The ACE Flare™ Account by MetaBank® is a new player to the prepaid game, and it’s making quite a splash.

Offered by a company that traditionally offers things like payday loans, the ACE Flare™ Account by MetaBank® is backed by Metabank and has a lot of great features.

It’s meant for folks with low credit profiles, but it still packs a punch, which, unfortunately, isn’t always true for no-credit credit cards.

Here’s my full ACE Flare™ Account by MetaBank® review.

What is ACE Flare™ Account by MetaBank®?

ACE Flare™ Account by MetaBank® is a prepaid debit card from Ace Cash Express. It’s issued, however, by MetaBank.

Ace Cash Express is headquartered in Irving, TX, and provides “non-traditional” financial services. Their target audience is primarily those with either no credit or those with poor credit.

The company has close to 1,000 stores in 22 states and was founded back in 1968. Ace Cash Express now also offers online services in 11 additional states, too.

Last year, they actually changed the name of their company to Populus Financial Group. But they still do business as Ace Cash Express to limit confusion. I thought I’d call that out since you may see that name elsewhere.

Ace Cash Express offers things like installment loans, check cashing, payday loans, as well as prepaid debit cards, in addition to some other financial services based on location. Today, I’ll be focusing on their prepaid debit card.

How does ACE Flare™ Account by MetaBank® prepaid debit card work?

ACE Flare™ Account by MetaBank® is a prepaid debit card, but it’s similar to a checking account. Meaning, you deposit the money you want to be able to use right onto the card.

And since it’s a regular debit card, you can use it like one. You can make purchases anywhere that accepts Visa.

While your balance won’t accumulate much interest while sitting in the ACE Flare™ Account by MetaBank® account (though it will earn some), you’re able to make as many purchases as you want with the card – with no limits.

In order to use the card, you’ll have to be mindful of limits for both your purchases and withdrawals. For pin-based transactions (like you’d do with a debit card), you can make up to a $5,000 purchase at one time. You can also withdraw up to $5,000 over-the-counter (i.e., non-ATM based). If you want to use an ATM, you’ll be limited to $400 per transaction and $1,000 per day.

Additionally, you can use the card to sign up for bill pay services. For instance, you can set up an auto-pay on your Verizon account to pay your phone bill from the ACE Flare™ Account by MetaBank® account every month.

Be mindful, though, some places will charge you a fee for using a debit card as a form of payment (like local utilities who often do this).

