For most, disability insurance is just something that you anticipate is included through your employer and you don’t think much about unless you actually know you need it.

But, if you are self-employed or make a lot of money, it might make a ton of sense to have disability insurance.

It takes less than 20 minutes to get a free quote online, and there’s no obligation. Below I’ll break down Breeze completely, so you can determine if it’s right for you or not.

What is Breeze?

Breeze is an insurance company that was founded in 2019 that offers disability insurance, and they operate entirely online. They named the company Breeze because going their application process is supposed to be a breeze (more on this below).

According to their site, “Breeze is the first insurtech company to modernize disability insurance – an old, confusing product that desperately needed it.”

Breeze works with a company called Assurity Life Insurance, which has been around since 1890 and has close to $18 billion already written in life insurance alone.

How does Breeze work?

Breeze claims their process for getting a quote is a breeze – so let’s find out if that’s true.

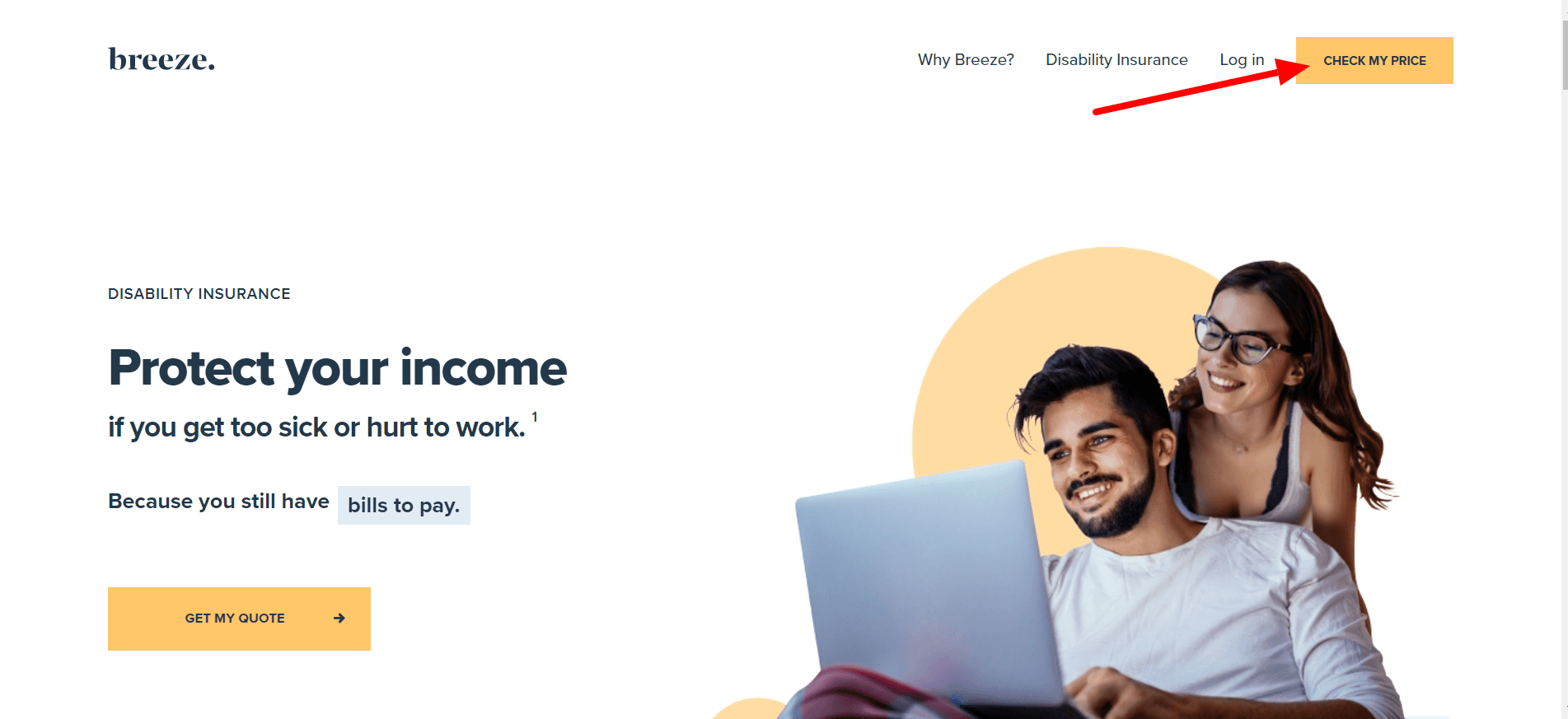

From their homepage, you’ll click “Check My Price” in the upper right corner.

