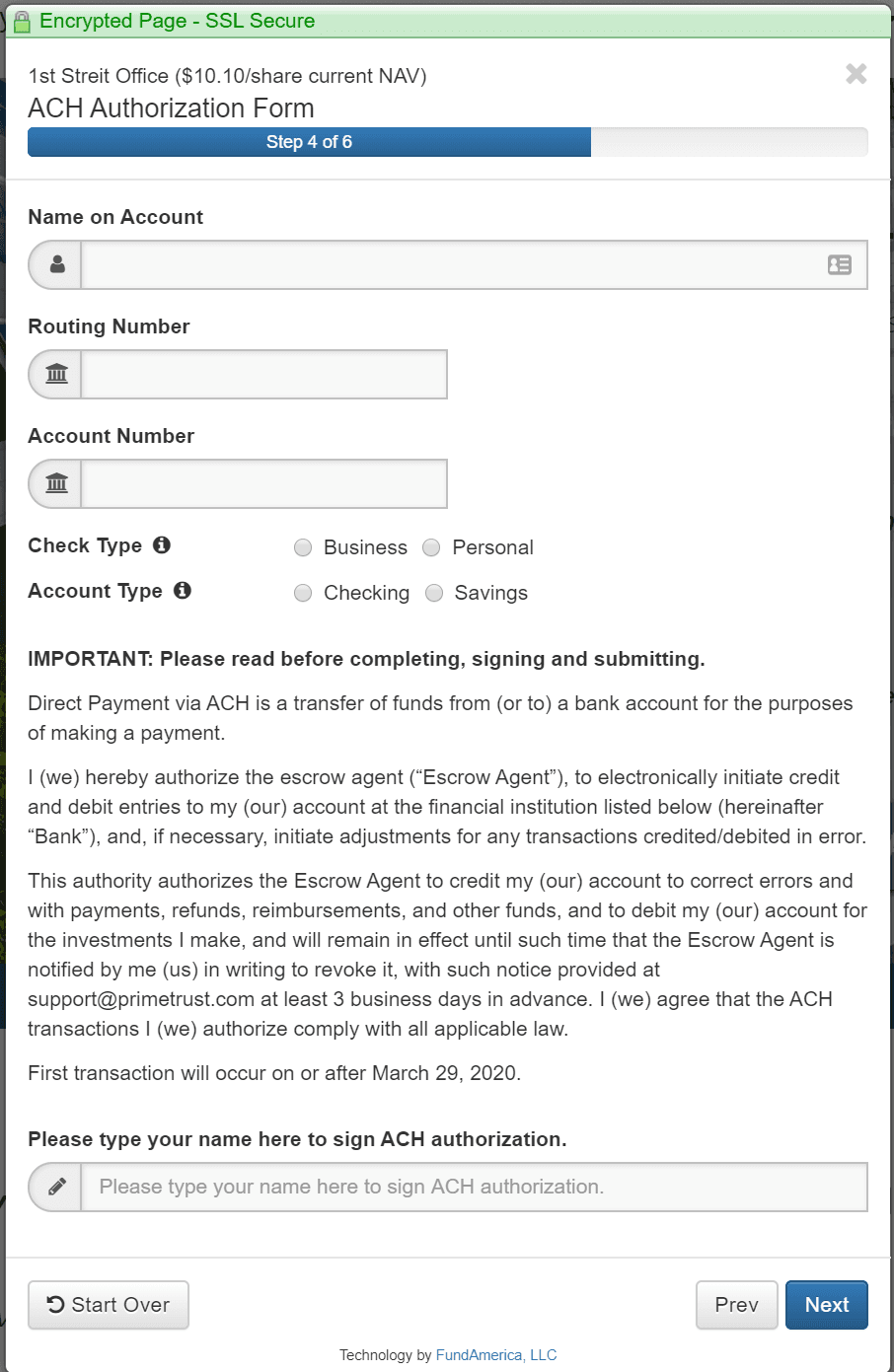

You’ll then fill out your bank account information in order to fund your account:

This is where things get a little more spaced out. After you input your bank account information, your money will take about one to two days to be moved into an escrow account.

