Real estate is one of the best investment vehicles available. But purchasing and managing properties can be time-consuming. There’s also a learning curve that can create a barrier to entry for those who simply want to invest money and earn a return.

A Real Estate Investment Trust (REIT) specializes in the funding part of real estate investing, separating it from the task of doing day-to-day management.

DiversyFund automates the REIT process, pairing everyday investors with real estate opportunities previously only available to the wealthy. The real estate company purchases a pool of properties, many of which are multifamily buildings like apartment complexes. DiversyFund’s experts then renovate those properties to generate a steady stream of income that it can pass on to investors.

Shares are $10 each, so $500 gave me 50 shares in . There are multiple benefits of investing in a REIT, starting with the return that has historically beaten the S&P 500 when it comes to long-term performance.

Keep reading for my experience using DiversyFund.

How does DiversyFund work?

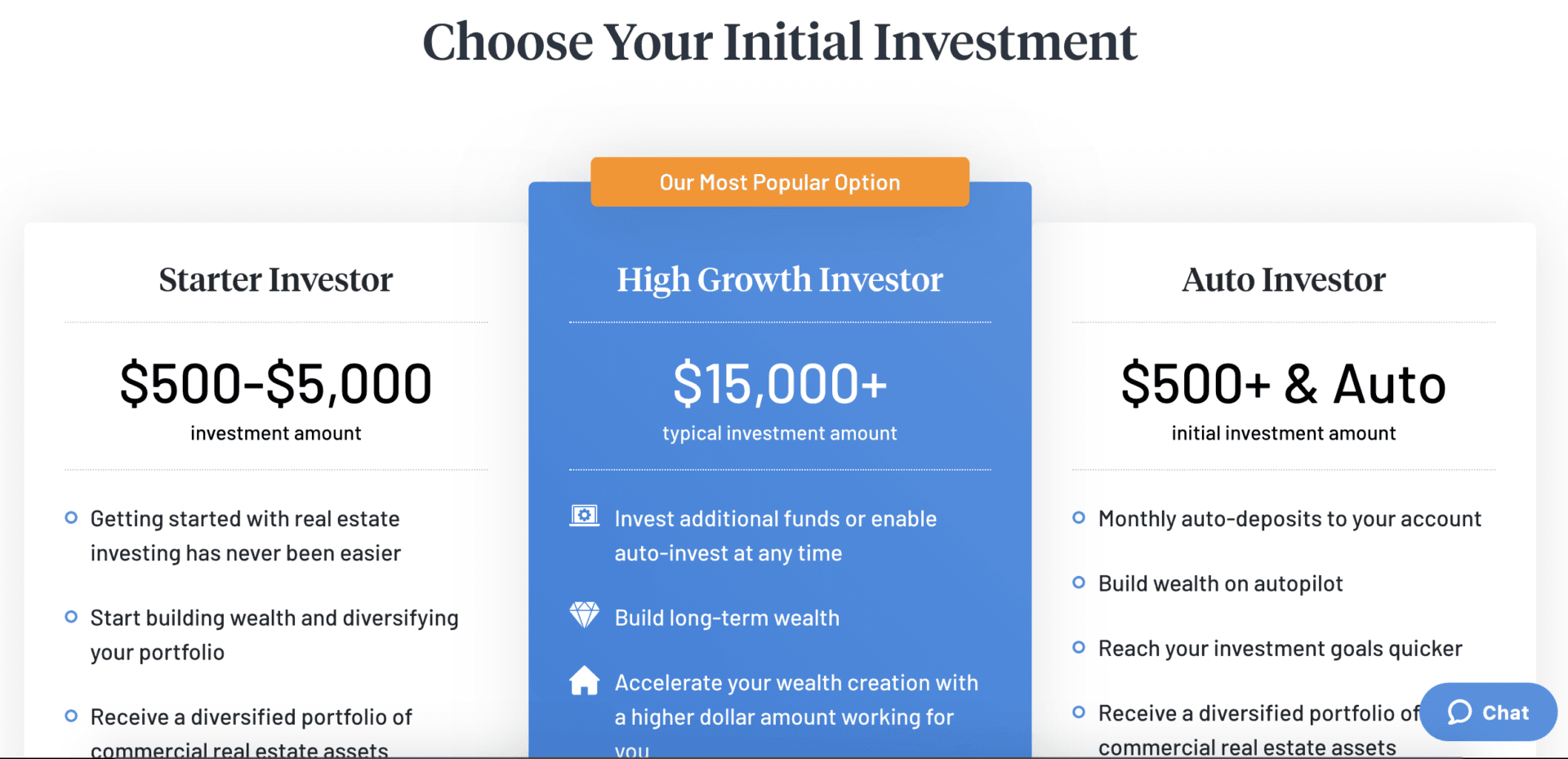

Your first step after signing up for a new account will be to choose how much you want to invest initially.

The chart you’ll see at signup, states that the most popular option is the one requiring a deposit of $15,000 or more, but you can get started with $500 by choosing between Starter Investor or Auto Investor.

I was curious about the difference between Starter Investor and Auto Investor, so I investigated both options. With Starter Investor, you can choose to invest any amount between $500 and $5,000. You’re in control of when money is transferred. With Auto Investor, you’ll turn over investing to the platform to handle, agreeing to transfer $500 initially, then allowing future investments to take place with monthly automatic deposits. The latter option is a faster path to achieving your investment goals.

