Investing can be tedious, time-consuming, and utterly confusing. And if you’re investing in individual stocks, I recommend you choose anywhere from 10 to 30 different stocks. If you know what you’re doing and have the time, that shouldn’t be an issue to manage. But most of us don’t have that kind of time to analyze our investments – and let’s not forget, this includes time to buy, sell, and rebalance almost constantly.

So this is where index fund investing comes into play. If you prefer a more simplified approach, index funds can give you instant diversification and a passive way of investing in a broad array of industries – with as little as a single fund.

An investment that’s passively managed gives you time back to focus on other things – such as family, work, or your side hustle.

But the best thing about index fund investing is that it’s easy. Anyone can invest in index funds. It’s pretty hard to screw up. And since many people aren’t comfortable picking and managing individual stocks, index funds provide you a way to get the same potential returns with more “guardrails,” if you will.

On top of that, index funds take away the emotion of buying and selling stocks during the ups and downs of the market – which we’ve been experiencing for the past several months now.

What is an index fund?

Let’s first start with understanding what an index fund is (and isn’t).

For a simple look at what exactly index funds are, here’s a quick video:

An index fund functions a lot like a mutual fund or ETF in that it contains a wide variety of investments under one fund, and it trades just like a stock. Meaning, you can buy a single share of an index fund and get instant exposure to a ton of industries. The goal of an index fund is to match the specific index it follows (such as the S&P 500 or NASDAQ) as closely as possible – meaning the index fund should “contain” investments in that index.

While the Dow Jones and S&P 500 are the most commonly known indexes, there are indexes for pretty much every type of investment, every sector, every natural resource, and the list goes on. There are a LOT of index funds to choose from – which gives you the ability to mix and match them to build a portfolio that suits your style. Index funds can be purchased directly through a the best online brokerage accounts, which is what I recommend.

Technically, Vanguard is an index-fund provider since they have their own index funds. However, I still consider them an online brokerage (and one of the better ones for index fund investing at that).

And because there are sometimes thousands of stocks within an index fund, you’re not only diversifying but also mitigating risk.

And Warren Buffett has consistently said you should invest 90% of your portfolio in U.S. stocks and the rest in bonds or cash. So you could easily do a 90/10 portfolio makeup with index funds.

A point of clarification: index funds vs. ETFs

For the sake of this article, I am going to use index funds and ETFs somewhat interchangeably. A TRUE index fund (i.e., one you can buy from an index fund company like Vanguard) may have a higher minimum investment amount. It may trade more like a mutual fund (will execute at the end of the trading day).

But today, so many ETFs are acting as index funds, such as the Vanguard S&P 500 ETF (VOO), which is essentially an S&P 500 index fund that allows you to trade it like a stock throughout the day. So while there are minute differences, the differences to me are a matter of semantics.

How to invest in index funds

Now that you have a better idea of what index funds are and what they can do for your portfolio let’s break down how to invest in them.

Step 1 – Decide on an investment account

Like I said before – the easiest way to invest in index funds is through an online brokerage account.

If you already have an online broker that you’re happy with, you can skip to the next step. But if you’re on the fence and considering a change or don’t yet have an online broker, here are two things you should be thinking about before just blindly signing up.

The type of investor you are

If you’re someone who merely wants to invest in index funds and nothing more, the amount of research you’ll need to do and the tools you’ll need will be less than someone who actively trades individual stocks.

An index fund investor could get by with a low-cost (or free) online broker that doesn’t have all the bells and whistles – simply because they’re not needed. Alternatively, if you want to dive into the metrics, look at advanced charts, compare index funds, and do a lot of analysis, you might want to look at a more advanced platform.

The selection of index funds

Different investment firms will offer various index funds. For example, Vanguard has its index funds, but iShares may have a similar set of index funds. Both funds should be pretty similar, but if you have a preference for a particular type of index fund or a specific investment firm, you’ll want to consider that. For example, companies like Vanguard are great, but they only offer Vanguard funds, limiting your options.

Step 2 – Figure out your investment strategy

Remember that index funds can follow an industry (i.e., energy, steel), a type of company (i.e., large, small, South American), as well as an asset-type (i.e., stocks, bonds, treasuries).

One of the most common types of index funds you’ll see is an S&P 500 index – which tracks the 500 largest companies in the United States stock market.

