Trusted by over 200,000 small businesses, a Novo Business Checking makes it easy for small business owners, startups, and freelancers to open and manage a free checking account dedicated to separate business expenses with no minimum balance requirements. Set up easily online, budget, deposit checks with your phone, transfer money and make electronic payments for things like marketing expenses all with the Novo app.

Our editorial team has been researching and publishing reviews on the top financial products you should know about since 2006. When evaluating banking solutions, like business checking accounts, we look at fees, relevant balance and account requirements, ATM access, transaction limits, additional features, and who these work best for vs alternatives (with your small business in mind).

Novo is an online business platform geared towards small business owners, startups, entrepreneurs, and freelancers. When you start your own business, you’ll quickly find that using your personal bank account can get overwhelming.

That's where Novo comes in with an easy to set up free checking account dedicated to separate business expenses.

- No monthly fees or balance requirements

- Unlimited fee-free transactions

- Smart Insights for your business

- No cash deposits (money order required)

What is Novo?

Novo is an online business banking platform with easy money management built for small businesses. Novo, among other funding and business solutions, provides an online-only business checking option for small businesses, startup founders, entrepreneurs and freelancers with no hidden fees. Novo advertises a team comprised of the brightest minds across tech to financial services with the goal to “change how businesses bank”.

A businesses checking account with Novo is straight-forward with no monthly fees or minimum balances to maintain, options to deposit and send checks, a debit card, and no transaction limits.

As we share in our review, if you’re business there’s much to be exciting about finally opening up a new checking account for your business with Novo.

Pros & cons

Pros

- Fee-free business checking — There are no monthly fees and no minimum balance requirement attached to your free account.

- Easy setup — Link up your other banks and easily transfer funds from your business to your personal accounts. Plus, there’s connections available to thousands of business apps.

- Unlimited transactions — There are no transaction limits so you can spend freely using your Novo debit card.

- Deposit & send checks — You can deposit and send checks right in th Novo app.

- Refunds ATM fees up to $7/month — ATM fees, local or international, will be refunded by Novo at the end of the month up to a total of $7.

Cons

- No direct cash deposits — If you’re regularly paid in a majority of cash, you’ll be better off choosing a bank with a local presence since would need to purchase a money order with Novo to ultimately deposit the cash.

- No recurring payments — You can not current set up recurring payments with Novo but add a list of payees so they’re saved for easier payments in the future.

How do you get started with Novo?

Once you click on the ‘Get Started’ button on Novo’s website, you’re invited to start your application. You don’t have to commit to completing the entire process today with an option to finish an application you’ve already started on this page.

Signing up

You’ll input a business email and password early on in the application process that you can use to get back in later.

Once you’ve input your business email and created a complex password, Novo will send a confirmation code to your business email address. You’ll need to input in this code within 60 minutes or it will time out and you’ll have to request another one.

It’s important to note that if your business is related to cryptocurrency, privately-owned ATMs, marijuana/cannabis, gambling, crowdfunding, or some money services, Novo will reject your application. There are also a few other types of businesses that currently can’t use the platform. You’ll get a warning about that before you proceed.

At this point, Novo will take you through the application process, gathering your financial and background information. This data will be used to determine whether you qualify for an account.

Link accounts and transfer funds

Once you’re approved for an account, you can link up your other bank accounts to easily transfer funds back and forth. You can also start accepting ACH payments, depositing checks and paying your bills using your new account.

Novo fees

There are no minimum balance or monthly fees with Novo. There no hidden fees.

You won’t, however, earn interest on the funds in your account. It’s meant to help you facilitate business transactions. I make sure I transfer any extra money I make over to my personal savings from time to time to earn at least a little interest on it.

You’ll enjoy mostly fee-free services with Novo. For instance, Novo no longer has Non-Sufficient Funds (NSF) fees. There are, however, some minor spare fees you might come across from Novo, like for Express ACH (up to $20) for faster payments from your account.

Tip

You can transfer 'extra money' over to a personal high-yield savings account from time to time so earn interest on the idling funds.

Features of Novo

As a freelancer, entrepreneur, or small business, you’ll get many benefits from using Novo, including:

Free from account fees

Even if you keep a $5 balance each month, you’ll never pay a monthly fee for your account with Novo or be subjected to a minimum balance requirement. That makes it perfect for freelancers and small business owners who simply need an extra account to keep finances separate.