The first step is basic – I need to enter my birthdate and gender.

Note that if you’re female, they’ll ask if you want maternity leave coverage, too.

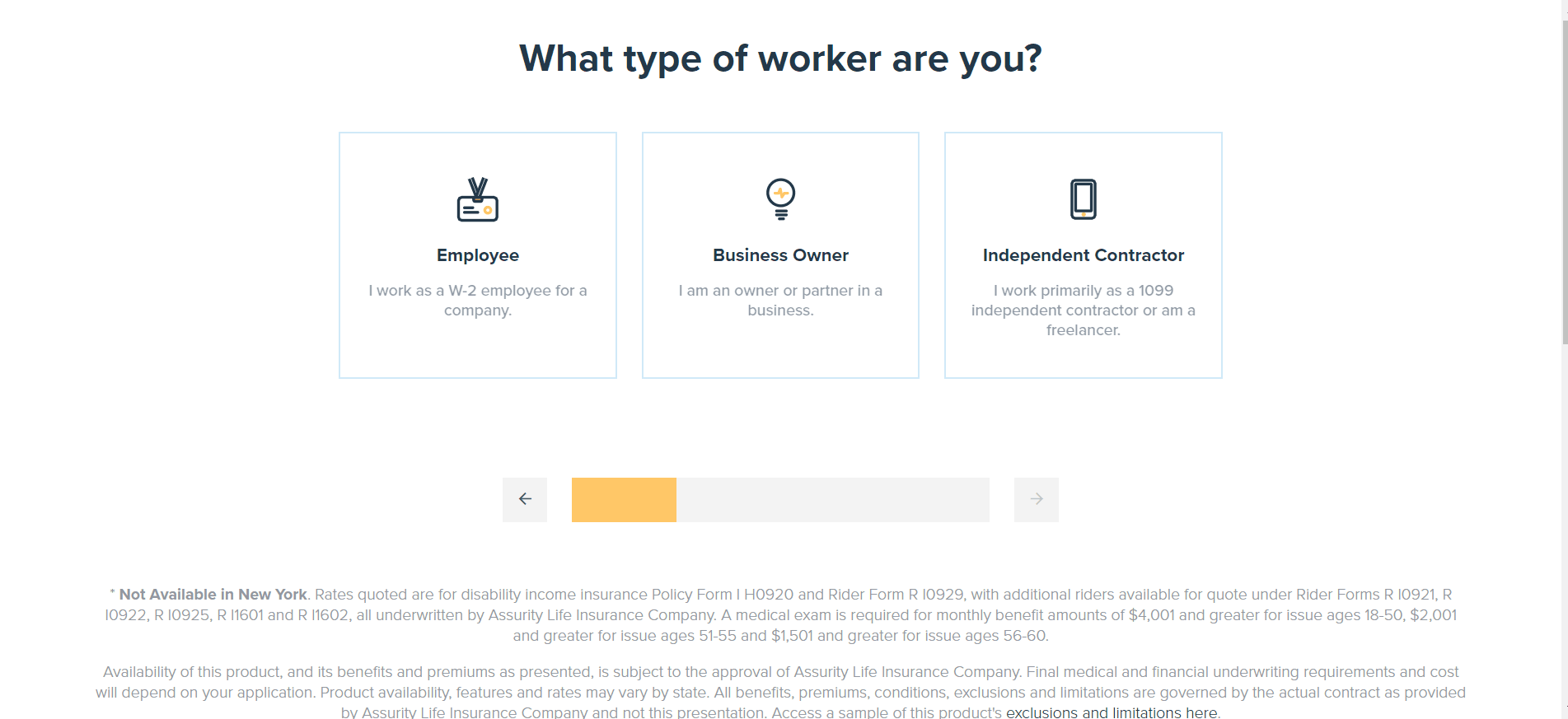

Next, I need to tell Breeze what kind of worker I am. For the sake of this example, I’ll say I am a small business owner.

