With no minimum to open an account and only $5 required to start investing, the Acorns app ranks as one of the best robo-advisors that’s safe to use for new investors. The useful features from Acorns, like Round-Ups® and Smart Deposit, and a well-designed mobile app make it easy to save and invest.

Our editorial team has decades of experience researching the best personal finance products with the valued context of over 500 financial service reviews published. When evaluating a robo-advisor, like in this Acorns review, we contemplate ease of use for beginning investors, saving and investing tools, how much the cost is, and more to give perspective users the big picture before signing up.

Acorns makes it easy to start investing (even if you know nothing) and provides helpful tools to help you save more automatically. In under 3 minutes, start investing spare change, saving for retirement, earning more, spending smarter, and more.

- Effortless automated investing

- Easy-to-use savings features

- Low-cost solution to manage money

- Flat monthly fee more expensive for smaller accounts

- Can use more robo-advisor features

What is Acorns?

Acorns is a multifunction financial app that offers automated “micro-savings”, investment portfolios, a checking account, and a shopping coupon and cash-back tool. Acorns offers five main different products: “Invest”, “Later”, “Early”, “Earn”, and Acorns “Bank”/”Checking.”

Each Acorns product works on its own or in conjunction with the others.

Acorns Checking offers an easy-to-use checking option. You can set up recurring deposits to Invest and Later, as well as round up your purchases, with the spare change going toward your portfolio. But one of the best features with an Acorns checking account is Smart Deposit. With this, Acorns lets you set up your direct deposits to automatically split between your checking, savings, and investments.

Acorns’ shopping savings and cash-back tool, Earn, is a free add-on for all members. With a free Chrome extension, you can earn cash automatically when you buy 15,000+ offers from over 450 brands.

Whether you use one of Acorns’ features or all of them, the company’s goal is to provide members with all of the tools they need to set money aside for the future.

Acorns pros & cons

Pros

- Automate your investments — Acorns makes automatic investing effortless. You do not need to know anything about the stock market to start investing in just 10 or 15 minutes.

- Easy-to-use saving features — Round-Ups® and Smart Deposit features can help even the most hapless savers put some money away.

- Low-cost investing and saving — With the $3/month Personal plan you get checking, investment, and retirement accounts that are seamlessly integrated. It’s beautifully simple money management. (If only there were a savings account, too).

Cons

- High fees on small accounts — For investment accounts of certain smaller balances, Acorns is more expensive than competitors.

- Invest product is very basic — Other robo-advisors can offer richer features and slightly more control over your portfolio depending on what you select.

How does Acorns work?

Acorns Invest is a robo-advisor that invests your money for you in one of their automatically-managed portfolios. It’s Acorns’ foundational offering.

Although all robo-advisors offer the ability to schedule automatic investments from a linked bank account, Acorns Invest offers the option to use Smart Deposit. You can schedule automatic investments as often as daily. But you can also turn on “round-ups”. With Round-Ups®, Acorns will automatically round up purchases made on your linked accounts and invest the difference.

Acorns Later works like Invest but adds the ability to invest for retirement in an IRA. You can make automatic investments of as little as $5 at a time in your Later account.

Acorns Checking (under Acorns Banking) is a full-featured, FDIC-insured checking account that comes with a cool tungsten metal debit card. Using the Checking account makes Round-Ups® and other automatic investments instantaneous. The Smart Deposit feature can automatically set aside money from your deposits before you spend it. It’s an automatic, built-in way to pay yourself first. (This is, in my opinion, the very best savings habit you can have!)

Acorns Earn is a suite of cash-back and other savings tools designed to help you save and earn money in your everyday life. You can link debit and credit cards or use a Chrome browser extension to take advantage of special pricing and cash-back deals from over 400 top brands including Apple, Airbnb, Hotels.com, Nike, Walmart, and more. Acorns Earn also has job search tools to help you find better-paying work or even a side-hustle.

Acorns Early adds the ability to save for one or more children’s futures with UTMA/UGMA accounts.

Acorns plans and pricing

Acorns plans and pricing are straightforward. There are three simple, transparent plans: “Personal,” “Personal Plus” and “Premium.”

Acorns Personal

Acorns Personal plan includes basic investing tools for $3/month. You get access to a taxable brokerage account and IRA retirement account. You can earn through 450+ in-app partner brands (Acorns Earn) and open the checking account mentioned above. You’re also provided with videos and tips from Acorns that can be helpful for both new or experienced investors.

This tier of Acorns may be enough for you if you’re just starting out your financial journey.

Acorns Personal Plus

As the name Acorns Personal Plus name implies, this is the Personal plan plus available for $5/month. You’ll get access to the same taxable brokerage account and IRA investment account. Your checking account will include an optional non-interest-bearing demand deposit account separate from your investments and spending called the Acorns Emergency Fund. This lets you adjust for any out-of-budget expenses that may pop up.

