As an investor, you want to diversify your portfolio with a variety of assets and maybe even explore asset classes not tied closely to the stock market. Commercial real estate or CRE can be an exciting opportunity to be a part of. But what if you don’t want to, or can’t, purchase a property on your own? Or deal with managing it after purchase?

And these aren’t even close to the only problems that come with real estate investing. Finding viable properties with promising returns, reaching out to developers, and researching locations for property data and trends are other realities of CRE investing on your own.

This is where platforms like CrowdStreet come in. CrowdStreet is a real estate crowdfunding platform for high-net-worth, accredited investors looking to take advantage of passive real estate investing. In this CrowdStreet review, find out who can invest with this company, who should invest with this company, and everything you need to know to get started.

CrowdStreet is a commercial real estate investment platform only for accredited investors that provides a pathway to invest directly in real estate projects from some of the nation's top project sponsors and developers.

- High rates of return advertised

- Variety of investor resources

- Diversified Funds and tailored portfolios

- High minimum initial investments

- Only for accredited investors

What is CrowdStreet?

Founded in 2014 in Portland, OR, CrowdStreet connects accredited investors to pre-screened commercial real estate investment opportunities. This platform uses real estate crowdfunding to allow investors to add real estate to their portfolios without needing to purchase entire properties on their own or manage the properties themselves.

With crowdfunding, CrowdStreet investors pool their investments to purchase real estate and split the earnings. They can choose from curated projects or even pay for advisory services to receive personalized portfolio recommendations.

CrowdStreet is an intermediary, not a special purpose vehicle (SPV). This means that CrowdStreet investors work directly with sponsors instead of through CrowdStreet. This is a big deal because SPVs can cause communication issues or delayed funding, in addition to eating significantly into your returns. CrowdStreet gives you the freedom to manage your own relationship with your project sponsor.

Since its founding, CrowdStreet has funded 709 projects and sold a total of 153. For these deals, there was an average hold period of three years, an internal rate of return of 18.8%, and an average equity multiple of 1.55x.

So how does CrowdStreet identify good opportunities? Its sponsor vetting process is rigorous, to say the least, including background checks, reference checks, and more. Only 5% of deals make the cut and qualify for CrowdStreet. CrowdStreet is strictly commercial-only, so you won’t see any residential or fixer-upper projects.

Pros & cons

Pros

- Superior technology — CrowdStreet.com is superbly designed and optimized. New and seasoned investors alike will find all of the information they need on each deal.

- High returns — As of December 2022, CrowdStreet boasts an average equity multiple of 1.55x and an internal rate of return of 18.8%.

- Investor resources — CrowdStreet provides a variety of ways for investors to learn more about real estate investing and ask questions including an Investor Relations team, articles on CRE topics, and educational videos.

Cons

- High minimum investments — The average minimum buy-in for a CrowdStreet deal is around $25,000. Even for accredited investors, that might be a tough pill to swallow.

- Only available to accredited investors — Non-accredited investors won’t be able to invest in real estate with CrowdStreet.

- Low liquidity and long hold periods — The average hold period for deals is between two and six years but some may be longer than 10 years. Investors can’t sell their shares before the hold period is up, so their money will be tied up.

- Fees — You may charge up to 2% to CrowdStreet for asset management and between 1% and 5% to sponsors for various project stages and milestones.

How does investing with CrowdStreet work?

Getting started with CrowdStreet is quick and easy, and this simplicity carries over to the day-to-day user experience as well.

Here’s how to start investing with CrowdStreet.

Creating your account

You can begin investing with CrowdStreet in three steps:

- Create an account

- Complete your investor profile

- Browse deals and invest

You can even start browsing available deals before funding an account by creating a profile with your email.

To be eligible to start investing in real estate with CrowdStreet, you must be an accredited investor and you’ll need to confirm this when setting up your account.

Accredited investors are persons, entities, or funds that meet certain requirements for net worth that serve to demonstrate a higher risk tolerance. The SEC created accreditation to protect less wealthy and experienced investors from taking on too much risk.

To qualify for SEC accreditation, you’ll need to meet at least one of these income requirements:

- Have an individual net worth, or joint net worth with a spouse, of at least $1 million (not counting the value of your house)

- Earn an individual gross income of at least $200,000 or $300,000 with a significant other with no reason to believe you’ll earn less next year

- Invest on behalf of a business or investment company in more than $5 million in assets with only accredited equity owners

- Hold a Series 7, Series 82, or Series 65 license

If you don’t meet any of these criteria, you may not qualify for accreditation and this can limit your investment opportunities in commercial real estate. Again, only accredited investors can access CrowdStreet’s marketplace of commercial real estate investment projects.

