That’s why I wanted to check out LendingClub, which offers interest rates of up to 0.15% on checking accounts, plus an intriguing checking option called Superhero Checking.

What is LendingClub Bank?

If you love the convenience of financial technology but miss the friendly customer service of a local bank, LendingClub might be the bank for you. LendingClub has serviced over 3 million members since 2007, and they are committed to providing leading technology-driven platforms to make sure that customers are going to earn more on the savings front and pay less on the borrowing front.

How does LendingClub Bank work?

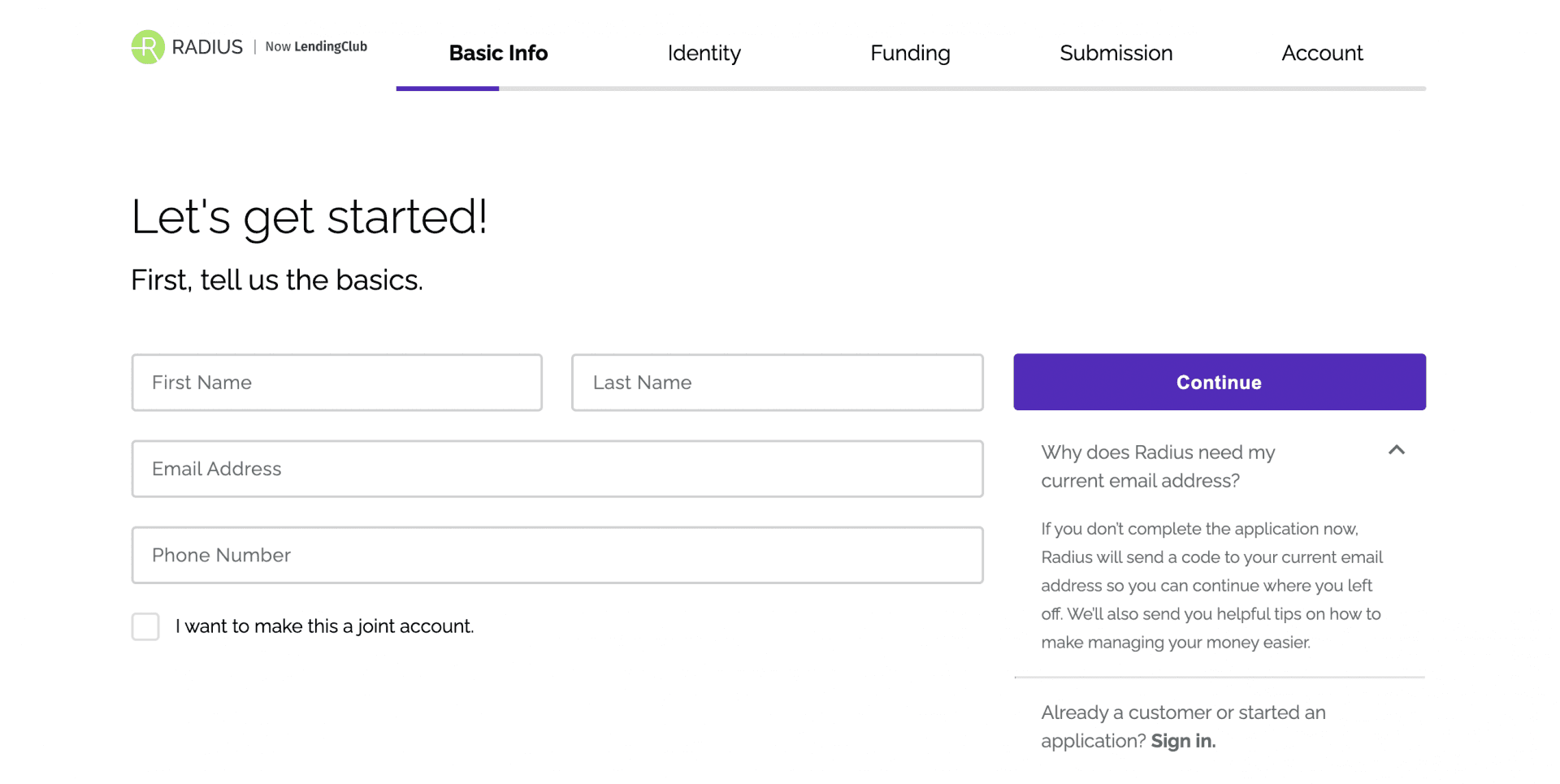

One of the things I love about LendingClub is how simple it is to open an account. Unlike some major national bank chains, you can sign up for an account with LendingClub without ever stepping foot in a bank branch. I prefer to manage my money online, so LendingClub’s streamlined signup process — honestly, three minutes or less — suits my style. Your information is protected with 256-bit encryption when you sign up this way.

