Banking online makes life a little easier. You can transfer money to friends, check your balance, and pay bills…all before you even get out of bed in the morning.

Chase Bank has all the tools you need to bank from wherever you are. If you maintain a certain balance, you can even get checking with no service fees. It’s an affordable, feature-rich banking option that can cover all your banking needs.

If you’re in the market for a new checking account, there are a few reasons to consider making Chase your new banking home.

What is Chase Bank?

Tracing Chase’s history is a little like looking at your own family tree. The company now known as J.P. Morgan Chase began all the way back in 1799 as a lender called The Manhattan Company. A series of acquisitions and transitions led to the 2000 merger of J.P. Morgan and Chase Manhattan, forming the large corporate lender you see today.

Chase Bank is a full-service financial institution with both an online and local presence. The company continues to add branches and is known as one of the Big Four banks. Its market dominance means it has a large selection of financial offerings, including checking, saving, investments, loans, and credit cards.

How does Chase Bank work?

There are two ways to sign up for an account with Chase Bank. You can visit one of the over 4,700 branches located around the globe, or you can join online. If you’d prefer to apply in person, you can use the branch locator to find one near you. When applying at a branch, make sure you take identification and account numbers for at least one other account you hold, whether it’s banking, a loan, or a credit or debit card.

To get a Chase Bank checking account online, go to Chase.com and click on “Not enrolled? Sign up now”, which is beneath the “Sign in” button.

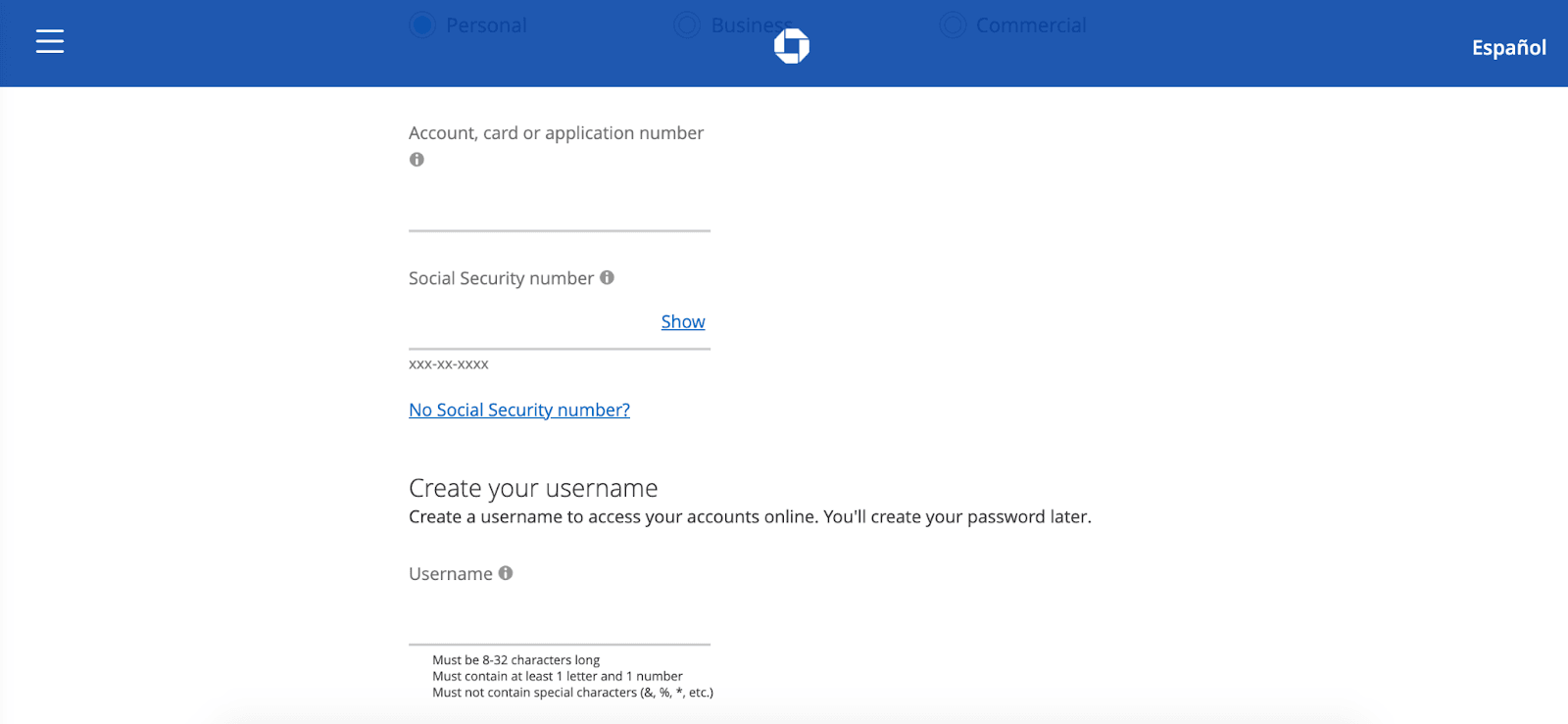

Before you start the process, gather your Social Security Number and your current bank account information. You’ll need both to sign up.