Pricing for ACE Flare™ Account by MetaBank®

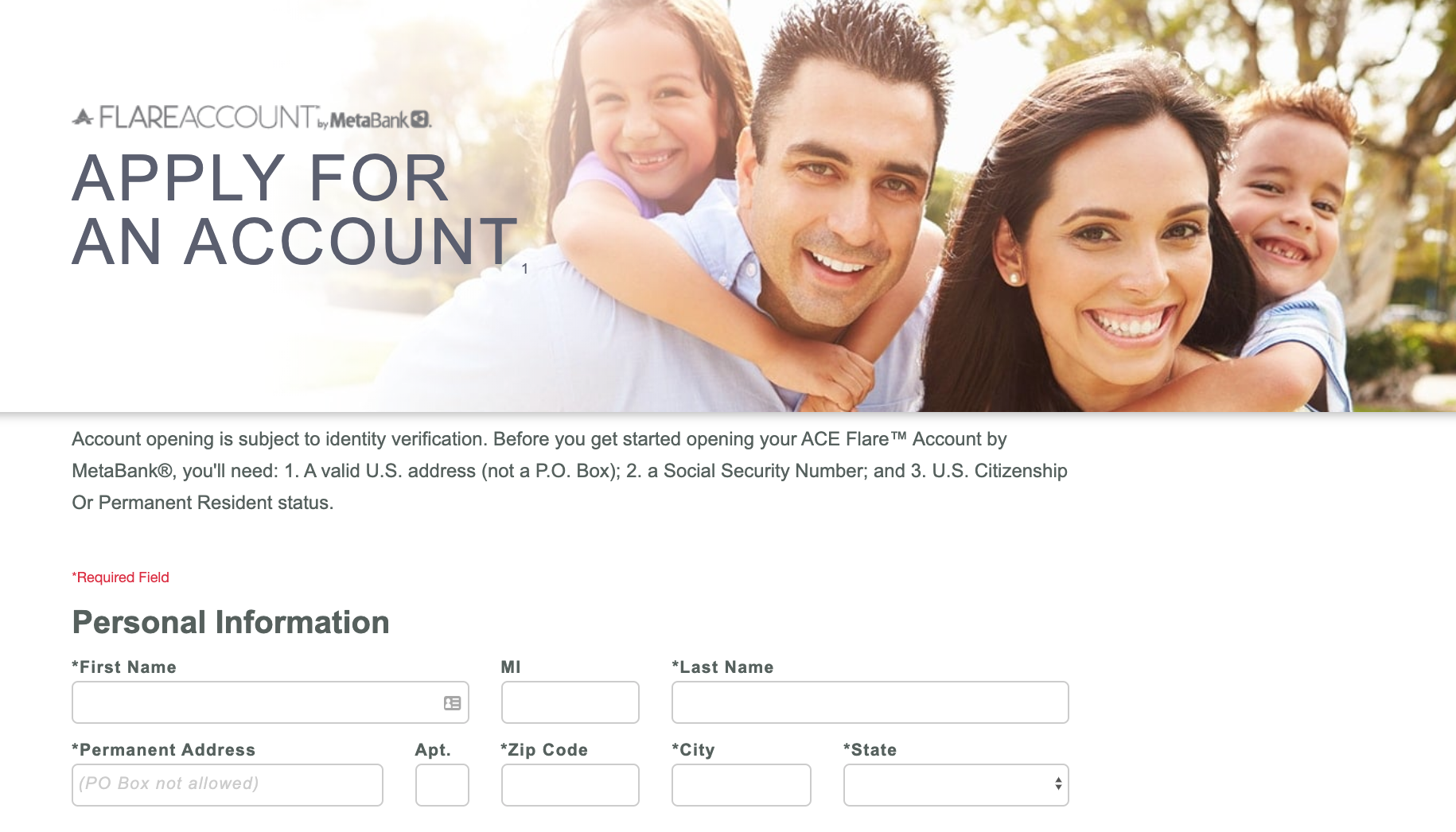

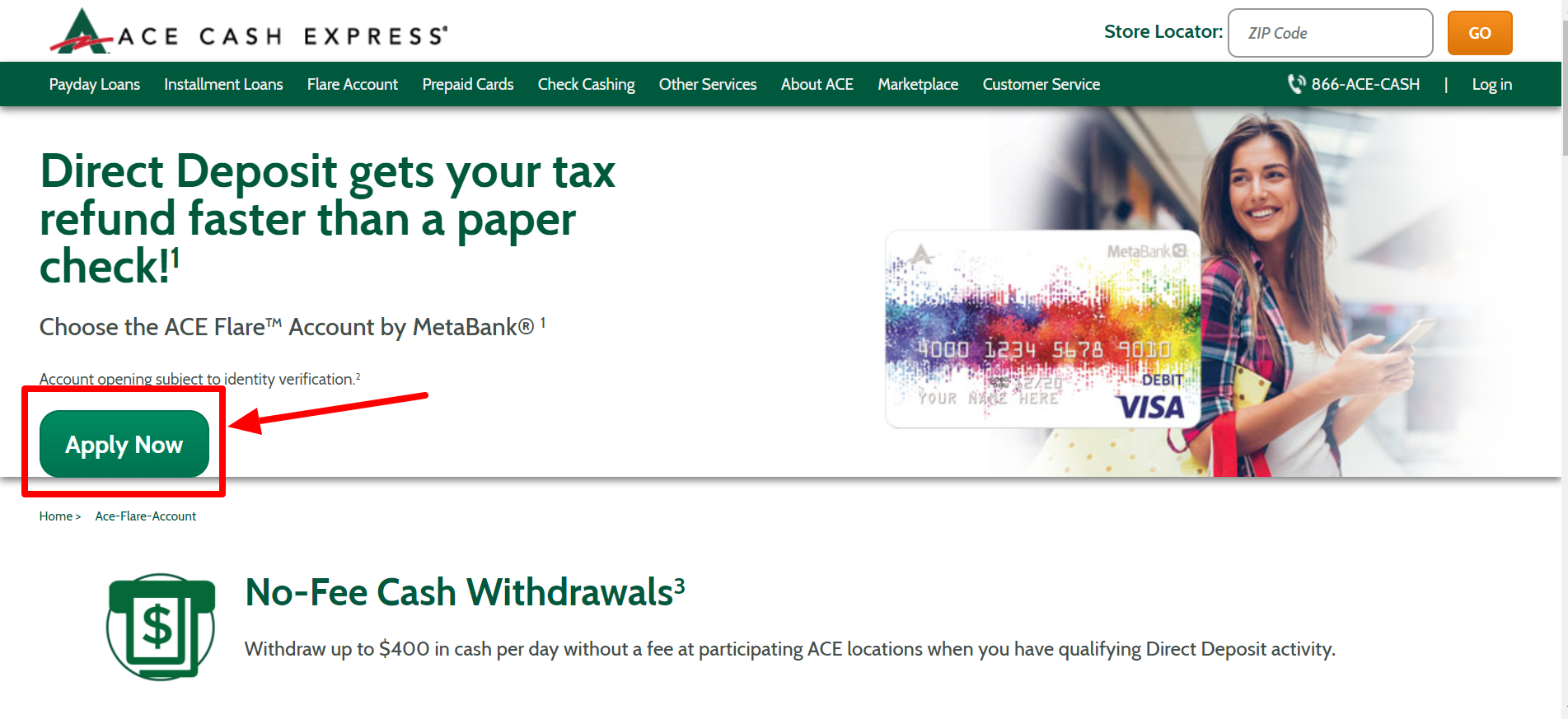

ACE Flare™ Account by MetaBank® is absolutely free to open online or via phone. But if you apply for the card at a retail location, it’ll cost you a $3 application fee. There’s also no minimum balance required to open the account.

There are two plans for ACE Flare™ Account by MetaBank®: The first plan is if no direct deposit is set up – which cost you $9.95 a month. The second plan is if you set up a total direct deposit of at least $500 each month – then your monthly fee drops to $5.

Here are some of the other notable fees for the ACE Flare™ Account by MetaBank® account:

- Direct deposit – $0.

- Domestic ATM cash withdrawal fee – $2.50.

- International ATM cash withdrawal fee – $4.95.

- Foreign transaction fee – 3%.

- Balance inquiry fee (domestic or international) – $1.00 (does not apply when checked on the mobile app, text, or email.)

- Over-the-counter withdrawal fee – $2.50.

- Stop payment fee – $0.

- Statement mailing fee – $5.95 per statement (note that you can get these free online as well.)

- Additional or replacement debit card – $3.95 per card (this goes to $4.95 if you request a custom card.)

- Account-to-account transfer fee – $0, if done online (it will cost you $4.95 if you’re using a customer service representative, though.)

Limits on deposits

One of the nice things about ACE Flare™ Account by MetaBank® is that there’s no deposit limit for any direct deposit from, say, your employer or an ACH transfer from your bank.