There are a ton of banking options available:

- Reward Checking.

- Superhero Checking.

- Essential Checking.

- High-yield Savings.

- Certificates of Deposit (CD).

- Credit cards.

- Personal loans.

- Yacht loans.

- Mortgages.

- Insurance.

I don’t have a yacht to insure (I wish), but I have been looking for a solid personal checking account option that offers interest, so that’s what I’d like to get.

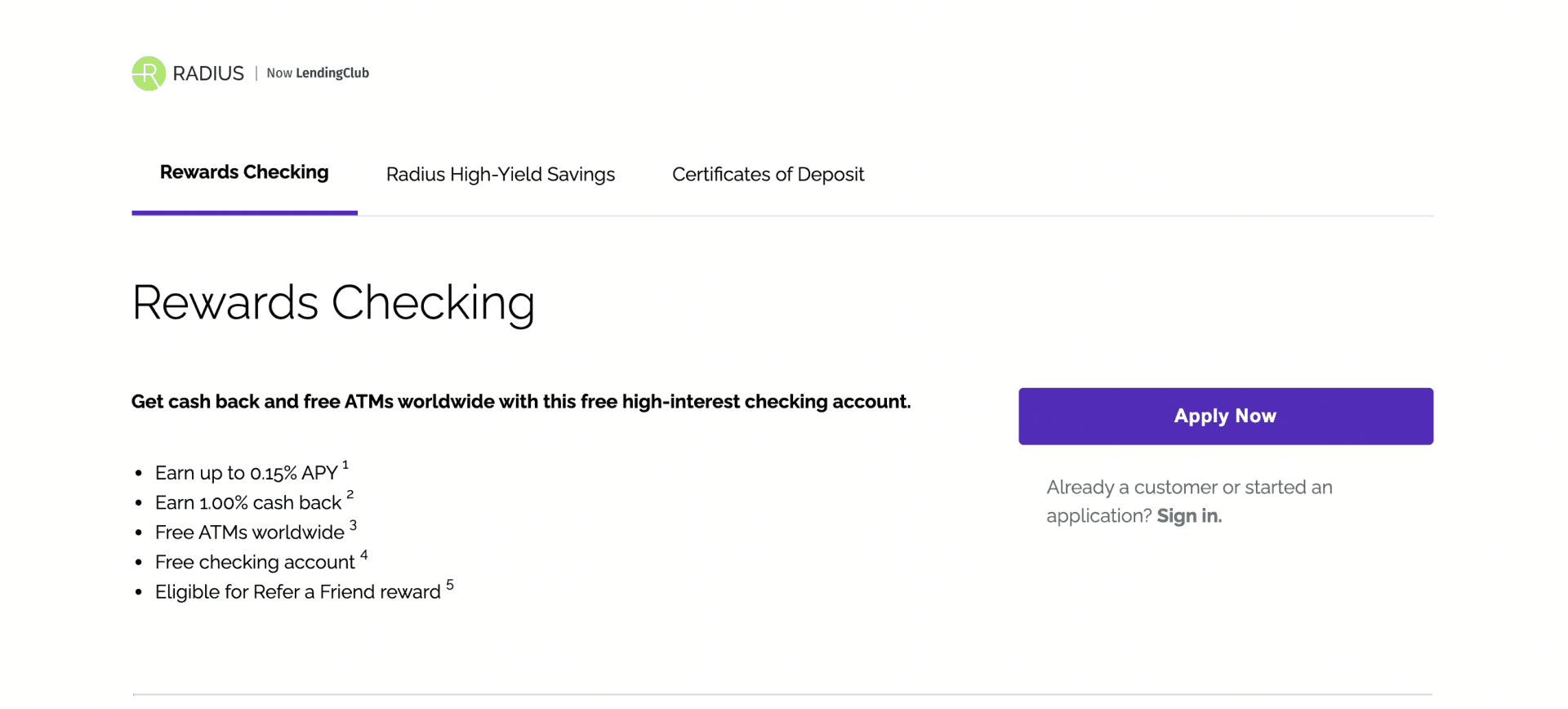

After clicking the bright orange “Open Online Now” button from their home page, I checked to make sure I was applying for a Rewards Checking account. (This should be the default selection, but it never hurts to be safe.) Immediately I was struck by how clean and simple to use their interface was. Some banking websites are cluttered and confusing to navigate, seeming to ask you for 20 things at once and burying important details in the fine print. LendingClub, on the other hand, was very simple and straightforward.

Of course, there was still some fine print. But at least it was all in one place. Plus, their customer service team is standing by ready to help me via live chat.

I clicked “Apply Now” and settled in, expecting a long process.

I was pleasantly surprised. Not only did LendingClub show me exactly what to expect during the sign-up process, but they explained why they collect certain information, which I appreciated. It can feel nerve-wracking sharing your personal information online, so it’s good to see the reason behind what they’re asking for. Especially with some parts of the application, where the information LendingClub collects is required by the federal government to protect bank fraud.

Identity verification is an important part of bank applications, and LendingClub is no exception.

If you need to pause your application, you can do that, too — LendingClub lets you log back into your banking application later, so you don’t lose your work if you have to interrupt what you’re doing. And later, once your application is approved, you can log in to your account right at the LendingClub website, too.

How much does an account at LendingClub Bank cost?

There are a number of different options at LendingClub, of course, but they’re all affordable. You’ll pay no monthly fees, with the exception of one account designed to help you get back on your financial feet. Most accounts are interest-bearing, too — even checking.