Once you have that, scroll down on the above page to provide your Social Security Number and account information. In the account information field, you can enter the number for any of the following:

- Checking or savings account.

- Investment account.

- Credit or debit card number.

- Auto loan or lease account numbers.

- Mortgage account number.

- Or an application number if you’re currently applying for one of those account types.

An important note before you continue. You can’t come back to this page to make any changes if your application is denied due to a wrong entered number. So be sure you double-check your information before continuing.

Once you’ve input your information, Chase Bank will verify your identity and take you to the next stage of the application process.

Once you’ve gone through these steps, you’ll just have to transfer some money over in time to either pay your monthly fee or to meet the minimum balance requirements (more on this below).

Pricing for Chase Bank

You have multiple checking options with Chase Bank. To help you compare, here’s the breakdown of their standard checking accounts.

| Chase Total Checking® | Chase Secure Banking℠ | Premier Plus Checking℠ | Chase Sapphire℠ Banking | Chase Private Client Checking℠ | Chase First Banking℠ (ages 6-17) | Chase College Checking℠ (ages 17-24) | |

|---|---|---|---|---|---|---|---|

| Monthly service fee | $12, or $0 with ways to waive | $4.95, or $0 with a way to waive | $25, or $0 with ways to waive | $25 or $0 with minimum balance | $35 or $0 with minimum balance | $0 | $12 after graduation (with ways to waive) |

| Fees waived at non-Chase ATMs | No | No | Yes (up to four times per statement period) | No ATM fees worldwide | No ATM fees worldwide | No | No |

| Autosave | Yes | Yes | Yes | Yes | Yes | No | Yes |

| Fee-free money orders and cashier checks | No | Yes | Yes | No | No | No | No |

Minimum daily balance requirements

If you want the monthly Chase Total Checking® fee waived, you’ll need to maintain a minimum daily balance of at least $1,500, or an average daily balance of $5,000 or more in combination of this account and a linked qualifying deposits/investments, or have at least $500 in qualifying electronic deposits (such as payroll providers or government benefit providers) made into the account.

The Chase Secure Banking℠ account’s $4.95 monthly service fee can be avoided when you have electronic deposits made into the account totaling $250 or more during each monthly statement period.

Chase Premier Plus Checking℠

For Chase Premier Plus Checking℠, you’ll need an average daily balance of at least $15,000 to have the monthly waived, but this can be distributed across all your qualifying Chase accounts, including checking and savings. If you don’t have that balance, Chase provides two other alternatives to waive: have a linked qualifying Chase first mortgage enrolled in automatic payments from your Chase account or have qualifying military ID (for current servicemembers and veterans of the U.S. Armed Forces).

Chase Sapphire℠ Banking

Chase Sapphire℠ Banking requires an average daily balance of $75,000 to waive the monthly service fee. If you have other Chase accounts linked to your checking, your balances on those qualifying accounts may count toward this $75,000 minimum.

Chase Private Client Checking℠

Chase Private Client Checking℠ requires a $150,000 minimum daily balance in all your linked qualifying deposit and/or investment accounts for eligibility on the waived service fee. If you have a linked Chase Platinum Business Checking℠ account, the fee may also be waived.

Chase First Banking℠

If you opt for a Chase First Banking℠ account, you’re in luck! It’s the only account on this list without a monthly fee to worry about.

Chase College Checking℠

Chase College Checking℠ waives the $12 monthly service fee for up to five years while you’re in college. The fee will also be waived if you have at least one electronic deposit going into your account each month of $500 or more or if you maintain an ending day balance of $1,500 or more in your checking account.

Chase Bank features

Chase is a big name in banking, but there are plenty of lenders that have both an online and local presence. Here are some of Chase Bank’s top features.

Chase Total Checking®

Chase Total Checking® is the most popular account type. You’ll get a full suite of features, including overdraft protection, access to free withdrawals at Chase ATMs, mobile banking, and online bill pay. As long as you meet the minimum requirements for waiver, you won’t pay a monthly service fee with this account.

Chase Secure Banking℠

If you tend to keep a lower account balance or you don’t have at least $500 in monthly electronic deposits, the Chase Secure Banking℠ account will be the best account for you. There is a monthly service charge, but it’s only $4.95. It can be avoided if you have electronic deposits made into the account that total $250 or more during each monthly statement period. You’ll get all the basic banking features, including bill pay and mobile banking.

