Stride Funding provides student loans for college, grad school and even coding bootcamps. Loans may be available with no co-signer or FICO score requirements.

Stride Funding is one of those options, offering an alternative to income-based loans, letting you repay the money as a share of your income rather than a fixed monthly payment.

Let’s take a deeper dive into all that Stride has to offer.

What is Stride Funding?

Stride Funding was founded by Tess Michaels, who was inspired by her own journey with student loans. She saw a need for an alternative to the traditional lending model. Instead of stressing about finding a job that pays enough to cover loan payments, her idea was to have students pay a portion of their post-graduation income.

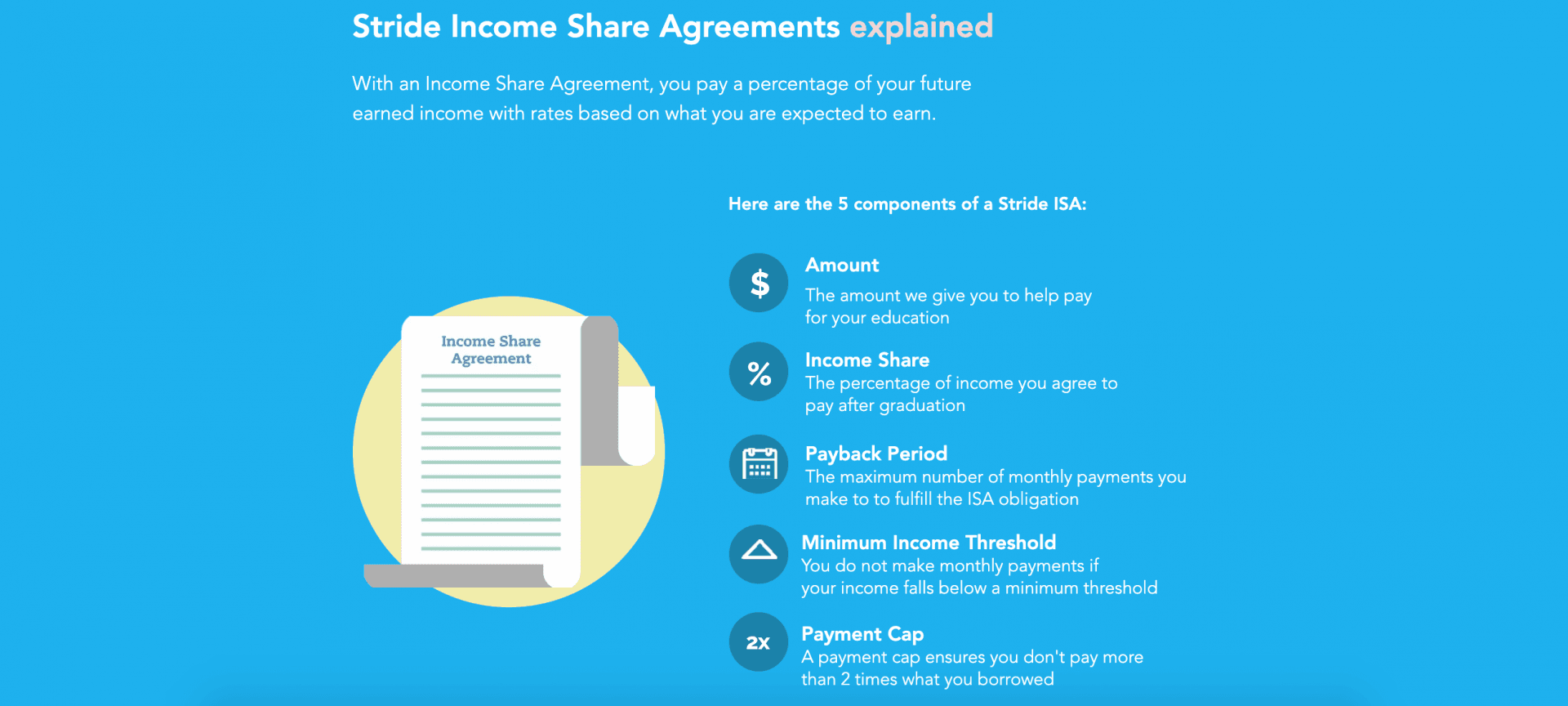

Enter the income share agreement. With Stride Funding, you agree to pay a portion of your income toward your student loans – typically between 2% and 10%. The best thing about Stride Funding is that if you don’t make a salary minimum – $30,000 to $40,000 depending on your individual agreement – you don’t have to pay on your loan.

Stride Funding pros & cons

Pros

- No fees — As long as you have no late payments, you’ll pay no fees to use Stride Funding’s services.

- Income-based payments — Your loan payments are based on your income, and you’ll only pay if your monthly salary meets the minimum, which is currently between $30,000 to $40,000 per year.

- Career support — You’ll not only have one-on-one customer support if you need it, but Stride Funding provides networking opportunities to help borrowers meet their career goals.

- Easy application — The entire application process takes less than half an hour, which is very quick compared to other student loan options.

- Networking events — Stride offers networking events, industry experts, and skill workshops in addition to their student loan offerings.