After that, your funds will be received and sit in an escrow account for about 10 days before being cleared for share issuance.

Once your funds clear, the money will be typically invested mid-month or end-of-the-month, depending on exactly when your funds clear.

At that point, you’ll get an email saying your account has been funded and you can create an account username and password, then begin monitoring your account.

Unfortunately, it takes upwards of four weeks to get your account funded and up and running.

Pricing for Streitwise

If you aren’t familiar with REITs, it will be helpful to know that they carry more risk than traditional investments such as stocks or index funds. REITs will also tend to have much higher fees than your average stock fund.

That being said, Streitwise charges 3% as an upfront investment fee (for organization expenses) in addition to a 2% management fee (annual). However, the 2% fee has been taken out of the dividend so investors won’t see that deduct from their ownership, either.

These fees might sound high, but Streitwise notes that no amount will be taken out of the shares you’re purchasing and that 97% of what you invested will go to the REIT & Operating Partnership as proceeds.

This might sound high, but again, you’re not comparing apples to apples. It’s apples to oranges – meaning, REITs are in a different category than stock funds. So this is actually a fairly low-cost for a high-quality REIT. Also, I was impressed that Streitwise was rated as having the best fees in The Real Estate Crowdfund’s Review.

One final note about fees: you’ll be charged these fees regardless of how the REIT performs, so there is some inherent risk.

Streitwise features

Low minimum investment

You can sign up and get started with Streitwise for a minimum of $5,000, which is awesome when you think about the types of investments you’re getting access to (large-scale commercial real estate).

This $5,000 can be increased in $500 chunks if you want to invest more (i.e., $5,500, $6,000, $7,500, etc.).

Multiple account types

One of the things I love about Streitwise is the flexibility in account types. You can open an individual taxable account, an individual retirement account (IRA), or even a trust.

iOS mobile app

If you have an iPhone or iPad, you can now access the Streitwise app in the app store. The easy-to-use app lets you keep an eye on your real estate portfolio whether you’re home, in the office, or traveling. You’ll need to first set up a Streitwise login on the website to use the app.

Invest using cryptocurrencies

Cryptocurrencies can be volatile. Streitwise lets you fund your investments using Bitcoin or Ethereum to move those funds into a less risky asset type. It can also be a way to fund your investment account without having to take money out of your savings or checking.

Reinvest your dividends automatically

One of the features I found most useful was the DRIP (dividend reinvestment plan) option, where you can automatically have your dividends invested back into the REIT you hold.

This is common with many robo advisors, but it’s really nice to see with a platform like Streitwise, which isn’t as liquid – so it gives you a little extra boost every once in a while through dividends.

Ability to liquidate

One of the downsides with most real estate investing platforms is the lack of liquidity. Basically, since you’re putting your money into a real estate project, it’s not as easy to just sell on a dime like you could with a stock.

Because of that, Streitwise has a lockout period where you can’t liquidate the money you’ve invested. What’s nice, though, is this lockout period is only one year. So it’s almost like buying a one-year short term CD.

Once you’ve passed the one-year mark, you can elect to partake in the Stockholder Redemption Plan, which happens once a quarter. Now, there are specifics that you’ll have to manage through, depending on the specific REIT you’ve invested in.

Basically, though, with the Stock Redemption Plan, you can get a percentage of the NAV (net asset value) you’re owed up to five years, at which point you can liquidate all of it.

So for example, within the first two years, you’ll only get 90% NAV if you liquidate. If you wait for five years, though, you’ll get 100%.

The point here is that Streitwise, and REITs in general, are long-term investments. So be prepared to let your money sit for a while.

Helpful tax benefits

In case you missed it, there was a law enacted back in 2018 that changed some of the tax benefits for business income, earned income for individuals, as well as REIT investors (in addition to other changes).