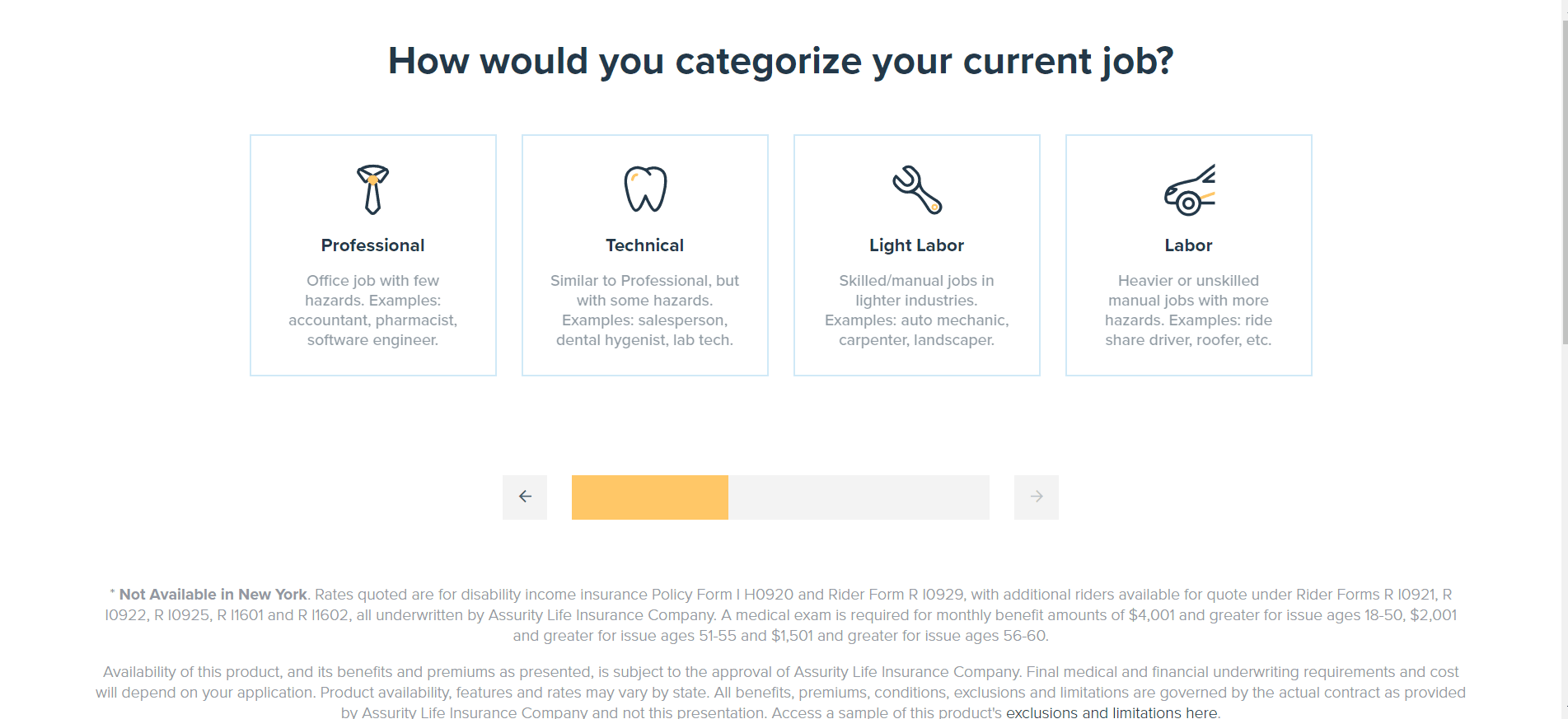

Then, I need to categorize the work I do and say if I work at least 30 hours a week or not.