Cons

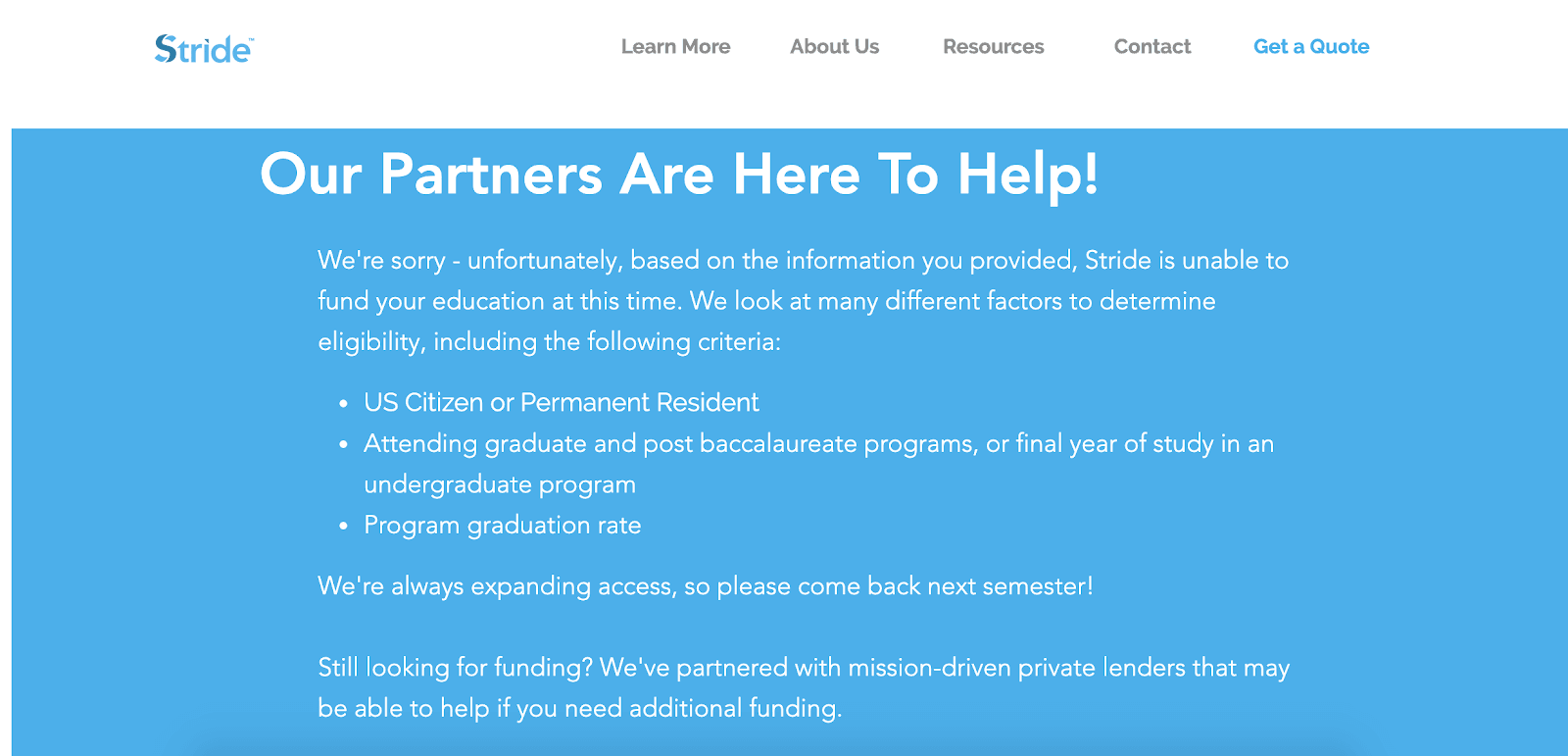

- Limited availability — Stride Funding is very selective about the loans it approves, prioritizing upperclassmen, graduate students, and those majoring in high-demand areas like STEM and healthcare.

- Tough to refinance — WIth Stride Funding, you’re signing an agreement to pay a portion of your salary, which means it’s not a loan that you can easily refinance if you find yourself in a pinch.

How does Stride Funding work?

To get started with Stride Funding, you’ll simply go to the website and click “Apply Now”.

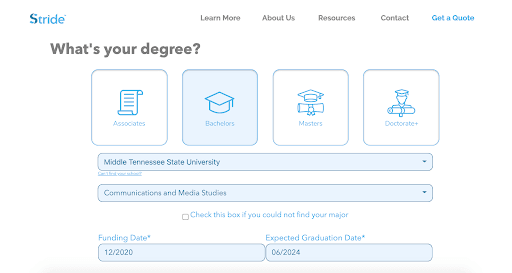

Stride Funding first needs to know the type of degree you’re pursuing, as well as the specific school and your major. You’ll also need to input the date you’ll need funding to begin and the date you anticipate you’ll graduate.

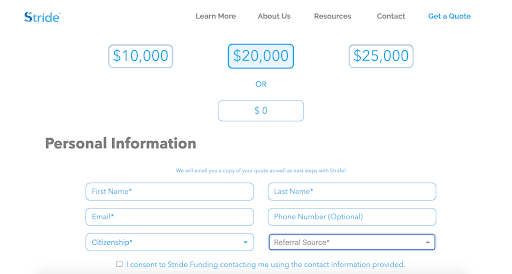

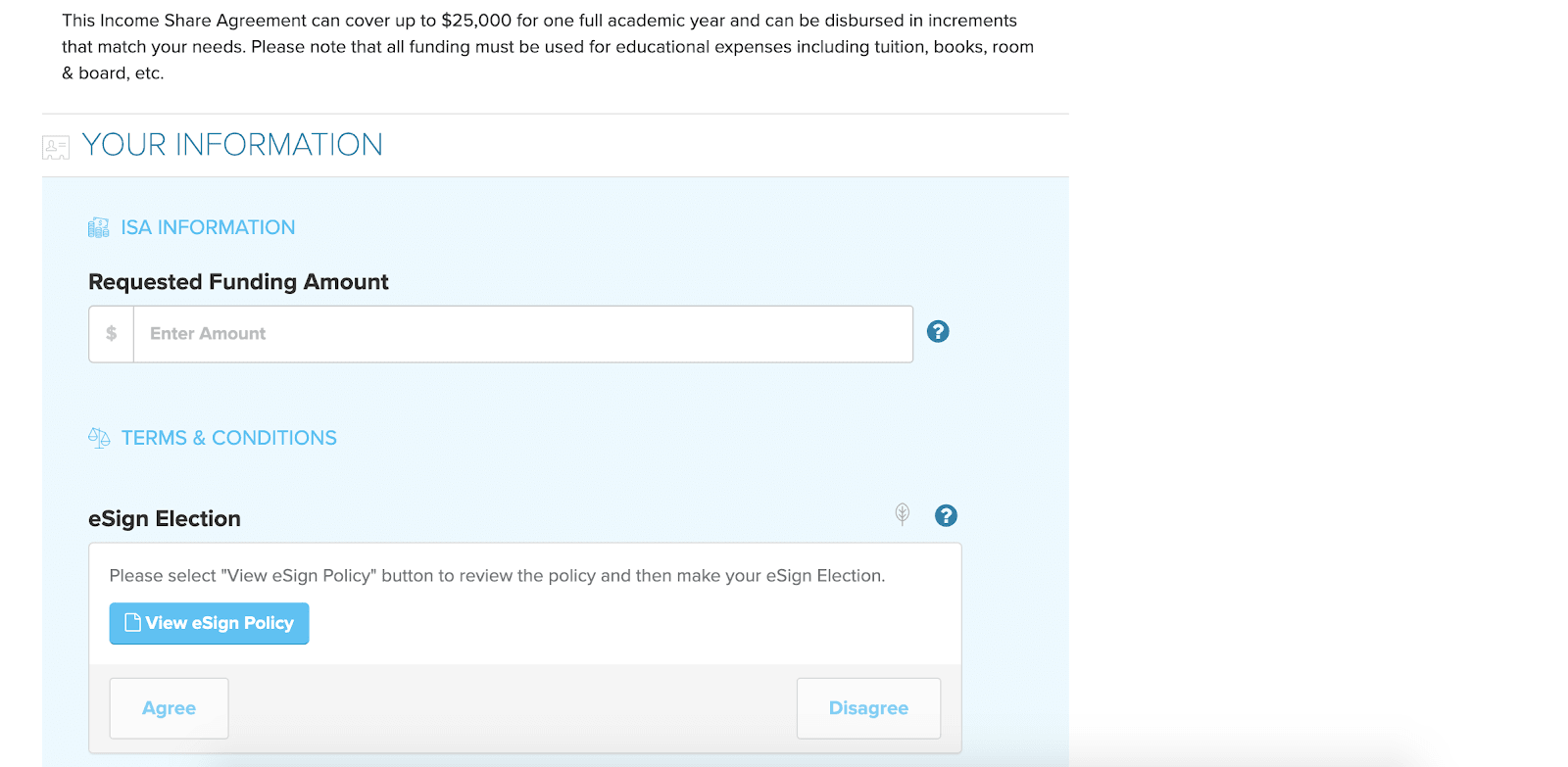

Next, you’ll let Stride Funding know how much money you’ll need before inputting your contact information, citizenship status, and referral source. For the referral source, Stride Funding simply wants to know where you heard about their services.