The change now allows REIT investors to make as much as a 20% deduction of the dividends you’ve earned from your taxable income. Which is absolutely HUGE.

And like anything else with taxes, there are rules, stipulations, and exceptions, so you’ll want to read the fine print. But essentially, the taxable income of a REIT is able to be reduced through its depreciation expense.

In accounting, this is considered a non-cash expense and is actually pretty common with most real estate investing.

Outside of that huge tax advantage, there are a few other things you should know about taxes with Streitwise, particularly related to the distribution of dividends:

- Any dividends that come from earnings (as normal dividends do) are taxed at the normal income tax rates as they would be with stocks or other investments.

- Dividends from capital gains (when an investment is sold for more than it was purchased for), are going to be taxed at the long-term capital gains tax rate. Note this if you’re taking dividends from a REIT that’s doing very well.

- Return of capital dividends typically is not taxed. A capital dividend basically is when a company pays you a dividend out of shareholders’ equity or paid-in capital (versus being paid out of the company’s earnings). This is a nice bonus since your tax liability is going to be lower, allowing you to maximize capital gains in the future.

While an awesome tax software will typically manage these intricacies for you, it’s good to know what you’re in for regarding taxes and REITs. Now, you can skip this whole fuss if you open up a tax-exempt account (such as an IRA) with Streitwise and let your earnings grow tax-free.

Expanded participant eligibility

Many U.S.-based investment apps limit membership to residents. But Streitwise is open to international residents, along with LLCs, trusts, and IRAs.

Who is Streitwise for?

While Streitwise does allow both accredited and nonaccredited investors (remember – this means that you meet certain income and/or net worth requirements), there are limitations to nonaccredited investors.

As an accredited investor, you can invest in anything you want and invest as much as you want. Note that to be an accredited investor you have to make $200,000 or more if you file your taxes individually or $300,000 if you filed as married.

The other way to meet the accredited investor status is if you have a net worth of at least $1 million NOT INCLUDING your primary home. For most, this is a pretty tall order.

If you aren’t an accredited investor (meaning you don’t meet the requirements I listed above), you can still invest, but you will have limitations.

To be specific, you can only invest as much as the greater of either:

- 10% (or less) of your total annual income.

- 10% (or less) of your total net worth (this excludes your primary residence).

So for example, if you make $60,000 a year and your net worth (not including your home) is $100,000, you’d only be able to invest $10,000 (10% of the greater between the two).

So all in all, Streitwise is really for anyone who wants to get into real estate investment – particularly large scale, commercial projects – and has at least $5,000 to invest.

Who shouldn’t use Streitwise?

If you’re someone who doesn’t want to take on a lot of risks, can’t bear to have your money tied up for at least a year (but probably more if you want to get the full benefit), and don’t really know too much about real estate, I would probably stay away from Streitwise.

It does require some knowledge of the real estate market, some money, and a comfort level with letting your money sit for a long time.

Pros & cons

Pros

- Anyone can invest — The problem with a lot of investment platforms that allow you to invest in large scale projects (like some crowdfunding) limits investing to only accredited investors. This knocks out a bunch of newer investors, who have to miss out on potential excellent gains. Streitwise opens it up to everyone, though there are limits for nonaccredited investors (as I described above).

- Low initial investment — You can get started with only $5,000 with Streitwise. Honestly, this is a lower buy-in than even some mutual funds, so the low barrier to entry makes it an excellent option for investing in real estate. You can also use Bitcoin or Ethereum to fund your account.

- High dividend — According to their website, Streitwise states that they’ve given a 10% annual dividend from 2017 to 2019. Frankly, that’s unbeatable (especially considering today’s market).

- Generous lockout period — The lockout period is one year. Meaning, you can’t get your money out before that. After a year, though, you can get as much as 90% of the current value of your investment through the Stock Repurchase Plan. This makes it a viable long-term investment, but not so long you are stuck not being able to get your money out.