You will be limited on cash deposits, though the limits are quite high. By depositing cash through the Netspend Network, you can deposit up to $7,500 at once (and per day) and up to $15,000 every thirty days.

Again, for most people using this card as a spending account, that should more than suffice. You’re also able to deposit checks into your ACE Flare™ Account by MetaBank® account, but limits there will depend on the originating bank. ATM deposits are not allowed.

Overdraft coverage

You can add overdraft protection to your ACE Flare™ Account by MetaBank® account as an add-on service, assuming you meet the requirements.

ACE will charge you $20 for every transaction that brings your account into the negative by more than $10.

Thankfully, though, there’s a limit of five fees charged per month. But by signing up for overdraft protection, if you bring your account to even within a 24 hour period after overdrawing, the fees will be waived.

If you overdraw by less than $10, though, there’s no fee.

ACE Flare™ Account by MetaBank® features

No minimum balance requirement

One of the nice features on the ACE Flare™ Account by MetaBank® account is that there’s no minimum balance required to open or maintain the account. Now, that’s not to say you should let it sit idle, as you’ll be charged a monthly fee (see above).

You’ll earn a bit of interest

Let’s just be clear out of the gates, here. You’re not investing in a mutual fund, so the interest earned is very, very little. But the point is, you get SOMETHING.

Currently, ACE Flare™ Account by MetaBank® pays 0.01% APY on the pre-paid debit card. It’s not much, but you are able to earn more if you add-on the ACE Flare™ Account by MetaBank® Savings Account.