My initial attempts for funding were repeatedly rejected. I tried requesting funding for a full four years at a university, an associate’s degree at a beauty school, and the final year of associate’s and bachelor’s degrees at various schools and colleges.

Stride is careful about the degrees it funds. The lender prefers those who are more advanced in their pursuit of a degree. Stride Funding also goes by the graduation rate for the area of study you’ve chosen at your college.

I was able to test out the quote feature by asking for funding for the final year of a computer programming master’s degree at Middle Tennessee State University. That was accepted, with congratulations on choosing such a great degree program. This came with a notification that quotes would be provided to me via email within 24 hours.

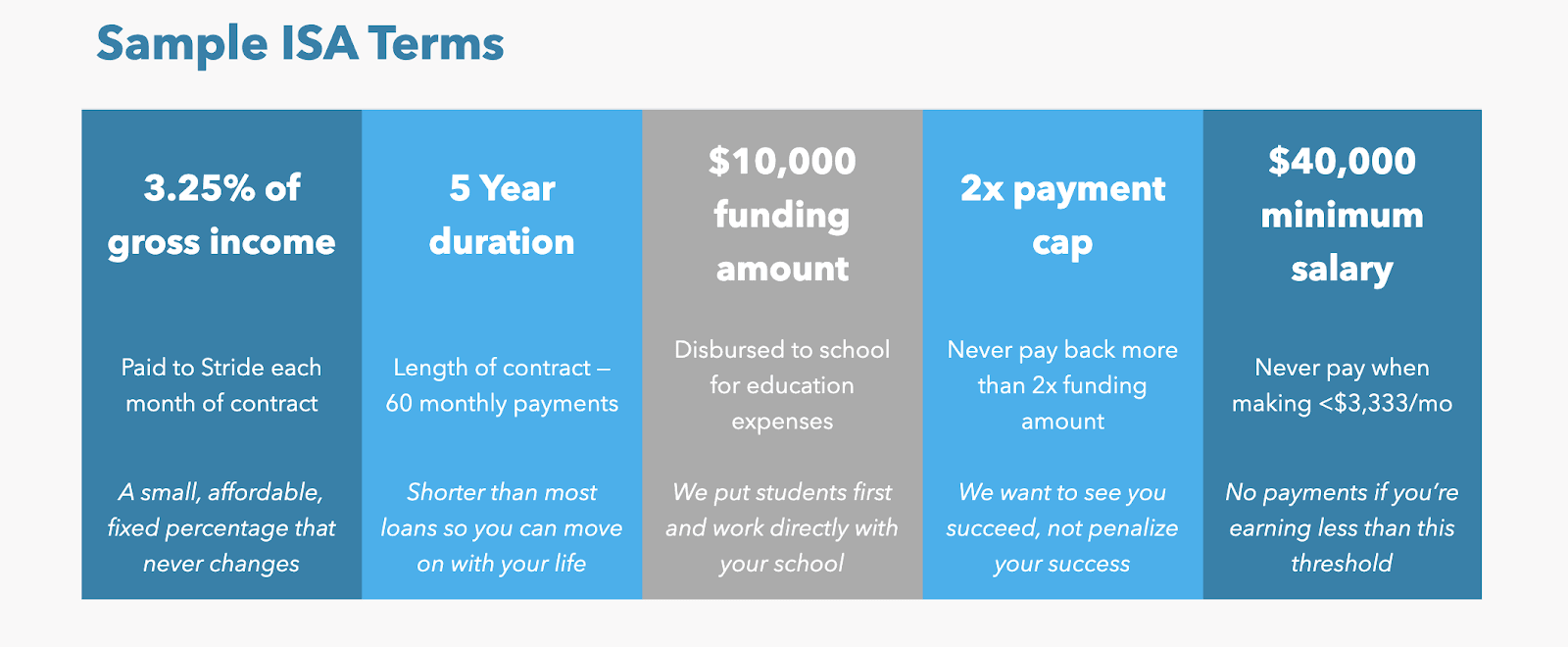

Stride Funding offered some sample terms as an idea of what to expect.

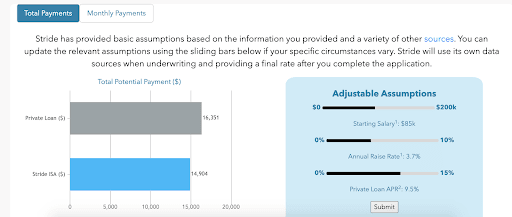

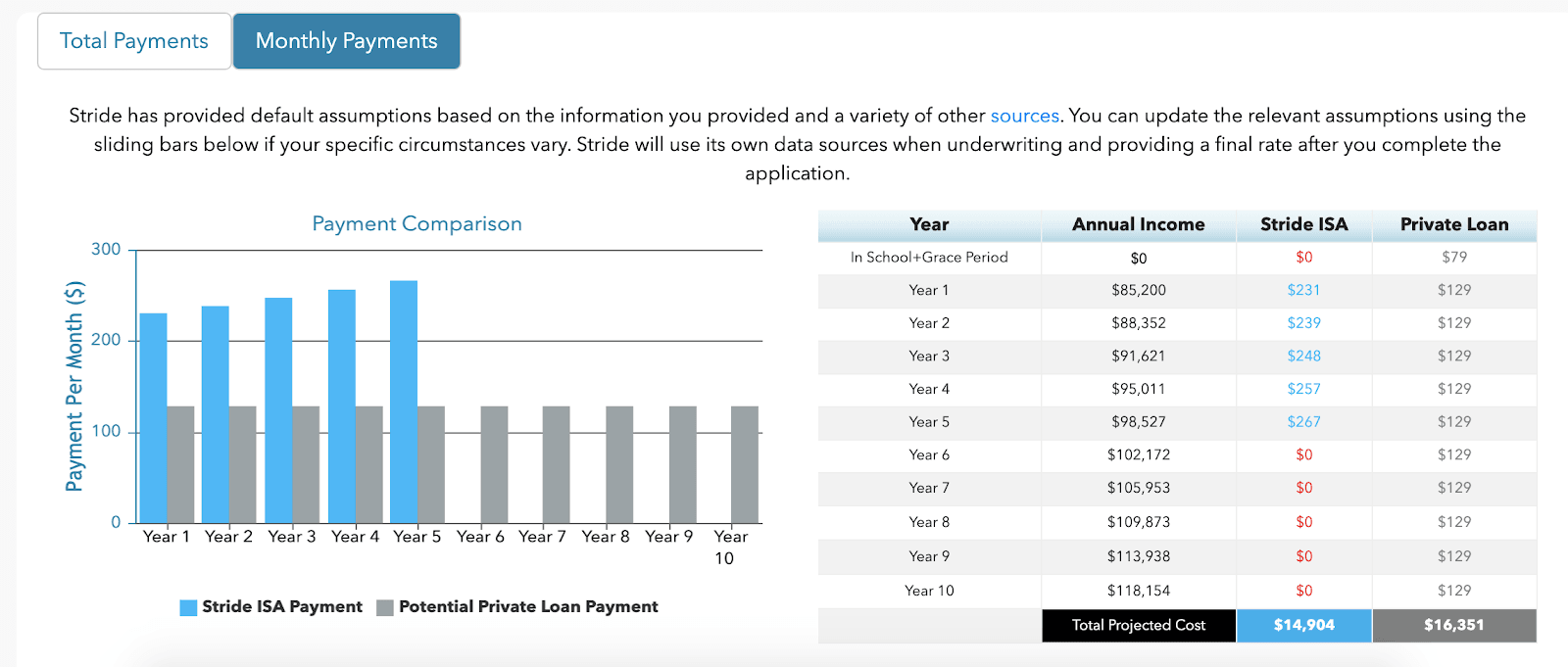

They also gave some basic assumptions, which included total payments expected and interest rates.

