Trust & Will is an online service offering a variety of easy-to-use legal products for estate planning that can protect your family. With Trust & Will, you can create a Will or create a Trust and customize it yourself, saving you money from the lower fees than you’d pay an attorney to do it for you. All the documents from Trust & Will are created by attorneys and are designed to satisfy the laws of your state.

Our editorial team has decades of experience researching and delivering honest reviews of the best products and services in their respective space with over 500 published since 2006. When evaluating online services, like Trust & Will, we examine the convenience and cost versus more traditional options. See if this online estate planning platform is for you.

Trust & Will is an online service that makes the task of estate planning a little less unpleasant and expensive. For much lower fees than you’d pay an attorney to do it for you, you can create a Will or Trust yourself. You can also purchase probate support.

This service is affordable and easy to use, making it a good option for people with relatively straightforward estates.

- Easy to use from your own home

- Lower cost than hiring an attorney

- Customizable options

- Complex estates may require additional fees

- Subscription fees for certain features

What is Trust & Will?

Based in San Diego, California, and launched in 2017, Trust & Will is an online service providing legal forms for and information about estate planning. All material is vetted by estate planning attorneys.

Trust & Will provides a low-cost and secure way to prepare your own documents online, making it easier and faster for millions of people to arrange legal provisions for their dependents and assets.

Trust & Will has a Better Business Bureau rating of “A+”, the highest rating on the scale of A+ to F. It has been BBB accredited since November 2018.

Trust & Will pros & cons

Pros

- Process is simple — Trust & Will’s process for using their legal documents is pretty straightforward and simple from beginning to end.

- Low cost — Trust & Will provides estate planning tools and services at a fraction of the costs traditionally charged by attorneys.

- Customizable — Make unlimited updates to your plans with an annual membership (free for the first year).

Cons

- Fees for attorney support — If you have a complex estate, you may require attorney support to make Trust & Will work for you, and this comes at an added price of $200 a year.

- Subscription fees — Paid membership is required for continued access to your plans and the ability to share and update your documents.

- Can’t create an irrevocable living Trust — This type of Trust is more complicated than a revocable living Trust and usually requires legal advice from an attorney.