Rewards Checking

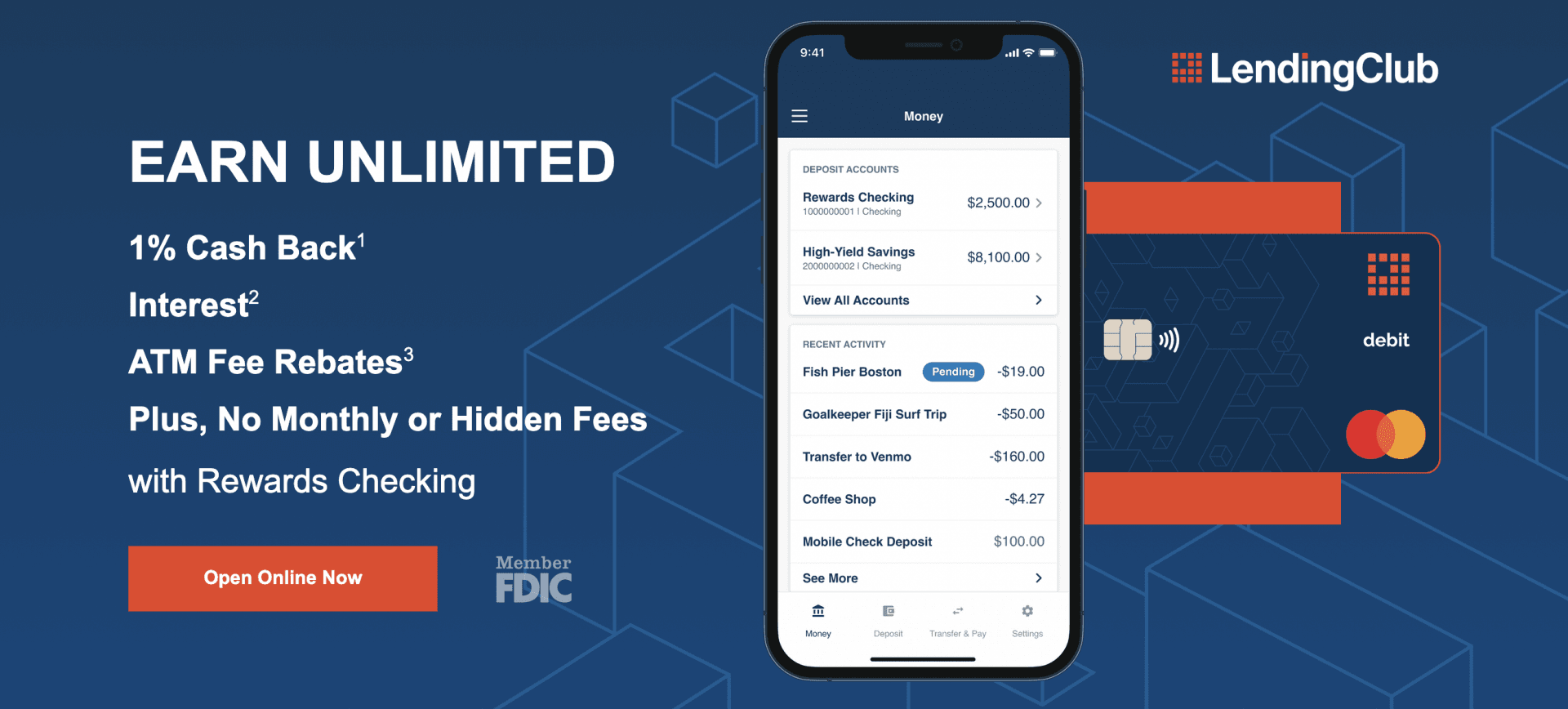

My top pick is the Rewards Checking account. Not only are there no monthly service fees, but you actually earn money — plus 1% cash back on signature-based transactions made with your LendingClub debit card.

Superhero Checking

If you’ve got a big heart for at-risk babies, you’ve got to go with the Superhero Checking account, which gives valuable donations to the March of Dimes through your everyday spending — 1% of your debit card purchases every month.

Plus, every penny of interest you earn will be matched by LendingClub and donated to March of Dimes. There are no monthly service fees and you can access free ATMs worldwide. I love the idea of effortlessly helping premature babies every single month, just by going about my everyday business.

Essentials Checking

If you don’t quite qualify for either of these checking options, you may still be eligible for Essentials Checking, which carries a monthly fee of $9. If you successfully manage 12 months with a positive banking history, you may be able to upgrade your account to Rewards checking.

Business Checking

LendingClub serves small and mid-size businesses, too. The LendingClub Tailored Business Checking account is designed for growing businesses and features the same free-ATM bonus as its personal-banking counterpart. You’ll earn 0.10% APY on your business banking balance of $5,000 or more, with no per-transaction fee and free bill pay. The opening balance requirement is $100 with a $10 monthly service fee on accounts below $5,000.

Savings

High-yield savings accounts are where it’s at, and LendingClub pays 0.15% APY on balances between $2,500 and $25,000. At $25,000 and above, your rate is 0.25%. There are no fees for this account, and transfers are free, too. You’ll receive a free debit card and LendingClub won’t charge you ATM fees, either.