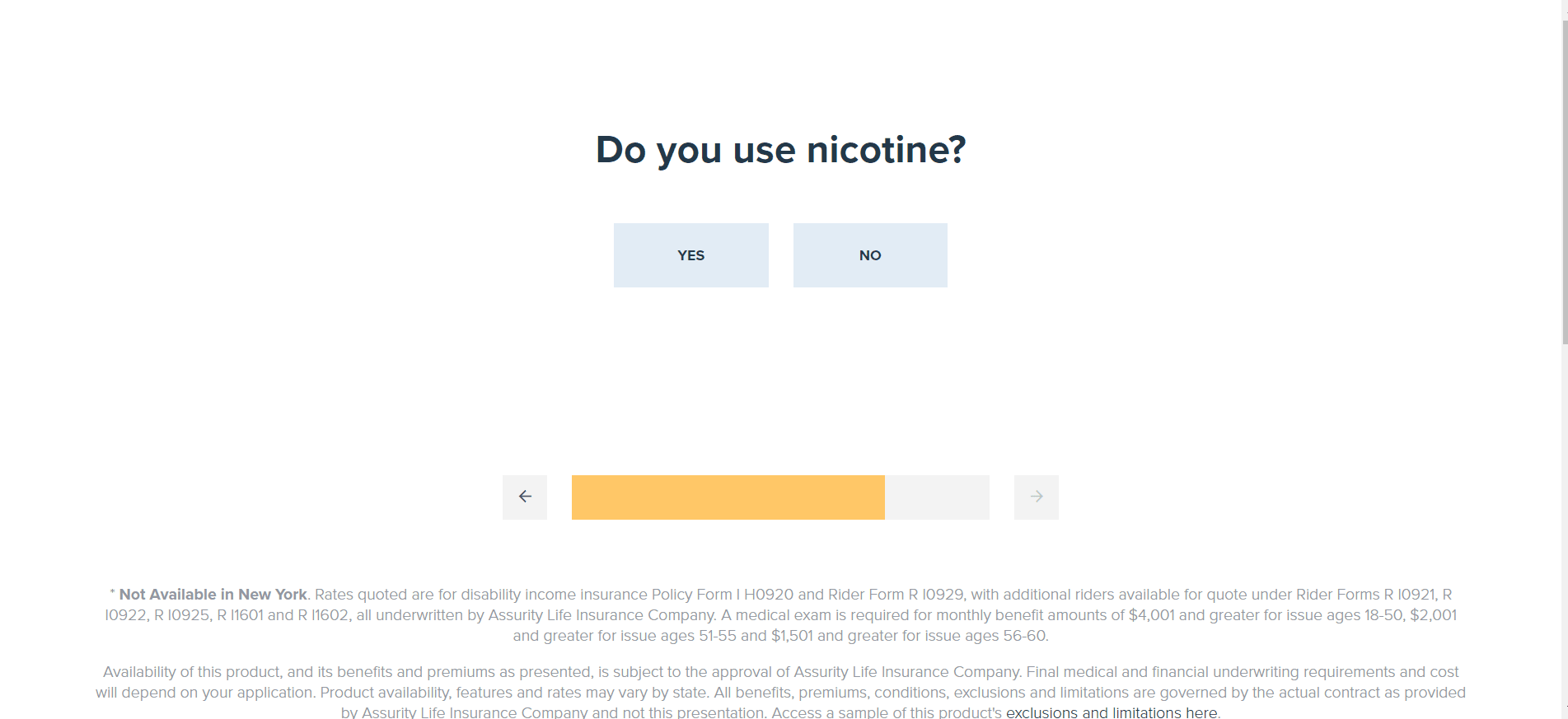

If I say yes to working 30+ hours, I need to specify my income (otherwise it goes to the next step). Then, I enter my zip code and need to say whether or not I use nicotine.

