Let’s say you’re crushing it at work, or you got a tax refund, and you finally have enough cash on hand to pay off your auto loan in full.

It’s a tempting move: You’ll have one less bill each month, you’ll save a few hundred bucks on interest payments, and you’ll finally get your car’s title from your lender (meaning you can downgrade from full coverage auto insurance). It might be worth paying off your car loan early.

But believe it or not, there are also big advantages to staying on your repayment schedule — even if you’re capable of paying off your loan in full.

A Quick Recap of Auto Loan Basics

Before we discuss the pros and cons of paying off your car loan early, let’s do a refresher on how auto loan payments work in the first place.

Principal is the total amount of money you’re borrowing to buy the car. So if you’re buying a $30,000 car and can make a down payment of $5,000, you’ll be borrowing the other $25,000. That’s your principal.

Interest is the “fee” charged by the lender for borrowing money. Interest equals income for lenders; keep that in mind as we dive further in.

In your existing and future loan documents, you may also run into two different types of interest:

Simple interest, which the vast majority of lenders use, is calculated using your outstanding balance on the day your payment is due. If you start making payments earlier, more frequently, or simply pay more than your monthly payment, your remaining interest should shrink in real-time, allowing you to pay off your car loan early.

Precomputed interest is all calculated upfront, and the total amount of interest you have to pay your lender doesn’t change even if you start paying off your car loan faster.

Whether you’re paying simple or precomputed interest will make a difference in your options for early payment.

For simple interest, some lenders will charge you a fee for paying off your loan early since they’ll be missing out on some expected interest aka income.

With precomputed interest, lenders tend to be less concerned with how quickly you pay off your loan since they’re getting the same amount of interest either way. For that reason, if you ever consider this type of loan agreement, you’ll definitely want to ensure that your lender offers an early repayment refund.

Most of the time, though, you’ll be on a simple interest plan — so that’ll be our focus moving forward.

If I Pay Extra on My Car Loan Does It Go to Principal?

Auto loans are amortized, meaning some of your monthly payment goes to your principal and some goes to interest.

So, if you pay $1,000 instead of $500 next month, where does the extra $500 go? Principal or interest?

Every lender is different, but many will simply see the extra money and go “gee, thanks!” and apply more of it to interest (i.e., pay themselves).

But you’re allowed (and encouraged) to tell your lender “hey, please apply this to my principal so I can pay off my loan faster.”

Most lenders will have a checkbox somewhere to indicate that you’d like extra payments to apply to your principal. Check your loan documents or just give them a call to find out what their process looks like.

What Happens When You Pay Off a Car Loan Early?

Generally speaking, lenders won’t stop you from paying them back early. After all, any amount of outstanding debt is a risk for them.

That said, they may charge you a fee, called a prepayment penalty.

What Is a Prepayment Penalty?

A prepayment penalty is a fee that a lender charges you for paying back your loan before the end of your scheduled loan term (your designated time period for repayment).

It may sound baffling or spiteful, but it’s actually just simple economics.

As illustrated by our auto loan calculator, if you take out a $35,000 loan at 5% interest for 36 months, you’ll end up paying about $2,750 in total interest.

Now, if you get a new job and pay off your loan in full in just 18 months, you may save yourself around $1,350 in interest. Nice!

But your lender will be like ummm interest is our income — we’re glad you paid us back what you borrowed, but you’re also kinda stiffing us out of $1,000.

In the olden days, lenders would charge you that full $1,000 to get their due. But thankfully, the average charge these days is just 2% of your loan’s remaining balance, according to Experian. So if you pay back an outstanding balance of $3,000 with a lump sum payment, your lender may tack on a $60 fee to recoup a small percentage of their lost income.

That said, some online lenders don’t charge this fee at all. If you’re trying to decide between two lenders offering a comparable interest rate, the one that doesn’t charge a prepayment penalty has a clear edge.

Does Paying Off a Car Loan Help Credit?

Here’s another weird quirk of auto loans that catches some borrowers off guard:

Paying off your car loan early can actually decrease your credit score by a few points.