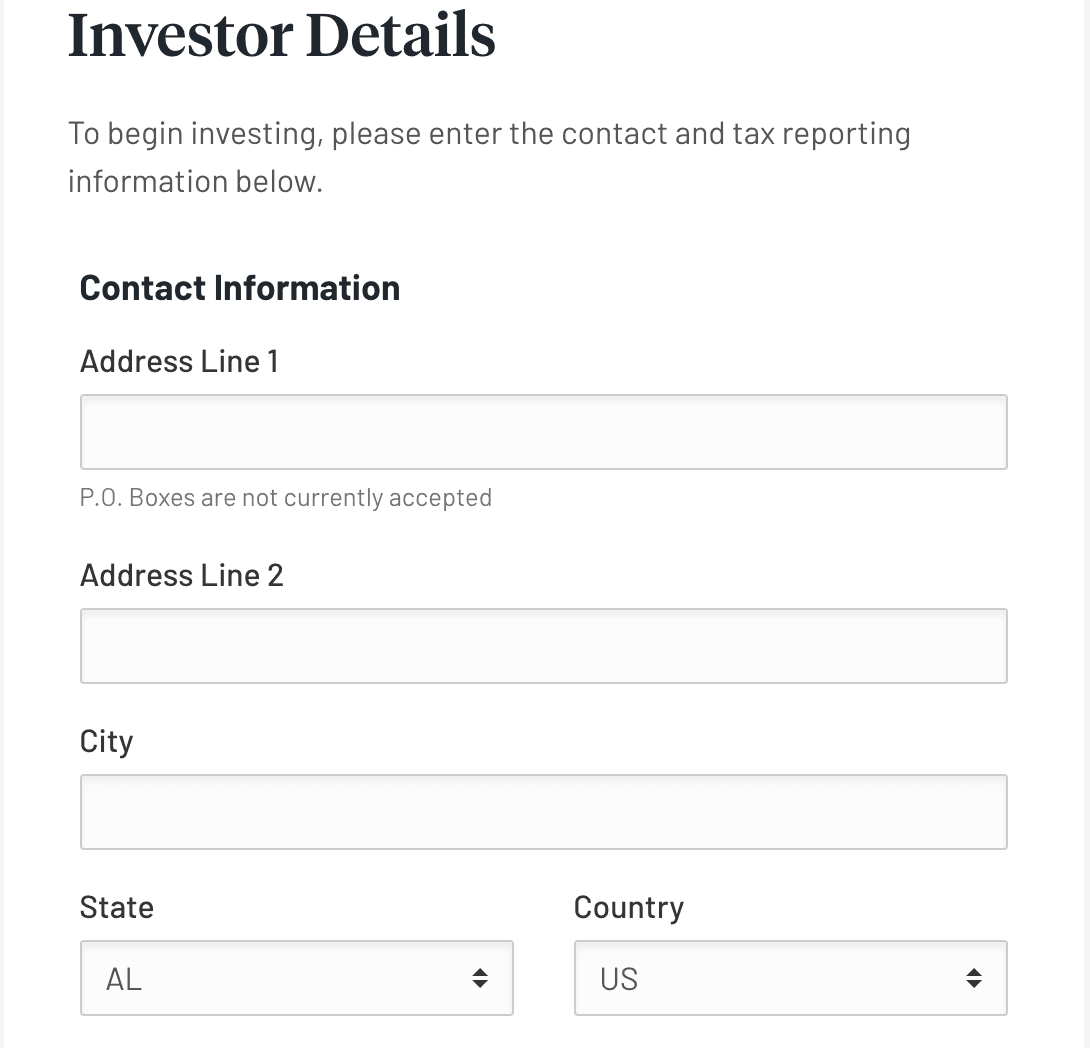

Just choose which plan you want and input your contact information and Social Security number for tax reporting purposes.

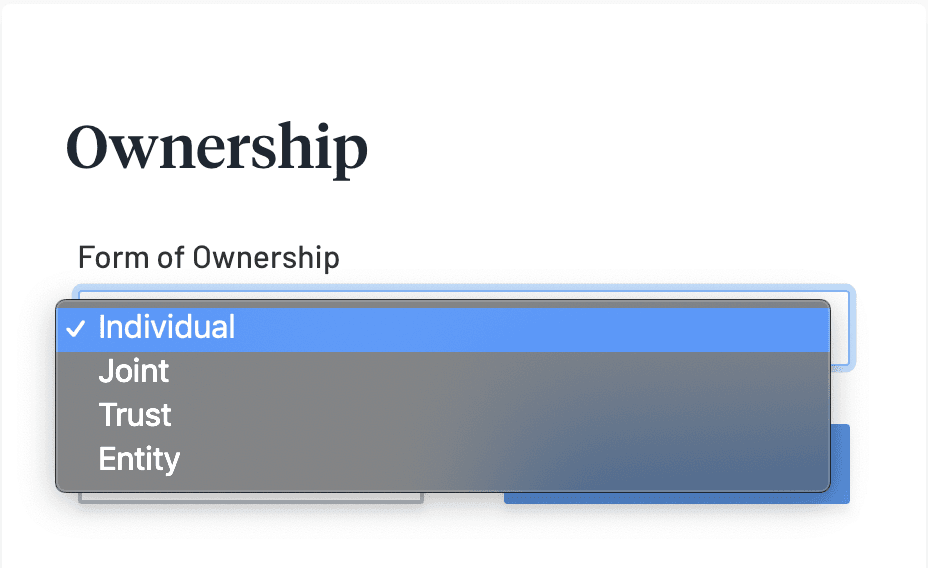

You’ll be asked the type of ownership you’ll have in your investment account. The options are:

- Individual.

- Joint.

- Trust.

- Entity.

For the purposes of this article, I chose individual ownership.

