The start of 2022 was rough for the stock market. As of June 30, 2022, the market suffered its worst starting six months since 1970, with the S&P 500 dropping almost 21%. And yet, the U.S and other Western economies experienced persistently strong economies and one of the tightest labour markets on record (generating a significant amount of inflation).

So, what gives? Isn’t the market supposed to be driven by the economy?

Turns out, it’s not so simple.

According to London Business School professors Elroy Dimson, Paul Marsh, and Mike Staunton, there’s only a slight positive correlation between GDP growth and stock performance. In fact, the professors observed there’s actually a negative correlation between national per capita GDP growth and stock performance.

While what happens in the economy and the market might not be 100% related, knowing the difference between the two, and their relationship with each other, is helpful for understanding your own financial journey.

What Is the Stock Market?

The stock market is the collection of company shares and other financial securities that trade on exchanges or over the counter, that investors can buy and sell.

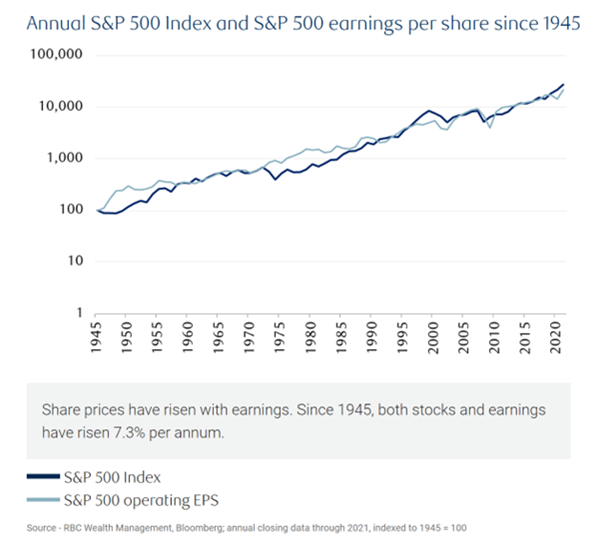

While the value of these financial securities goes up and down over time, the performance of the market (defined by the S&P 500) tends to follow the earnings performance of companies.

What Is the Economy?

The economy is the production and consumption of, well… stuff, whether it be goods or services. The most common measures that describe the health of the economy are employment rates, GDP (gross domestic product), and inflation.

When employment is strong, GDP is rising, and inflation is low and stable, chances are the economy is in good shape.

When these figures get out of whack though, we start to see economic issues.

While GDP, employment, and inflation are important economic indicators, they are backward-looking or “lagging indicators.” This means they only describe something that has happened versus something that is going to happen.

What’s Up With the Disconnect?

There are several reasons why the stock market and the economy don’t run in lockstep.

1. Lots of People in the Economy Don’t Participate in the Stock Market

The number of Americans who own stocks is far fewer than those who participate in the actual economy.

According to Gallup, only 58% of Americans report owning stocks, with the wealthiest 10% owning 89% of all U.S. stocks.

Since a large percentage of Americans don’t own stocks, and an even smaller few own most U.S. stocks, their individual actions don’t always accurately reflect the broader population’s purchasing behaviour, or the willingness of businesses to invest in new projects.

2. Publicly Listed Companies Represent a Small Amount of U.S Employment

Public companies make up less than 1% of all U.S. companies and one-third of non-farm U.S. employment.

Since most of the U.S.’s employment landscape is not solely driven by publicly traded companies, stock market gyrations don’t always result in widespread job losses and economic contractions. While what happens in the stock market may color the decisions of non-public companies, it’s not a direct relationship.

3. The Largest Companies by Market Cap Disproportionately Impact the Stock Market

Most people think about the stock market as the S&P 500, but the S&P 500 only represents a collection of the largest 500 U.S. publicly traded companies by market capitalization. (“Market cap” refers to the total value of a company’s stock.)

If you compare that to the ~4,100 publicly listed companies in the U.S., it’s easy to see that S&P 500 companies doesn’t account for the majority of U.S. public companies. In fact, the S&P 500 has historically made up about 80% of all U.S. equity market capitalization, so companies in this group have a disproportionately large impact on the market as a whole.

Additionally, since the S&P 500 is driven and weighted by a company’s market capitalization, the organizations within it may not represent the largest employers in the U.S. For example, as of July 10, 2022, Apple was the largest company in the S&P 500, but it’s nowhere near being in the top five largest employers in the U.S. That list is topped by Walmart , Amazon, Home Depot, FedEx, and Target.