If you’re just starting, it may not be a bad idea to begin with an S&P 500 index fund since it gives you such broad exposure out of the gates, but remember that you can buy multiple funds to build a portfolio that fits you and your goals.

For example, the Fidelity ZERO Large Cap Index (FNILX) tracks mutual funds with no expense ratio. So you won’t pay a dime to invest in this index fund, and your exposure will be a lot different than just a typical S&P 500 fund.

Or maybe you want exposure to specifically the energy sector. The Vanguard Energy Index Fund (VENAX) tracks all sized companies across the broader energy sector.

Whatever you decide, make sure it fits what your goals are, and if you choose to go a little more narrow (i.e., an energy index fund), make sure you’re adding a few other funds in other sectors to maintain diversification.

Step 3 – Look at costs and minimums

While index funds are typically inexpensive, not all of them are. For example, some of the index funds with Vanguard have a much higher expense ratio than I’d want to pay. You just need to know what to look for and determine what you’re willing to pay.

You might wonder why there’s an expense ratio for an index fund, especially since someone is not actively managing it. The reality is, there are administrative fees, and there are people behind the scenes managing these funds, albeit much differently than an actively managed fund where stocks are being bought and sold regularly. So the costs will be deducted from your overall returns – which is why it’s so important to understand those costs.

Here are two of the essential costs you need to think about before jumping into an index fund:

The expense ratio

I talked briefly about the expense ratio above, but it’s the main cost you should be concerned with when buying an index fund. This amount is usually not super high, but it can chip away at your yields over time.

It’s in place to manage administrative costs for running the fund. It’s worth noting, however, that index funds have significantly lower expense ratios than, say, mutual funds, which are actively managed.

The minimum investment amount

If you’re trading an ETF, there typically isn’t a minimum investment amount since it trades like a stock. But if you’re buying a pure index fund, say through Vanguard, there will likely be a minimum investment amount that you have to meet to buy into the fund. You’ll often pay a higher expense ratio for a lower buy-in amount.

Step 4 – Fund your account

If you’re investing in index funds through your company-sponsored retirement plan, such as a 401(k), it’s pretty easy to fund the account and invest. Since your 401(k) contributions are automatically deducted from your paycheck, all you have to do is pick the funds you want to invest in and set up automatic investments (more on this below). It’s relatively simple.

If you’re doing it on your own with an online broker, though (perhaps in an IRA or taxable investment account), you’ll need to fund the account however the brokerage wants you to do that. Usually, this can be done by simply making a bank transfer or ACH, and your funds are available within a couple of days.

Step 5 – Purchase shares of the index fund

Once your account is funded, you can either leave the money in the account until you’re ready to buy, or start looking right away.

To reiterate, make sure you look not only at the type of fund you’re buying but what stocks are included in it and (most importantly) what it costs to invest in. Some brokers will let you buy index funds from other companies, but they’ll charge you a premium. So if you know you want a specific fund, it always pays to check with that fund provider (i.e., iShares) to see if it’s cheaper to invest with them directly.

Of course, the downside is that your investments might be scattered across a variety of accounts, which can get confusing. So if you plan to invest in multiple different funds from different investment companies, your best bet is to get a low-cost brokerage where you can find them all for a reasonable price.

A real-life example

For a quick example, I’ll show you how simple it is to invest in an index fund using my TD Ameritrade account (now under Charles Schwab):

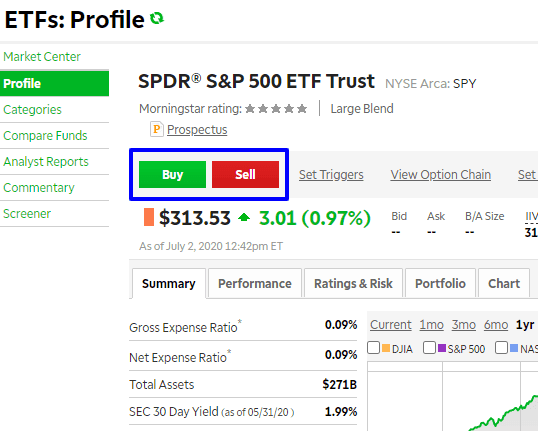

Let’s say I wanted to buy the SPDR S&P 500 ETF Trust (SPY) ETF that I mentioned earlier. I enter the ticker symbol in the search bar to start:

After clicking the search button, it’ll pull up that funds’ overview for me. Here you can see it’s currently trading at $309.98 (as of this writing) and it’s clear where I can click Buy or Sell:

So I’ll click “Buy,” and a little order screen will pop up at the bottom of the screen (most others will take you to a separate page).