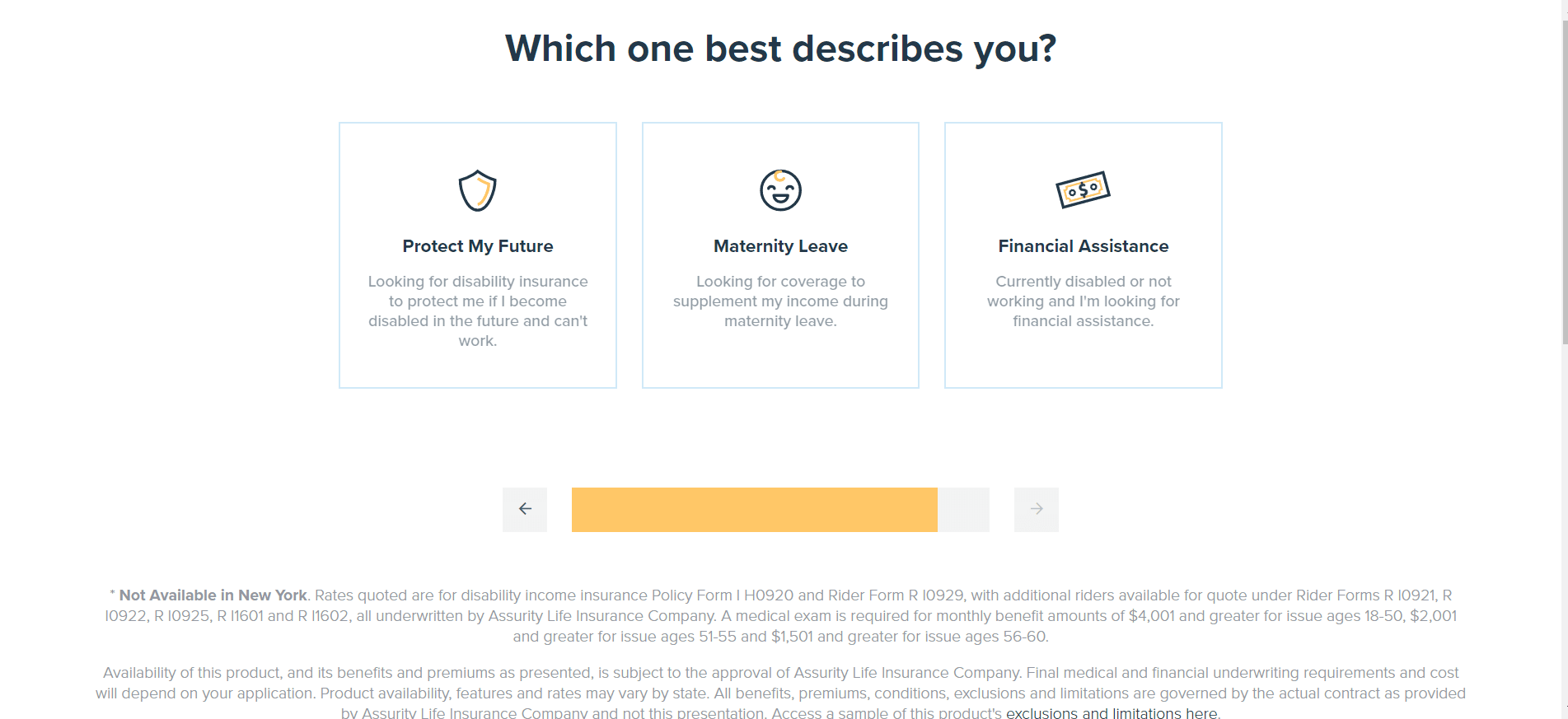

Next, I have to say what scenario best describes me. For this demo, I am going to select “Protect My Future”.

Breeze then asks if I want quotes for life insurance, too (I am going to say no).

