Sometimes, however, a recipe that sounded delicious, made by a beloved chef, doesn’t quite dazzle the judges as we’d hoped.

That’s what I think happened here with The Owner’s Rewards Card by M1. It should have been a sensational hit:

- The chef, M1 Finance, was a crowd favorite with rave reviews on the App Store and Play Store.

- The recipe sounded amazing: a rewards card that generates up to 10% cash back

It was all set up to win, but I think M1 Finance just pulled it out of the oven too quickly. Not only are there a few ingredients missing – but the base of the card leaves a bitter aftertaste.

That being said, I do think there’s a certain type of investor that will still find The Owner’s Rewards Card by M1 “delicious.”

Overview of The Owner’s Rewards Card by M1

- Best for – M1 users who invest in individual assets.

- Intro offer/sign-up bonus – None.

- Cash back – Everyone can earn 1.5% on all purchases, and M1 Plus members can earn 2.5%, 5%, or 10% on 75 various large retailers, airlines, and other name brands.

- Intro APR – None.

- Regular APR – Variable.

- Other notable features – Visa Signature® benefits including hotel discounts and ID theft protection.

In-depth analysis

Let’s break down the individual pieces of The Owner’s Rewards Card by M1, starting with its incredibly unique rewards structure.

Rewards

I’ve been reviewing credit cards for years, and I can say with absolute confidence that The Owner’s Rewards Card by M1 has the most unique and complex rewards structure I’ve seen.

Buckle up.

Ok, so to even begin unpacking this card’s reward system, I have to explain how M1 Finance works.

M1 Finance is built for passive, long-term investing. The whole purpose of the app is to build “lazy portfolios” that you design once, fund, and otherwise let sit so they can mature and grow your money without intervention.

M1 Finance helps you build “Pies,” which are like lazy portfolios made up of individual assets, ETFs, and even other Pies. M1 Finance themselves curates over 80 Pies with various themes like the 60/40 Pie (60% stocks and 40% bonds) and the Moderately Aggressive Pie.

There’s also a social, dare I say, collaborative element to M1 Finance since you can chat Pies on the M1 Finance subreddit. If you like another user’s Pies, you can search for it, add it to your Pie, and share in the spoils.

The Owner’s Rewards Card by M1 is M1 Finance’s first credit card. It’s a premium rewards card clearly trying to peel M1 users away from their big bank cards.

So how does it all work, and how can you score some 10% cash back rewards?

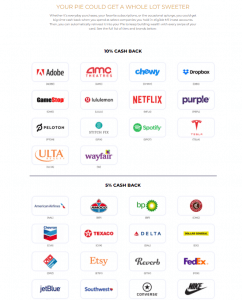

The Owner’s Rewards Card by M1 offers four tiers of rewards for M1 Plus members:

- 10% cash back on purchases from 14 major companies including Chewy, Tesla, and Netflix.

- 5% cash back on 20 more companies including Starbucks, Southwest, and UPS.

- 2.5% cash back on 39 more companies including Apple, Amazon, and AT&T.

- 1.5% cash back on all other purchases.

You can see the complete list of companies and rewards tiers here. In total, you’ll get 2.5% cash back or higher on purchases from 75 very big, very recognizable companies.

Is there a catch? Of course. Two of them, in fact.

- Maximum $200 per month earn rate. Sadly, no, you can’t save 10% or $4,000 on a new Tesla Model 3. It’s also a bummer that the 1.5% cash back category isn’t unlimited like it is with most rewards cards – even those with no annual fee.

- You have to be an M1 Plus member to receive tiered cash back.

APR

The Owner’s Rewards Card by M1 charges variable APR based on the prime rate.

That’s honestly lower than I thought it would be – premium rewards cards, especially those with high qualification requirements, tend to charge the maximum possible interest rates (because why not?).

Even still, you want to avoid missing a payment with this card at all costs since there’s no late payment forgiveness – your missed payment will start accruing interest (and be reported to Experian to lower your credit score) right away.

Other fees

Start combing through The Owner’s Rewards Card by M1’s terms & conditions, and you’ll soon run into the card’s other fees.

First thing’s first, The Owner’s Rewards Card by M1 charges no foreign transaction fees. It also charges zero balance transfer or cash advance fees because – get this – it doesn’t allow balance transfers or cash advances.

The last of The Owner’s Rewards Card by M1’s fees worth mentioning are the penalty fees:

- Late Payment – $25.

- Over-the-Credit Limit – None.

- Returned Payment – Up to $37.

Not much to unpack here, aside from the fact that these fees are surprisingly low for a premium, paid rewards card. Late payment fees are typically $40 at least.

Perks and benefits

The Owner’s Rewards Card by M1 is a Visa Signature® card, meaning it includes a nice assortment of money-saving, stress-reducing, and downright bougie perks.

Not all Visa Signature® cards are exactly the same, but The Owner’s Rewards Card by M1 includes these perks and more:

- ID Navigator powered by NortonLifeLife – High-caliber ID theft protection.

- Roadside Dispatch – Pay-per-use roadside assistance.

- Travel & emergency assistance services – 24/7, multilingual reps you can call for help rebooking travel, seeking medical care overseas, etc.

- Visa’s Zero Liability Policy – Basically super-duper fraud protection.

