With student loan debt affecting Millennials across the United States, one of the most common questions I get is: “should I save or pay off student loans?” My answer is usually that it depends. Each individual will need to take a slightly different path in order to pay off their debt, while still meeting important financial goals.

So, if you are stuck at a fork in the road and are unsure of which direction to choose, let me help you figure it out. I’ll even explain what I would do if I was tackling this decision myself.

Prioritizing your financial goals

Although it can be daunting to start out with a lot of education debt, you may want to resist the urge to repay those student loans as fast as possible.

Earlier, I outlined a roadmap to financial success that provides six steps you can follow to prioritize your financial goals. This post follows up with a real-life case study in which I apply these steps (and go a little further). It’s in response to an excellent question from reader Kaitlyn:

“Should I focus on building up my emergency fund and just pay what is due on my student loans until my emergency fund is where it needs to be, or build my emergency fund at a slower rate and go full force at my loans?”

In Kaitlyn’s case, she used her student loan six-month grace period to save an emergency fund equal to six months’ expenses. (Nice work). She had planned to make bi-weekly payments on her student loans of up to twice the scheduled minimum payments, but then her situation changed. Kaitlyn moved to take a new job. It paid more, but required moving to a more expensive city. Says Kaitlyn:

“I now make a lot more money but have higher expenses than I previously had (higher rent, higher car insurance, higher amount to put in savings, not on my family’s insurance anymore, higher retirement contributions, etc.). I don’t have the cushy window before my loans kicked in.”

So her savings will no longer cover six months’ expenses and, presumably, smaller fluctuations in expenses may impact her more because she has less wiggle room in her monthly budget.

Let’s look at where she falls in the seven steps:

- Build a Bank Account Buffer™. Kaitlyn has an ample emergency fund (at least for her prior expense level), so she’s obviously all set here.

- Invest a token amount for retirement. Retirement savings is something that didn’t come up in her question, but if she’s not contributing at least a little bit towards retirement I recommend starting.

- Get rid of bad debt. In my steps, I define bad debt as “credit cards, personal loans, and anything with an interest rate of more than 7%”. So that sometimes includes student loans. Hence my advice to Kaitlyn: Pay off any loans that have rates above 7%, otherwise move on…

- Save for emergencies AND start a Roth IRA. A Roth IRA is the perfect complement to an emergency fund because – if you ever face a true emergency – you can withdraw the principal from a Roth penalty-free.

- Save for life.

- Invest and donate as you see fit.

- Create an additional stream of income.

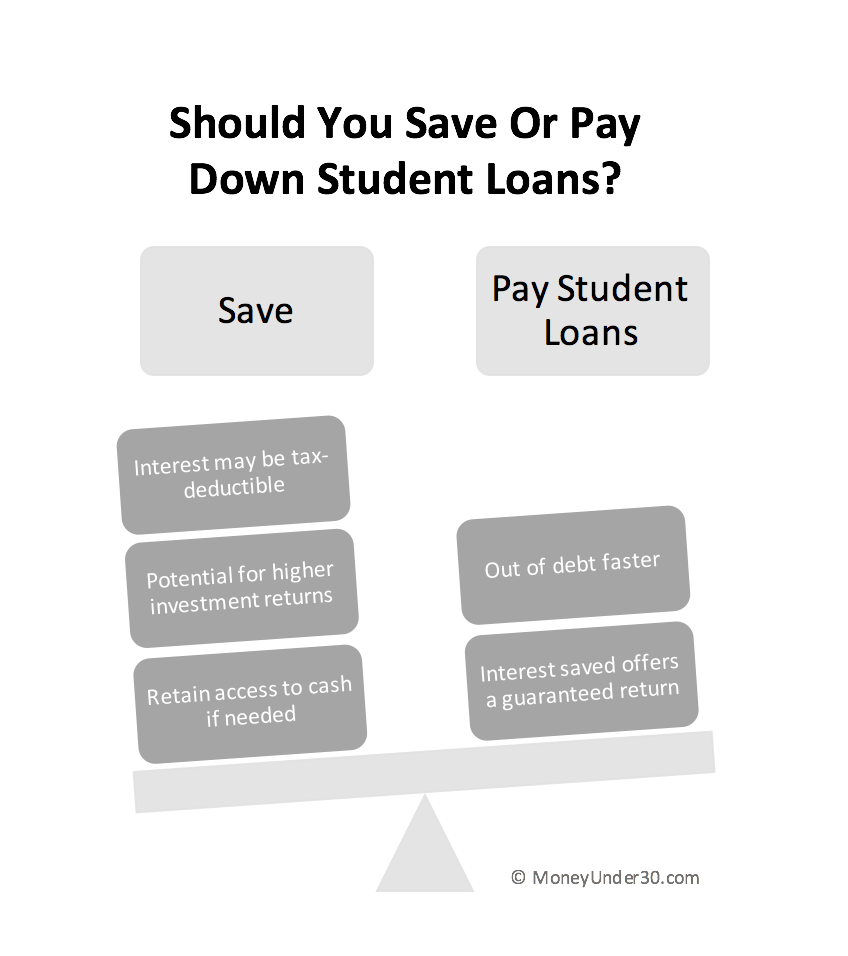

Although I didn’t make it explicit in the above steps, paying so-called “good debt” like mortgages and, in many cases, student loans, would fall under step six. Debt, including student loans, is essentially negative savings. By paying it down, you are investing in your financial future just as much as you are when you put money in stocks and bonds.

What would I do?

In Kaitlyn’s case, I might pay off student loans with interest rates of 7% or more, build-out savings for both retirement and other shorter-term “life goals”, and then focus on wiping out the student loans.

Following my steps, I would first ensure I had a small cash bank account buffer™ and were saving a small amount for retirement. Then I would pay down any student loans with interest rates of 7% or more. If the interest rates are lower than that (as is often the case with federal student loans), I would only make the minimum payments on them and focus on:

- Building an emergency fund that makes me comfortable.

- Getting money into retirement accounts.

Of course, personal finance is personal, so what would I would do might not work for everybody. (I have a lot of friends who want to be out of debt more than anything else, so they would pay down the student loans as fast as they could, whatever the interest rate).

Let me break down my recommendation:

Over the long run, your investments can (hopefully) earn 6%-7%

With some sound investing and a little luck, average annual returns in the stock market can match – and maybe beat–the interest rates on your loans. And the sooner you start investing, the longer it can grow.

Some student loan interest is tax-deductible

It’s still no fun paying interest, but the student loan interest tax deduction only adds to the fact that your money could work harder for you if you invest it.

Liquidity is a good thing (this is important!)

On paper, it doesn’t matter if you pay down your student loans early or put cash in the bank: the tracking of your net worth increases by the same amount month after month. But, let’s assume the worst. God forbid you lose your job or you need a life-saving operation? The more cash you have on hand, the better prepared you’ll be to deal with such a big financial setback. If you’ve paid off half of your student loans early, you’re still going to have a minimum payment and you won’t have as much cash on hand.

Consider student loan refinancing

If you have a good credit history and a consistent income, you should consider refinancing your student loans. You could lower your interest rate, consolidate multiple student loans into one monthly payment, and reduce your total monthly student loan payments.

Summary

So that’s my take: save a little bit of an emergency fund, pay off student loans great than 7%, then focus on retirement and other savings goals while making minimum payments on the other student loans.