CashUSA is a a website that connects users with personal loan lenders willing to work with borrowers who have credit problems. CashUSA is not a lender itself, but earns money from lenders and — this is worth noting — by selling your information to other marketers after you submit a loan request.

If you have bad credit and need to borrow money, be careful. Understand that:

- Borrowing money when you have bad credit is extremely expensive and, often, may make a bad situation worse.

- Lots of less-than-great companies out there take advantage of people with bad credit looking to borrow money.

That said, it is sometimes possible to get a personal loan even when you have bad credit. You can read more about the best way to find personal loans and learn how to see if you qualify — and at what interest rate — from legitimate lenders.

About CashUSA

CashUSA.com matches borrowers with lenders for unsecured loans between $500 and $10,000. These installment loans can be paid out over the course of between 90 days and up to 72 months, or 6 years.

CashUSA claims that APRs generally range from 5.99% – 35.99%, the industry average. Unfortunately, if you have bad credit, your interest rate is likely to be at the very high end of that range, if not higher. A 5.99% APR on an unsecured personal loan would only be given to somebody with nearly perfect credit.

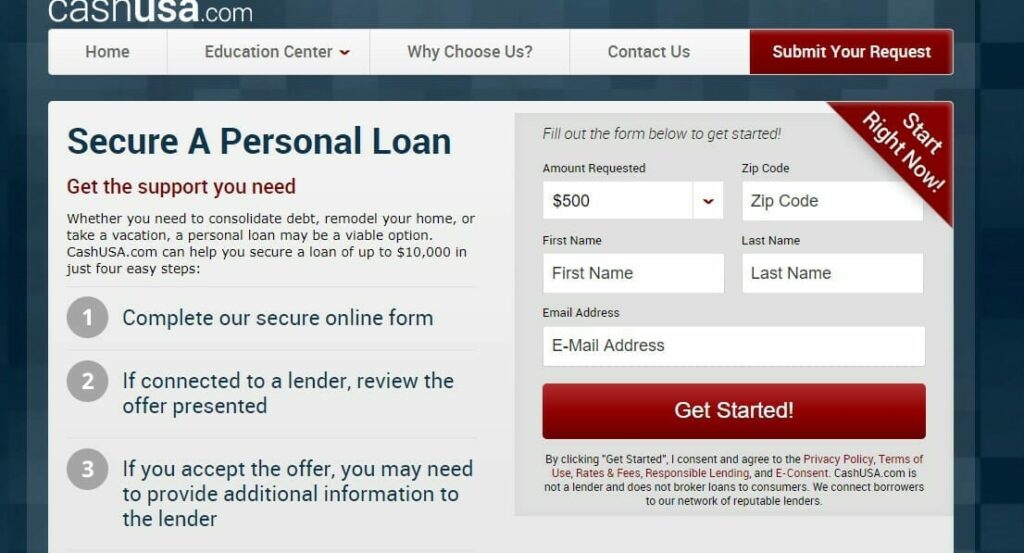

How CashUSA.com works

Using CashUSA is as simple as filling out a few online forms. You must provide a lot of personal and financial information that will be used to match you with lenders, but CashUSA also makes it very clear that they will sell the info you provide to third-party marketers. These marketers may include companies providing debt management or credit repair services. This is a big red flag — some of these companies are known for aggressive sales pitches and providing expensive and less-than-helpful services.

What information does CashUSA ask for?

When we tried CashUSA’s service, they asked for the following information. Step one asks basic questions:

- Name

- Email address

- Zip code

- Whether or not you’re an active member of the military

- The amount you’re requesting for a loan

Step two asks more details including:

- Phone number

- Physical address

- Whether or not you own your house

- How long you’ve been living there

- Income source

- How long you’ve been employed at this job

- How often you get paid

- Name of employer

- Employer’s phone number

- How much you make per month

- Driver’s license/ID

- Social security number

- Bank account type

Finally, you’ll move onto step three, where you’ll provide your bank account information, whether or not you own a car, if you are paid by direct deposit, and what your official job title is.

How CashUSA matches you with lenders

After you click submit, your loan request will be sent out to the CashUSA.com network of lenders.

Lenders’ computers will process your application info and CashUSA will display any “matches” for you to review. There are many reasons you might not match with a lender: credit qualifications, loan amount requested, where you live, or simply because a lender has met its quota of loan originations for the day.

CashUSA will display the interest rates and loan terms from any matched lenders. This is where you need to slow down and carefully look at the details of each loan. Understand exactly what you’ll be signing and what you’re going to owe.

How to take out a loan

If you like a loan that is presented to you, then you will be directly connected to the lender itself.

At this point, you’re not yet under any contractual agreement with the lender. Until you actually sign the contract, you can still walk away from the loan offer without any penalty, charges, or fees.

Each lender will have a slightly different process for finalizing the loan. Some will make it quite easy — a few online signatures. Others may require that you submit copies of your driver’s license and paycheck statement or other proof of your income.

CashUSA complaints

While most people who understand how CashUSA works and use it anyway to get matched with a personal loan are happy with how the service works, there are a high number of complaints about CashUSA’s practice of sharing personal information with marketers.

CashUSA is not accredited by the Better Business Bureau (which, by itself is not necessarily an indication of any problems), but has a number of complains filed against them there. Most have to do with the selling of personal information or unrelated loan scams that reporters have mistakenly attributed to CashUSA.

CashUSA review summary

CashUSA is one of many websites that offer an easy way to “shop” for loans by providing your application information once and submitting it to several different lenders. CashUSA does the job, but sells your personal information in the process.

To their credit, they are very clear about this fact on their homepage, where they say:

By clicking the button above, you consent and agree:

- To receive marketing communications for both loans and other credit-related products like debt relief, credit repair, banking, and credit-monitoring.

Still, there are plenty of places you can get personal loans (including our own network of lending partners below) that will keep your personal information secure. You may get follow-up marketing from the network itself, but not from sketchy debt relief companies.