Their entire operation is built around it. Because of that, they’ve managed to speed the entire application process, and even reduce much of the paperwork requirements.

About Quicken Loans

Founded in 1985, and based in Detroit, Michigan, Quicken Loans has grown to become the largest retail mortgage lender in the US, as well as the largest online mortgage lender.

As a mortgage lender, Quicken Loans offers all types of mortgages. But rather than offering retail locations, where you can complete applications face-to-face with company personnel, the whole process takes place online.

In 2016, Quicken Loans launched its Rocket Mortgage division, which also functions as an entirely online mortgage lending platform. Rocket Mortgage is perhaps the better known of the two, because of the substantial TV advertising used to promote it. In fact, Quicken Loans and Rocket Mortgage seem to be gradually merging into the same organization under two different names.

Quicken Loans has a Better Business Bureau (BBB) rating of “A”. The company has been BBB accredited since 1986.

Quicken Loans mortgage programs

Quicken Loans is a full-service mortgage lender offering the following loan programs:

Conventional mortgages

These are loans available to all borrowers for either purchase or refinance, but they generally require better credit than the other loan types.

Properties can be purchased or refinanced as a primary residence, vacation home, or even investment property. In most cases, the minimum down payment will be 5%.

FHA mortgages

These are government insured mortgages that are available to borrowers with less than perfect credit. They are available only for owner-occupied primary residences, for purchase or refinance, and typically require a down payment of at least 3.5%.

VA mortgages

Va mortgages are available for eligible veterans and active duty military personnel, for the purchase or refinance of a primary residence only. The major benefit of VA loans is that they offer 100% financing. They’re also generally at least a little bit more flexible on credit than conventional mortgages.

Jumbo mortgages

The mortgage types above are available for loan amounts of up to $484,350 for single-family properties, or up to $729,525 in designated high cost areas. But Jumbo mortgages are available for larger loan amounts. However, they generally require higher down payments and better credit profiles.

USDA loans

Similar to VA loans, these also offer 100% financing on owner-occupied homes. But they’re limited to low- to moderate-income borrowers, and generally at lower loan amounts.

They’re also restricted by county, but still available in 97% of counties nationwide.

HARP refinances

These loans enable holders of conventional mortgages to refinance their loans, even if they owe more on the house than the house is worth. Qualification is minimal, and though the program is set to terminate at the end of each year, it’s renewed for the next.

Reverse mortgages

These are FHA mortgages available to senior citizens to access the equity in their homes without a monthly payment.

For example, you borrow $200,000 against your home, and the lender makes monthly payments to you, providing you with an income. The loan is paid when the home is sold.

YOURgage

This a conventional loan that enables you to purchase a property with as little as 3% down, as long as the home will be uses as a primary residence. Loans are available at fixed rates, with amounts up to $484,350. You can also choose the term of the loan, enabling you to reduce it to less than 30 years.

Most of the above mortgage loan products are available as either fixed rate or adjustable-rate mortgages. They’re also available in terms ranging from 15 years to 30 years.

How does Quicken Loans work?

Quicken works through Rocket Mortgage

When you apply for a mortgage with Quicken Loans, the entire process takes place online. But what you’ll notice almost immediately when you apply is that it goes through Rocket Mortgage.

They are, after all, two parts of the same organization. You’ll even be given the option to transfer to the Rocket Mortgage website.

Creating an account

When completing the application, expect to provide the typical information you would when applying for any mortgage. You’ll start by creating an account, then complete other information as required.

First and foremost, you’ll start with the address of the property you are purchasing. If it’s a refinance, you’ll only need to provide your current address. Information about the property will automatically populate from the website.

This is one of the advantages to applying for a mortgage online from a platform dedicated to the process. They’re able to access third-party, online sources for much of the information. This will make completing the application easier.

And personal information

You also need to enter personal information, including the Social Security number for each person who will be on the loan. They’ll be able to run a credit report, then offer a rate based on a combination of your credit score and property specifics.

Your rate will lock

The rate offered will be the actual rate, though it will be subject to verification of all your information. If you choose to go ahead with the process, you’ll need to pay a fee of $400 to $750, after which the verification process will begin.

Verifying your information

Even though Quicken Loans is an online lender, one thing they do have in common with traditional mortgage lenders is supplying of documentation.

You’ll need to provide that documentation to support information included in your application. But the advantage is that you can upload the information on the website, rather than needing to mail in physical copies. If much of the documentation is already stored on your computer, the process will be even easier.

Where possible, Quicken Loans will attempt to verify your information through online sources. That can include verifying employment, income, and bank savings account information. The more complete you are in providing information, like specific account numbers, the more they can be verified this way.

But in case any information is not available online, you may need supply some or all of the following:

- Your most recent pay stubs

- W-2s for the past two years

- Income tax returns, if you’re on commission, self-employed, or have rental property

- Documentation of Social Security or pension income

- Copies of recent statements for bank and brokerage accounts, as well as retirement accounts

- A copy of the purchase contract on the home you’re buying

- Evidence of any earnest money funds deposited on the new home

- A copy of your divorce decree, if you either pay or receive child support or alimony

- Any other documentation required by Quicken Loans

Once all your information has been submitted, the application will be reviewed by an underwriter. If any additional information is needed, it will be requested.

Once your loan has been approved, a pre-approval letter will be issued.

Quicken loans features and benefits

Availability

Quicken Loan mortgages are available in all 50 states.

RateShield

Once you’re pre-approved, you can lock in your interest rate for up to 90 days. That will give you plenty of time to shop for a property, secure in the knowledge that your loan approval and interest rate are safe.