Solid ACE Flare™ Account by MetaBank® mobile app

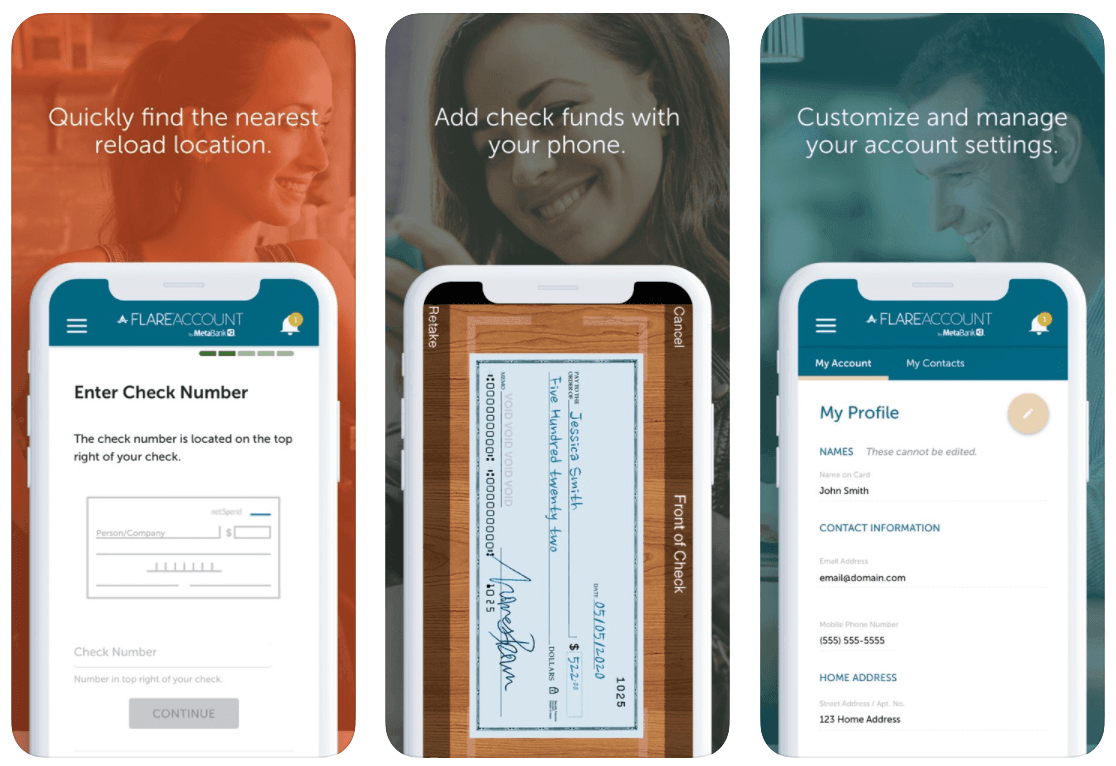

You can download the ACE Flare™ Account by MetaBank® mobile app for both iOS and Android. The app is pretty basic, but it gets the job done.

You’re able to send money to others, deposit checks, check your balance and purchase history, as well as access the Netspend Pre-Funded Check Service, which is optional.

Another feature I like with the app is the ability to get mobile text alerts for different happenings on my account.

Accessible customer support

You can reach ACE’s customer service through both phone and email. One of the issues I found, though, was that they didn’t list their particular hours of operation. So you’re kind of rolling the dice.

Electronic statements

You can access all of your account statements online, like any other traditional bank. Note, however, that if you don’t allow ACE to send you statements electronically, you’ll get paper statements in the mail. This will cost you $5.95 – so make sure you sign up for electronic statements right away.

ACE will only provide statements if a transaction occurred that month – otherwise you’ll get them quarterly.

My experience using ACE Flare™ Account by MetaBank®

The ACE Flare™ Account by MetaBank® website is incredibly simple to navigate, and applying for a card (identity verification purposes only) takes about three minutes.

One thing I love was the ability to select a card design, which adds a bit of flair to the card you’ll be using. It’s a small detail, but one that many credit card companies don’t offer.

The mobile app is pretty clean and modern-looking, too, which surprised me for a card focused on poor credit profiles. Typically, those sites look like they never left the nineties.

Who is ACE Flare™ Account by MetaBank® for?

