We think the Capital One Platinum Secured Credit Card is likely the best secured credit for someone looking to build credit for the first time or improve poor or damaged credit.

This card give you the flexibility of a credit line that goes up to $1,000. It also offers top digital financial tools and the power to check your credit standing as often as you’d like. Practical benefits, like travel assistance and mobile wallet compatibility, add to the appeal.

Capital One Platinum Secured Credit Card

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking to access your account from your desktop or smartphone, with Capital One's mobile app

| Annual Fee | Intro APR, Purchases | Intro APR, Balance Transfers | Regular APR | Credit Needed |

| $0 | N/A | N/A | 29.99% (Variable) |

|

Card overview

The Capital One Platinum Secured Credit Card is a solid and reliable secured card that can help you build your credit score and give you the lifeline of emergency credit. The Capital One Platinum Secured Credit Card stands out among other secured cards because it offers the chance to get a credit limit that’s bigger than your security deposit.

Key facts

- For people rebuilding credit: The Capital One Platinum Secured Credit Card is geared towards borrowers who need to rebuild their credit or build it from scratch. If you’ve been refused other credit cards in the last few months or your credit score is below 600, the Capital One Platinum Secured Credit Card is for you.

- No annual fee: There’s no annual fee, so you can use this credit card without worrying about an up-front annual cost.

- High APR: The interest rates on the Capital One Platinum Secured Credit Card are high at 29.99% (Variable), but the whole point of using this credit card is to pay off the balance in full each month and build credit. If you do that, the interest rates won’t bite. You’re likely to improve your credit score.

- Higher line of credit: The Capital One Platinum Secured Credit Card stands out from other secured cards because your credit limit can be automatically considered for a higher credit line in as little as six months without requiring you to add to your security deposit.

- Reports to the credit bureaus: Unlike a prepaid credit card, the Capital One Platinum Secured Credit Card is a credit card in every way. This means it reports to all three credit bureaus, so you can generally improve your credit score.

- No rewards: The Capital One Platinum Secured Credit Card isn’t out to woo borrowers with cash back and air miles. It’s a solid card that gives you access to credit and supports you in rebuilding your credit score.

- See Rates & Fees.

In-depth analysis

If you think that the Capital One Platinum Secured Credit Card could be right for you, but you need more details before you take the plunge, here’s an in-depth look at the most important features of this card.

Higher line of credit

It’s important to remember that the Capital One Platinum Secured Credit Card is not a prepaid card. Your security deposit is just that, a deposit that will be refunded when you close the card. You could get a $200 credit line for a $49 security deposit, depending on your financial situation. Capital One also offers a higher credit limit of up to $1,000 if you add to your security deposit. It’s rare to find a secured credit card that allows borrowers to start with such a high credit limit.

My daughter paid $200 and got the starter $200 credit line, but she took her responsibilities seriously. In as little as six months, Capital One raised her credit limit without making her add to her security deposit.

Rates and fees

First and foremost, there’s no annual fee. So if you pay off your balance in full each month, you can use this card without the cost of interest. The APR of 29.99% (Variable) is high, but that’s to be expected in exchange for a credit card for borrowers with low credit scores.

The Capital One Platinum Secured Credit Card is also great for use abroad, thanks to the zero foreign transaction fees. You can use it overseas like a regular credit card. All your purchases will be converted into dollars without extra charge, and you’ll be charged interest on them at the standard rate. See Rates & Fees.

Credit building tools

Capital One wants to help you build your credit so that you can move on to fun credit cards with plenty of perks and special offers, so they present a range of credit-building tools. The credit card reports to the three leading credit agencies so that your responsible credit card use quickly gets noticed.

Security and support

I’ve always been concerned about the risks of identity fraud and credit card theft, so I’m relieved to find a card that takes them as seriously as I do. Capital One Platinum Secured Credit Card is covered by $0 Fraud Liability that promises that you won’t have to pay anything if your card is lost or stolen.