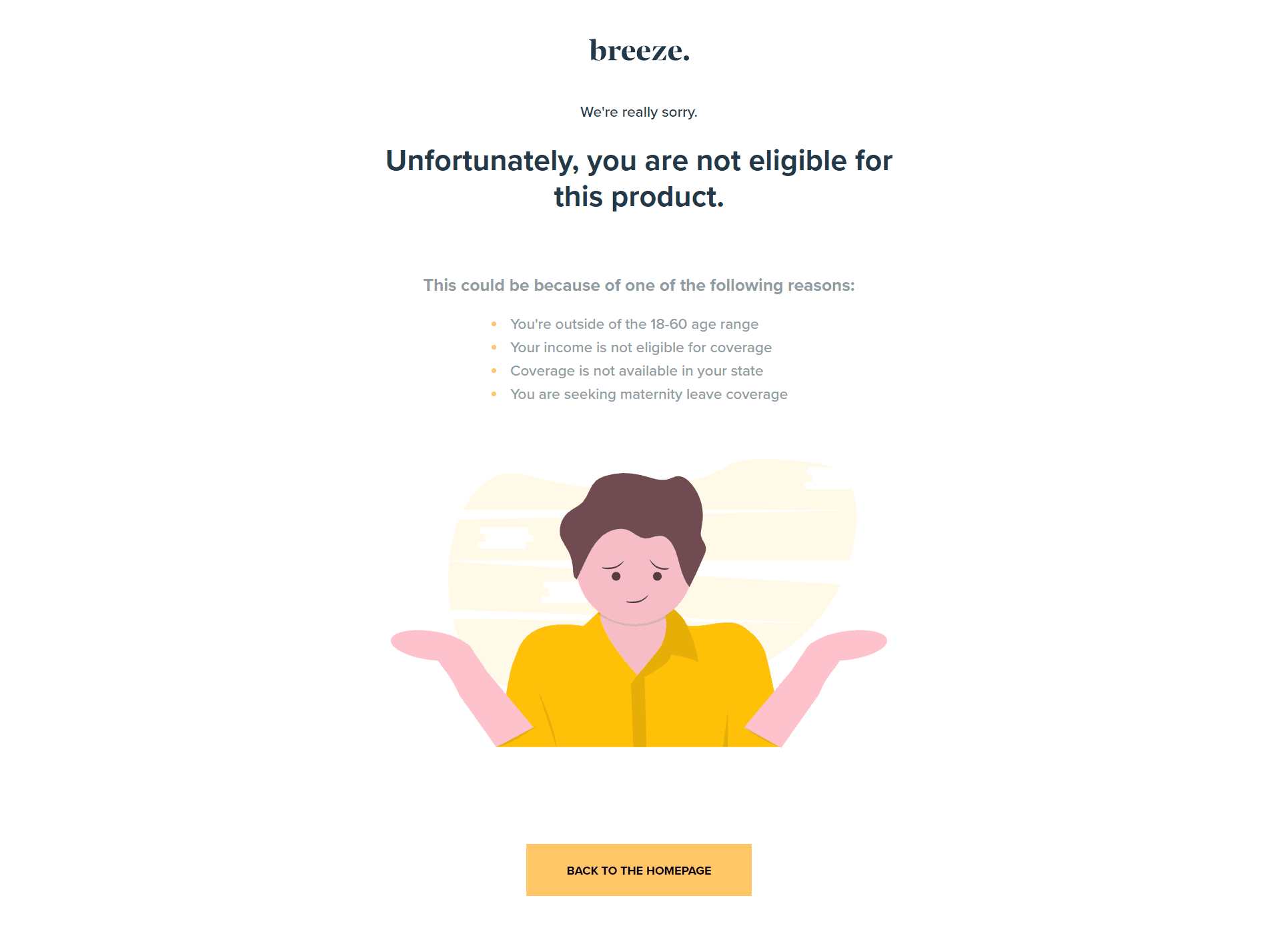

And after all that, I was told I wasn’t eligible for coverage, but they didn’t specify why.

Now, assuming you do qualify, this is where Breeze would display your options for disability coverage. I have to say, although I don’t qualify, the process of getting a quote was incredibly fast and simple.

Pricing for Breeze

For most, disability insurance is just something that you anticipate is included through your employer and you don’t think much about unless you actually know you need it. But, if you are self-employed or make a lot of money, it might make a ton of sense to have disability insurance.

Because Breeze is an insurance agency, their pricing is going to depend on the person applying for the insurance. And since it’s disability insurance, this can vary greatly. Meaning, some people are a much higher risk than others based on many factors, so their pricing will be higher.

Honestly, the best thing you can do is take 15-20 minutes to complete the simple online application process with Breeze. This way, you’ll know if you can protect your income against disability with a policy that is tailored specifically to you.

Breeze features

Quick application process

Breeze has its name for a reason. The application takes very little time, and once you have a quote, you can enact the policy in as little as 15 minutes.

For most of us who have very little time to worry about things like disability insurance, this is a huge value add.

Automated underwriting

The online application process is not only quick, but it’s completely streamlined. Breeze has set up a system, through algorithms and their questionnaire, to enable automated underwriting of policy online. If you qualify for automated underwriting, this means you don’t need to wait for a human to review your file – it just works.

Affordable pricing

Breeze focuses on providing affordable disability insurance. Because they operate entirely online, their overhead is low and they can offer far more affordable prices.

Flexible policies

One of the things that set Breeze apart is the flexibility it has within its policies. They issue policies to anyone between the ages of 18 and 60 years old with benefits ranging from $500 to as much as $20,000.

In addition, they have multiple options for waiting periods (how long you have to wait before your benefits kick in) of 30, 60, 90, 180, and 365 days.

Finally, unlike many insurers, Breeze has guaranteed renewability until ages 65 or 67.

Numerous built-in features

All Breeze policies have a number of built-in features, including things like partial disability, presumptive disability, home modification, organ donor benefits, survivor benefits, and vocational rehab. This just enhances your disability insurance policy even more.

Additional riders

On top of great pricing, flexible terms, and built-in features, Breeze includes several critical riders into their policies, including non-cancelable feature, catastrophic disability benefit, critical illness benefit, and automatic benefit increase.