Chase Premier Plus Checking℠

This account has a few perks that you won’t get with standard accounts. Unless you can keep a $15,000 balance or qualify with the other waiver options, you’ll have to pay $25 a month, though. The biggest benefit of this account is that you can use non-Chase ATMs up to four times per statement period without Chase charging you for it. Surcharge fees from the ATM owner/network still apply and a foreign exchange rate adjustment fee may apply on ATM withdrawals in a currency that’s not USD.

Chase Sapphire℠ Banking

For those who can keep a minimum daily balance of at least $75,000, Chase Sapphire℠ Banking provides fewer fees and higher daily deposit and purchase maximums.

With a Chase Sapphire℠ Banking account, you get features that include a dedicated 24/7 banking line and free personal design checks. You’ll also get fee-free ATM access worldwide with this account.

Chase Private Client Checking℠

You’ll get V.I.P. service with Chase Private Client Checking℠. This account comes with the same perks as Chase Sapphire℠ Banking, but you’ll also get a dedicated business banking advisor.

Accounts for minors

If you’re still in school or you have children over the age of five, there are two accounts for younger children to take note of. Chase College Checking℠ is for adults ages 17 to 24. This account for those enrolled in college or a vocational, technical or trade school is designed to get students started building credit and managing money. Chase First Banking℠ lets you set your children (ages six and older) up with an account and start teaching them good financial habits.

Local and online options

One of the best things about Chase is that you get access to both local and online banking options. If you want to walk into a branch and speak to a human representative, you can. But you can also bank from home or while on the go using the mobile app.

ATM access

Another great feature of a bank with a huge brick-and-mortar presence is that you get easy ATM access. Often with online banking, that can be a bit of a downside. Chase Bank has 15,000 ATMs located across the globe, giving you easy access to withdraw cash whether you’re at home or traveling.

Easy-to-use mobile app

The Chase Mobile® app lets you manage your account from your iOS or Android device. You can view up to two years of transactions and up to seven years of account statements, block transactions on your card if you’ve misplaced it, send and receive money, make bill payments, and more.

Free debit card

Once your account is approved, you’ll get a debit card within three to five days. Chase may also a Disney-themed debit card for select checking account members.

Chase QuickDeposit℠

As long as you have a mobile device with a camera and the Chase mobile app, you can deposit checks in just a few steps. Snap a picture of the front and back of your check, type in the amount, and the check will be deposited.

Special offers

Chase often has special offers to new customers. To earn a specific bonus, you’ll likely need to successfully open an account and complete qualifying transactions or meet other noted terms and conditions.

Account alerts

With your Chase account, you’ll get customizable alerts for your account activity. You’ll be alerted by text or email if your account drops below the limit you choose. You can also set alerts to notify you of large transactions or even every single payment that comes through your account.

No service fees

As long as you maintain a minimum daily balance or meet deposit requirements, you can enjoy service fee-free checking. With Chase Total Checking®, you’ll only need to keep daily balance of at least $1,500 in your checking account, $5,000 in checking and linked qualifying deposits/investments or have at least $500 in combined electronic deposits going into your account each statement period. With one of these, you avoid the monthly service fee.

Automatic savings

If you set up Chase Savings℠, you can have money automatically sent to your savings account with a few simple steps. Best of all, you won’t pay service fees on your savings account as long as you have at least $25 a month going into it. You can set it up to transfer a fixed amount on a regular schedule or a portion of every deposit.

Overdraft protection

Chase offers several options when it comes to overdrafts, like Chase Overdraft Assist℠. You can link a savings account that will kick in to cover any shortages in checking. But standard overdraft protection takes care of overdrafts by either paying them or returning them for a fee of $34. That same protection applies to your Chase debit card.

Military banking benefits

Current servicemembers and veterans of the U.S. Armed Forces with qualifying military ID get all the perks of Chase Premier Plus Checking℠ with the monthly service fee waived. Active duty and reserve military servicemembers of the Army, Air Force, Coast Guard, Navy, Marines, and National Guard who direct deposit their military base pay receive enhanced benefits:

My experience researching Chase Bank

At first, Chase’s checking account offerings were a little overwhelming. There are three separate sections: Everyday, Kids & Students, and Premium. It felt a little complicated.

But really, for most of us, the options under Everyday are going to be all we’ll need to pay attention to. And Chase Total Checking® is the most popular for a reason. Unless you have $15,000 to put into your checking and savings account (if so, lucky you!), the balance requirements of Chase Total Checking® are the best way to get fee-free checking. Just $500 in monthly electronic deposits would get me there, even if I had a month where my balance dropped below $1,500.

Other than monthly fees, picking an account is pretty straightforward. But I’d recommend deciding which one you want before you sign up. I’d also recommend taking a look at the ATM locator to see how many Chase ATMs are in your area before choosing along with familiarizing yourself with what’s offered. Outside of that, the Chase Total Checking® account has a non-Chase ATM fee of $3 per withdrawal at a non-Chase ATM in the U.S., Puerto Rico and the U.S. Virgin Islands and $5 fee per withdrawal at a non-Chase ATM outside these areas. Surcharge fees from the ATM owner/network still apply.