Read more: Best real estate crowdfunding sites for non-accredited investors

Investment options

There are three different ways to invest with CrowdStreet. These are:

Individual Deals – Work directly with sponsors to invest in properties you choose yourself (from a list of options provided by CrowdStreet). You are not responsible for closing these purchases or selling the properties as these are still crowdfunded through the platform.

Diversified Funds – Invest in a fund containing multiple properties with different benefits and profiles.

Tailored Portfolio – Work with CrowdStreet experts to put together a personalized portfolio of investments designed to help you meet your goals.

If you want a more hands-on approach, you might prefer to find individual deals and invest in the ones that seem most promising to you. But if you want to stay as hands-off as possible while still taking advantage of the benefits of real estate investing (such as portfolio diversification, the potential for high returns, etc.), you might choose funds or tailored portfolios.

CrowdStreet assigns different profiles to different types of investments according to how much risk they present investors, how much cash flow they’re generating, and how much profit they may offer over time. These categories are:

- Core Deals – Least risk, steady cash flow on fully-occupied properties

- Core-Plus Deals – Low risk, mostly-occupied properties requiring some capital for improvements

- Value-Add Deals – Moderate risk, promising properties requiring dramatic changes with the potential for significant returns

- Opportunistic Deals – Most risk, properties in development that will not initially generate cash for investors but may present the highest returns over time

The payment structure is different for every property and usually depends on existing cash flow. If a property is already generating revenue, investors may start getting paid as soon as the deal is closed, which is ideal for those wanting passive income. But if a property is not yet generating cash flow and requires construction and improvements, it might be a while before investors start getting paid. Sponsors decide how and when to distribute payouts.

Any time you’re ready to invest in a new property or fund, you’ll submit an offer. In your offer, you’ll say how much you’re willing to invest and which properties you’re interested in. CrowdStreet will then either approve or decline your offer and, if approved, you’ll be able to transfer the funds.

