Insurance is all about risk. Your insurance premiums are a direct reflection of how risky your provider thinks it is to insure you and how likely you are to file a car insurance claim.

Most car insurance companies tend to punish high-risk drivers with absurd premiums or may not offer them coverage at all. But The General sells insurance to almost anyone, regardless of mistakes, and specializes in offering better rates to drivers other companies might not want to insure.

In this article, we’ll take a look at what makes The General auto insurance unique, how to sign up for a policy, and who should consider this insurer the next time they’re looking for coverage for their vehicle.

What is The General Insurance?

The General Automobile Insurance Services, Inc., often just called The General, began business in 1963 as The Permanent General Agency. Today, it is owned and operated by the American Family Mutual Insurance Company.

This car insurance provider offers auto insurance coverage to groups of people who would typically have a hard time getting coverage. This includes, but is not limited to, high-risk drivers.

You may be considered high-risk if you:

- Have recently gotten your driver’s license

- Have had your license suspended

- Have had one or more auto accidents

- Have multiple traffic violations on record

- Have one or more DUIs or DWIs on record

- Have bad credit

- Have been required by your state to submit an SR-22

In addition to catering to these folks and others, The General offers discounts on home and renters insurance bundles, a military discount, and a good student discount. This insurer also offers far more types of insurance policies including home, renter’s, pet, health, life, and many others, but for the purposes of this article, we’ll just cover The General auto insurance.

Pros & cons

Pros

- Affordable rates for high-risk drivers — Lower-than-average premiums for high-risk drivers.

- SR-22 friendly — If your state requires you to submit an SR-22, The General can accommodate without significantly spiking your rates.

Cons

- Higher premiums — With fewer discounts and above-average rates, this insurer is not ideal for safe and experienced drivers.

- Fewer discounts — There aren’t as many ways to save with this company compared to other popular insurers.

How to get an auto insurance quote

Getting a quote from The General is pretty straightforward. First, you’ll go to the website or mobile app.

Throughout the site, you’ll see pictures of brand ambassador Shaquille O’Neal, who’s been working with this auto insurance provider since 2016. Go ahead and select “Get a Free Quote” next to the homepage pic of Shaq and the General to start the process.

There’s really nothing unusual or unique about the process from here. The application is basic, with typical questions and a clean and simple format that’s easy to navigate.

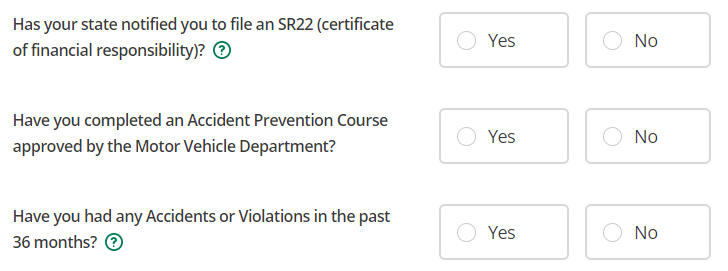

You’ll start by providing your personal information and a good email and phone number for contacting you. Nothing surprising. When you get to the bottom of the first page, you’ll indicate whether or not you have had accidents recently or been required by your state to file certain forms or take courses as a result of an incident.

If you answer “yes” to the question about accidents or violations in the past 36 months, you’ll need to choose from a dropdown menu to categorize the incident — from options including at-fault accidents, failure to yield right of way, speeding, etc. — and add another if there’s more than one.

These questions are used to determine your liability and help The General put together an accurate quote for you (though this still might not reflect your exact final offer).