For me, the closest ATM is 18 miles away. Considering there are two ATMs within 10 miles of my house for my current bank, I obviously wouldn’t be compelled to switch. I was surprised there are so few Chase ATMs near me.

If you do most of your banking online and you rarely get cash, this may not matter much. I know I rarely get cash, and being able to deposit checks remotely takes away any need for a local branch. Chase Bank’s mobile and online offerings make it attractive even if you never intend to bank at a local branch.

Who is Chase Bank best for?

In-person customers

Even with all the online banking options now available, some people simply prefer walking into a bank and talking to someone. Chase has over 4,700 branches around the globe, and you can check their ATM and branch locator to make sure there’s one near you before you sign up.

Full-service bankers

Chase Bank can be a one-stop shop for all your banking needs. In addition to checking, you can get savings, credit cards, auto and home loans, and investments. You can even do your business banking through Chase. If there are balance requirements, some accounts factor your balances across all accounts into those minimums.

Those with children

Chase’s youth accounts make it perfect for parents. Once your child reaches the age of six, you can set up a Chase First Banking℠ account, complete with a debit card. You’ll then be able to use the online app to teach your child how to manage money.

Who shouldn’t use Chase Bank?

Low-balance customers

If you regularly keep a low bank balance, it might be worth pricing alternatives. You’ll pay a monthly service fee unless you can keep a minimum daily balance. If you have at least $500 in electronic deposits each month, though, Chase Total Checking® will be fee-free for you.

International travelers

Unless you qualify for one of Chase’s higher-balance accounts with no ATM fees worldwide or no Chase fee for a number of first transactions in a statement period, you’ll pay a non-Chase ATM fee per a withdrawal.

Pros & cons

Pros

- Wide range of options — Chase’s range of offerings means you can do all your banking with them.

- Prominent local presence — In many areas of the U.S., you’ll find at least one nearby local branch to do in-person banking.

- Family-friendly options — Chase has an account type for everyone in the family, starting as young as age six.

Cons

- Balance requirements — If you want freedom from monthly service fees, you’ll have to meet the minimum balance requirements.

- Low interest rates — You won’t earn interest on your checking account balances and their savings interest is lower than some competitors.

- ATM fees — When you bank online, you rely on ATMs for cash, and Chase charges fees for non-Chase ATMs on its most popular accounts.

The competition

| Financial Company | Service fees | Other fees | Unique features |

|---|---|---|---|

| Chase | $0-$35 monthly, depending on account and balance | Insufficient funds: $34 | Child-friendly accounts, branches and ATMs across the U.S. |

| Novo | $0 | Insufficient funds: $27 | Free incoming wires |

| NorthOne | $10 monthly | Insufficient funds: $25, domestic wires: $15 | Business management tools to make expensing and bookkeeping easy |

Chase vs Novo

For easy online banking, there’s Novo, a an option with no hidden fees geared toward small business owners and freelancers. Unfortunately, you won’t be able to use Novo for personal accounts, though.

Novo is an online business platform geared towards small business owners, startups, entrepreneurs, and freelancers. When you start your own business, you’ll quickly find that using your personal bank account can get overwhelming.

That's where Novo comes in with an easy to set up free checking account dedicated to separate business expenses.

- No monthly fees or balance requirements

- Unlimited fee-free transactions

- Smart Insights for your business

- No cash deposits (money order required)

There’s no monthly fees or minimum balance requirements. There are some minor general fees like a charge for an insufficient funds transactio, but even in that case, you’ll pay $27, which is still less than Chase Bank. Unfortunately, you won’t be able to use Novo for personal accounts, though.

You’ll get all the usual banking tools, as well as compatibility with the top business solutions, including QuickBooks, Shopify, and Stripe. ATM fees are also reimbursed up to $7/month.

» MORE: Read our full Novo Review

Chase vs NorthOne

If you run a small business or do freelance work, NorthOne is geared toward your needs. You’ll get unlimited banking transactions for a flat monthly service fee of $10.

With NorthOne, there are no extra fees for deposits, transfers, or purchases, although there is a $15 fee for domestic wires.

Since NorthOne is a business account, its most useful tools are geared toward managing business finances. Each purchase using your debit card or direct payments will be categorized automatically for easy expensing at tax time. You can also connect your NorthOne account to your business’s payment processor to save time.

Summary

Chase Bank is a well-known lender with a heavy brick-and-mortar presence. If you prefer in-person banking, it’s definitely one to consider, but its mobile offerings also make it competitive. Compare the monthly service fees to what you could get with competitors before signing up and make sure it’s the best option for you.