![]()

Barclays Online Savings is a straightforward high-yield savings account with no minimum balance requirement. It pays a consistently high interest rate, currently 3.70.

I’m well-qualified to provide this Barclays savings review, as I’ve been a customer myself for nearly 10 years.

Overall, I’ve been very happy saving with Barclays and have kept my money parked there this year, even as some competitors offer better interest rates. Although Barclays doesn’t offer the absolute highest interest rate, its rates are always near the top and — here’s the important part — they have never lowered their rates arbitrarily.

When shopping for an online savings account, be aware of “teaser” rates from banks that don’t have a long track record of paying consistently high rates. Many banks will use a high rate to woo new depositors then slash the rate when they’ve met their goals for new cash.

Overview: Barclays Online Savings

Barclays Bank PLC, the company behind Barclays Online Savings, is a London-based international bank launched in 1690. Today, the company offers banking services to 48 million customers worldwide, and its U.S. division is based in Philadelphia.

Although Barclays Bank began in the U.K., it’s a truly international bank that’s licensed and regulated here in the United States.

Like many high-yield savings accounts, Barclays Online Savings is able to provide an above-average interest rate to savers because it’s an entirely online product. While you cannot walk into physical branches to withdraw or deposit cash, it’s easy to make electronic deposits, withdrawals and transfers via Barlcays’ website and mobile app.

Barclays Online Savings offers their flagship high yield savings account, as well as certificates of deposit (CDs) ranging from 12 to 60 months.

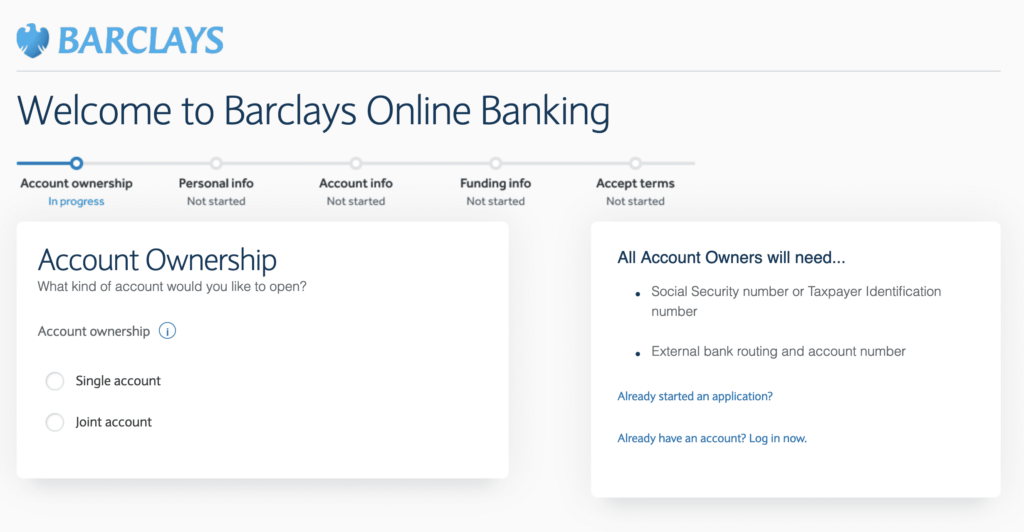

Account opening and funding

All things considered, opening a savings account with Barclays is pretty easy and can be completed in about 10 minutes. There’s no minimum deposit requirement.

You’ll need to provide some basic information about yourself, including your Social Security Number or Taxpayer Identification Number. You’ll also need to have ready the account and routing numbers from the external bank or credit union(s) you want to make online transfers between accounts.

While there is no minimum balance requirement to open an account, presumably you want to move funds to your new account to start to save money!

To fund your account, you’ll need to transfer money from one or more external bank accounts that you already own. The first time you link an account, you’ll need to verify ownership before you can make an online transfer of money into your Barclays savings account. If you’ve never done linked bank account verification before, what happens is Barclays will make two very small (less than a dollar each) deposits into your external bank account.

These small direct deposits will post to your other account in a day or two. Once they are there, you’ll need to go back to the Barclays website or Barclays mobile app and enter the amounts of the two deposits. Once this is done, you are free to move money into your new account. (Barclays will then withdraw the two verification deposits, sorry!)

Online transfers and direct deposit

Barclays allows you to connect up to three external bank accounts. Once connected, you can transfer money to or from your Barclays account from their website or mobile app. You can set these as either a one-time transfer or recurring transfers to post every week, two weeks, or month.

You can also have all or part of any direct deposits sent right to your new savings account. You can view your Barclays account and routing numbers when logged into your account and simply provide these to your employer for direct deposit.

There are no limits on transfers (deposits or withdrawals).

Other deposits

Barclays online savings accounts allow you to deposit checks directly either by snail mail or electronic capture on the Barclays mobile app. Both methods are free.

How to access your money

The only way to access money in your Barclays online savings account is to transfer it to one of your linked accounts, which only takes a day or two. Barclays does not offer ATM access or the ability to send checks from your savings account.

Costs and fees

The Barclays Online Savings account has no monthly maintenance fees or annual account fees.