How Trust & Will works

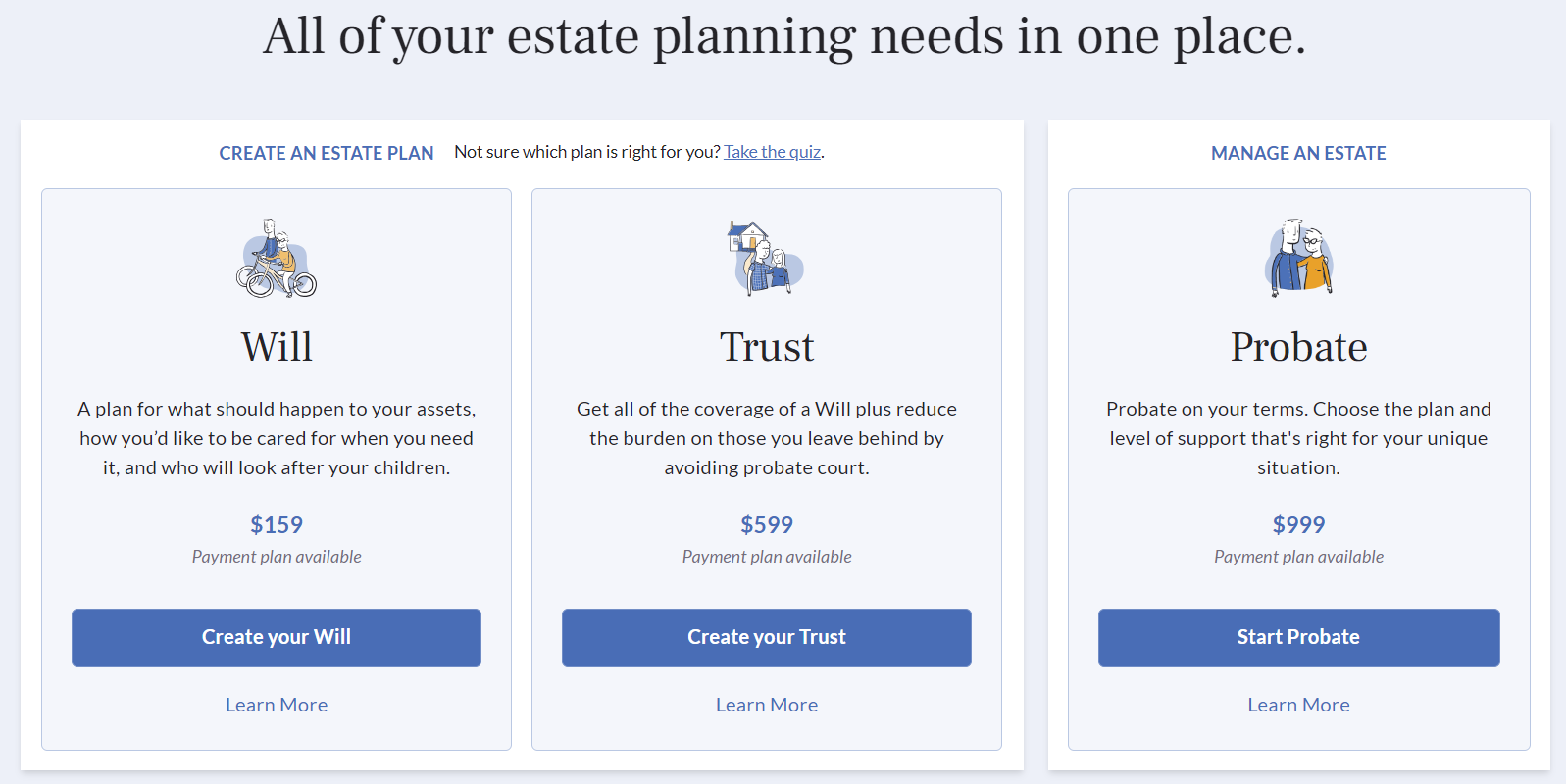

Trust & Will offers two main estate planning products: Wills and Trusts. They also offer customizable probate support and deed transfer services for a total of four different services. You can use as many of these services as you like. Here’s what you can do with each.

Wills – Create a Will-based estate plan for yourself or for yourself and your partner using a template created by attorneys. Choose from four different documents.

Trusts – Create a Trust-based estate plan for yourself or for yourself and your partner using a template created by attorneys. Choose from seven different documents.

Probate – Choose from one of two probate plans and even schedule a free consultation with a probate professional to discuss your options.

Deed transfer – Retitle your real estate assets and transfer them to your Trust for a flat fee.

All documents are created in accordance with the laws of your state. You can make unlimited changes to Trusts and Wills as your needs and financial situation change. For Trusts and Wills, you’ll pay a fee to create your plans, which includes unlimited updates in the first year, and an ongoing membership fee each year if you would like to make unlimited updates after that.

How to get started with Trust & Will

Trust & Will makes it easy to start estate planning.