You can transfer and add funds as needed with no minimum deposit, initial or otherwise.

» MORE: Best Banks for Small Businesses

Easy sign-up

Applying with Novo can take under 10 minutes. One barrier to setting up a more traditional business-specific checking account is the time and effort it takes to do so. Novo removes that obstacle, letting you easily sign up online for Novo.

You’ll go through the application process and with a good credit you’ll be approved.

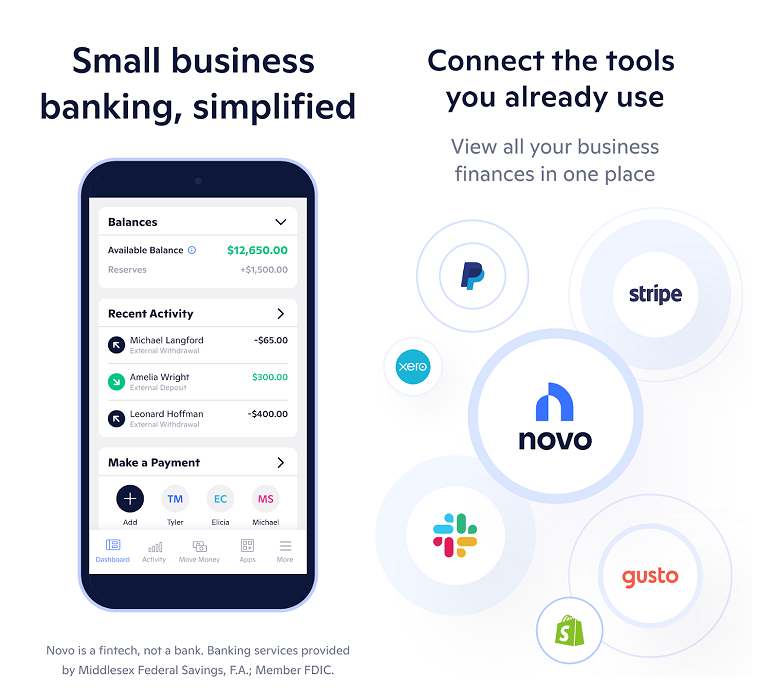

Integrations

Novo integrates with a number of apps and products, including Slack, Gusto, Freshbooks, Zoho, Xero, Zapier, Shopify, eBay, Etsy, Quickbooks, and Amazon. If you connect on Slack, for example, you’ll seamlessly get alerts on transfers, chargers and more directly on Slack so everyone on your team is in the know. With integrations, you can transfer funds and push updates to your communication channels.

I personally connect up to Xero so that at tax time, I can pull reports on my income and expenses for the year and take them to my tax preparer without manual exports and uploads.

Then there’s integrations for payment processing platforms, which include Cash App, PayPal, Venmo, Stripe, Square, and Wise (formerly TransferWise). With Novo Boost, you get Stripe payouts up to 95% faster, free of charge.

Easy transfers

Since Novo isn’t intended to be your sole checking account, it’s essential that you can easily transfer funds back and forth.

If you need $100 to pay a vendor, you’ll have to be able to move that money over from your personal account if you don’t have the funds available. But, most importantly, you can transfer money occasionally to your personal account, letting you eventually pay yourself a salary for the hard work you’re doing.

Free ACH transfers (outside of express), incoming wires, and the sending out of unlimited mailed checks are also easy transfer highlights of this business checking account.

Invoicing

Novo offers an invoicing product that comes included with your account. You can send unlimited free and professional invoices from the Novo app and have your customers pay you directly via integrated payments, like Stripe, Square, and/or Paypal.

These can be set as as recurring invoices so you’re not sitting there sending the same invoice over and over.

Smart insights

Novo provides automatic categorization and an overview of your business’ finances all in one place, providing you smart insights into your business.

Novo Reserves for budgeting

Novo Reserves within your business checking account let you slot in money for future expected expenses, like taxes. These can be set automatically by percentage if this is how you want to set aside your own salary from your business for future transfer. And if something changes, you can make payments directly from Reserves or Moving money in and out of these are instant. You can create up to 20 of these Novo Reserve accounts.

The actual balance shown of your account includes these Reserves since they’re not technically sub-accounts.

Debit card

Your debit card that comes alongside your business checking account is accepted worldwide and includes a number of protection features, like card lock and notifications. You’ll get a virtual debit card as soon as you make your first account deposit so you can start spending.