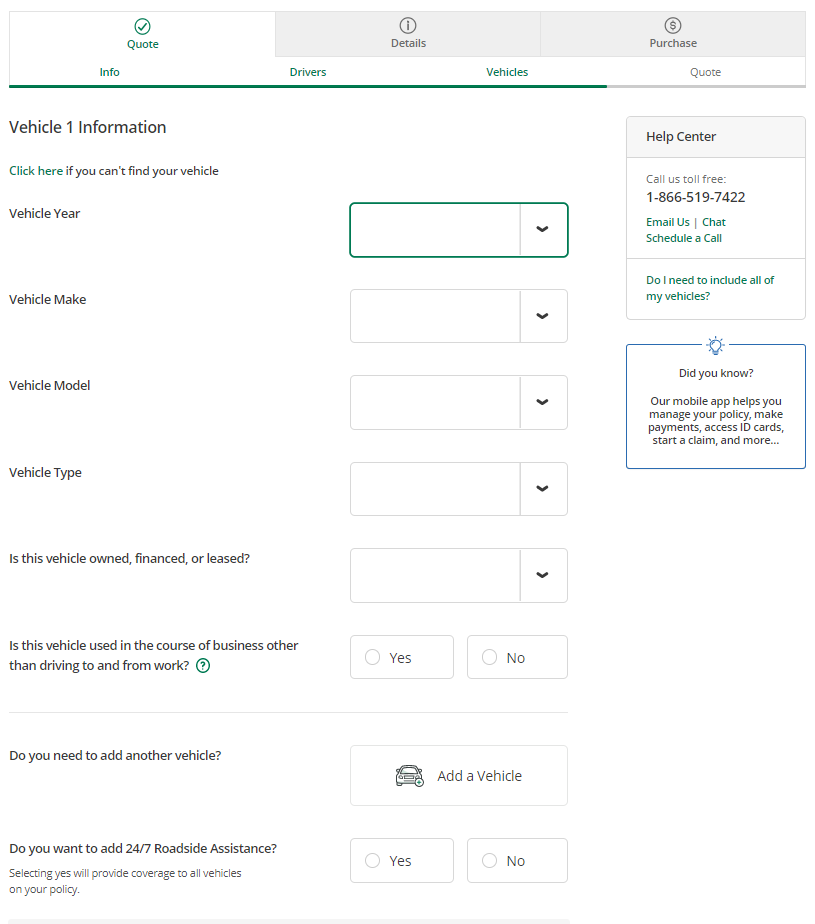

Next, you’ll include or exclude the people in your household from coverage before going to the next page. On the next page, you’ll fill in information about your vehicle and whether you own it, are making loan payments, or leasing it. If you make payments or lease, your quote will automatically show Comprehensive and Collision coverage. You’ll need to call an agent for help getting coverage if you’re planning to use the car for business.

If you want to add a Roadside Assistance plan to your policy, this is where you’d do that. This is available through Nation Safe Drivers (NSD) for an additional $11.50 a month and includes emergency roadside services, free tows within 15 miles, tire changes, jumpstart, and more.

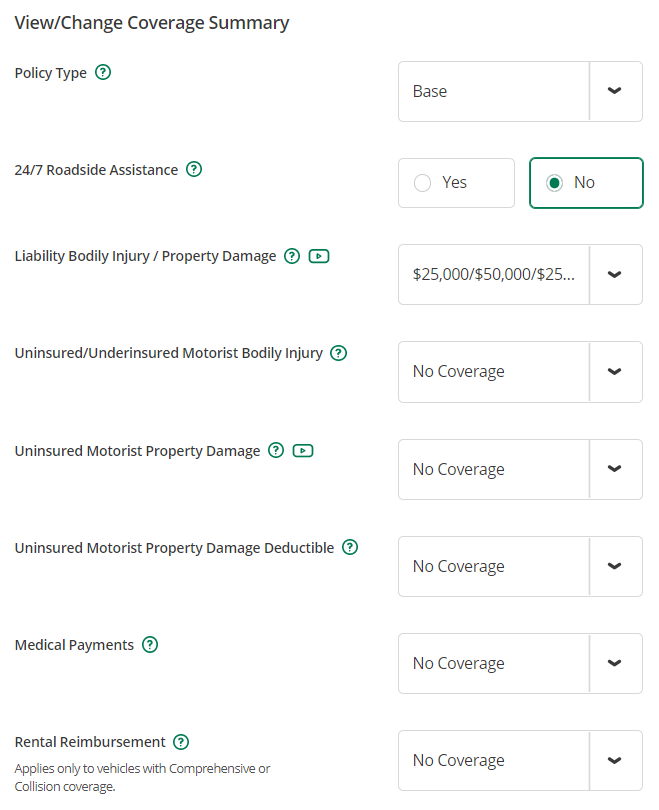

The final page will give you a coverage summary that you can customize. For example, you can add between $500 and $5,000 of coverage for medical payments, adjust your coverage for liability bodily injury and property damage, or apply rental reimbursement coverage.