Cons

- Only one option — At present, there’s only one option for a REIT with Streitwise. While it’s broadly-diversified, it doesn’t give you a lot of options if you want to mix things up a bit.

- High upfront fee — I’m really not a fan of the upfront 3% fee when you make your first investment. With a lockout period AND an annual management fee, this feels unnecessarily high, although Streitwise has been acknowledged as having the best fees in the industry.

- Short track record — The REIT currently in place with Streitwise has only existed since 2017. This is concerning since they only have about two full years of data to prove value, and there’s some risk to that.

Streitwise vs. competitors

Fundrise

Fundrise is an online crowdfunding real estate investment platform that allows you to invest in both residential and private commercial properties.

Fundrise is an online crowdfunding real estate investment platform that allows you to invest in both residential and private commercial properties. The cool thing about Fundrise is that anyone can invest. It’s not just for wealthy investors.

- Open to all investors

- Low investment minimum

- Simple and easy to get started

- Not a short-term investment

- Variety of fees may be difficult to understand

You do this by pooling your cash with other investors and investing in specific projects. The cool thing about Fundrise is that anyone can invest. It’s not just for wealthy investors.

Similar to Streitwise, Fundrise’s main offering is a REIT (they call it an eREIT). Their REITs invest in real estate that produces income both through holding mortgages as well as purchasing and managing buildings. In addition, Fundrise offers what they call an eFund, where you as an investor can pool your money with other investors to purchase land, develop housing, then sell it.

As an investor, you’ll buy individual shares of either the eFund or eREIT through one of the four portfolios offered – Fundrise Pro, Supplemental Income, Balanced Investing, and Long-Term Growth. Each has its own portfolio makeup and risk tolerance.

Within each portfolio, Fundrise actually chooses the blend of eFunds and eREITs for you, including the properties owned within each.

» MORE: Sign up for Fundrise or read our full Fundrise review.

RealtyMogul

With RealtyMogul, you can invest in commercial real estate as both an accredited and nonaccredited investor. And they’re not new to the business either.

RealtyMogul gives you a chance to invest in real estate without a hefty downpayment or a ton of detailed research on your local real estate market. While the service isn’t perfect, it does offer opportunity and diversification for those interested in investing in real estate.

- Open to both accredited and non-accredited investors

- Not limited to a single project

- REIT options

- Need to sign up to view some details

- Fees can be more transparent

According to their site, over $200 million has been realized on investments. They’ve also had over a $1 billion invested on the platform with more than $6.9 billion in deals posted. In addition, they now have over 280,000 members.

The company says that they focus on investing in properties that produce cash flow, which helps you as the investor develop a passive income stream through dividends – similar to Streitwise.

Also similar to Streitwise, RealtyMogul gives its investors access to REITs, which are both public and nontraded.

» MORE: Open a RealtyMogul account or read our full RealtyMogul review.

My experience using Streitwise

There are so many things that are huge wins for me about Streitwise: I love Streitwise’s business model, and the ability to throw $5,000 in as a minimum is such a low risk compared to other investments right now.

I also like the idea of investing in commercial real estate projects without having to worry about too much detail. That’s what I like about REITs – they’re basically an index fund for real estate projects. I love simplicity.

And bonus: Streitwise’s signup process is quick. My only word of caution is that as with everything in life if you have questions when signing up with Streitwise or any other company, be sure to get them answered so every part of the process is completely transparent.

Summary

Overall, Streitwise provides a pretty awesome REIT that’s not only privately traded, but also has a nice track record over the past few years. One thing I have learned is to make sure to read the fine print everywhere so you’re 100% sure you’re not missing anything at all.

I completely recommend exposure to real estate in your portfolio, and you have several options to do this. A REIT is a great option, and from what I can tell, Streitwise is offering a darn good one. If you have at least $5,000 extra to invest, it’s definitely worth a try.

Open a Streitwise account today.