And from here it’s pretty straightforward. You can set a limit price or just buy it at the market price, determine how many shares you want, and submit the order. It’s that simple.

Step 6 – Automate

If you’re investing with your 401(k), by setting your contributions and where they’re going, you’re already doing enough. But if you have an online brokerage, it will get a little more complicated. The best thing you can do is set up an automatic, recurring contribution to your account every time you get paid. This way, your account will be continuously funded.

Some brokers will allow you to invest those contributions automatically. In contrast, others will have you make the investments on your own (if you want to invest automatically, look for brokers that offer fractional share investing).

Step 7 – Monitor and rebalance

Now that you’ve invested in an index fund (or funds), it’s time to set up a calendar reminder to check in on your portfolio. Some people will do this naturally, but I like to set up monthly reminders to go in and check on how my portfolio is doing.

I want to make sure my asset allocation is still correct. I don’t need to make any significant changes to my investments. You’ll want to make sure you rebalance at least semi-annually, if not quarterly, too.

Where should you buy your index funds?

I’ve talked a lot about brokerage accounts above, so now I’m finally going to recommend two of the best options:

Robinhood

Robinhood functions right off of your phone, so if you’re looking to make index fund trades without getting on a computer and from the ease of your phone, this is your best bet. Robinhood doesn’t charge any fees for investing in stocks and ETFs/index funds, either, making it a cheap option.

Robinhood also has a really useful newsletter called Robinhood Snacks. They serve up bite-sized content on information that you need to know. This is helpful if you’re looking for quick information, rather than diving into overly-complex opinion pieces.

» MORE: Read our full review of Robinhood review.

E*TRADE

E*TRADE is an incredibly powerful platform. In fact, it’s my number one recommendation for investors who want to buy individual stocks, since the amount of tools and resources E*TRADE provides isn’t matched by other online brokers.

With that said, it might be a bit overpowering for you if you’re JUST looking to invest in index funds. I’d say if you were going to do some index funds AND a handful of individual stocks, it would pay off for you, but otherwise, E*TRADE might be a bit too advanced of a platform.

The advantages of investing in index funds

Index funds offer a surprising number of advantages to investors, especially small investors.

Some of those advantages include:

Low minimum investment

You can generally invest in index funds with just a few dollars, not thousands.

Ease of diversification

Since index funds usually have no minimum required for investment, you can spread a relatively small amount of money across several different funds.

Low cost

Index-based ETFs can be traded at most major brokerage firms commission-free. That will remove trading fees from your investment performance.

Favorable income tax consequences

Since index funds rarely trade securities, they’re less likely to generate taxable capital gains than actively managed funds and individual stocks. This enables your fund to grow without tax consequences, at least until the day you sell your position.

Low expense ratios

Since index funds only trade securities when the composition of the underlying index changes, they have very low expense ratios (often less than 0.20% per year) to reduce your investment performance.

Simplified investing

Index-based ETFs trade like individual stocks. They can be bought and sold at any time, and the absence of commissions at most brokers makes it even easier.

Passive investing

Since index funds are based on market performance, you don’t need to be concerned with what securities to buy and when. You simply invest your money and relax.

Build your portfolio any way you want

Since there are so many different sectors index funds are based on, you can create a portfolio based on your preferred industry or geographic groups.

If you ever doubt the many advantages of index funds, consider that not only have they become popular among traditional investment managers, but they are also the mainstay of nearly all robo-advisors. That speaks volumes about how far index funds have come.

Are there any disadvantages to investing in index funds?

There isn’t an investment on the planet that doesn’t have disadvantages, and index funds are no exception. Though they should represent the foundation of your investment portfolio, there are a few disadvantages you should be aware of.

Index funds will never outperform the market

If that’s your hope, it will never happen with index funds. As already stated, index funds are designed only to match the underlying index.