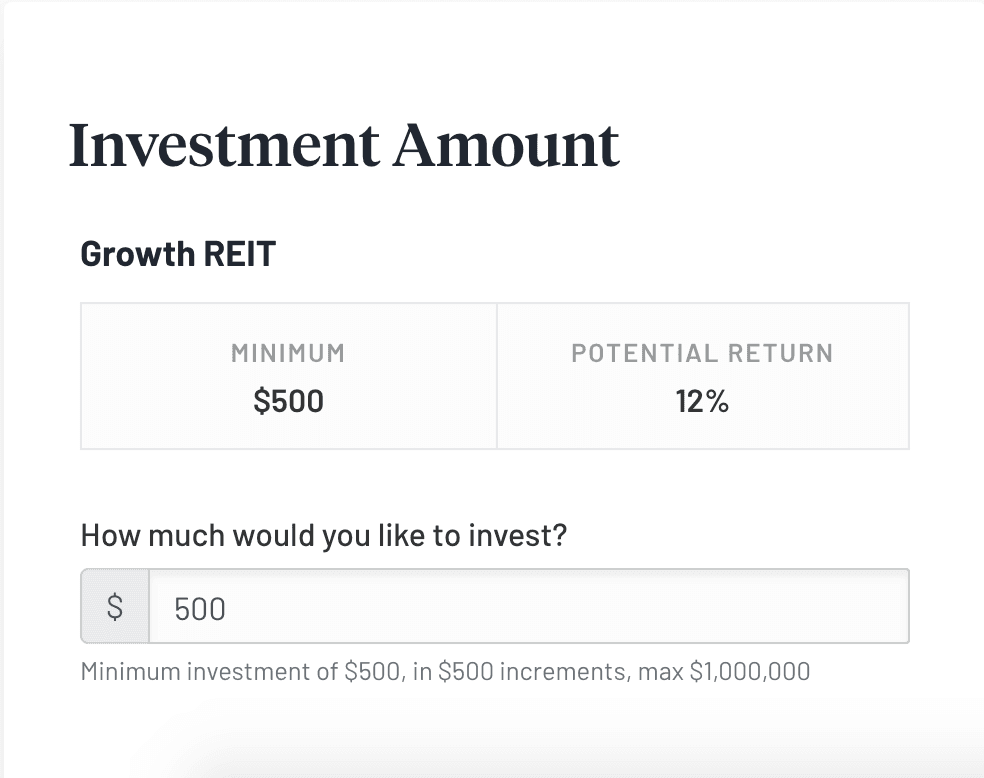

I selected the Auto Investor option at signup, so my next step was to choose how much I wanted to invest both initially and each month. I chose to make a $500 initial investment, which offers an initial return of 12%.

You can up that initial investment in increments of $500, with a maximum initial investment of $1 million.

Once you’re completely signed up, DiversyFund takes you to the dashboard, where you can begin monitoring your investments. The investors take care of buying properties and managing them, passing a percentage of the proceeds on to you and other investors.

Pricing for DiversyFund

DiversyFund charges no fees to investors, taking the money you put toward their projects to create revenue-generating rental properties. The goal is to get proceeds rolling in that the company can then split with us as investors. It’s a win for all parties involved.

But your $500 investments aren’t the only way DiversyFund makes money. According to a presentation the company’s leadership team made to prospective investors, there are two major ways DiversyFund makes money:

- Selling the properties in its portfolio. Purchasing and renovating properties allows them to capture rents, but eventually, they’ll sell those assets, which will bring in revenue.

- Developer fees. By acting as the broker and the developer, DiversyFund can collect developer fees.

This revenue model has DiversyFund projecting it will make between 10 and 100 times the revenue of competitors. DiversyFund estimated it could collect $1.2M in project/developer fees, as well as a future income of $21.2 million on the sale of its acquired assets.

Features of DiversyFund

You’ll get many benefits from using DiversyFund, including:

No experience required

Unlike many REIT investment opportunities, DiversyFund requires no previous real estate experience or income minimums to participate. Anyone willing to invest $500 or more into the opportunity can get started.

This brings the security and earnings opportunities of real estate to people of all backgrounds, rather than limiting it to a small pool of wealthy, experienced investors.

Fee-free investing

Every dollar of the money you deposit goes toward your investments, thanks to DiversyFund’s fee-free revenue model. They also ensure you get paid as money starts rolling in.

Currently, participation is priced at $10 a share, which means you’ll have to buy at least 50 shares to make the $500 minimum initial investment.

Expert investors

DiversyFund’s background instills confidence in potential investors. After two decades as an investor, Craig Cecilio came up with the idea for DiversyFund as a way to make real estate investing accessible to everyone.