Free resources

Since disability insurance is a bit obscure, Breeze also offers a resource center that not only has FAQs but a bevy of in-depth guides to better understand this type of insurance.

Some of their better guides I enjoyed were their guides on no exam disability insurance, workers’ compensation insurance, and short term disability insurance.

Who is Breeze for?

Breeze is primarily for people who need disability insurance. Most importantly, I would say people who don’t already get disability insurance through their employer are the ones who will benefit most from Breeze. This will typically include people who are self-employed or are gig-workers.

In addition, I would recommend people who are at a higher risk of disability take a look at Breeze. Even if your employer is giving you benefits, if the odds of you becoming disabled are a lot higher (i.e., you’re close to retirement), it might be worth checking into Breeze.

Who shouldn’t use Breeze?

If you already get disability insurance through your employer and you’re younger and generally healthy, there’s really no need to sign up for disability insurance. What you get through your employer should definitely suffice.

The problem is, finding disability insurance specifically can be a hassle. Before Breeze, I honestly wouldn’t have even known where to begin looking. But thankfully Breeze offers disability insurance online – and they make their process super simple.

Pros & cons

Pros

- Underwritten by a highly-regarded provider — Breeze has all of its policies underwritten by Assurity Life Insurance, who has been around since the 1800s. So you’re not dealing with a company that’s inexperienced.

- Great coverage — Aside from the perks, the coverage is excellent and will replace at least a portion of your income if you’re hurt or too sick and can’t go to work.

- Lots of flexibility — Breeze has not only a lot of options but plenty of perks within its coverage, including additional riders. They give you multiple options for quotes so you can choose what fits you best and what’s most affordable for what you need.

- Fast quotes — You can get an accurate quote in less than a minute on the Breeze website. So you can literally get your application submitted in about 15 minutes, instead of dealing with a mess of paperwork and waiting weeks.

Cons

- They only sell disability insurance — This may be a good thing since they specialize, but I would prefer a company that can take care of multiple insurance-related needs. At one point I was asked if I wanted life insurance, but my understanding is that it’d be offered by their underwriter.

- A brand new company — While their underwriter has been around forever, Breeze itself is only less than a year old.

The competition

| Company | Insurance types | Pricing | Underwriters |

|---|---|---|---|

| Breeze | Disability only | Varies | Single |

| PolicyGenius | Multiple – including disability, life, homeowners, renters, and more | Varies by product | Multiple |

Breeze vs Policygenius

Policygenius is a little different than Breeze in that it’s a full-scale insurance broker that offers a plethora of different insurance types. Bear in mind, though, that they don’t actually underwrite the policies, they work with other insurance providers to do that.

So while you can get all of your insurance through Policygenius, they don’t underwrite it – so you’ll have policies with multiple companies if you want multiple types of insurance.

Now that I’ve cleared that up, Policygenius is a pretty great platform to use if you need more than just disability insurance, but their policies for disability are great too. They work with a bunch of different insurance companies (as opposed to Breeze who uses one) to get you the best possible rate.

But with that being said, Breeze’s niche is that they only focus on disability insurance – so they have a more well-rounded system.

» MORE: Read our full Policygenius Review

My experience using Breeze

As you saw above, the information I entered wasn’t qualified for a disability insurance plan. It took me all of five minutes to enter that information, so the process really was a breeze. The next screen would have shown my options, however, if I did qualify.

The one thing that annoyed me was the fact that they didn’t stop me during the process when something I input didn’t qualify (i.e., income, age, location) and they also didn’t tell me why I didn’t qualify at the end.

It was just a picture of someone doing the international gesture for “oh well” and a link back to their homepage. Not very user friendly in my opinion.

That said, I do like what Breeze is doing – they’ve basically cornered the disability insurance market in a positive way and are positioning themselves as experts in this one particular type of insurance.

If I were going to get disability insurance, I would use Breeze since they focus on one product. I get nervous when my insurer offers me a bunch of different types of insurance because it makes me feel as if they aren’t specialists in any one of them. That’s just my two cents though.

Summary

Overall, Breeze makes a lot of sense if you need disability insurance. Yes, they’re a new company, but they’re underwritten by a company that has been around for a very long time – so that brings some assurance.

I didn’t like how I was “rejected” without any type of understanding as to why, but if you do go through the five minutes it takes to get a quote and you qualify, the process is amazingly simple from that point forward.