This generic quote also included an estimate of what I could expect my monthly payments to be, comparing it against a private loan payment to show what I’ll save.

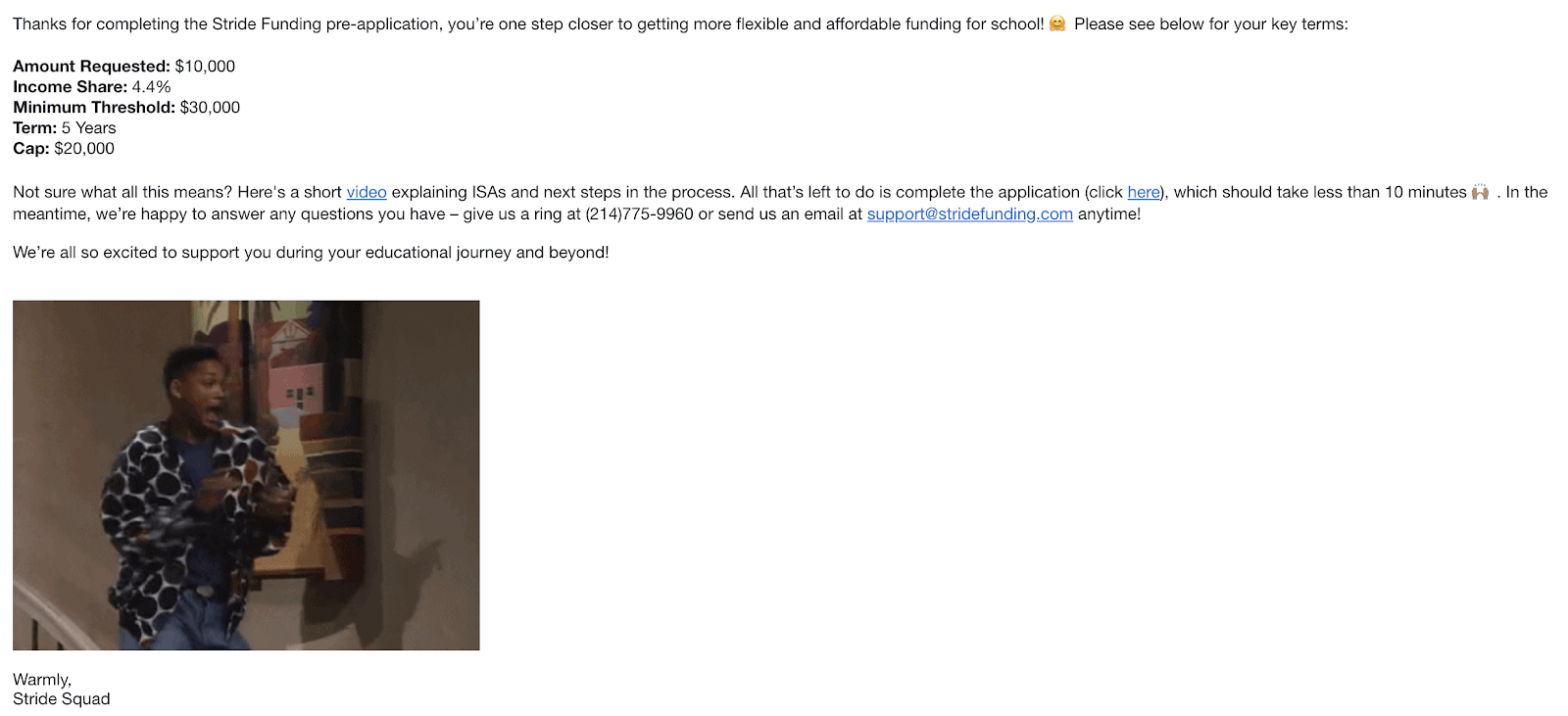

After some confusion about my request for a quote, my actual quote arrived by email. As you can see below, I was quoted 4.4% with a $30,000 income threshold. That means I won’t make payments in the months my income doesn’t equal at least $2,500, or one-twelfth of $30,000.

If I accept the agreement, after a three-month grace period, I’ll owe 4.4% of my income each month. So if I’m offered a salary of $50,000 a year, my payment will be $183 a month. I’ll pay 4.4% of my monthly income for five years, assuming no months are skipped due to earning $2,500 or less, and pay no more than $20,000 total over the course of the term.

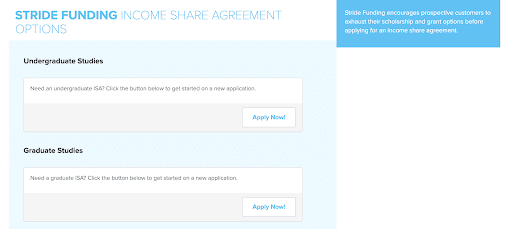

The email included a handy link for going straight to the income share agreement. There are separate agreements for undergraduate, graduate, and doctoral degrees.