Finding deals

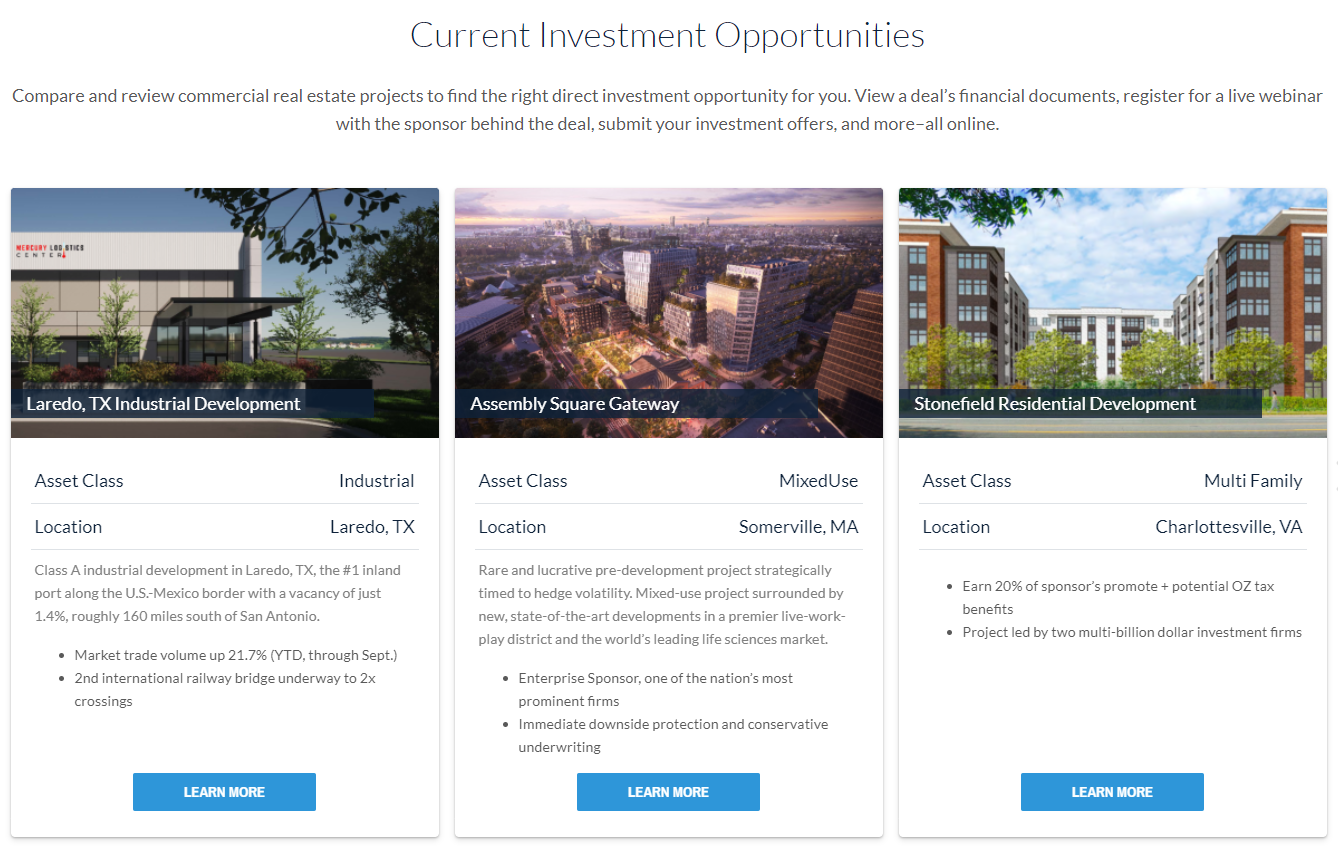

The Marketplace shows all commercial real estate opportunities currently available to CrowdStreet investors.

As you can see, each investment overview includes the asset class for the property and information about the return structure and potential benefits for investors. For example, if it’s a co-investment, if there are any perks like tax benefits or downside protection, and any unique location features that might make a property more appealing.

If you want to dig more into the details of a deal, you can select “Learn More” or “View Details” depending on which page you’re coming from. Then, you’ll get the following information:

- Photo and video

- Minimum investments and targeted investment periods

- Business plans

- Property type

- Investment profile (e.g. opportunistic)

- Live webinar invites and recordings

- Essential documents

- Site plan, unit plans, amenities, etc

- Sponsor info with track records

- Q&A forms

- And more

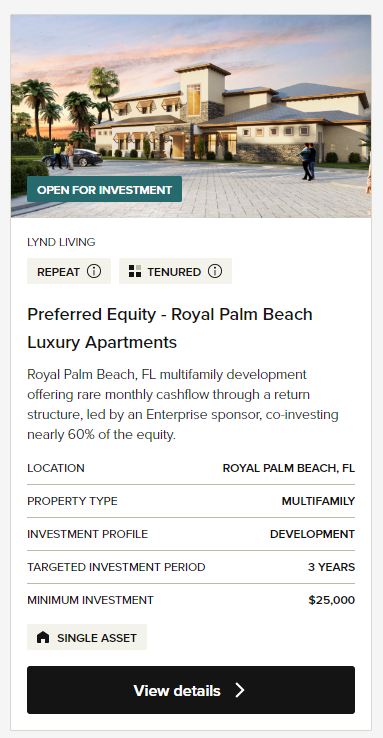

Here’s an example of what a deal card looks like.

In short, CrowdStreet organizes an astonishing level of information for each deal it posts in a crisp and clean manner.

CrowdStreet has made investing in commercial real estate astonishingly simple. The site is robust and easy to use, and there is little to no learning curve even for those brand new to real estate investing.

Managing your investments

Once you’ve invested in a property or fund, you own direct equity in real estate. You can see how each investment is performing from your account dashboard and access any documents you may need for tax purposes. You are never responsible for managing or selling properties you’re invested in.

How much does CrowdStreet cost?

It’s free to create a CrowdStreet account but you may pay asset management fees depending on which services you choose. CrowdStreet charges a 1% to 2% annual fee for asset management by CrowdStreet Advisors in Tailored Portfolios and funds.

Sponsors can also charge different fees at different stages of a deal, usually as a percentage of the cost of a project or development and as an ongoing or one-time charge. They may charge some or all of the following:

- Acquisition or disposition fees – One-time transaction fees charged as a percentage of purchase price to offset finding and brokering costs, usually around 2%.

