When you need life insurance, the last thing you probably want is to go through a tedious application and wait to find out if you’re approved.

Walnut Insurance makes it easier to get insured. With this online provider, you can get a quote for a term life insurance policy without submitting a medical exam. Plus, you might even spend less in a month than you do on a meal at your favorite fast casual restaurant. Find out how Walnut Insurance works, how much it costs, who it’s best for, and more.

Walnut sells life insurance policies exclusively online, so there are no offices or in-person agents. You can get a quote without a medical exam and purchase a policy, if approved, in a matter of minutes.

- Affordable policies

- Convenient application

- No medical exam

- Low coverage maximum

- No permanent life insurance policies

- No riders

What Is Walnut Insurance?

Walnut Insurance is a Canada-based insurance company founded in 2020 that offers term life insurance and digital protection services. Insurance policies, provided by the Savings Bank Mutual Life Insurance Company of Massachusetts, are available to residents of every state except New York and North Carolina.

Walnut sells life insurance policies exclusively online, so there are no offices or in-person agents. You can get a quote without a medical exam and purchase a policy, if approved, in a matter of minutes.

In addition to term life insurance policies, Walnut also offers digital protection memberships through Cyberscout and optional member benefits through Headspace, ClassPass, and Dashlane. Digital protection requires a separate policy and member benefits cost extra on top of your life insurance coverage.

Features of Walnut Insurance

Here’s all the information you need about term lengths, coverage, and member benefits.

Age requirement

Anyone between the ages of 18 and 55 can apply for Walnut Insurance, but being within this range does not guarantee approval.

Term lengths

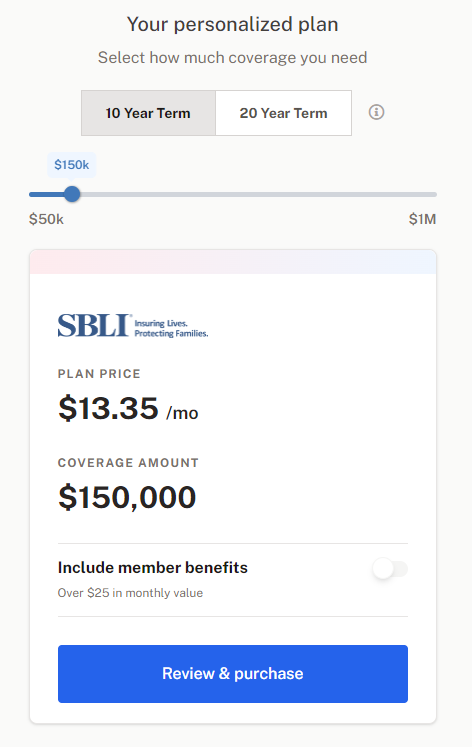

Walnut Insurance only offers term life insurance in two term lengths — 10 years and 20 years. After the term ends, your coverage ends, and you have to reapply for a new policy if you want to continue your coverage. For comparison, most traditional life insurance companies offer terms of up to 30 years, and many have term lengths in increments of 5 years for more flexibility.

Coverage limits

With Walnut Insurance, you can get a term life policy with coverage between $50,000 and $1 million. If you need more than $1 million in coverage, you’ll need to look elsewhere. However, there are plenty of other life insurance companies that offer coverage limits of $5 million and even higher, if you don’t mind paying a more expensive rate.

Read more: Calculator: how much life insurance do I need?

Member benefits

One of the standout features of Walnut Insurance is its member perks. When you buy a life insurance policy, you can enroll in the member benefits program for a few extra dollars per month. This is part of Walnut’s goal to provide a more holistic insurance experience.

This optional membership includes access to wellness-related services, including Headspace for meditation, ClassPass for digital fitness classes, and Dashlane, a password manager that can help protect your online identity.

Pros & cons

Pros

- Affordable policies — Plans start at just $10 a month.

- Convenient application — The application is fully digital and takes less than five minutes to complete.

- No medical exam — Most applicants aren’t required to submit a medical exam to apply and get approved for coverage.

Cons

- Low coverage maximum — You can only borrow up to $1 million, which is on the low end of average for term life.

- Limited terms — Policies are only available in 10- and 20-year terms.