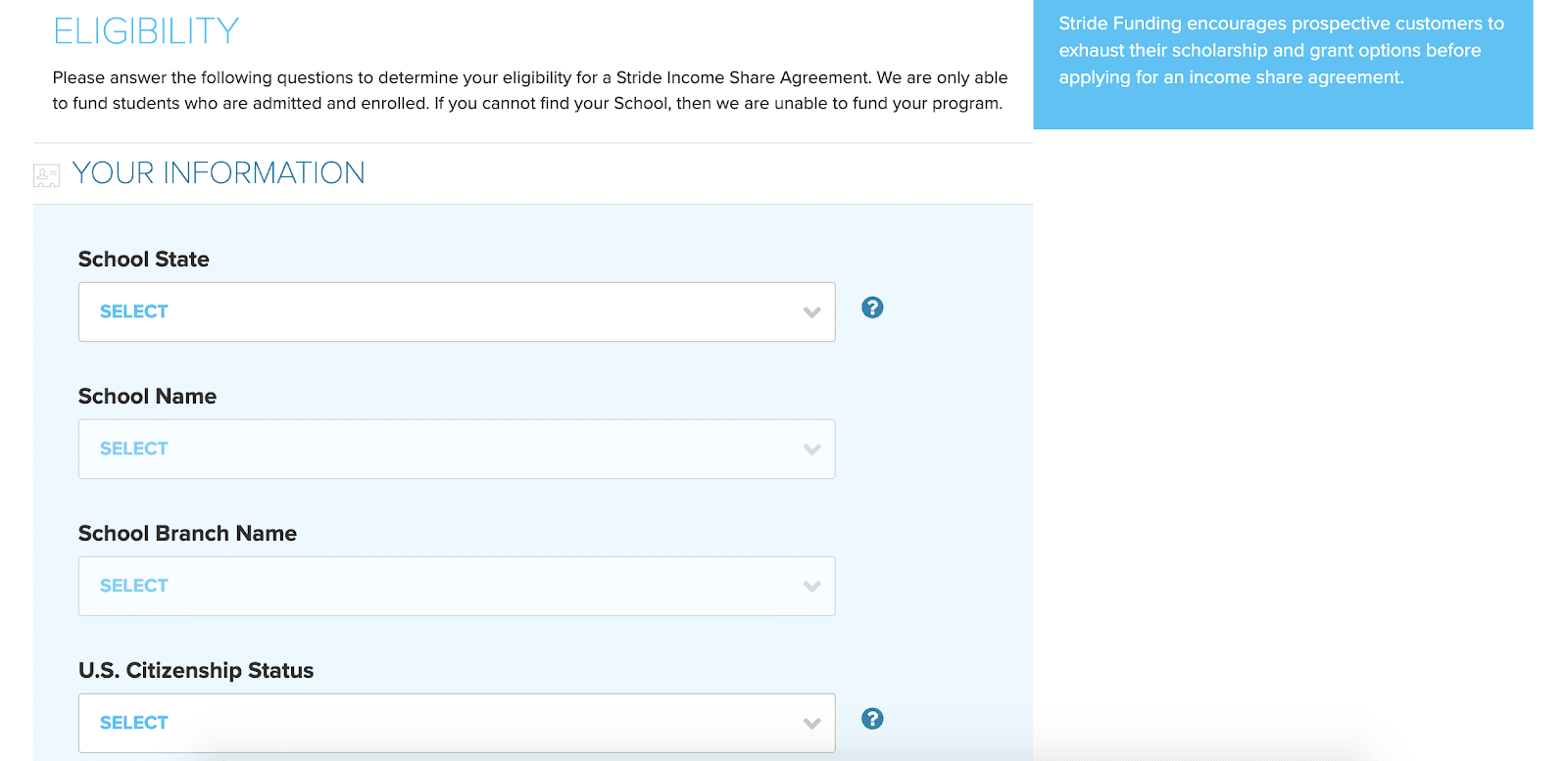

Stride checks your eligibility again. You’ll need to input your school name, location information, and citizenship.

If your school is approved, you’ll progress to the agreement. The process takes about 10 minutes. You’ll need to provide information about you, your school, your degree program, and your expected earnings and housing status.