Its most notable fee is a $5 non-sufficient funds fee — in other words, a penalty if you overdraw your account. But keep in mind a $5 fee is far less than the $30+ mainstream banks charge when you overdraw a savings or checking account. Other notable fees include:

- Returned deposit: $5

- Cashier’s check: $5

- Paper statement copy: $0.50

- Rush document delivery: $25

Pros & cons

Pros

- Competitive APY — The 3.70 APY is right up there with the best high-yield savings accounts offered in the U.S.

- No account minimums of any kind — Some banks require a minimum balance to open an account or earn at their highest interest rate.

- Minimal fees — You won’t pay any fees provided you use the account as it’s intended, and fees for atypical uses are low.

- Customer service — Barclays reps are available seven days a week.

Cons

- Online only — No physical branch or ATM locations in the United States.

- Limited features — No checking account capabilities.

- No chat or email support — Service reps are available by phone or postal correspondence only.

The competition: Other best savings accounts

There’s no shortage of high-yield savings accounts competing for your deposit. Some of them are currently offering even higher APYs than Barclays.

When choosing a high yield savings account, you need to weight the interest rate, features and costs of the account, and your confidence in the bank’s security. (Although bank failure is a rare occurrence, I remember in 2008 some of the very same banks offering top interest rates failed.)

Although it’s not always the case, sometimes a banking offering an interest rate much higher than the competition is a sign the bank is desperate for deposits and could soon be in even bigger trouble.

CIT Bank Platinum Savings Account

Those who can maintain a minimum balance of $5,000 or more with the CIT Bank Platinum Savings account earn a 4.00% APY. See site for details. That’s one of the highest interest rates we could find.

With no account opening or monthly service fees, the CIT Platinum Savings Account is a premier option that offers a competitive 4.00% APY with a balance of $5,000 or more.

With an initial deposit minimum of just $100 to open an account and no minimum balance required after, this is an easy high-yield savings account to open. See site for details.

- Earn up to 4.00% APY

- No monthly service fees

- Unlimited transfers and withdrawals

- Fast, easy account opening

- Balance requirement for max APY

- Lack of ATM access

There are no account opening or maintenance fees with CIT Platinum Savings so you don’t have to worry about eating away your balance (note there is a $100 minimum opening deposit to get started).

Your deposit accounts are safe and secure and insured up to $250,000 per depositor as CIT Bank is a division of First-Citizens Bank & Trust Company, a member of the Federal Deposit Insurance Corporation (FDIC). There’s also a helpful CIT Bank mobile app to deposit checks remotely and make transfers.

» MORE: Read our full CIT Bank Platinum Savings Account review

Capital One 360 Online Savings Account

The Capital One 360 Performance Savings Account is a strong contender and was the account I used prior to switching to Barclays. They pay a 4.25% APY as of May 24, 2024 (see bank's website to confirm latest rate).

Capital One typically pays a competitive savings interest rate and offers a suite of products (from free online checking to their market-leading suite of credit cards). Capital One makes it easy to open multiple savings accounts under one login — that’s helpful for saving for multiple goals because you can see the money in different “buckets”. The downside is that Capital One’s customer service can be hit-or-miss; I had an incident when they shut down my debit card for suspected fraud but didn’t alert me.

FAQs

Does Barclays Online Savings offer checking accounts?

No, Barclays Online Savings does not offer a checking account, only savings accounts and CDs.

Does Barclays Online Savings offer ATM access?

Unfortunately, no. Unlike some competing high yield savings accounts, Barclays Online Savings does not offer a debit card or ATM card. That means there is no way to withdraw funds from your savings account at an ATM.

Although that may be a deal-breaker for some, I see it as a feature, not a bug. A savings account, by definition, should be something you rarely touch. Easy access to cash from your savings account is counterproductive. Limit ATM withdrawals to your checking account!

Is Barclays Online Savings safe?

Yes, your savings are 100% safe with Barclays Online Savings. Barclays is a large, multinational bank with millions of customers. Accounts are protected with two-factor authentication.

And, if that’s not enough, Barclays is a Member FDIC and all deposits are FDIC-insured up to $250,000.

Who is the Barclays Online Savings account for?

The Barclays Online Savings account is a great fit for those who are comfortable banking online and who already have a checking account with another financial institution.

Who shouldn’t use the Barclays Online Savings account?

The Barclays Online Savings account might not be a good fit for those who are accustomed to banking in person at brick-and-mortar branches, and who are not comfortable banking online.

As a bona fide savings account, it’s not an ideal solution for those seeking a hybrid checking-savings account to handle all their banking needs.

What’s the minimum balance required for a Barclays Online Savings account?

There are no minimum balance requirements to open or maintain a Barclays online savings account. There are no monthly maintenance fees for accounts of any size.

Summary

The Barclays Online Savings account is one of the simplest tools available for saving money. It offers a consistently-high interest rate on your savings without a minimum deposit or monthly fees.

Barclays savings accounts may not be the best option if you want access to in-person banking, or if you’re looking for a mixed account that offers features for both checking and savings. But if you’re comfortable with a fully online banking experience, it’s a great option.