His co-founder, Alan Lewis, was a former Wall Street investment banker and corporate lawyer who transitioned to real estate development in 2014. Together, they bring expertise in locating and renovating multifamily properties, and investors reap the rewards of that expertise.

Earnings potential

There’s a reason experienced investors flock to real estate opportunities. The return can easily beat other types of investments, including stocks. But DiversyFund eliminates the risk that can come with other real estate ventures.

The founders focus on multifamily properties that are already generating rental income and put money into improvements for even better results. As investors, you can recoup 7% of our money before DiversyFund starts taking its split. The company estimates 17% annual returns for each investor.

Who is DiversyFund best for?

Novice real estate investors

If you’ve never invested in real estate – or even invested at all – DiversyFund can help you get started. You’ll turn your money over to experts who will take care of everything from there, working hard to honor the trust investors have placed in them.

At the same time, you’ll have access to a dashboard that shows your earnings, and the process could help you gain confidence that you can take toward other types of investing.

Risk-averse investors

DiversyFund’s model is set up to keep risk at a minimum. Your money will go toward multiple properties, which means that even if one fails, others will offset the loss.

But DiversyFund focuses on properties that are already generating income and strives to make those properties even better. This is all in addition to the fact that even when the economy is struggling, real estate typically holds its value, coming back even stronger once things pick back up again.

Experienced investors new to real estate

This type of platform can be a great way for experienced investors to dip their toe into real estate. Simply dedicate $500, or a portion of your monthly spend, to the platform and monitor its performance. If it starts to exceed your other ventures, you can then increase its presence in your portfolio.

Who shouldn’t use DiversyFund?

Experienced real estate investors

Some real estate investors do it all. Instead of putting your money into a REIT, you may scour the globe for the best property, purchase it, and upgrade it to flip at a profit.

You may even be the type of investor who buys multifamily or rental properties and collects rent each month, taking on the management duties yourself. Although this type of investor can definitely benefit from putting some money into DiversyFund for extra income, if you think you might get frustrated with someone else doing the development and management, it may not be the best choice for you.

Those looking for quick returns

With real estate, you’re playing the long game. In fact, it could take you five years to begin seeing a significant return on your investment. If the market takes a downturn, you’ll wait even longer.

Those who look for a quick return on investments will probably want to steer away from real estate, unless you can find a great deal on a fix-and-flip property.

Investors in need of income

Any returns you make will be reinvested, so if you’re hoping for a steady flow of cash from your investment, this won’t be a good route for you. Instead, look for a rental property you can purchase and rent for that regular income if real estate is your interest.

Even stocks and bonds will generate quicker income, provided you choose an investment vehicle that performs well.

Pros & cons

Pros

- No fees — DiversyFund won’t charge you any maintenance fees, which is a rarity in investing.

- Low risk — The properties are already established, reducing the risk to investors.

- Open to everyone — Novice investors needn’t worry, as DiversyFund’s expert team handles choosing and managing the properties.

Cons

- Slow growth — With any real estate investment, you could be looking at years before you start to see significant money rolling in.

- An untested platform — DiversyFund is a new concept, which means we’re technically considered early adopters.

The competition

| Investment platform | Fees | Minimum investment | Investment type |

|---|---|---|---|

| DiversyFund | Free | $500 | Multifamily properties |

| Fundrise | Investment advisor fee: 0.15%; Asset management fee: 0.85%; Additional acquisition fees: 0-2% | $500 | Primarily real estate loans |

| RealtyMogul | 1.00% – 1.25% per year | $1,000 | Multifamily and commercial properties |

DiversyFund is great, but it isn’t the only real estate investment option. Here are some to compare before you buy.

DiversyFund vs. Fundrise

Fundrise is billed as a crowdsource-based real estate investment app. Like DiversyFund, this simply means you put a small amount of money in rather than ponying up the full amount yourself.

Fundrise is an online crowdfunding real estate investment platform that allows you to invest in both residential and private commercial properties. The cool thing about Fundrise is that anyone can invest. It’s not just for wealthy investors.