Identity theft is also tackled head-on with Mastercard ID Theft Protection™. It is available to help should you become the victim of identity theft.

Travel benefit

If your card is lost or stolen, Capital One’s 24-hour global assistance line will help you cancel the card and send you a temporary card the next day if you’re in the U.S. or within two business days, no matter where you are in the world.

Digital banking

The Capital One Platinum Secured Credit Card is a card for the digital world. You can use the Capital One mobile banking app and digital wallet to track your spending anytime, anywhere. The mobile app shows your recent purchases, allows you to set up autopay to pay your bills on time, and gives you an overview of your financial circumstances.

With the digital wallet, you can take photos of your receipts, and the wallet will automatically link them to your recent purchases to help you stick to a budget. You can also lock and unlock your card through the digital wallet.

To help you stay on top of everything you must remember in today’s busy world, Capital One will also send you email or text alerts through the app to remind you to pay your bills. You can adjust your settings through the app, including choosing your payment date and method. It’s all at your fingertips.

Finally, the Capital One Platinum Secured Credit Card rides the cutting edge of contactless payments by incorporating Apple Pay. Apple Pay permits contactless payment in stores and fast, secure payment in apps and online.

Credit card benefits

Although you’re using a secured card, you will not get any lower level of service than unsecured card users. There’ll be nothing on your card to mark it as a secured card, so there’s no need for embarrassment.

Standard credit card benefits like Extended Warranty for eligible purchases are available, and you’ll find them extremely useful. These include doubling the original warranty up to 24 months to the standard manufacturer’s warranty on expensive smaller items such as appliances and jewelry worth up to $10,000.

Master RoadAssist® Roadside Service throughout the United States is also included. Capital One will send someone to rescue you if you break down, no matter where you are.

If they can’t get you started again, they’ll tow you to the nearest mechanic. There’s also MasterRental Coverage if you rent a car for up to 31 days using your Capital One Platinum Secured Credit Card. You’ll get coverage for collision, damage, and theft, potentially saving many dollars since car rental firms charge high rates for these levels of coverage.

Pros & Cons

Pros

- Low Fees — This card has no annual fee (See Rates & Fees.).

- You Don’t Need Perfect Credit — This is a great card for rebuilding your credit.

Cons

- Small Credit Limit — You will likely receive a low initial line of credit.

- Costly Interest Charges — This card has a high standard interest rate.

Should you get the Capital One Platinum Secured credit card?

The answer to this question will be different for everyone, according to their personal financial situation. But, I think anyone who wants to build their credit or adjust to good credit card habits should turn to this credit card first.

The lower credit limits and credit tools help anyone who needs to rebuild credit, as well as students and graduates who are on their first credit card after being authorized users on their parents’ cards. Anyone learning responsible financial habits and budget balancers will also benefit from the account reminders, auto-pay, and spending tracking features.

With digital banking and NFC payment features, it’s cutting-edge and responsible. At the same time, security-conscious users will be reassured by the anti-fraud and identity theft measures that are built in.

If you have an excellent credit score and want top cash back or travel rewards, this isn’t the card for you. But if you have a poor credit rating and want a solid, reliable card to boost your credit score while reassuring you of an emergency credit card, this should be your first call.

When to consider a different card

The Capital One Secured Credit Card is a great way to start building your credit score if you have poor credit or no credit.

However, there are situations where it’s worth considering alternative cards instead. Here are a few of them:

If you have a fair credit score (600+)

Unless you have poor credit, there’s really no reason to use a card that requires a security deposit. It would unnecessarily tie up money you could use for something else.

If you have a credit score of 600 or higher, consider the unsecured version of the Capital One Platinum Credit Card card instead. Only a fair or average credit score is required for approval for this card.

Like the Capital One Platinum Secured card, there are no annual or foreign transaction fees in the unsecured version. You’ll be automatically considered for a higher credit limit in as little as six months (See Rates & Fees.).