If you can park your cash for a while, LendingClub has Certificates of Deposit (CDs) with 0.10% APY.

LendingClub Bank features

In addition to its innovative Superhero checking, LendingClub offers other cool features, too.

Bank on the go

Why drive to the bank branch when you can deposit a check from your couch? LendingClub’s online and mobile banking tools include a mobile banking app, a mobile card app (use it to toggle your card on and off, set limits and alerts, and more) and mobile wallets that work with Apple Pay, Google Pay, or Samsung Pay on your phone.

No ATM fees

LendingClub won’t charge you a single ATM fee — plus, they’ll actually reimburse you for the fees you incur at out-of-network ATMs. At more than $4 a pop, you could be looking at $300 a year in savings. LendingClub does charge some fees, including $25 non-sufficient fund fee, $5 daily overdraft fee, $3 money order fee and $10–$40 for domestic and international wires.

Low opening balance requirement

Open your account with just $100.

No minimum balance

Once you’ve opened your account, don’t worry about maintaining a minimum balance — while you’ll need to maintain a certain balance to take advantage of some of the perks, you’ll never be charged a low balance fee.

Financial management tools

You can actually use your LendingClub dashboard to grow your net worth with the following features:

Budget

Link external accounts to see all of your information in one place, then create a budget to manage your spending.

Trends

Track your spending over time to see where your money is actually going.

Net worth

Know your “big-picture” number so you can take steps to increase it.