Loan servicing

One of the major advantages with Quicken Loans is that they service 99% of the mortgages they originate. This means you’ll be making your monthly payments to the same lender you closed your loan with.

This is very different than the industry standard, in which you close with one lender, and your loan will quickly be transferred to another.

Pre-approval letter vs. pre-qualification letter

A pre-approval letter requires a full underwriting and approval of your application. But you can have a pre-qualification letter provided with a credit check and basic information.

The pre-qualification letter will let you know how much you can borrow, and how much house you can afford to buy.

Verified approval

If you’re unable to close on the loan you were approved for, you’ll be paid $1,000.

Customer service

Live chat is available Monday through Friday, from 7:00 am to midnight, and Saturdays and Sundays, from 9:00 am to midnight, Eastern time.

hone support is available Monday through Friday, from 8:00 am to 10:00 pm, Saturdays, from 9:00 am to 8:00 pm, and Sundays, from 10:00 am to 7:00 pm, all times Eastern.

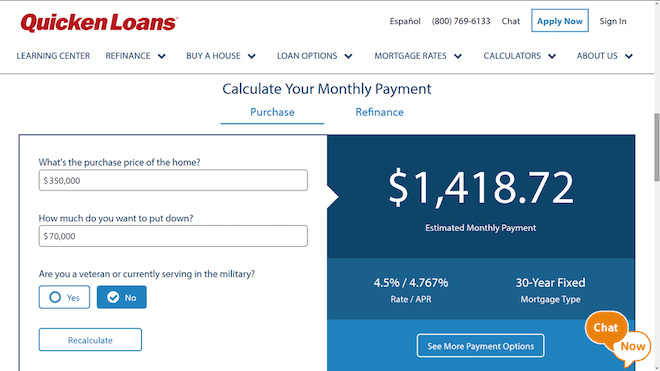

Mortgage calculators

Quicken Loans offers the following calculators:

- Mortgage calculator, to calculate your mortgage payment amounts.

- Affordability calculator, to calculate the maximum house price you can buy.

- Refinance calculator, to calculate your new monthly mortgage payment.

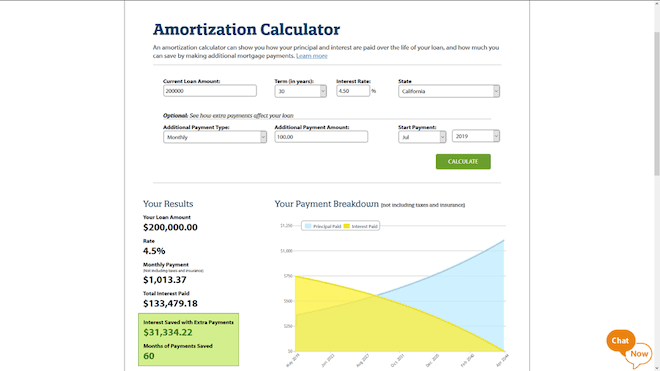

Amortization calculator, to track your progress in paying down your mortgage balance.

Tutorials

Quicken Loans is more than just a platform to apply for a mortgage. It’s also a full-service mortgage resource.

For example, there are resources available for first-time homebuyers, real estate investors, buying a vacation home, corporate relocation, paying off your mortgage faster, and refinancing with a HARP loan.

You can get as much education as you need before applying for a loan.

Quicken loan fees and pricing

They require a deposit of $400-$750

Once your loan is approved, Quicken Loans collects a deposit that will range between $400 and $750. They can be paid using a credit or debit card, as well as gift cards, however they don’t accept checks.

The deposit is used to pay for your credit report and appraisal. If the deposit exceeds the cost of those two items, the difference will be refunded and applied toward your closing costs.

Their rates are a little higher

Quicken Loans mortgage rates tend to be a little bit higher than many competitors. What’s more, if you read the fine print under their rates, you’ll find they include a generous amount of points.

Pros & Cons

Pros

- Quicken Loans is available in all 50 states — This is an important advantage, since many mortgage lenders operate only in a few states.

- Preapproval letter or prequalification letter available — If you just want to know how much you can qualify for, you can get a prequalification letter. But you can get a preapproval letter issued when your application is fully approved. That will enable you to shop as a fully approved homebuyer.

- Customer service is available until midnight, seven days a week — Most mortgage lenders are only available during regular business hours.

- Third party verification will simplify documentation — Quicken Loans makes heavy use of online verification, minimizing the amount of paperwork you need to download with your application.

Cons

- No physical branches — But then Quicken Loans is an online only mortgage lender, so that goes with the territory.

- No face-to-face contact — This is the traditional way the mortgage process has worked, but it’s clearly moving to online. Quicken Loans is on the cutting edge of that shift.

- No secondary financing — Quicken Loans doesn’t offer second mortgages or home equity lines of credit. If you do you need secondary financing, you’ll have to get it from another source.

- Interest rates are a bit higher than the competition — But you’ll gain speed, as well as the convenience of being able to complete the entire process from home.

Summary

Quicken Loans has become the largest mortgage lender in the country. That should give you a strong indication of how valuable the service is. Rates may be a little higher than competitors, but many borrowers today favor simplicity, speed, and saving time.

Just be sure that when you apply for a loan you’re fully prepared with all the necessary documentation. The more documents you have, and the more accurate your information is, the quicker the process will be.

If you’d like more information, or if you’d like to check out the loan programs, visit the Quicken Loans website.