Novo does not charge ATM fees for your associated debit card and refunds ATM fees up to $7 a month incurred at months end.

Customer service

Novo advertises they feature expert customer service with a dedicated Novo team there to help with any questions or concerns you may have. This can be done via app, email, or mailing address. There’s also a help center if you have any common questions that can be answered with a quick answer.

» Open a Business Checking Account with Novo

My personal experience using Novo

I use apps to make everything else I do easier, so why not my business finances? Technology has made it easier than ever to start and run a business. If your business is a freelance venture, like mine, think of Novo as your business’s bookkeeper.

When you log in, you’ll get all your recent transactions in one place. I also get helpful tips like how much I’ve spent on purchases at a specific retailer this month (both through app and notifications). I also love that it tracks my average expenditures in certain areas and weighs current spending against it.

But my favorite feature is the Send Payment option. You’ll choose your payee from a list. If you manage a team, you can add them to ensure they show up on the list. You can also input your regular vendors. These aren’t recurring, but it’s nice to work from a designated list.

Once you’ve selected a payee, you’ll be prompted to input an amount and the type of transaction. ACH sends the money directly from your bank to the other party’s. However, you can also choose to wire the money, either domestically or internationally, at no additional cost to you. Novo also integrates with Wise, formerly TransferWise, if you prefer to send money to your international vendors using that app.

Everything can be done through my iPhone (same for you Android users), which makes it easy to manage my business on the go. That keeps me from being chained to a desk 40 hours a week, which is one of the biggest benefits of being a freelancer, or owning your own small business if that’s your mission.

User Novo reviews

Reviews for Novo from business owners are generally favorable. The Novo app for small business checking on Google Play for Android Apps is rated 4.5/5 stars on about 5,000 reviews while in the App Store for iOS it holds a notable 4.8 stars on over 13,000 reviews. On Trustpilot Novo holds an excellent 4.5/5 stars on over 4,000 reviews.

Who is Novo best for?

Businesses that pay freelancers

Paying freelancers brings its own challenges, whether you subcontract some of your work or you run your own business.

You can easily pay via ACH, or link up bank accounts to pay using your favorite payment app. You can even pay freelancers through Slack and other collaboration platforms that you integrate into your business checking account. And, if you’re working with the Novo app, you can include frequent freelancers on your list of payees for faster future payments.

Freelancers and small business owners

Novo is geared toward freelancers, as well as entrepreneurs who own small businesses or startups. There are plenty of options for large companies and too many options to count for personal consumers. This option is designed for those who fall in between those two extremes.

You’ll have an app to help you manage everything and the tools necessary to run your business without having to navigate an account wondering if that was a business or personal expense.

Tech-savvy consumers

Using an online-only platform means being comfortable using the apps that have become a part of the banking solution experience with most lenders today. However, with traditional banking, even with these apps and tools, you’ll have a local branch you can call or visit whenever you need that personal experience.

It’s important to make sure you’re comfortable using apps. Novo’s customer service is indeed human-backed if you need help, but your actual transactions on the regular will all be through the app.

Who is Novo not best for?

Those who don’t own businesses

Easy one here. Not only is Novo not ideal for personal accounts, you won’t even be approved unless you’re running a business. Weigh options for a personal checking account instead.

If you’re a freelancer, as long as you can demonstrate that you qualify as a sole proprietorship under the IRS definition, you’ll likely be good.

Paper check writers

Novo is set up to be electronic, making it not quite ideal for those who still maintain and want to continue to maintain a paper checkbook.

If you need to write a check and give it to a vendor, you’ll have to go through Novo to initiate the transaction and send them a check. Although it’s indeed convenient to have Novo manage those transactions for you, for frequent check writers that consider putting a pen to check as an integral part of their daily deals, it can become a nuisance.

Those who prefer brick-and-mortar banking

If you’re looking for a bank with a local branch, Novo won’t be the option for you. You may still be fine with Novo and do as I did — keep a personal account for features like withdrawing cash and speaking to loan officers.

Businesses with cash deposits

I’m never paid in cash, but some small businesses are, and that can be a problem with Novo. To be transparent, you can only deposit via Novo’s mobile app, which means cash isn’t an easy possibility. You can turn that cash into a money order and deposit it that way, but this extra step won’t be feasible if cash deposits are a regular occurrence for your business. No cash drop-off at the end of the business day here.