- Open to all investors

- Low investment minimum

- Simple and easy to get started

- Not a short-term investment

- Variety of fees may be difficult to understand

Although Fundrise charges fees for its services, it does have a longer history in the real estate crowdfunding space. If you’re on the fence, it’s worth checking out what Fundrise has to offer.

» MORE: Sign up for Fundrise or read our full Fundrise review.

DiversyFund vs. RealtyMogul

RealtyMogul is a bit more of an investment, typically requiring a minimum of $5,000 to get started.

But the platform is especially beneficial to existing investors who have capital gains to reinvest. Simply use a 1031 Exchange to reinvest the proceeds from your sale and defer those gains until you later decide to sell.

My experience using DiversyFund

I loved the $500 minimum

One of my favorite things about DiversyFund is the fact that it allows younger investors to actually get in on the real estate investing game. As long as you have at least $500 to invest, you can get started slowly with DiversyFund.

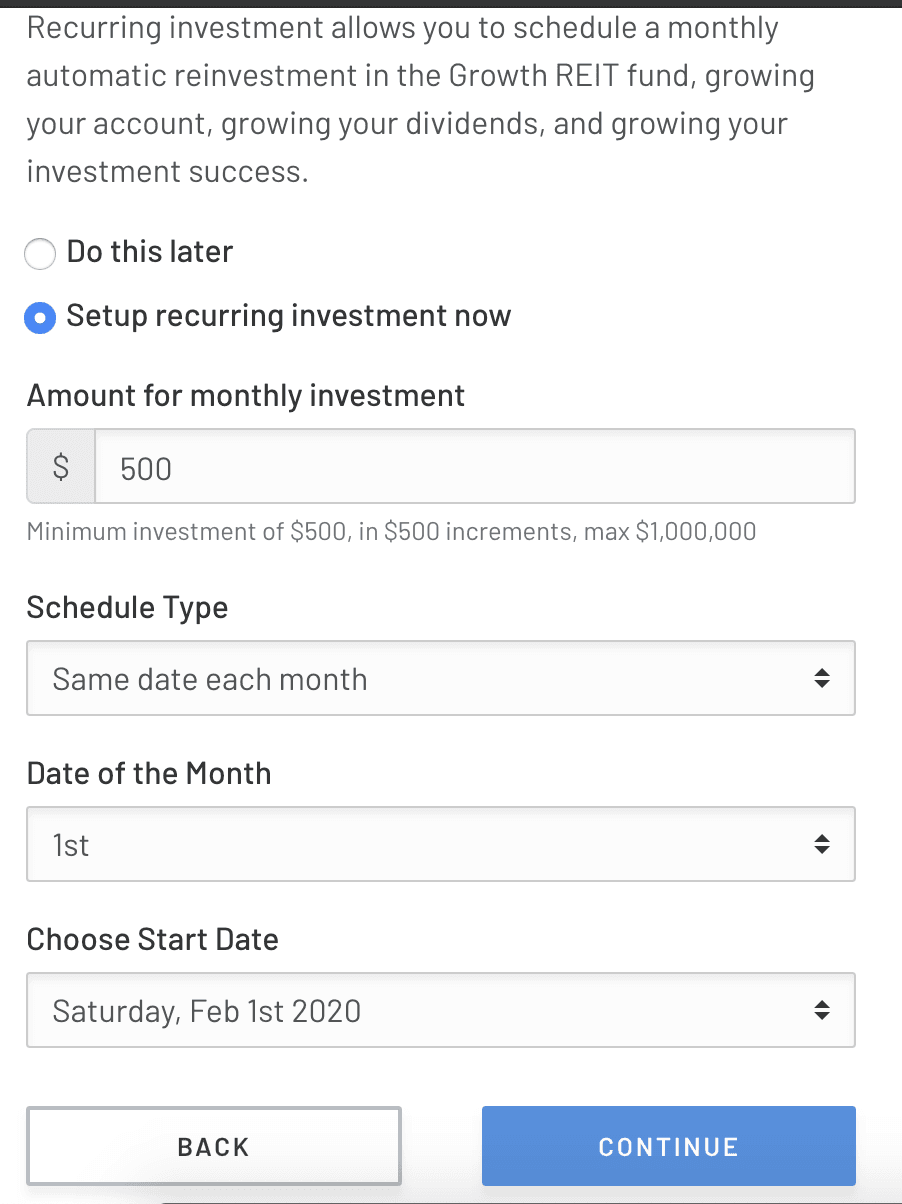

When you choose the $500 Starter Investor option, you can get a feel for how the platform works. I chose to experiment as Auto Investor to see the options available there. I first found that I could choose how much I wanted for my initial investment, but when I scrolled down, the platform invited me to set up my recurring monthly investment.

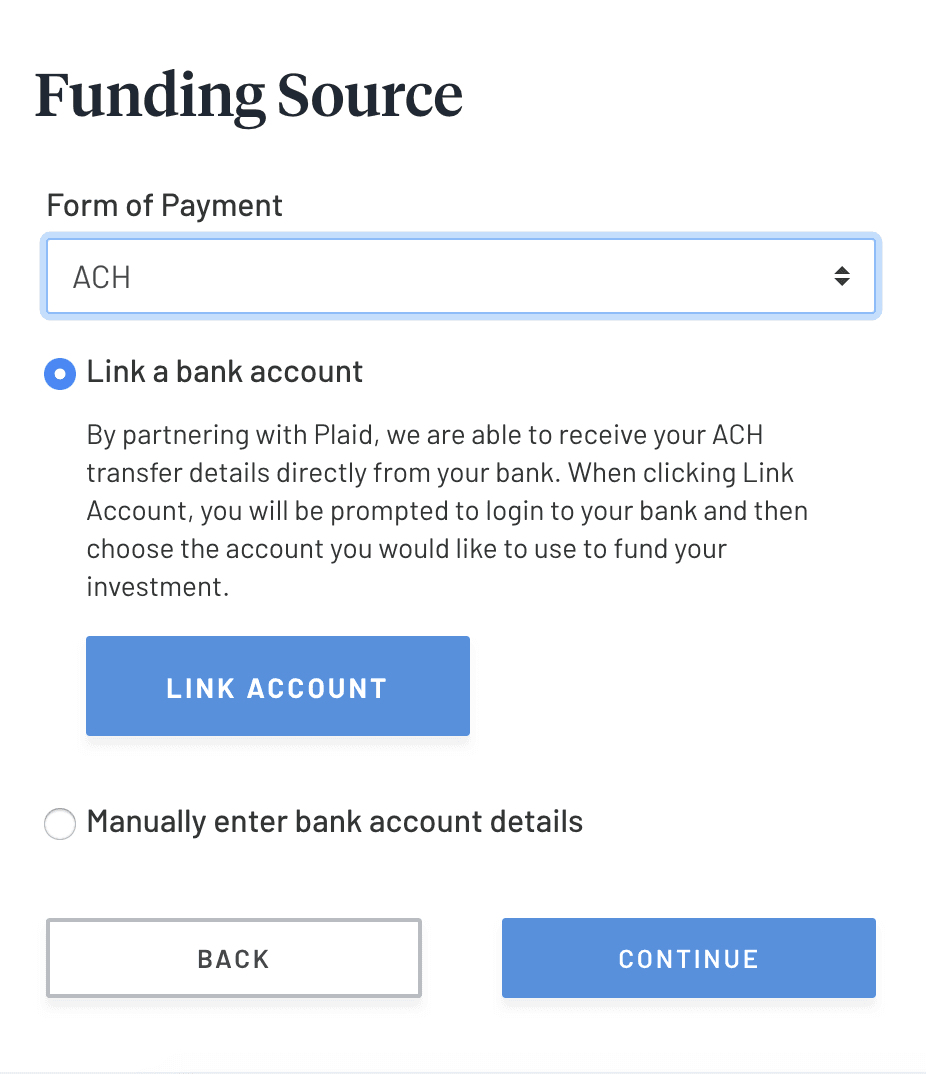

You can opt for setting this up later if you aren’t yet sure how much you want to automatically transfer each month. I chose the minimum recurring monthly investment of $500, at which point I was given only one option: ACH.