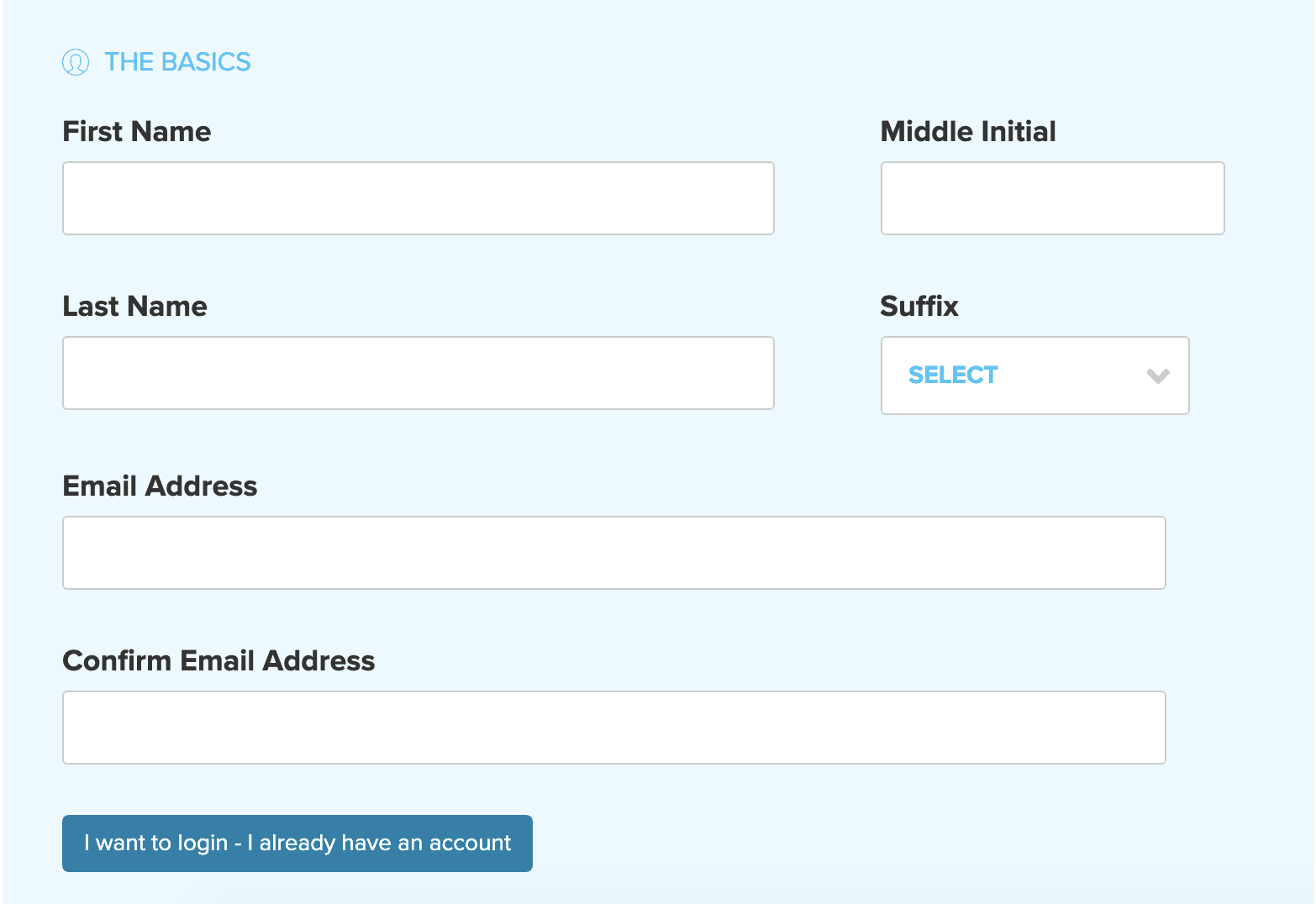

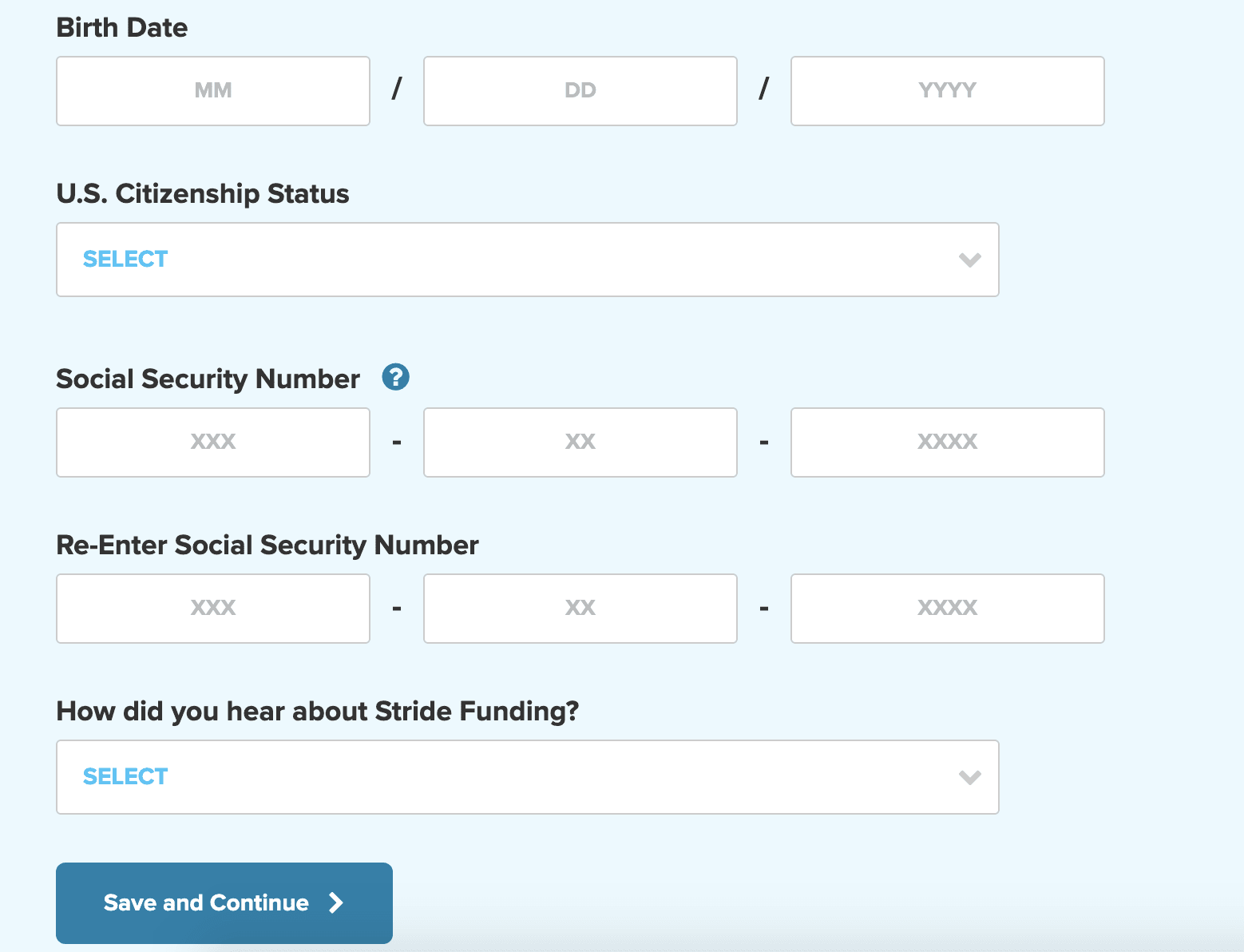

You’ll also have to provide school transcripts and a personal reference. The agreement will also request your Social Security number for a credit check. The first screen will have you setting up an account and password, as well as inputting some basic contact information.

On the same page where you enter your contact information and choose a password, you’ll provide the information necessary to verify your ID. This won’t happen until you reach the end of the application and agree to have Stride Funding run a credit check on you.

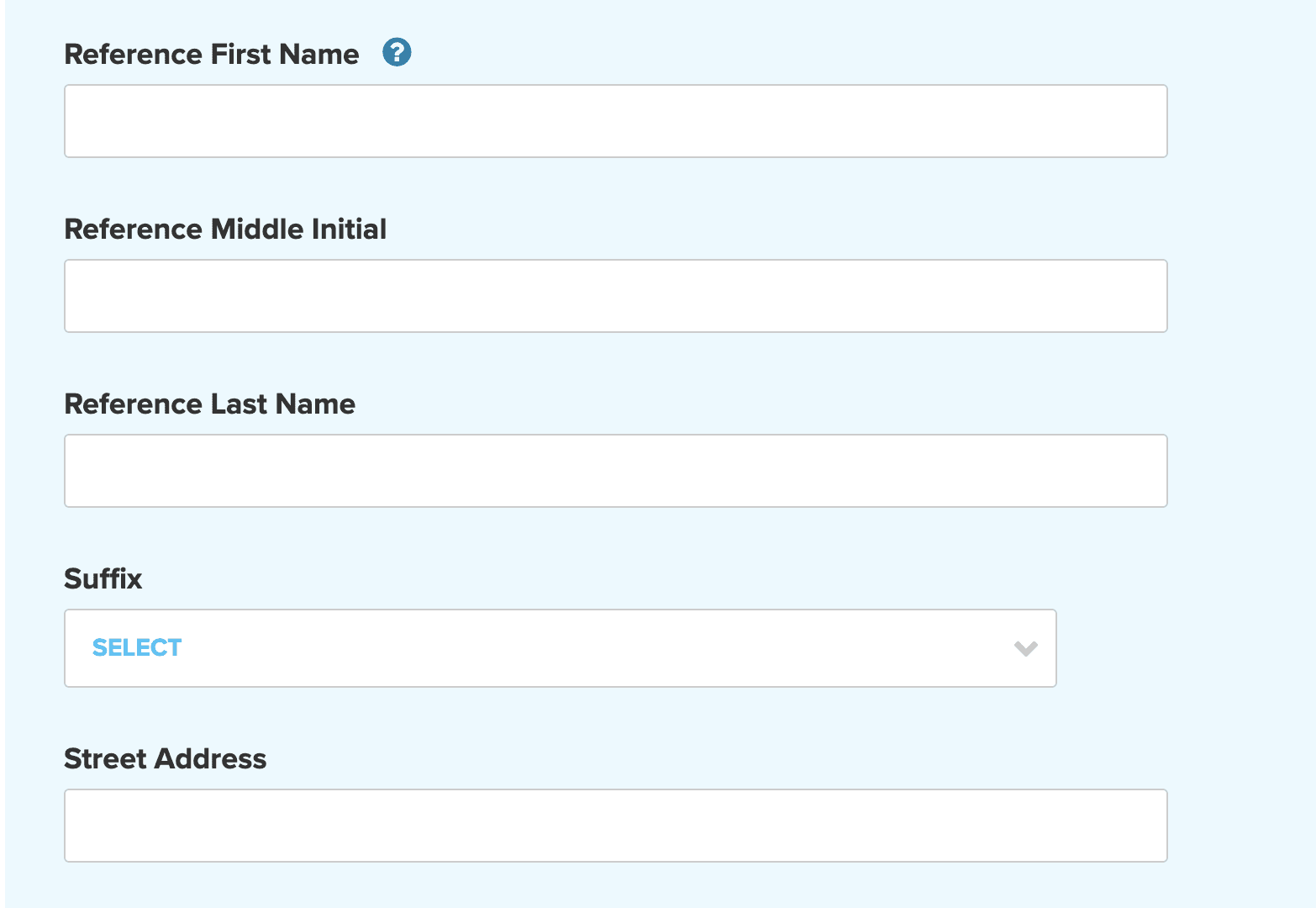

The next page will ask for contact information on your reference. You’ll need to provide the name, street address, and contact phone number for the person you want to speak to Stride Funding about you.