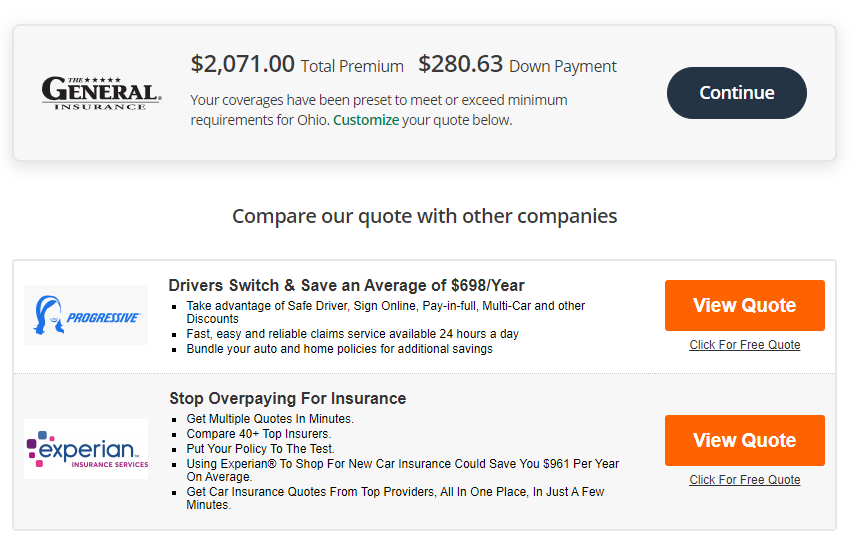

Puzzlingly, The General will also point you in the direction of other insurance providers with a section that says “Compare our quotes with other companies.” But you can’t actually compare your offers here. To actually see these quotes, you need to click “View Quote” and this redirects you to the sites for other insurers. For me, this was Progressive and Experian.

This wasn’t all that useful since I couldn’t compare quotes in one place, but maybe it could save you a couple of minutes if you’re still in the process of narrowing down your choices.

How to file claims

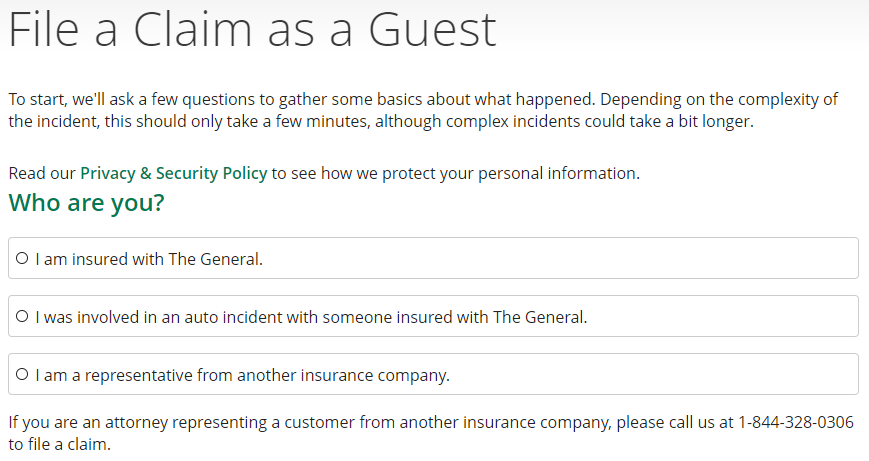

Once insured, you can file a car insurance claim by signing into your account online or through the mobile app. You can do it yourself or call 1-800-280-1466 to report a new claim any day of the week, any time.

If you have an outstanding claim and want to check its status, email claims@thegeneral.com or call 1-800-544-9021 between 8 am and 5 pm EST Monday through Friday.

You can also file a claim as a guest if you were in an accident with a driver who has auto insurance through The General or if you work for an insurance company.

Features and benefits

The General offers the most benefits for customers with less-than-perfect driving records and/or credit scores. Check out some of those here.