The competition

Freelancers and startup founders have a wide range of options for checking. Although Novo, in our opinion, ranks among the best business checking account options, there’s a number of competitors worth considering including LendingClub Bank, Lili, Bluevine, and Chase Business Complete Banking® just to name a few.

Here’s a quick comparison with some of these other top options.

Novo vs Lili

Lili is tailored toward freelancers, with solutions geared specifically to running a solo enterprise – featuring many simple and easy-to-use tax and expense management tools.

Lili is an all-in-one online banking solution for small business owners and freelancers. You’ll get all the tools you need to manage your expenses and for tax prep, as well as the debit card and fee-free ATM access.

Accounts are FDIC insured with no hidden fees on four plans to choose. Plus, the paid plans with Lili offer a high-yield savings account that earns a competitive interest rate.

- No minimum deposit or balance requirement

- Fee-free MoneyPass ATM network

- Early payment feature

- Expense management tools and tax prep

- No paper checkbooks

- Out-of-network ATM fees

- Some useful features require paid plans

With Lili, you’ll get business checking with no hidden fees or minimum balance requirements, so you can set the account up and use it as you need it. If you need cash, Lili lets you use more than 38,000 MoneyPass locations with free of charge ATMs with your fee-free Visa® business debit card. You can also deposit checks and transfer funds using the mobile app. Like Novo, Lili is an online-only banking option, so you can sign up directly on the website in just three minutes (they even timed it).

Lili also offers a number of paid monthly options if you just want a little more, like a Tax Bucket so you’re absolutely certain you have enough for your taxes, and even a notable 4.15% APY on savings account balances up to and including $100,000 so you don’t have to go through the hassle of transferring surplus funds to your personal savings.

» MORE: Freelancer? Compare Novo with our full Lili Business Checking review

Novo vs Chase Business Complete Banking®

If your business accepts credit cards, Chase Business Complete Banking® is a competitor we’d suggest you look into and consider.

Chase’s integrated payment processing means you don’t need a third-party vendor to accept credit cards, and their QuickAccept® feature makes it possible to get cash in your account the same day. You’ll pay 2.6% + 10 cents for in-person transactions using a provided mobile card reader (dip, swipe, tap, tap to pay) or 3.5% + 10 cents for manual transactions.

There is a monthly service charge of $15 with multiple ways to have it waived, one of which is a $2,000 min. daily balance during each statement period. You’ll also get unlimited debit card purchases and Chase ATM transactions, and Fraud Protection Services.

» MORE: Read our review of Chase Bank

Novo vs LendingClub Bank

LendingClub Bank offers both personal and business checking, with its business accounts targeted to small and midsize businesses. Like Novo, their business checking account will let you do all your banking online, making it easy to transfer money back and forth from your personal account.

One thing that sets LendingClub Bank apart is that its LendingClub Tailored Business Checking Account earns interest. The APY depends on your balance with only a minimal amount for any funds above $100K, but you’ll also earn unlimited cash back on qualified purchases post-eligibility made with your debit card which is a nice perk.

One thing that stood out to us we want to make sure to note is that if your account has less than $500 you will be charged a $10 monthly maintenance fee with this option.

Summary

Whether you’re a freelancer, a small business owner, or in a startup, free Novo Business Checking will help you separate your finances without extra stress. You can link you banks, integrate with business apps you’re likely already using, and manage everything in an easier fashion from your mobile device.

With Novo’s notifications and insight tools, you’ll have ongoing insight into how you’re spending money so that you can focus on ways to reduce expenses and keep more of your monthly income.

» Open a Novo Business Checking Account

Novo FAQs

Is Novo a real bank?

Novo is a fintech company; not a bank. It acts as a service provider with deposit account services are provided by Middlesex Federal Savings, F.A., Member FDIC. It serves as a online business banking platform.

Does Novo charge fees?

Novo accounts are completely free with no minimum balance requirements. Minor general fees in the fee schedule include outgoing Express ACH (max $20), insufficient funds charge ($27), and uncollected funds returned fee ($27).

Does Novo run your credit?

No; Novo will not check your credit history when you apply for an account with them. Your credit isn’t is not hurt or helped by holding an existing account with Novo.

What do you need to set up an account with Novo?

You’ll need to be at least 18 years old with personal identification (like a signed driver’s license or passport), a mobile phone based with a major US carrier, a SSN a US address to start your application. You’ll also need additional documents based on your business type and your state laws.

The actual application takes less than 10 minutes with Novo.