- No permanent life insurance policies — Walnut doesn’t sell any permanent life insurance like whole, universal, or indexed universal life insurance.

- No riders — Optional riders, including built-in riders like accelerated death benefits, are not available.

How does Walnut Insurance work?

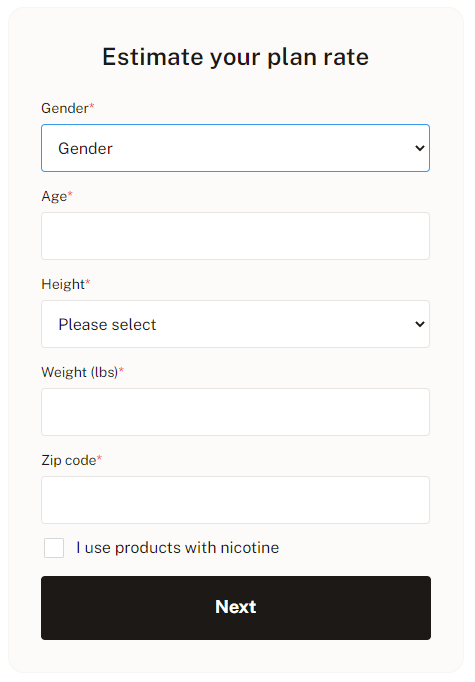

Getting life insurance from Walnut Insurance is quick and easy. To get a quote before applying, you must enter some basic personal information, like your gender, age, height, and weight. You’ll also need to disclose your nicotine use upfront.

On the first page of the application, you’ll fill out your contact information, date of birth, and social security number. Next, you’ll provide your citizenship status.

Then the application will take you through a series of questions about your personal life and risk factors.

The questions are pretty standard. If you’ve never applied for life insurance before, you’ll be asked about your family health history, participation in risky activities (such as skydiving and motorcycle riding), experience with cancer, alcohol and drug use, criminal charges, COVID-19 history, and surgeries.

Finally, you’ll consent to letting Walnut check medical databases and reporting agencies to confirm your answers and click “Continue.” Then, you’ll add at least one beneficiary and indicate what percentage of your benefits will go to them.

Once you fill out your personal details and contact information, you’ll personalize your policy by choosing a term length of either 10 or 20 years and the amount of coverage you want (between $50,000 and $1 million).

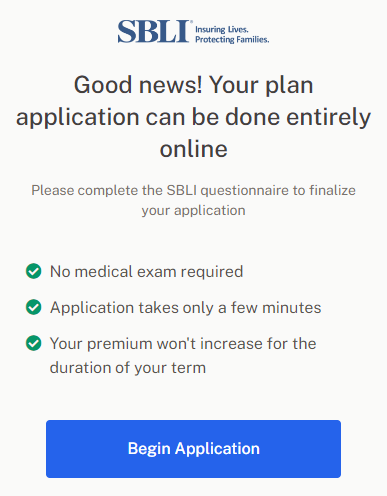

You’ll notice the application never asks you to upload exam results. This is because most applicants are not required to undergo a medical exam. While this can be good news for healthy individuals looking to save time, it won’t be ideal for you if you have a medical condition or history of health issues.

If you qualify to apply without an exam, you’ll receive this message.

The application and health questionnaire took about 10 minutes and was easy to fill out. Unfortunately, I was declined for coverage due to my health history, but I appreciated the fact that I didn’t have to wait to find out. If you are approved, you can pay the first month’s premium via ACH bank transfer, and your coverage takes effect immediately after you check out.

How much does Walnut Insurance cost?

Walnut plans start at $10 a month. But like any insurance policy, how much you’ll pay depends on your coverage and term. So to give you an idea of what prices you might be looking at, here are some sample quotes I received.

Quote samples for 10-year terms:

- $100K coverage: $10.35/month

- $250K coverage: $12.40/month

- $500K coverage: $17.40/month

- $750K coverage: $23.93/month

- $1M coverage: $30.45/month

Quote samples for 20-year terms:

- $100K coverage: $11.31/month

- $250K coverage: $15.66/month

- $500K coverage: $23.93/month

- $750K coverage: $33.71/month

- $1M coverage: $43.50/month

These quotes were not super personalized because I got them before applying, which tells me that this is right around average for a lot of applicants. But for reference, I’m a 25-year-old cisgender woman at the time of writing this.