SR-22 insurance forms

If you’ve had multiple traffic violations in the past (especially DUI/DWIs), your state might require you to collect an SR-22 form from your insurance provider to show that you have state-minimum auto insurance coverage. An SR-22 is a certificate of insurability or proof that you’re sufficiently insured, and without it, the state can revoke or suspend your license.

Many insurance providers don’t provide SR-22 forms and those that do will sound the alarm and skyrocket your premiums if you request one. The General doesn’t.

Discounts

The General offers a few types of discounts. These are:

- Multi-car discount – Save when you insure multiple cars with The General

- Homeowner’s discount – Save if you own a home

- Academic achievement discount (A.K.A. good student discount) – Save if you’re a full-time student with good grades

- Defensive driving discount – Save after voluntarily completing a defensive driver course to learn tips for driving more safely and avoiding accidents

- Passive restraint discount – Save if your vehicle has a factory-installed passive restraint system to prevent collisions and injuries

How much you’ll save with each of these discounts depends on your base premium and the vehicle(s) you insure. Just know that when you apply for a free quote, your quoted prices won’t include discounts you might be eligible for.

24/7 roadside assistance

The General offers an optional 24/7 roadside assistance program through Nation Safe Drivers (NSD) that amounts to an additional ~$11.50 per month on your premiums. The add-on covers almost anything you could need in the event of an emergency while driving.

This can be good for long commutes or driving a car you don’t quite trust, but you may be able to find better prices and more coverage with other companies.

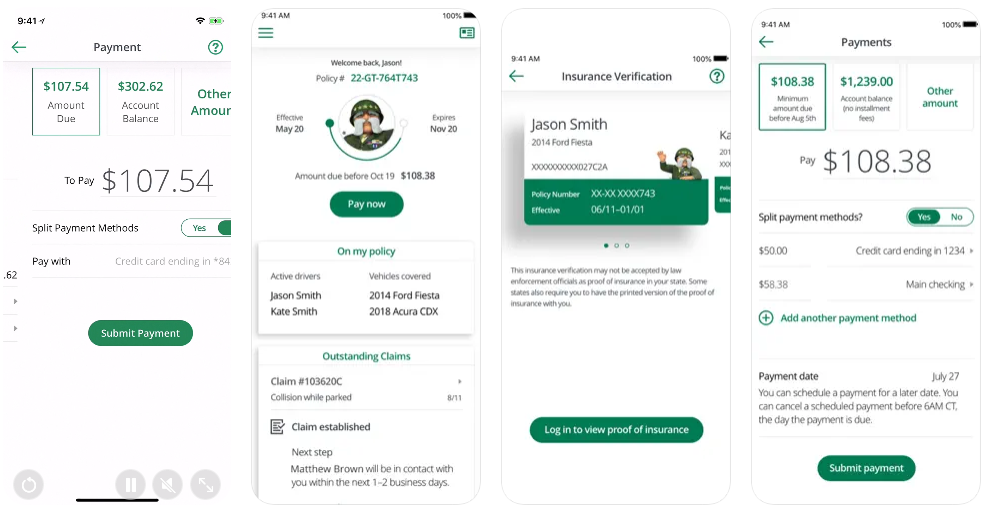

Mobile app

The General’s mobile app has 4.8 out of 5 stars on Google Play and 4.7 out of 5 stars on the App Store. A lot of users are happy with this app and use this instead of the online portal whenever they need to adjust their policy or file a claim. Bad reviews cite occasional issues making payments through the app, so consider setting up auto-pay to avoid this problem.

Customer service ratings

Consumer reviews of The General are mixed. As a rule, the biggest complaint seems to be that this company takes a while to process claims. This can be true of any insurer, but it’s a pattern on review platforms and forums for this provider. In terms of strengths, customers seem happy with the quality of service they receive when speaking to representatives.

The General Insurance’s BBB profile shows an A+ rating, meaning that the Better Business Bureau believes this insurer responds to customer complaints in a thorough and timely manner. This holds true when you review past complaints, all of which have either been resolved or answered. The General does process claims, but depending on the complexity of your situation and your own response times, you may wait a while.