- Emergency Card Replacement – They’ll ship you another card within 24 to 72 hours globally.

- Cardholder inquiry service – “Personalized support” from Visa Signature® card experts.

I mentioned that some of the Visa Signature® perks are downright bougie, and here are the prime examples:

- Visa Signature Luxury Hotel Collection – Didn’t I promise bougie? With The Owner’s Rewards Card by M1 you’ll get instant higher status at over 900 Visa Signature Luxury Hotel partners.

- Silvercar by Audi – Get a discount on Audi rentals from this unique service.

- Sonoma Wine Country – The Owner’s Rewards Card by M1 grants you unique perks and discounts at various participating Sonoma-area wineries.

- Troon Rewards – Grab your clubs, since The Owner’s Rewards Card by M1 will help you save at over 95 golf courses worldwide.

Pros & cons

Pros

- Up to 10% cash back on popular brands with M1 Plus — Ean earn up to 10% cash back on 75 big, name-brand companies.

- Automatically reinvest your rewards — You can withdraw your rewards as cash back or automatically reinvest them in your M1 Pies for maximum long-term returns.

- Visa Signature® benefits — The Owner’s Rewards Card by M1 includes a bevy of Visa Signature® benefits like hotel status, emergency card replacement, and more.

- No Annual Fee — Pay no annual fee with The Owner’s Rewards Card by M1

- Metal card — Who doesn’t like a sleek, metal credit card?

Cons

- M1 Plus Annual Fee — M1 Plus comes with an annual fee of $125 or pay no annual fee for non-M1 Plus members.

- It may be difficult to track which companies you’re invested in — M1 Finance doesn’t make it easy to see which individual companies you’re invested in at a given time. Plus, with automatic portfolio rebalancing toggled on, that list of companies may change overnight.

The Owner’s Rewards Card by M1 compared

| The Owner’s Rewards Card by M1 | Fidelity® Rewards Visa Signature® Card | Chase Freedom Unlimited® | |

|---|---|---|---|

| Investing perks | N/A | Auto deposit cash back rewards into your Fidelity investment account(s) | None |

| Cash back rewards | With M1 Plus earn 2.5%, 5%, or 10% cash back on purchases made with companies in the Owner’s Rewards Program, plus 1.5% cash back on all other purchases | Unlimited 2% cash back on all purchases | 5% cash back on travel booked through Chase Travel℠; 3% on dining at restaurants, including takeout and eligible delivery service, and drugstore purchases; and an unlimited 1.5% cash back on all other purchases (after your first year or $20,000 spent) |

| Signup bonus | $300 | None | Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That's 6.5% on travel purchased through Chase Travel, 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases |

| Annual fee | $95, waived with M1 Plus membership (free for one year, then $125) | None | $0 |

| APR | Variable | 13.99% Variable | 20.49% - 29.24% Variable |

Fidelity® Rewards Visa Signature® Card

The Fidelity® Rewards Visa Signature® Card certainly takes the cake as the simplest investor rewards card. You’ll get an unlimited 2% back on all purchases, which you can either redeem as cash back or invest it into your Fidelity investment account.

Naturally, the Fidelity® Rewards Visa Signature® Card is exclusive to Fidelity customers – but if that’s you, and you’d like a card that automatically invests for you, it’s a strong choice.

Chase Freedom Unlimited®

The Chase Freedom Unlimited® is not an investing credit card, but it is one of the best overall rewards cards on the market.

To start, you’ll get a sign up bonus of an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That's 6.5% on travel purchased through Chase Travel, 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases. After your first year or $20,000 spent, you earn 5% cash back on travel booked through Chase Travel; 3% on dining and drugstore purchases; and an unlimited 1.5% cash back on all other purchases.

Will it automatically invest your cash back? No, but you can always cash it out and invest it manually.

Who should get The Owner’s Rewards Card by M1?

In its current state, The Owner’s Rewards Card by M1 is really only a fit for those who can benefit by shopping at the companies in the 5% and 10% categories.

I’ll admit, that’s a narrow group of folks.

How to apply for The Owner’s Rewards Card by M1

If you decide to move forward with The Owner’s Rewards Card by M1, here are the steps involved.

First, you’ll need to sign-up – again, The Owner’s Rewards Card by M1 is free to sign-up and charges no annual fee. If you’re considering becoming a M1 Plus member, membership is $125.

Now, once you’re a bonafide M1 Finance member with your first Pie, you can apply for the Owner’s Rewards Card by M1 by heading to their homepage.

I appreciate how M1 does a thorough job of prepping you for the application – from auto-filling your info to reminding you to lift any manual freezes you have on your credit.

Now, I can’t show you the rest of the screenshots because it has my sensitive M1 info all over it, but the process will look pretty similar to applying for any ol’ credit card.

Once you’re approved, your sexy metal card should arrive within seven to ten business days.

Summary

As a fan of M1 Finance’s other “dishes,” I was excited to dip my spoon into The Owner’s Rewards Card by M1. Good chef, good recipe. My first bite tasted decent, but I’d hoped for better.

Clearly, there are a few ingredients missing – a competitive bonus, unlimited rewards, etc.

Even still, I’m sure The Owner’s Rewards Card by M1 will be preferred by those who can unlock some of the higher rewards tiers with M1 Plus.