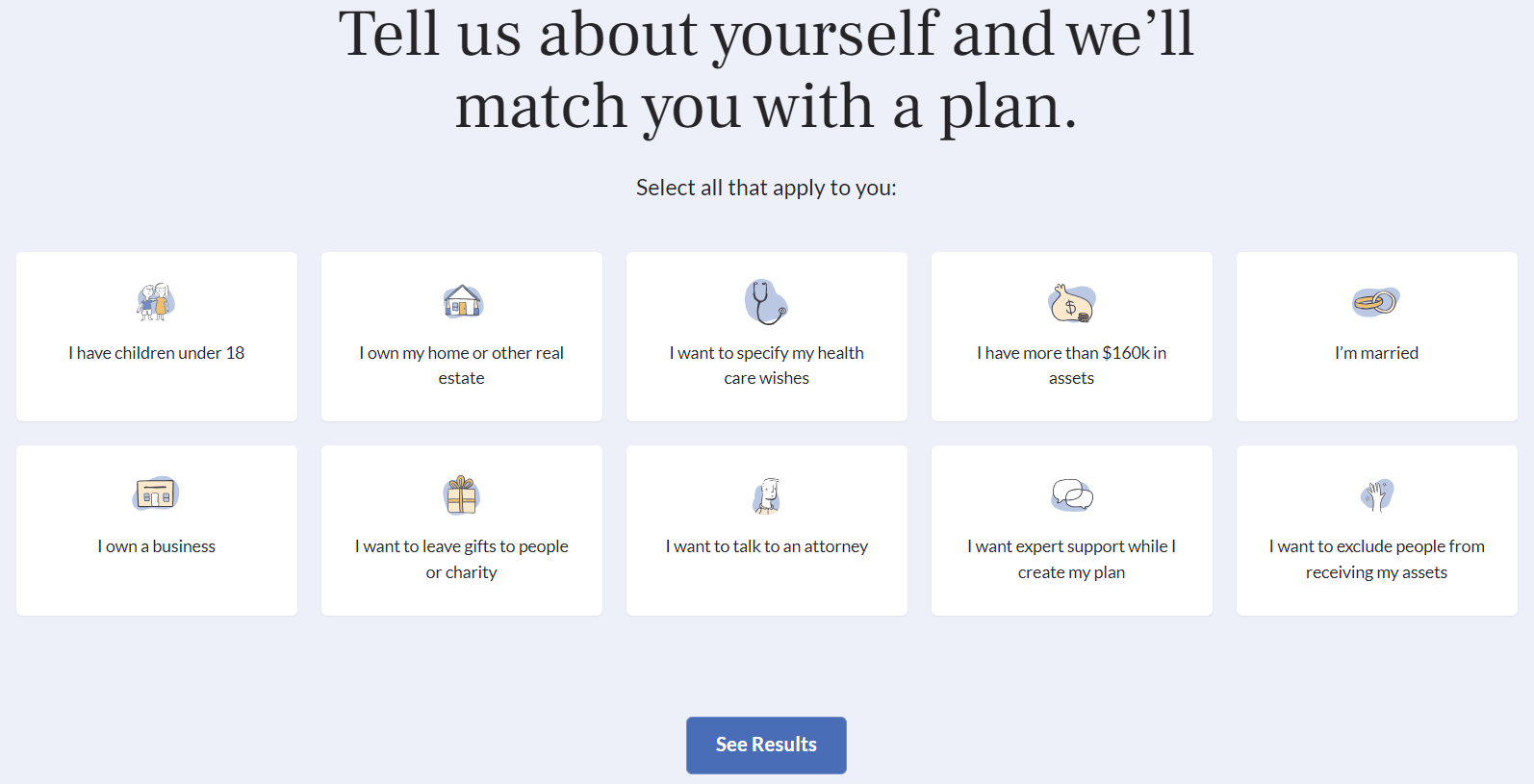

If you’re still early in the process of estate planning and not sure exactly what you need, you can take a quiz to find out where to begin. This will ask you what goals you’re working on and which scenarios apply to you. Once you know what you need, you can create an account and select a product to get started.

Each product or service will take you through a different series of questions.

For each document package, you’ll receive state-specific legal documents put together by attorneys.

You can chat with a representative at any time with questions about a product. When you’re finished, you’ll review and sign your documents. Then, you’ll be able to download them or request they be mailed. Everything you create Will be stored online in your account.

Trust & Will products and services

Trust & Will offers four products: Trust and Will estate planning services, probate support, and deed transfer.

Trust creation

Trusts allow you to create customized, state-specific, and legally valid plans for your assets and family on behalf of yourself or you and your partner. Transferring your assets to a trust makes it possible for your beneficiaries to avoid going to probate court to carry out your wishes.

You can create a Trust for as little as $599. Once created, you can make unlimited updates with an annual membership (free in the first year).

To create a Trust-based estate plan, you’ll answer questions about yourself, your family, and your assets. This includes naming guardians for your children and pets, specifying how your property and assets should be distributed, leaving gifts, choosing someone to carry out your will, granting access to your medical records, and more.

The Trust-based estate plan comes with seven different documents:

- Revocable Living Trust

- Schedule of Assets

- Last Will and Testament (Pour Over Will)

- HIPAA Authorization

- Living Will

- Power of Attorney

- Certification of Trust

Once created, Trust & Will experts will review them for completeness and you’ll be able to download them and get them notarized. A Trust goes into effect as soon as it has been funded.

Here’s the role of each document in your Trust creation.

Revocable Living Trust

This is your main estate planning document. It specifies how your assets should be managed and distributed when you’re gone and what to do with them until then.

Schedule of Assets

This lists the assets held in your Trust and can be changed as needed.

Last Will and Testament (Pour Over Will)

Your Last Will and testament is a detailed summary of your final wishes. It specifies which assets your dependents will receive and any arrangements that will need to be made to ensure everything is distributed as you intend.

Your Pour Over Will allows all of your assets to transfer into the Trust after your death.

HIPAA Authorization

HIPAA is a federal law that protects your personal health information from being accessed by unauthorized individuals or entities. This document lets you grant access to your health documents to specific people.

Living Will

This lets you make requests for your medical treatment and end-of-life care and authorizes third parties, including healthcare providers, to make care decisions for you if you are not able to make them for yourself.

Power of Attorney

This document assigns an agent to handle aspects of your business and personal life on your behalf.

Certification of Trust

This serves as proof of your Trust for use by third parties but omits personal details.

Will creation

A Will lets you make provisions for your children and assets after you die. This is where you can nominate guardians for your children and pets, determine final arrangements, and specify various preferences. A will does not go into effect until after your death.

You can create a will for as little as $199. Will-based estate plans through Trust & Will include the following documents:

- Last Will and Testament

- HIPAA Authorization

- Living Will

- Power of Attorney

For details about each of these documents, see the section above.

Wills are simpler than Trusts and often need to go through probate before they can be carried out. For help deciding if you need a will or a Trust, you can chat with a Trust & Will expert.