People also complain about The General’s rates. As we’ve covered, this auto insurance company is in the business of doing business with drivers who have gotten themselves into trouble on the road or with their credit in the past. But it’s not going to have the lowest rates for all drivers. It’s up to you to shop around for the best premiums you can qualify for and to keep an eye on your policy so you’re always aware of rate increases.

Who is it best for?

The General auto insurance is ideal for people who have trouble getting affordable insurance with other companies.

People with accident histories

Traditional auto insurance companies take advantage of poor drivers or may decide not to insure them at all. But with companies like The General being more forgiving, riskier drivers can get insured and ultimately make the road a safer place. People who have imperfect driving records with accidents, tickets, or other traffic violations will have an easier time opening a policy with this provider. Especially if you need SR-22 forms, The General is a great choice.

People with poor credit

If your credit is a work in progress and you can’t qualify for low rates elsewhere, The General can help you save money on your auto insurance policy so can afford the insurance you need until your credit is good enough to open up your options.

Read more: How to improve your credit score, step by step

Who is it not ideal for?

Compared to other car insurance companies, The General is probably not the best choice for brand-new drivers or people who don’t have trouble getting insured. Here’s why.

Non-high-risk drivers

If you have a squeaky clean driving record, you don’t need to choose an insurer that specializes in insuring those with greater risk. As a low-risk driver, you can get insured almost anywhere and you’re likely to spend less choosing a different company.

Read more: 6 Reasons to Shop Around for Car Insurance Every 6 Months

Teenagers

Teen drivers fall squarely into the high-risk category by default, but they’re not a good fit for The General. The provider tends to spike rates following your first at-fault accident (which is not uncommon but still not ideal), so a different provider with accident forgiveness would be a better fit in the long run.

However, if you qualify for a good student discount with this insurer, it could be more comparable to others in terms of price.

Read more: Best car insurance for young adults

The General vs. competition

See how The General compares with two popular auto insurance companies.

Liberty Mutual is an insurance company that has been around for over 100 years and has consistently marketed themselves as an insurer that really cares. In fact, one of their main slogans is: “we believe insurance should ease your concerns, not cause them.”

Liberty Mutual offers a big selection of policies, including home, renters, auto, life (term and whole life), flood, business, accident, and pet insurance.

- Lots and lots of discounts

- Make a claim in minutes

- Fast quotes

- Pay-per-mile option

- A company who cares

- Not the best customer service reviews

- Not all coverage is available in every state

Liberty Mutual is one of The General’s top competitors. With far more discounts to choose from and lower base rates for most applicants, this auto insurance provider could be a better option if you’re looking for cheap auto insurance. Discounts are also available for new drivers and Liberty Mutual offers accident forgiveness, so Liberty Mutual is better for teens and young adults.

But Liberty Mutual is not ideal for people with accident histories. This company offers SR-22 forms but will typically charge much higher for those who need them. Choose The General if you have a really blemished driving record or poor credit score.

Read our full Liberty Mutual review.

Allstate

Another popular insurance provider with discounts to spare, Allstate offers affordable auto insurance for the right applicants. You won’t pay a higher premium after your first at-fault accident with accident forgiveness but Allstate does reserve its best rates for its safest drivers. The average driver is likely to pay less with Allstate, but this company doesn’t go easy on drivers with bad records.

Another popular insurance provider with discounts to spare, Allstate offers affordable auto insurance for the right applicants. You won’t pay a higher premium after your first at-fault accident with accident forgiveness but Allstate does reserve its best rates for its safest drivers. The average driver is likely to pay less with Allstate, but this company doesn’t go easy on drivers with bad records.

Especially if you’re looking to bundle and save, Allstate might be the right provider for you. But if you’ve recently been in an accident, you might need to choose The General.

Read our full Allstate review.

Summary

The General automobile insurance services can be more affordable and flexible for drivers with poor credit or those considered high-risk, but for everyone else, this is not the best company. The General doesn’t offer as many discounts as other insurers but will cover you even if your driving record isn’t working in your favor.

If you are high-risk, it’s worth taking the time to get a free quote from The General and see which rates you might qualify for. But if you’re a safe driver with decent credit, you’ll probably pay less for equivalent coverage with a different insurance provider.