This ideally is someone like a teacher, a former manager, or another type of mentor who can speak to your work ethic and commitment to completing your education.

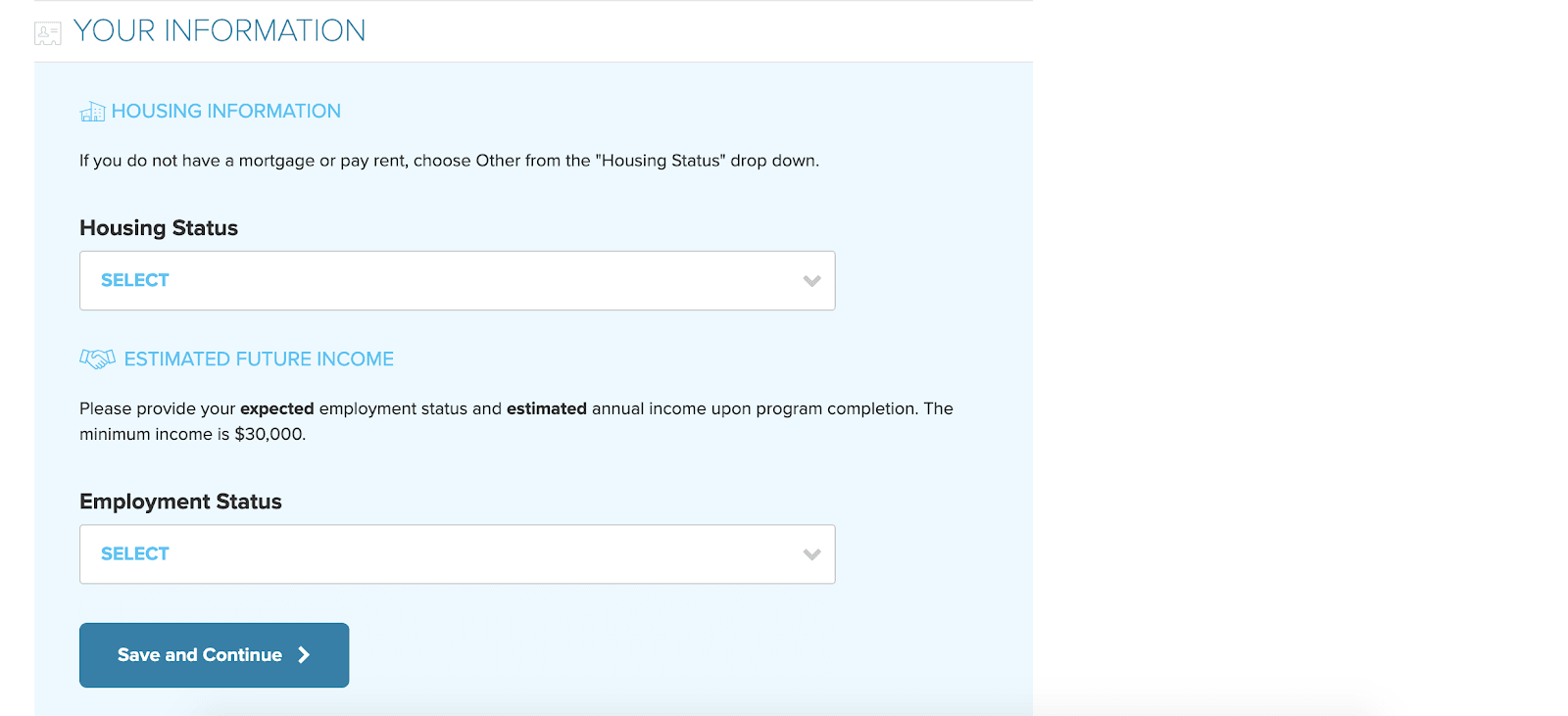

You’ll next be asked to provide information on whether you currently rent or own the place you’re living. You’ll also need to state how much you think you’ll make after you graduate.

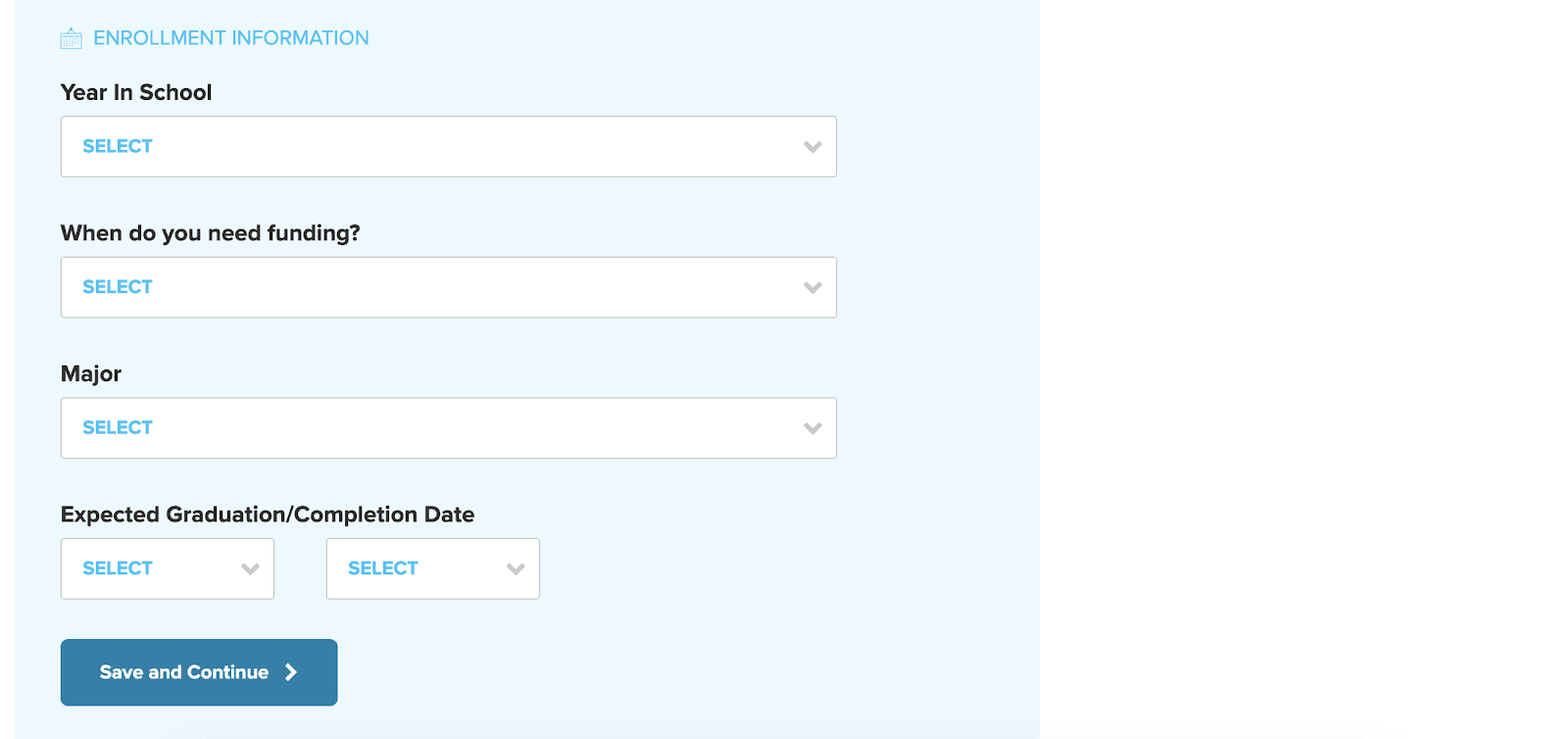

You’ve already provided information about your school, but now you’ll get into the details. What year(s) will you attend? When do you need funding? Make sure you choose the major that you chose when you requested a quote since Stride Funding is selective about the degree programs it accepts.

