Credit can be frustrating. Understanding what counts and what doesn’t count toward your credit score, what helps and what hurts, and what you need to do to build your credit history is tough. And to make matters worse, sometimes things that definitely seem like they should count toward your credit just… don’t.

Take your bills, for example. Did you know that a lot of your bill payments don’t show up in your credit file? That means many of the bills you pay on time aren’t doing anything for your credit. That is unless you use a tool like Experian Boost®. Experian Boost reports your bill payments on your Experian credit report to boost your score and build your history.

For credit newbies or people with less-than-perfect scores, Experian Boost offers an easy solution for building credit. Find out how it works and why you might want to sign up in this Experian Boost review.

What is Experian Boost?

Experian Boost is a free feature that searches users’ online banking data for timely utility payments. It adds these to your history to bulk up your credit file with positive payments, which can improve your credit score.

This is not a credit repair service. It’s more like a credit reporting service that just notifies the three major credit bureaus about bill payments you’re already making so they can work in your favor.

Pros & cons

Pros

- You choose your bills — You can pick and choose which bills you want to count, in case there are any you’re nervous to include.

- FICO® score tracking — Experian Boost focuses on your FICO credit score, which is widely used by lenders.

- Ongoing updates — Experian will continue reporting your bill payments for a greater chance of improvement.

Cons

- No guarantees — Like most financial services Experian Boost can’t promise results.

- Credit requirements — You can’t use this service if you’re brand new to credit. You’ll need at least six months’ worth of credit to qualify.

- Must link a bank account — Experian Boost works hard to keep your data secure, but you may still be uncomfortable handing over your bank account info.

- Only affects your Experian® score — Your score with the other major bureaus—Equifax and TransUnion—won’t be affected by this service.

How does Experian Boost work?

To get started, you’ll sign up for a free account with Experian® using your SSN and personal information. Experian protects your data with 256-bit SSL encryption. You may be prompted to link a payment method and sign up for a paid account, but you don’t need to.

To qualify to use Experian Boost, you need at least six months of credit history and at least one account that has been reported to the credit bureaus. Once your Experian account is set up, you’ll navigate to the “Credit” page from the dashboard and select the “Experian Boost” tool.

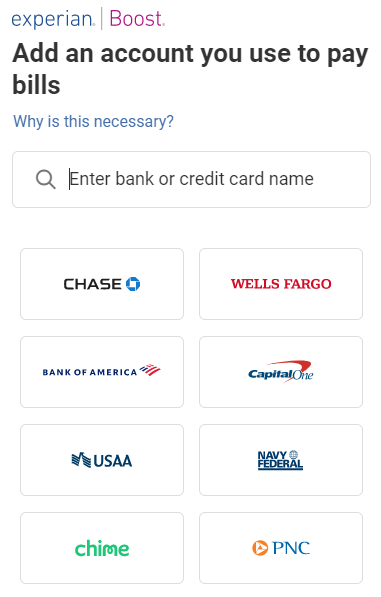

Next, you’ll link the bank accounts or credit cards you use to pay most of your bills. This will require you to authenticate your accounts by signing in and authorizing Experian to access your information.

If you can’t link your bank, Experian Boost probably doesn’t support it and you’ll need to try another option. You can add and remove accounts at any time.

After connecting your bank, you can start your boost. Experian will take a couple of minutes to scan for eligible bills.

When your boost is finished, you’ll manually select which bills you want to add to your Experian credit report of the ones found. It would be a good idea to choose the ones scheduled to be paid automatically. Each bill needs at least three payments over a span of six months to count with one of those payments being from the last three months.

You can report all of the following types of bills:

- Phone plans (including Verizon, AT&T, and T Mobile)

- Internet, cable, and satellite

- Streaming (including Hulu, HBO, Netflix, and Disney+)

- Power and solar

- Gas, electricity, and water

- Trash

This tool can even give you credit for residential rent payments if you make them through a supported online payment platform. If you pay rent with a check each month, you won’t be able to have it counted on your credit report.

If you see a bill you don’t want to add, click “Remove.” Then, verify that all other bills are accurate.

After boosting, your score may or may not improve immediately. If your credit score doesn’t improve right away, it doesn’t mean it’s not going to. Experian will check your account monthly for bill payments and update your account. But results are not guaranteed. Note that Experian uses FICO Score 8.

Pricing for Experian Boost

By itself, the Boost feature is free to use. And there are many other free resources that come with an Experian account including credit score monitoring and tracking.

You can pay to upgrade to a premium account and unlock even more tools as well as access to your FICO scores for mortgages, auto loans, and credit cards, but this isn’t necessary for using Boost.

Experian Boost features

Here are the key features and benefits that come with using Experian Boost.

FICO® score 8 monitoring

Experian uses FICO Score 8 for Boost. The vast majority of lenders are interested in FICO credit scores and FICO Score 8 is very commonly used to evaluate creditworthiness whenever you apply for credit.