The unsecured Capital One Platinum is a great way to continue building your credit score without requiring a deposit. That makes it ideal for people who have been denied credit in the past, don’t have much experience with borrowing, or just want to start with a lower credit limit.

It’s a great next step after the Capital One Platinum Secured card.

If you’re looking for a better rewards program

If you’re willing to pay a modest annual fee of $39, the Capital One QuicksilverOne Cash Rewards Credit Card might be a better option than the Capital One Platinum Secured card (See Rates & Fees.).

This card offers an unlimited 1.5% cash back on all purchases. So as long as you’re charging at least $2,600 per year to your card, you’ll break even on the annual fee. And any amount you spend beyond that is practically free money.

For example, if you buy $50 worth of groceries per week using your Capital One QuicksilverOne Cash Rewards card and immediately pay it off, that’d cover your annual fee.

A flat 1.5% back on everything means there’s no need to worry about rotating categories or monthly limits on how much you can earn.

A credit score of 600+ is also required to qualify for the Capital One QuicksilverOne Cash Rewards card.

If you’re looking for a lower APR

All the cards I’ve discussed here feature a high APR. If you don’t plan to pay your credit card balance off in full each month, you’ll want a card with a lower APR.

The Chase Freedom Unlimited® card is a great choice in this regard.

It offers an introductory offer of 0% Intro APR on Purchases for 15 months and 0% Intro APR on Balance Transfers for 15 months. Then, you’ll pay an APR of 20.49% - 29.24% Variable, depending on your creditworthiness.

There’s no annual fee for the Chase Freedom Unlimited® card, and you’ll earn an unlimited 1.5% cash back on all purchases.

This card also comes with an introductory offer that allows you to earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That's 6.5% on travel purchased through Chase Travel, 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases

After your first year or $20,000 spent, any travel purchased through the Chase Travel℠ comes with a whopping 5% cash back.

The main downside is that the Chase Freedom Unlimited® card requires a good to excellent credit score — 700 or higher.

How to apply for the Capital One Platinum Secured card

If you’ve decided that the Capital One Platinum Secured card is the right choice for you, here’s how to apply:

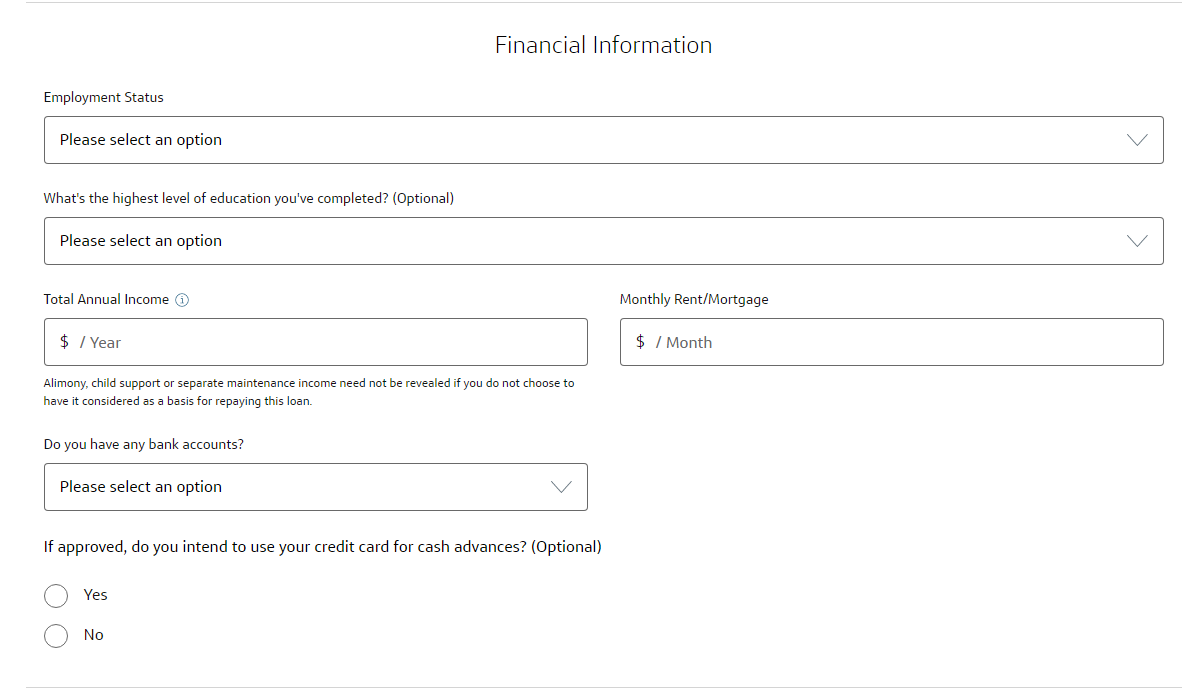

Before you start, you’ll want to gather some basic information. The application will ask for your Social Security Number, annual income, and monthly rent costs. So you’ll want to have this information on hand to complete the process in one sitting easily.

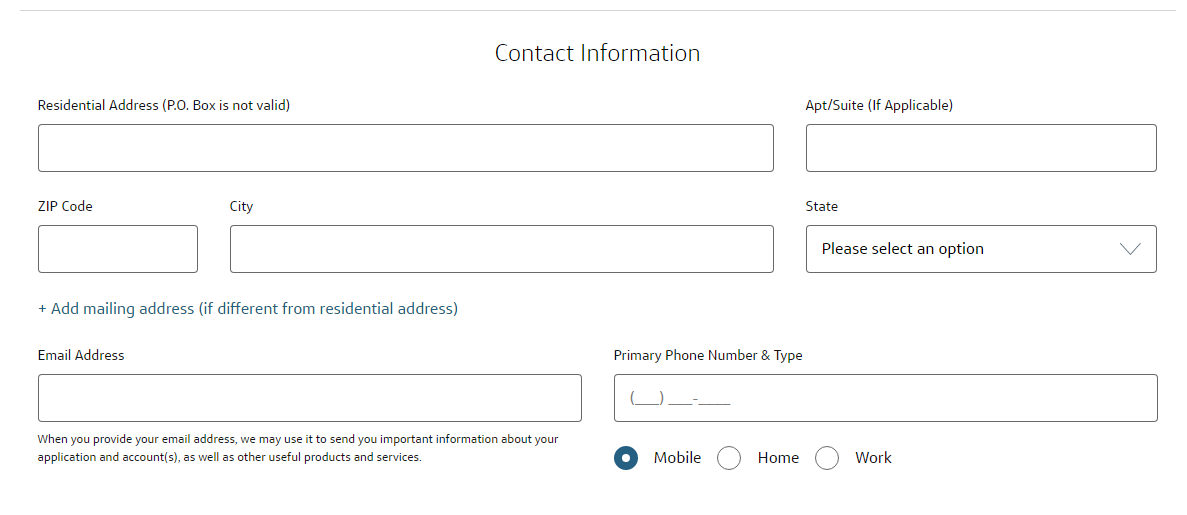

Enter your name, date of birth, tax ID, and citizenship status.

Next, you’ll need to enter your contact information. This includes your complete mailing address, email address, and phone number.

Lastly, the application will ask you for information on your financial status, highest level of education, total annual income, monthly rent/mortgage, and bank accounts.

You can choose to receive paperless communications and statements and whether you prefer to receive communications in English or Spanish.

Then, you’ll be ready to submit your application and wait to see if you’ve been approved.

Summary

If you have a poor credit rating or no credit, the Capital One Platinum Secured Credit Card is a solid and reliable way to improve your credit score.

This card requires a deposit and doesn’t offer any rewards or benefits. But it gives you access to a credit line of up to $1,000 with no annual fee and minimum income requirement. That makes it accessible to nearly anyone (See Rates & Fees.).

The Capital One Platinum Secured card is a great tool for someone looking to rebuild their credit quickly.