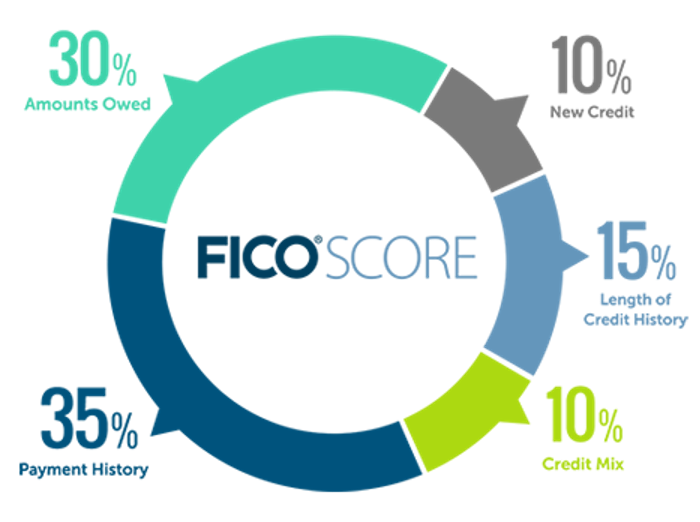

See, having an active car loan can potentially stretch your length of credit history, diversify your credit mix, and demonstrate strong payment habits. Those factors combined make up 60% of your credit score.

When you close your account, it still looks good on your credit report for 10 years — but you miss out on the opportunity to keep building credit.

So, if you have 12 months of car payments left and plan to apply for another big loan in 24 months (mortgage, student loan, etc.), you might actually consider using the opportunity to make 12 more on-time payments, which will beef up your credit score before applying for a much larger loan.

Of course, nothing is true for all borrowers. If paying off your car loan will improve your debt to income ratio you may be better off sending that extra cash to your auto loan.

Your debt to income ratio is how much debt you have compared to your income. It looks at what percentage of your income you are using to make debt payments.

How to Pay Off a Car Loan Early

Before deciding if paying off your car loan early is the right move, let’s consider your four repayment options:

- Pay the full lump sum

- Pay a partial lump sum (e.g., $5,000 on a $10,000 balance)

- Increase your monthly payments (e.g. $600/month instead of $500/month)

- Increase your payment frequency (e.g. $250 on the 1st and 15th instead of $500 on the 1st)

You can obviously mix and match, tossing in $50 here and there and choosing to make biweekly payments rather than monthly.

My final early payment “hack” may sound obvious, but it’s often overlooked:

Call your lender and just chat about early payment options.

At the very least, a simple ask like, “Hey, can we talk about the best way to pay off my loan early?” can lead to an enlightening conversation. Some lenders might even help you set up an ideal early payment schedule that avoids fees.

What to Do Instead of Paying Off Your Car Loan Early

Depending on your individual financial situation you may decide that your paying extra to your auto loan isn’t the best option.

Pay Off Other High Interest Debt

If you have other debts, especially higher interest debt like credit cards or personal loans, it could be better to reduce those balances and just keep paying your car loan like normal. This may end up saving you more interest in the long run.

Build Up Your Savings

If you are still building up your emergency fund you also have the option to put the extra money into a savings account.

It’s recommended that you have three to six months of expenses in savings. If you don’t have this yet it might be a good idea to build that up before you work on paying off your car loan.

Start investing

If your savings is in a good place you could also use the money to start investing. The earlier you can start investing the better. Compound interest is like magic and the longer you can be in the markets the better.

Another option here is to pay off your car loan balance and then take that old monthly car payment and start investing it.

So, Should You Pay Off Your Car Loan Early?

Let’s review some of the advantages and disadvantages of paying off your car loan early. I’ll also throw in a few other minor considerations I haven’t mentioned yet.

Advantages of Paying Off a Car Loan Early

The main advantage of paying off your car loan is that it reduces your monthly debt payments. If you can pay off your car and eliminate your car payment that frees up quite a bit of money each month for other things.

- Saves serious money on interest payments

- Reduces your monthly payments

- Gets your car title faster – because the lender technically owns your car until you pay it off

- Allows you to downgrade from full coverage insurance, which lets you save money come policy renewal time

- Frees up capital to invest elsewhere

- Eliminates the risk of being “upside down” on the loan (owing more than the car is worth)

- Improves your debt-to-income ratio (DTI)

Disadvantages of Paying Off a Car Loan Early

The main disadvantage of pay off your car loan is that it takes money that you could otherwise use for other expenses – such as building up your savings or paying down other debt.

- Might divert money from essentials, like your emergency fund

- May incur prepayment penalties

- Could hurt your credit score

- Might be smarter to invest repayment money in I Bonds or index funds (*if* your car loan interest rate is below, say, 4%)

- The extra money could be used to pay off other high interest debt instead

The Bottom Line

Paying off your car loan early is generally the right move if:

- You can truly afford it without causing other financial stress.

- It will save you more money in interest than you’ll cough up in prepayment penalties.

- Your credit score will still be high enough to meet your near-future borrowing goals, even after a small dip.

- The interest rate on your loan is higher than the likely return you’d get on investments.

But if the repayment funds are needed for more pressing matters, your credit score has serious room for improvement, or the interest rate on your loan is super low, it might actually be smarter to stay the course of your car loan term.