Since it’s 2020, I don’t think I could really survive without a debit or credit card. I almost never carry cash anymore. And some places, like airlines and hotels, don’t typically accept cash as a form of payment.

So putting the card argument aside for a minute (since it’s just a smart financial move to have at least one), you’ll need to decide what type of card you want. With credit cards, you run the risk of racking up debt.

And other debit cards require you to have a checking account with it. Sometimes it’s just nice to have a card for spending (which also helps you manage your spending).

That’s where I think the ACE Flare™ Account by MetaBank® card comes in. There are no limits on the number of purchases you can make and you can also use it to transfer money and pay bills.

So with all of that being said, if you’re looking for a new card and don’t want to build up a bunch of debt, and you also want to manage your spending, the ACE Flare™ Account by MetaBank® might be for you. It’s one of the best prepaid debit cards I’ve seen.

Who shouldn’t use ACE Flare™ Account by MetaBank®?

If you’re not looking for a simple spending account or card, the ACE Flare™ Account by MetaBank® will be a disappointment. It doesn’t come with any fancy rewards and doesn’t earn very much in interest. While it’s a breeze to use, many customers may be looking for more from their cards.

And if you have excellent credit, this won’t be the card for you. ACE Flare™ Account by MetaBank® is meant for those with no to little credit who want help starting to build a credit report. Those with good and excellent credit will find more rewarding cards elsewhere.

Pros & cons

Pros

- $0 minimum to open — You’re able to open the ACE Flare™ Account by MetaBank® with no money. Yes, you’ll still need to pay the monthly charge for having the account (as I outlined above), but this at least gives you the choice of starting the account without having to fund it right this minute.

- Get paid early — You can have your paycheck deposited to your ACE Flare™ Account by MetaBank® up to two days early. This also works with government benefit checks.

- Free cash withdrawals — As I mentioned above, you can take out up to $400 each time you visit an ATM (maximum $1,000 per day) without paying a fee. Note that you have to set up direct deposit to get this perk.

- Overdraft protection — If you overdraft by less than $10, there’s no fee. Go over that and there’s a $20 fee, but you can bring your account back to zero within 24 hours and that’s waived.

Cons

- Expensive monthly fee — I think the fee is a bit high at $9.95. If you’re able to deposit at least $500 a month in total, it drops to $5 which is more manageable.

- You must enroll in overdraft protection manually — This is annoying, but you have to manually enroll in overdraft protection by calling ACE directly.

- Stringent direct deposit demands — Until you sign up for direct deposit, you’re unable to get the full benefits of the card, like free ATM withdrawals.

ACE Flare™ Account by MetaBank® vs. competitors

| Card | ATM withdrawal fee | Foreign transaction fee | Activation fee | Reload fee |

|---|---|---|---|---|

| ACE Flare™ Account by MetaBank® | $9.95, dropped to $5 if you deposit $500 via direct deposit | $2.50 | 3% | None |

| Green Dot Prepaid Mastercard® | $7.95 (waived over $1,000) | $2.50 | 3% | Up to $4.95 |

| PayPal Prepaid Mastercard® | $4.95 | $1.95 | 2.5% | Up to $3.95 |

Green Dot Prepaid Mastercard®

The Green Dot Prepaid Mastercard® is actually pretty solid. The monthly fee is $7.95, but that’s waived if you load at least $1,000 every month onto the card. You’ll pay up to $4.95 to load money onto it in a retail store like CVS, but you can just do this online for free.

There’s no fee-free ATM network, so you’ll pay at least $2.50 to withdraw cash. But, the card has features that others don’t – like the ability to write checks.

Overall, Green Dot has been around for a long time and this is a pretty solid card.

PayPal Prepaid MasterCard

The PayPal Prepaid Mastercard costs $4.95 per month and lets you make unlimited purchases. There’s no activation fee, you get free direct deposit, and you can transfer money to and from your PayPal account for free.

ATM fees are $1.95, which is a bargain if you ask me. There’s also a slightly lower foreign transaction fee – 2.95% – on the card.

Summary

Overall, ACE Flare™ Account by MetaBank® has a lot to offer. It’s easy to apply and get started, and as long as you’re setting up a direct deposit of at least $500 total each month, your fees will be low. Plus, you’ll have access to a nice looking app so you won’t have to deal with the wonky, 90s-looking website shown above.