Early Direct Deposit

Want your paycheck a little faster? When you set up a direct deposit at LendingClub, you’ll be eligible to receive your paycheck up to two days faster.

Insured Deposits

Like all the best banks, your money is safe at LendingClub, insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC).

My experience using LendingClub Bank

The more I explored LendingClub the more I liked it. I’ve always been a fan of online banks, due to their higher yields (and the fact that I hate having to make trips to the bank, and their hours are usually inconvenient for me). So using an online bank is a no-brainer for me. I’m comfortable using online savings accounts and love that I can open an account at LendingClub online in five minutes.

But what really sells me on LendingClub is the combination of a high-yield checking option with mobile banking technology. Other banks offer a mobile app, and that’s great, but they don’t always give me an app that lets me toggle my card on and off if I suspect fraudulent charges, and they definitely don’t show me charts and graphics on my dashboard.

I’d have to use a lot of other apps and services to get what LendingClub offers in one account. Plus, LendingClub gives me interest and cash back on signed debit purchases, too. I’d love to see LendingClub offer even higher yields on their savings accounts in order to make it a truly irresistible package.

Who should use LendingClub Bank?

Here’s how LendingClub describes their customers:

“We proudly serve consumers, small and middle market businesses, unions, government entities and non-profit organizations as our core clients.”

So whether you’re looking for a personal bank account or you’ve got business or institutional banking to take care of, LendingClub has your back. They have a history of community-centered banking, and their business model puts you and your convenience front and center.

To take advantage of their very best rates, you’ve got to have a lot of cash ($100,000 worth), but even those of us with more modest means can still take advantage of their interest-bearing accounts.

Savers

If you’re ready to park your cash and watch it grow, you need accounts that earn interest — like LendingClub’s high-yield checking and savings. Plus, with their checking rewards, even when you’re spending, you’re saving.

You can even add to your balance with cash deposits at thousands of ATMs across the country, or deposit a check with a picture on your phone.

Smartphone users

LendingClub’s mobile technology is competitive with some of the biggest names in banking. You can deposit a check, transfer money to your savings account, track your net worth, and pay your bills, all without leaving your chair. Lose your card? Toggle your debit card off until you find it or report it missing, right from your phone.

People who appreciate customer service

Even if you prefer to do most of your banking online, it still helps to hear a friendly voice. You can talk to a LendingClub customer service rep through online chat, email or phone.

Who should not use LendingClub Bank?

Not everyone is going to find LendingClub a perfect fit. Here’s who LendingClub might not be right for:

Folks who prefer to walk into their bank branch

Although LendingClub technically has a Boston location, you’ll be doing your banking with them online. If you need to see your bank teller face-to-face for a satisfactory banking experience, LendingClub won’t be a good fit for you.

Rate hunters

Although LendingClub’s rates are competitive, they’re always not the highest in the land. If you have to have the absolute highest rate, you might find it somewhere else.

Pros & cons

Pros

- Free high-yield checking — Interest plus cash back rewards make this a valuable account.

- Mobile tech features — All the stuff that makes banking more convenient: mobile apps, phone deposits, electronic transfers from your couch.

- Philanthropic banking option — Superhero Checking is a simple way to continuously donate to a worthy cause.

- Free ATMs — No fees, even at out-of-network machines, thanks to their no-cap reimbursement policy.

- Customer service — Even if you’re far away, you can still get a LendingClub rep on the phone, in email, or through chat.

Cons

- Rates could be better — Interest rates are relatively low everywhere, but some higher ones can be found elsewhere.

- Business checking service fee — As with the APY, if service fees bother you, you might find lower or no-fee business checking somewhere else.

The competition

So how does LendingClub stand up?

LendingClub vs Chime®

Chime® is one of LendingClub’s biggest competitors. It really puts its focus on its spending or checking accounts. With savings, you’ll earn a decent 2.00%.

Chime does have a zero opening deposit requirement if you’re starting with nothing. But overall, I’d say LendingClub wins over Chime.

» MORE: Read our full Chime review

Summary

LendingClub has worked hard to put together the services and features that people want to see in a bank: mobile banking technology, friendly customer service, and rewards that go beyond basic banking.

They don’t charge monthly fees on their flagship accounts and they offer competitive interest rates, too. All in all, LendingClub is a solid online banking alternative, especially for personal checking.