How much should I save each month?

Learn why we recommend trying to save at least 20% of your income every month.

Learn why we recommend trying to save at least 20% of your income every month.

Learn how to make serious cash off the bulk Pokémon cards you may have sitting around. Here’s where to sell them and how to get the most money.

Banks may approve mortgage payments of up to 35% of your pretax income. But some experts advise limiting payments to no more than 25% of your after-tax income. Here’s why it matters.

There’s a big difference between what you’ll pay in interest over time if you’re offered a 3% vs. a 4% mortgage rate. Let’s take a look at the factors that determine your mortgage rate and calculate how much you’ll pay

A premium is what you pay to maintain coverage; deductible is the amount you pay for treatment before the insurance company covers remaining expenses; copay is for routine medical services; and out-of-pocket maximum limits the total amount you pay each

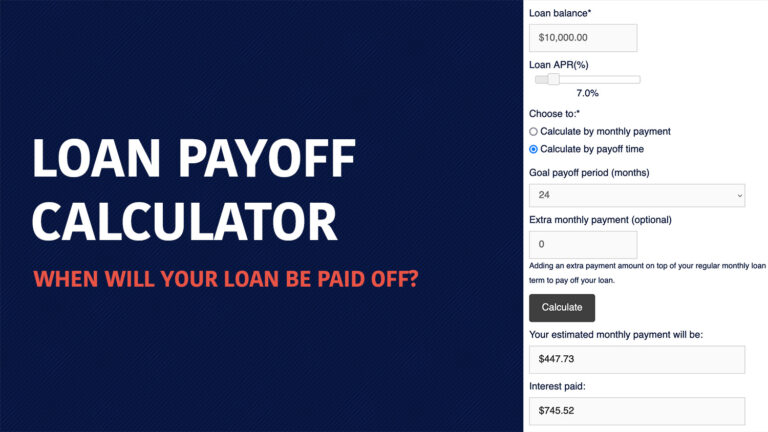

Calculate your monthly loan payment for a given term or how long it will take you to repay a loan with a given monthly payment.

Start generating passive income today with these tips and tricks! You won’t regret it in the future.

Dividend stocks can be an excellent way for investors to collect passive income. Here’s what dividends are how to invest in dividend stocks.

Grace periods are the time between graduation and when you need to start making payments on your student loans. Deferment allows you to stop making payments so you can return to school. Forbearance stops the payment requirement due to hardship.

Are you looking for a job that’s similar to Instacart? Here are some great alternatives like DoorDash and Lyft to start making money today.

If you’re invested in cryptocurrency, here’s what you need to know about what could happen if the prices take a turn for the worse.

Looking to make some extra cash with Amazon? Check out our guide to using an Amazon Flex Bot and start earning today!