Index funds aren’t for self-directed investing

The only aspect of self-directed investing provided by index funds is your ability to choose which ones to invest in, how much to invest, and when to sell.

Index funds CAN lose money

Index funds are investments in markets, and markets can decline just as individual securities can.

Index funds can prevent you from building your investment muscles

One of the most fundamental advantages of index funds – passive investing – can also be a disadvantage. Because you literally don’t need to know anything about investing, or even do anything about it, you may not expand your investment knowledge.

For example, since index funds are based on markets, there’s no need to learn anything about investing in individual stocks.

Index funds vs. actively managed funds

No discussion of index funds would be complete without comparing them to their first cousins, actively managed funds.

Generally speaking, index funds are exchange-traded funds, though an increasing number of mutual funds are also going the index route. By contrast, actively managed funds are usually mutual funds.

The basic difference between the two is that while index funds merely track an underlying index, actively managed funds attempt to outperform the index by buying and selling securities at hopefully opportune times. The fund manager hopes to accomplish this by investing in the strongest performers in an industry group.

Disadvantages of actively managed funds

The problem with actively managed funds is that they underperform the market between 85% and 92% of the time.

But underperformance isn’t the only problem with actively managed funds.

The other disadvantage is fees. As mutual funds, actively managed funds often charge load fees of between 1% and 3% of your investment in the fund. Load fees may be charged either on purchase, sale, or both. For example, an actively managed fund might charge a 1% load when you purchase the fund, then 1% when you sell it.

They have higher expense ratios

In addition to load fees, actively managed funds have higher expense ratios. This is due to the fact that they trade securities within the fund much more frequently than index funds do. These expense ratios, which can be around 1% each year, can seriously reduce the performance of your fund over the long term.

Since index funds are usually ETFs, there are no load fees. And these days, ETFs can be purchased and sold with most major brokerages commission-free.

A third potential limitation with actively managed funds is that they often require large minimum investments; usually it’s $3,000. This is very different from index-based ETFs, which usually have no minimum investment requirement.

Who should invest in index funds?

Truth be told, investing in index funds is for virtually everyone. That’s proven by the rising popularity of these funds in recent decades.

But along with their general appeal, index funds are an excellent choice for the following types of investors:

New investors

If you’re new to investing, investing in individual stocks is not recommended. There’s a long learning curve, and it’s much more time- and labor-intensive than most new investors realize. Also, you may need to “babysit” your portfolio, paying close attention to daily news reports and stock price swings.

Index investing gives you the ability to put your money into funds that are tied to broad markets. Your performance will never exceed the market, but it won’t underperform either. That’s a good place to be until you learn the ropes.

Passive investors

Millions of people want to invest, but they either lack the time or inclination to do it. Index funds are perfect for passive investors because they handle the job of investing for you, freeing up your time for other pursuits.

For example, many people today have demanding careers. They may want to invest, but their jobs take up most of their time and energy. Index funds allow such a person to invest money, without needing to concentrate on the investment corner of their lives.

Intermediate investors looking to transition into self-directed investing

Perhaps you’re somewhere in between being a new or passive investor and a self-directed investor. If so, index funds are an excellent investment foundation. You can hold most of your money in index funds, then begin self-directed investing with small amounts.

As your expertise grows, you can gradually transition your portfolio from index funds into the self-directed portion of your portfolio. Alternatively, you may decide to keep both on a permanent basis. Index funds give you that option.

Retirees

There was a time when retirees moved their retirement portfolios into safe, interest-bearing investments that reliably yielded 5%, 10%, or more. But those days are long gone. If you retire, you’ll need to have at least some of your money invested in the stock market. Without a doubt, the easiest way to do that is through index funds.

You’ll be able to maintain the desired amount of your portfolio in stocks, but without the job of investment management getting in the way of your retirement. If you have stocks in your portfolio when you’re retired – and you will almost certainly need to – index funds are the best way to do it.

Summary

I love index funds, especially for new investors or investors who would rather just have a hands-off approach. Make sure you know what an index fund is, how it tends to perform, what it tracks, and the pros and cons.

From there, ensure you’re buying funds that match your investment goals and objectives and don’t just blindly pick funds because someone told you to. In the end, an index fund can be a phenomenal investment strategy — and be very passive, yet return excellent gains over time.