Probate support

Trust & Will provides probate document preparation services for a relatively low price. There are two levels of service to choose from:

- Concierge

- Attorney

Concierge support costs $1,999 and provides a a level of guidance. It comes with a dedicated probate specialist, an in-depth review of your documents, and help to coordinate with your family.

Attorney support is a full-service probate plan that costs $5,000. It takes the responsibility off of you and turns the estate over to a probate attorney who will represent you in court and advise you on how to proceed.

Deed transfer

This service allows you to retitle your home and other real estate in the name of your Trust and includes expert guidance. This guarantees that your beneficiaries receive the assets they’re entitled to, likely without going to probate court.

Trust & Will partners with uDeed to offer this service.

Trust & Will fees and pricing

Trust & Will has different flat rates for each of its services and some membership fees for continued access.

Trusts: $499 for individuals and $599 for couples; $39 a year for membership after the first year.

Will: $199 for individuals and $299 for couples; $19 a year for membership after the first year.

Probate: $1,999 for concierge and $5,000 for attorney services. Payment plans are available. Terms apply.

Deed transfer: $265 per deed (plus local recording fees).

Attorney support: $300 a year.

Features and benefits of Trust & Will

Here are the most important features of Trust & Will and details about what can do as a member.

Annual membership

For Trust- and Will-based estate planning, you’ll need to pay a fee for membership each year to update your end of life plan.

Membership includes the ability to share and update your plans as well as upload supporting documents such as deeds and titles. The cost is $19 a year for wills and $39 a year for Trusts. With membership, you can make unlimited updates to your documents at no added cost and share what you would like to with relevant people. Everyone gets one free year of membership with the purchase of an Estate Plan.

Membership is optional but you’ll need it if you want to edit your estate plans. If you choose not to pay for a membership, you’ll need to opt out after the first year so it does not automatically renew and download all of your documents and store them somewhere safe after creating them.

Document review

Wills and Trust documents are reviewed by Trust & Will’s estate planning experts to ensure compliance with state laws.

Attorney Support

For an extra $200 each year, you can get unlimited support from attorneys. This is an optional service for those who need help with more complicated estates.

Attorneys can give you advice on your estate planning documents, review your documents, help you understand your tax liabilities, guide you through your state’s laws, and more.

This service is available in the majority of states, including California, Massachusetts, New Jersey, New York and Texas.

Share Access

You can easily share your documents with your loved ones, the best financial advisors, lawyers, and more online. Any executor, trustee, or family member you’ve granted Share Access to can virtually access your estate planning materials at any time.

Share Access is only available to those with annual memberships.

Customer support

Live customer support is available to all customers by chat Monday through Friday between 7 am and 5 pm Pacific time and on Saturdays between 7 am and 2 pm PT. You can also email support@trustandwill.com for help with your estate planning.

You will not have the same dedicated agent each time you contact support.

Satisfaction guarantee

If for any reason you’re dissatisfied with the documents or services you receive, you can request a refund within 30 days of purchase. For services, you may not be eligible for a full refund. Here is the amount that can be withheld from your refund for different services:

- Attorney Support – up to 75%

- Probate Concierge – up to 50%

- Notary – up to 75%

- Deed Service – up to 75%

Security

Trust & Will uses bank-level security to protect and encrypt all information transferred and stored. They also pledge they will never sell or share your information without your consent.

Who is Trust & Will best for?

There are many people who could benefit from using Trust & Will. Here are just a few examples.

Those with relatively simple estates

Since it can cost hundreds of dollars to draw up a will – or thousands of dollars for a Trust – with an attorney, you may want to bypass those high costs if your estate is small and relatively simple.

This will include the average person, who owns a home, personal possessions, and conventional assets, like retirement and brokerage investments.

People early in life

You may be asking yourself if you need a Will and when. If your budget isn’t large enough to cover attorney fees – but you still would like either a formal Will or a Trust – Trust & Will is a way to do it that will fit within your financial capabilities. Later, as your asset base grows, you can go the attorney route.

Who is Trust & Will not the best for?

Here are a couple of types of people who are less likely to find what they’re looking for with Trust & Will.

People with complex estates

We don’t recommend Trust & Will for those with complicated family or financial situations. For example, if you have children from multiple spouses, you may need more detailed documents than are available with Trust & Will.

Business owners

The same is true if you have an investment property or you own a business. Since each situation includes nuances with very specific legal consequences, you’ll be better served using an attorney. And although you can pay for attorney services through Trust & Will, they cost a good deal extra and you won’t receive a dedicated attorney.

Summary

Trust & Will is an excellent online service for estate planning and probate. If you want to save money and time creating a personalized and detailed plan for your assets, and your situation is fairly straightforward, this service might be right for you.