But lenders get to decide which credit scores to use and may choose not to look at your Experian credit report at all. Remember that Experian is just one of three major credit bureaus. The other two, TransUnion and Equifax, also calculate your credit score but may come up with slightly different results based on which FICO score models they use and which data points they gather.

Many lenders such as mortgage lenders will pull your credit report from all three credit bureaus. But there is also a chance that a lender won’t end up looking at your Experian credit score at all when evaluating your credit file.

Customizable reporting

Experian Boost gives you the opportunity to make your on-time bill payments work in your favor when they normally wouldn’t. Noncredit bills like utilities and rent usually don’t get reported because they don’t count as credit, but this tool lets you build your history more quickly by adding some of these payments.

And you get to choose what counts and what doesn’t. You pick a bank account or credit card you’re comfortable linking and add the bills you know will work best for you, such as those with more payments and those you’re most likely to pay on time.

Positive payment history

If you have any late payments in your bank account, Experian Boost will not report these. Experian Boost only pulls information that will help, not harm, your FICO® Score. It will skip data that would count against you and you’ll also be able to remove payment history you don’t want to be tracked.

This means that there is no risk of hurting your score using Experian Boost. Although you might not see a change for the better, you also won’t see a change for the worst. That said, more payments will have a larger impact on your credit long-term, so you want to make sure you’re paying your bills on time whenever possible.

Who is Experian Boost ideal for?

Here are a few people we can see benefitting from Experian Boost.

People with limited credit history

Experian Boost is designed for “thin-file” customers or those with little credit history. Adding on-time payments to your report can demonstrate that you’re responsible with your money, making it easier to borrow in the future.

Just remember that you need a credit history at least six months old to qualify to sign up.

People who need a small credit boost

Utility payments might only raise your score by a few points. Sometimes, though, those few points are all you need to fall into a more favorable bracket for a lender.

People working to improve their credit

The lower your credit score is, the more likely you are to see improvement using Experian. The change might not be significant, but any positive movement is a step in the right direction.

Who isn’t Experian Boost good for?

This tool may not be a good fit for the following people.

People with late payments or few utility bills

If for one reason or another you don’t have many utility bills to pay or you tend to make your payments late, Experian Boost is unlikely to help you out. The more on-time bill payments you have, the better.

People with no credit

If you’re brand new to credit, hold off on using Experian to improve your score until you can show six months or more of credit. Boost isn’t designed for building credit from scratch.

People applying for home loans

Most mortgage lenders use a version of the FICO® score that isn’t affected by Experian Boost. So if you want to up your credit specifically to get a home loan, Boost isn’t the best choice.

Experian Boost vs. credit repair

If you’re reading this and wondering how Experian Boost differs from credit repair, let’s clarify.

Credit repair can mean a couple of things. First, it can mean doing the work yourself to fix your credit. We’ll talk more about this in the next section, but basically any steps you take to improve your score such as repaying some of your debt, getting control of your spending, and avoiding borrowing too much can count as credit repair and work in your favor. When your credit is in bad shape and you work to change that, that’s credit repair.

Another version of credit repair is a service you pay for. Companies offering credit repair claim to be able to improve your credit for you. They do this by getting inaccuracies removed from your credit history and disputing errors or mistakes that could be bringing your score down. Credit repair companies work on your behalf to “clean up” your credit report by talking to the bureaus, but they can’t guarantee improvement or do anything you couldn’t do yourself.

If anyone tries to tell you that you need to pay to fix your credit, walk away (or hang up, or whatever). We do not recommend paying for credit repair services.

Experian Boost can fall into your own credit repair strategy, but this tool is not the same as a paid credit repair service even if you pay to upgrade your Experian account.

Are there other easy ways to build or rebuild your credit?

There are a variety of things you can do right now to start building or repairing your credit. Here are just a few.

Get a secured credit card – Secured credit cards have higher acceptance rates than traditional unsecured credit cards. They require a refundable cash deposit as collateral but otherwise function like a normal credit card. You’ll pay off your bill each statement period and your payment activity will be reported to the bureaus and affect your credit (for better or worse).

Apply for a credit builder loan – Credit builder loans are designed to improve your credit with regular positive payments. You take out a loan and make monthly repayments with interest. This can be a good option for new borrowers and those with delinquencies.

Become an authorized user on someone else’s card – A parent, spouse, or close friend can add you as a user to one of their credit cards, allowing you to spend on their account. This can add positive payment history to your credit as long as they pay their bill on time and does not require you to qualify – but asking to be an authorized user on someone’s card is a big deal.

Summary

For those who want credit for their on-time bill payments, Experian Boost is worth checking out. This tool may not immediately improve your score or boost it at all, but it’s not going to hurt it or cost you anything.

If you’re not comfortable linking a bank account or credit card, consider other options.