- Property management fees – Ongoing fees for day-to-day operations charged monthly as a percentage of gross revenue, usually between 3% and 4%

- Construction management fees – One-time fee charged as a percentage of construction costs for renovations and design planning, usually around 5%

- Development fees – One-time fee charged as a percentage of costs associated with pre-construction testing and hiring, usually between 3% and 5%

- Asset management fees – Ongoing fees for investment management charged monthly or quarterly as a percentage of equity or gross revenue, usually between 1% and 2%

Sponsors must disclose any fees they charge on the details page of an offer.

Features and benefits

Compared to other real estate investing platforms, these are some of the features that make CrowdStreet stand out.

Commercial real estate investments

With CrowdStreet, you can invest in a variety of projects in the commercial real estate market, including office buildings, retail centers, and multifamily properties. CrowdStreet makes it easy to diversify your commercial real estate portfolio and access a variety of investment opportunities whether that’s properties already earning cash revenue or those with high potential to turn significant profits.

Connect directly with sponsors

CrowdStreet is not a specialty purpose vehicle (SPV) or investment middleman. You get to work directly with sponsors for a smoother, faster, and often more profitable process. Other platforms may require you to work through them to make offers.

Selective screening

CrowdStreet does not offer residential or fix-and-flip opportunities. They eliminate 95% of their developer applications through a thorough screening process including reference and background checks. This means you can trust that sponsors have been vetted.

Not every deal will be right for you, but CrowdStreet chooses only quality deals and is transparent about offers.

Marketplace

The CrowdStreet makes it easy to find deals and read about them with the Marketplace. And if you ever want to ask about a property, you can call the investor relations team for help.

Funds investing

If you’re interested in diversifying your portfolio with commercial real estate with as little commitment on your part as possible, you might be interested in CrowdStreet funds. CrowdStreet offers managed funds containing more than one property curated to serve different purposes. For example, some are sponsor-backed and take advantage of an individual sponsor’s specialties while others may focus on a particular location or asset class.

The option to invest in funds instead of individual deals also allows you to spread the same minimum of $25,000 usually required for just one project across multiple investments to stretch your capital further.

Who is CrowdStreet ideal for?

CrowdStreet is best for people interested in a passive, hands-off approach to real estate investing who are willing (and able) to pay for quality and authority. Here are some investors most likely to benefit from using CrowdStreet.

High-net-worth and accredited investors

CrowdStreet isn’t the most accessible real estate investing platform. In fact, it’s designed to be exclusive and does not hide this fact. And a peek at their featured offerings reveals that they want clients who can make illiquid investments of five-plus years.

CrowdStreet’s ideal client is an accredited investor who can invest at least $25,000 into a commercial real estate deal and forget about it for at least five years.

If that doesn’t sound like you, it doesn’t mean you won’t like CrowdStreet or make a profit using it, but it might not be a good fit.

CRE newbies

Commercial real estate investing platforms like CrowdStreet make real estate investing less intimidating for newbies while also lowering potential barriers to entry. Although the cost to start is still high, it’s lower than it would be if you were to purchase a property on your own.

By pooling together capital from a large number of investors for a single real estate investment, crowdfunded real estate platforms finance projects that would otherwise be out of reach for individual investors. Furthermore, they do the work of scouting deals and sponsors for you.

By investing in commercial real estate through a platform like CrowdStreet, investors new to CRE investing can avoid many of the traditional hassles and headaches like property management and lease negotiation.

People who want direct exposure to real estate companies

For real estate investors who want direct exposure to real estate professionals, Crowdstreet is a great platform. Whether you’re interested in office buildings, shopping centers, apartments, or storage units, you’ll be able to communicate directly with sponsors.

And because it’s an online marketplace, it’s easy to find and compare deals.

Who is CrowdStreet not ideal for?

Crowdstreet is an exclusive platform that’s not for everyone by its very design. More specifically, it isn’t the right real estate investing platform for the following investors.

Short-term investors

CrowdStreet’s average Target Investment Period (TIP) is usually three to five years but may go up to 10. There are deals with TIPs as short as two years, but these deals might not provide the high returns of a longer-term CRE investment. If you’re looking for quick in-and-out so you can reinvest elsewhere, CrowdStreet (and CRE in general) might not be for you.

Low-net-worth investors

The minimum buy-in amount for a deal on CrowdStreet’s platform is $25,000. If you want to start investing in real estate with less than this, you’ll have to choose a different platform or approach.

Those who need advisory services

CrowdStreet does not provide true investment advising.