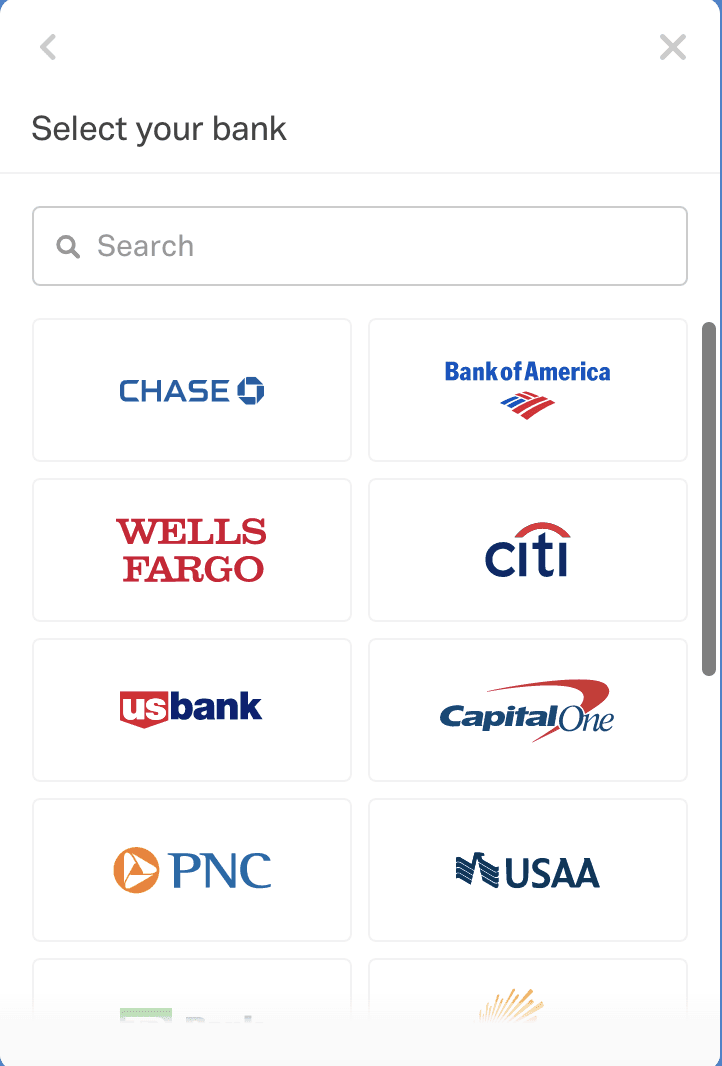

You can either choose from DiversyFund’s automatic bank linkup through the third-party service Plaid or manually input your bank account information.

From there, it was just a matter of linking up my account and the automatic transfer begins.

I was able to easily monitor my investments

Once I made my investment, I was easily able to monitor my performance on the dashboard. I was able to get my current earnings, but DiversyFund also provided a handy five-year and ten-year projection to help me make sure I was on the right track.

I was impressed by the payouts

DiversyFund’s payouts are even more impressive. After my $500 investment, DiversyFund will distribute the first 7% of all rents collected to me and other investors. All remaining profits after that 7% are split between us and DiversyFund.

The other investors and I will get 65%, with DiversyFund taking the remaining 35%. Once the investors have earned a 12% return in a given calendar year, DiversyFund will split all remaining proceeds for the rest of that year 50-50.

Summary

DiversyFund makes it easy for investors of all backgrounds to get started in real estate investing. With just a small upfront investment of $500, you can try it out without paying any fees.

If you can wait a few years to start seeing a return on your investment, DiversyFund could be just the platform you’ve been seeking.