This takes you to the last page of the agreement. I was approved for up to $25,000 for one full academic year. I can also take out as much as I need throughout that year up to that amount. I can only use the money for educational expenses, including room and board.

Once you’ve signed everything, you’ll wait for approval. Stride Funding will use the information you entered to verify your identity, run a credit check, and contact the reference you provided on the application.

Pricing for Stride Funding

When you borrow funds for your education from Stride Funding, you sign an Income Share Agreement that stipulates a portion of your income you’ll pay each month. There are no application fees and you’ll pay only the share you agreed on. If your payment is late, though, there is a $10 late fee.

Stride Funding features

Private loans are a great way to find competitive rates for your college expenses. Here are some features that set Stride Funding apart.

Fixed payment options

Your payments will always be a portion of your income. If you have to take a low wage while you pay your dues, you won’t have to worry about trying to pay high college loan payments. The minimum income threshold runs from $30,000 to $40,000 per year depending on your agreement. If your month’s income doesn’t equal one-twelfth of that minimum, you don’t pay.

With Stride Funding, you’ll typically get a five- to seven-year repayment term. Stride wants to make paying your student loans down a quick and easy process, which is why they have such a short term, compared to the typical 20-30 year terms.

In addition, you’ll also get an interest rate as low as 2.0% per $10,000 in funding.

Flexible approvals

Stride Funding bases its loan approvals on your degree program and where you stand in your education. Only certain degree programs qualify for loans from Stride Funding, which means that you can get a loan even if you don’t have a high credit score or a cosigner.

Easy quote process

To get a quote from Stride Funding, you’ll merely need to provide some basic contact information and answer some questions about your education. You’ll know immediately if you qualify for a loan. If so, within 24 hours, you’ll receive quotes in your inbox. Only if you accept the offer will you progress to a more thorough application.

Payment cap

When you take a student loan, you know you’re going to have to repay more than what you borrowed, typically in the form of interest. Stride Funding guarantees your final payment won’t be more than double what you borrowed. If you took out $10,000, your repayment will total no more than $20,000. The vast majority of borrowers don’t reach that full payment cap.

Ongoing support

If you need help, either during the application process or after you’re approved, you can call or text (214) 775-9960 for one-on-one support.

Exclusive benefits

In addition to student loan offerings, Stride Funding also offers some pretty sweet benefits to borrowers. They offer networking and workshops, as well as exclusive job and internship postings. They want to ensure that students have the best opportunities after graduation.

My experience using Stride Funding

My biggest “make or break” moment with Stride Funding came from its offer. Paying 4.4% of my future earnings is a great deal compared to the monthly payments I found when pricing other lenders. If my income goes above $50,000 a year, that payment will go up, of course, but even a $100,000 yearly salary brings a monthly payment of only $367.

What I love most about Stride Funding, though, is the fact that the company encourages STEM degrees. These jobs often pay well while also struggling to find talent. The fact that Stride Funding looked at my degree program and school more than my credit score is a huge bonus. The focus is on my future potential earnings, not my past.

Of course, the biggest benefit comes from the “skip a payment” option. Anyone who’s ever become unexpectedly unemployed knows the fear that comes with knowing there are bills to pay. It can take a while to get back on your feet after a layoff or firing, and having relief from debts can help. I also love that I wouldn’t be penalized for taking a part-time job or gig work to make ends meet while shopping around for a full-time position.

Overall, the process of getting a quote and completing an application was easy, especially when compared to other student loan options. As long as you have a personal reference and you’ve chosen an eligible school and degree program, the process of getting a quote, applying, and finalizing your student loan can be done in less than half an hour, with some wait time for approvals in between.

Who is Stride Funding best for?

Graduate students and upperclassmen

Stride Funding is designed to cover the later years of your college experience. They tend to fund students in their junior year or above, primarily in science, technology, engineering, mathematics, or healthcare. They also prioritize educational institutions that are eligible for Title IV aid.

Borrowers building their credit

Many college students are still working to build a credit score. Stride Funding can step in where other lenders fall short. Since loan approval is based on your degree program and level of education, you won’t have to worry about rounding up a cosigner.

Those concerned about employment

When unemployment rates are up, many workers grow concerned about paying their student loans. With Stride Funding, if you don’t make the minimum salary in your agreement – between $30,000 to $40,000 per year, prorated by month – you can skip your loan payment.

Who shouldn’t use Stride Funding?

Early-stage students

If you’re pursuing a bachelor’s degree, you likely won’t qualify until you’re at least a junior. That same likelihood applies if you plan to pursue an associate’s degree or you’re attending a trade school. Stride Funding targets students who are nearing degree completion or pursuing graduate degrees.

Those who haven’t shopped around

Before you complete an application for Stride Funding, make sure you’ve researched all your loan and grant options. You should be aware of how much federal loans and other private grants will cost you so that you can compare those payments to what Stride Funding is offering.

The competition

Stride Funding’s income-based lending approach sets it apart from traditional private lenders, but there are others who are innovators in the field. Here an alternative to consider.

Stride Funding vs Ascent Student Loans

Like Stride Funding, Ascent Student Loans offers the option of landing a loan based on your future income rather than your credit score. But that’s where the similarities end. Whether you get the loan using your future earnings potential or your credit history (which is also an option), the loan itself will be traditional in nature. You’ll have a monthly payment and interest. If you find yourself unemployed, you’ll still owe on your loan with Ascent.

Ascent provides flexible options to pay for college, with or without a cosigner.

With an Ascent loan, you can pay for college, graduate school or even a career certificate program like a coding bootcamp.

- No cosigner required loan options

- Resources to help get internships and jobs

- Loans for bootcamps

- Non-cosigned loans have higher APRs

Due to its traditional payment setup, you can easily refinance an Ascent Loans if you need to lower your payments at some point. You’ll also get a nine-month grace period, which is longer than Stride Funding’s three-month setup, but Stride gives you “grace” in letting you skip payments if you aren’t making a decent income yet.

» MORE: Read our full Ascent Student Loans review

Summary

Stride Funding is a great way for students to get a private loan without a high credit score or a cosigner. It’s limited to students who are in the later years of their education, but if that’s you, it’s definitely worth checking in for a quote.