Keep in mind that registered investment advisors are required by law to act in their client’s best interests. This fiduciary duty ensures that registered investment advisors will always put their client’s interests first when making investment decisions. Additionally, registered investment advisors are required to have a deep understanding of their client’s financial goals and needs before recommending any investments.

By contrast, CrowdStreet does not require its users to undergo any sort of financial assessment before investing. As a result, CrowdStreet investors may end up investing in projects that are not suited to their needs or goals.

CrowdStreet reviews

On consumer review platforms, CrowdStreet does pretty well for itself. Users celebrate the platform’s intuitive and simple functionality and investor dashboard. Most notably, they report feeling confident about their investments because they trust CrowdStreet’s vetting process.

On the other hand, many users reported the same two frustrations. First, the time window for investing in the best deals seems to be shortening as the platform grows more popular. Some deals are fully funded almost immediately after opening, and this problem is likely to get worse the more investors join CrowdStreet. For best results, you have to be willing to wait for a good deal sometimes and act quickly when you find one you’re interested in to ensure you get a spot on the list.

Another criticism was lack of communication and updates after a deal is closed. Many users report feeling frustrated that they don’t hear back from CrowdStreet much after closing a deal and wish they’d receive regular check-ins from the team. Similarly, response times are a common theme in reviews with several users complaining about waiting up to five days to hear back from support.

The competition

CrowdStreet is ideal for accredited investors with a significant amount of money they’re willing to part with for several years. Let’s talk about how CrowdStreet compares to competitors with different benefits and requirements.

CrowdStreet vs Fundrise

Fundrise is a popular real estate investing platform known for accessibility. This option is ideal for non-accredited investors and those with less to invest.

Fundrise is an online crowdfunding real estate investment platform that allows you to invest in both residential and private commercial properties. The cool thing about Fundrise is that anyone can invest. It’s not just for wealthy investors.

- Open to all investors

- Low investment minimum

- Simple and easy to get started

- Not a short-term investment

- Variety of fees may be difficult to understand

Fundrise requires a minimum investment of just $10 for Fundrise Pro and charges lower fees than CrowdStreet with an annual advisory fee of 0.15% and management fee of 0.85%. You do not need to be accredited to get started. Fundrise shows both commercial and residential properties

Fundrise investments are still illiquid, so this is only a good fit for long-term investing of at least five years. But overall, Fundrise requires less of a commitment because you don’t need as much capital to get started. If you have less to invest and/or you’re not accredited, choose Fundrise over CrowdStreet.

CrowdStreet vs Roofstock

Roofstock is another real estate investing platform with higher minimums than Fundrise. You can get started with as little as $5,000, and unlike CrowdStreet, you don’t need to be accredited to invest.

Roofstock specializes in single-family rental properties rather than commercial real estate and only chooses listings with tenants already living in them. This platform also offers curated portfolios for greater diversification with less effort.

If you’re accredited but don’t have as much money to invest right now, you might want to choose Roofstock so you don’t have to wait to raise the funds. But if you’d rather invest in CRE, you’ll need to pick CrowdStreet.

CrowdStreet vs RealtyMogul

Another competitor that’s friendlier to non-accredited investors, RealtyMogul offers a selection of real estate investment trusts (REITs) and individual real estate projects.

REITs can sometimes deliver higher yields and more regular cash payouts than single-sponsor deals but do present a fair amount of risk. To mitigate their illiquidity and higher risk, RealtyMogul may offer a buyback program where they’ll buy back your investment at a small loss.

The investment minimum for REITs is $5,000 but for individual properties is anywhere from $25,000 to $50,000. Management fees are comparable between RealtyMogul and CrowdStreet and you can expect to pay around 1% annually. If you’re looking to invest specifically in REITs, RealtyMogul is your best bet. Otherwise, CrowdStreet and RealtyMogul are closely matched.

Summary

CrowdStreet is a well-designed platform that simplifies the process of commercial real estate investing for people looking to branch out into real estate and diversify their portfolios – that is, people who can afford it. The high investment minimum and accreditation requirements will automatically rule out a lot of potential investors, and you need to be willing to wait at least a handful of years for your investment to grow.

But if you do qualify, the timeline works for you, and you’re comfortable with the general risks of CRE investing, CrowdStreet gives you access to high-quality deals targeting a variety of different growth strategies and a platform that’s tough to beat (and easy to use).