Since the stock market rewards companies with higher market capitalizations for generating more revenue, operating profits, and earnings per dollar of expenses needed, it makes sense why the biggest and most influential company stocks may not have the most impact on the economy.

The Stock Market Looks Forward While Economic Data Looks Backward

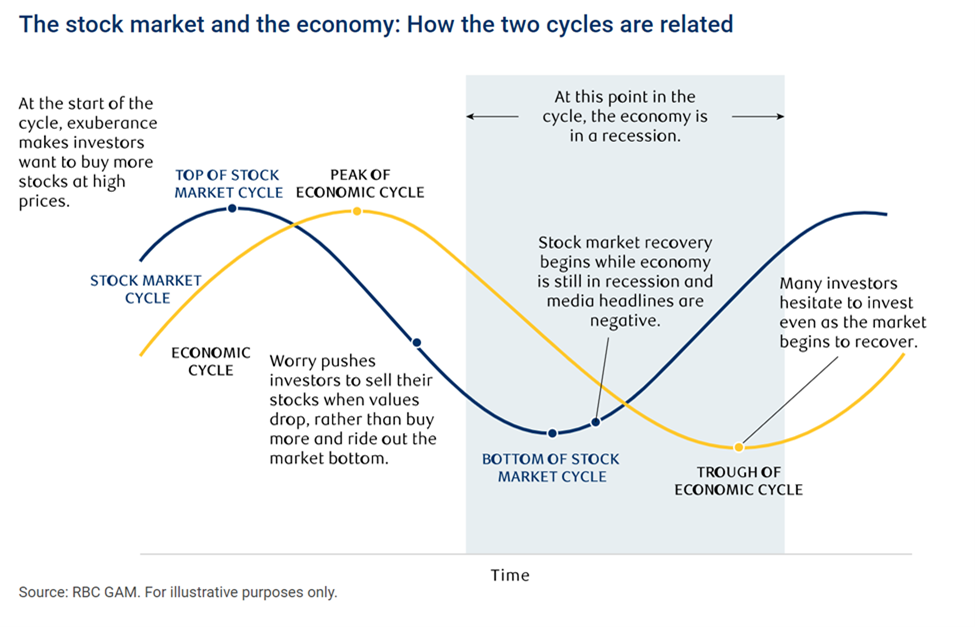

Going back to the idea that a lot of economic data is backwards-looking, the stock market is a forward-looking indicator.

This means that market participants are always looking ahead to what might happen in the future, in the form of earnings expectations. If investors think companies will have better prospects tomorrow than they do today, they are more likely to invest, which in turn tends to drive up the stock market.

On the other hand, if investors think companies will do worse in the future than they have in the past, they will likely sell their stock, which if done all at once without a counterbalance of buying, drives down the market.

Since there are many well-documented instances in economic history of market participants getting expectations about the future prospects of companies wrong, this is another reason why what happens in the stock market doesn’t always reflect what is happening in the economy.

The Bottom Line: Why These Differences Matter to You

The biggest reason for why what happens in the market is important for the economy comes down to one thing: how individuals and businesses feel about their own finances.

When the stock market is hot, both businesses and individuals tend to feel better about their current and future economic prospects, which results in something called the “wealth effect.” This is the idea that when one becomes richer due to higher asset values, they spend more. For businesses, this could be in the form of more hiring, investing in growth programs, or going public themselves. For individuals, this means just more general spending, which in turn drives the economy higher.

Nowadays, the wealth effect is amplified by the news and social media, adding fuel to the fire both on the way up and the way down in the markets.

As a result, it’s important to approach what happens in the stock market with a strong sense of perspective. Just because the stock market falls 20% doesn’t mean the world is going to end or you are about to lose your job.

A more productive way to think about the relationship between the stock market and the economy is to approach it from the perspective of how those making capital allocation decisions might feel about the next 12 months.

If you think about the market/economy relationship this way, you’ll be far less likely to:

- Get caught up in the wealth effect while the market is hot and overextend yourself.

- Get too pessimistic about the world and your future prospects when the market has trouble.

Instead, you’re now armed with the knowledge to adopt a healthy sense of fiscal conservatism that will enable you to invest for the long term like an optimist while preparing for the worst like a pessimist.