Your premium is determined by your age, health, family medical history, and overall risk factor. But as you can see, this is a pretty affordable option overall.

Read more: Is life insurance worth it and when do you need it?

Member benefits

Member benefits cost $2.50 extra regardless of what policy you have. The benefits package, which includes Dashlane Premium, ClassPass Digital, and Headspace Plus, is valued at over $25 a month. All of the quote samples above do not include member benefits.

Who is Walnut Insurance best for?

People who want to buy term life insurance online

If you want a term life insurance policy, Walnut Insurance is a good choice. The coverage limits are sufficient for a lot of people, and there is no medical exam required. Plus, if you get approved, you can purchase life insurance on the spot — no waiting period necessary.

Walnut Insurance operates entirely online, so it’s perfect if you want to avoid working with an agent or calling to get a quote. You can get a quote anytime, anywhere, and purchase a policy from behind your computer screen. It doesn’t get much easier than that.

People who are really healthy

Term life insurance in general tends to be a better fit for people in their 20s and 30s with reasonably clean bills of health. Insurance providers like Walnut that don’t require a medical exam to apply will ask you questions about your health history and may not approve your application if you have certain conditions that could increase your risk.

People who’ll use the member benefits

Although optional, Walnut’s member benefits are a unique perk at great value. For just $2.50 extra a month, you’ll receive Headspace, ClassPass, and Dashlane subscriptions. These would cost a lot more than that if you were to purchase them separately.

Who is Walnut Insurance not for?

People who live in New York or North Carolina

Walnut Insurance is licensed to sell coverage in most states, except New York and North Carolina. If you live in one of these states, you won’t be able to purchase coverage from Walnut.

People who want permanent life insurance

The only policy available from Walnut is term life insurance. If you want a permanent policy, like whole life or universal life, you should look into a different provider.

Read more: Term vs. whole life insurance: What’s the difference?

People looking for life insurance riders

Walnut Insurance doesn’t offer any life insurance riders, which are optional policies that can fill gaps in your coverage. Most life insurance companies, including some online providers, offer at least a few riders.

Walnut Insurance vs. competitors

You have a lot of options when it comes to term life insurance from the top life insurance companies. Here’s how Walnut Insurance compares to two of its competitors and some of the most popular providers, Lemonade and Bestow.

Walnut vs Lemonade Life

Lemonade Life offers up to $1.5 million in coverage in terms of 10, 15, 20, 25, or 30 years.

Lemonade is an excellent insurance provider if you want cost-effective insurance, fast. It’s easy to get a quote and apply to purchase coverage online in just a few minutes on a wide variety of insurance products, including car insurance, condo insurance, home insurance, renters insurance, life insurance, and pet insurance.

- Affordable policies

- Online quotes

- Mobile app

- No permanent life insurance

- No live agents

- Not available in all states

Lemonade Life policies start at just $9 per month, so this could be a slightly cheaper option than Walnut depending on your age, health, and personal circumstances. Rates may vary when you apply. But because neither Lemonade Life nor Walnut requires a medical exam, you’re not likely to apply and qualify for either if you’re in poor health. And if you’re older than 55 but younger than 60, choose Lemonade Life over Walnut.

Walnut vs Bestow

Bestow is another digital life insurance provider that offers term life insurance with instant decisions. You can choose from term lengths of 10, 15, 20, 25, or 30 years.

In addition to offering more term options, Bestow also has a higher coverage limit than Walnut Insurance at $1.5 million. Both applications are quick and easy and don’t require a medical exam.

Bestow might be a better option than Walnut for anyone who needs more coverage or a longer term, but Bestow’s prices are a little higher on average than Walnut’s.

Summary

In a nutshell (pun intended), Walnut Insurance is an impressive life insurance provider for people of many ages, whether you’re single or have a family that you want to protect. It’s easy to apply, the prices are lower than many other insurance providers, and you can take advantage of the member perks for a few dollars more each month.

Even if you aren’t entirely sold, it’s worth getting a quote — it only takes a few seconds on your phone or computer.