You’ll earn through the same 450+ in-app partner brands with Acorns Earn but also receive a 25% match on rewards, up to $200 per month. The videos and tips acorns provides to Personal plan members comes with live Q&As with investing experts in this more premium plan. It’s everything that’s in an Acorns Personal plan and a touch more across the board.

Acorns Premium

Acorns Premium includes everything you need to save and invest you both you and your family for $9/month. There’s the aforementioned same taxable brokerage account and IRA investment account available as with the other plans, but you’ll also be able to customize your portfolio with the ability to add individual stocks. That’s exclusive to the the Premium account with Acorns. Another feature with this account is Acorns Early, which lets you open an investment account for your kids.

Then there are the features that make Acorns Premium really stand out from the other plan options. With Premium, there’s a $10,000 life insurance policy for eligible customers and a partnership with Trust & Will that provides you a complimentary Will for yourself or yourself + spouse or a Trust at a discounted rate. The no-cost Will to help plan for your family’s future is valued up to $259.

Acorns Premium tier subscribers are also offered a GoHenry account for free. GoHenry is an app designed to help parents teach their kids and teens about money. Kids get access to a debit card to make their own purchasing decisions while on the other side parents are provided real-time visibility and notifications showing you how much was spent and where. There’s also a chore tracker and a feature for automated allowance included with GoHenry.

Acorns features

Let’s take a look at the features of Acorns’ product suite that makes the app stand out as one of the best personal finance apps.

Sign-up offer

Acorns allows you to claim a sign-up $20 bonus investment offer via our Acorns link in three simple steps. This is a limited time offer where terms and conditions apply (of course).

-

- Set up your Acorns account in under 3 minutes

- Set up recurring investments

- Make your first successful recurring investment (min. $5) – get your $20 bonus within 10 days of following month

» Get your $20 bonus with Acorns

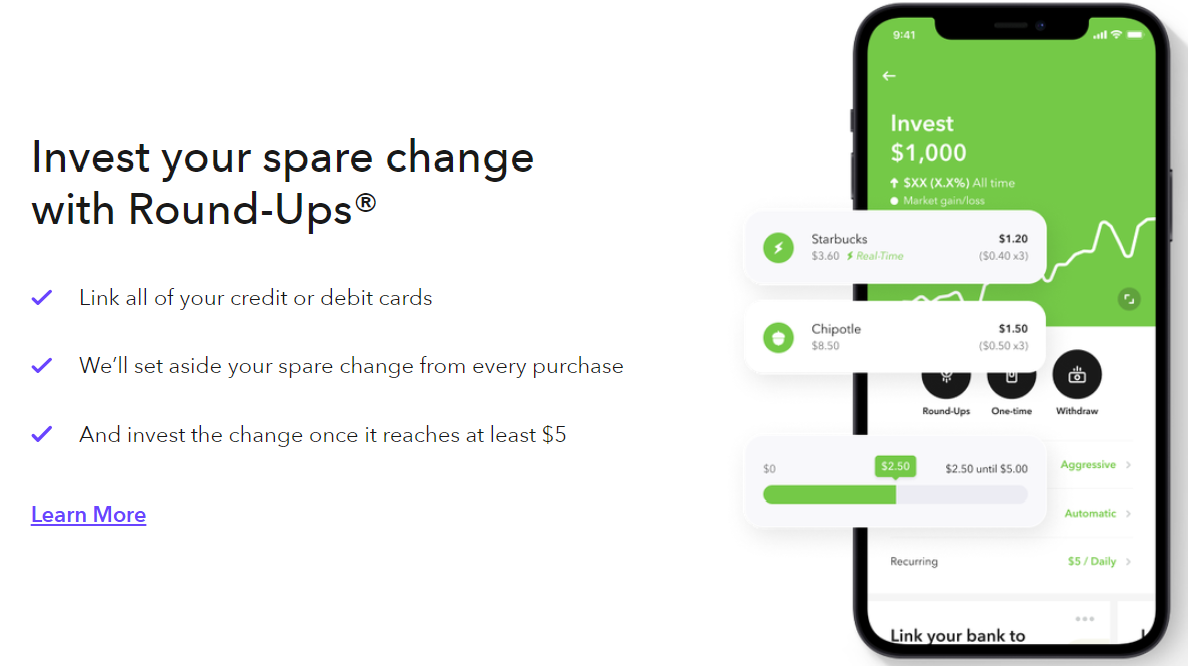

Round-Ups®

Perhaps Acorns’ most novel feature is the ability to link your credit and debit cards to the app and have it round up your purchases and invest the difference.

Acorns downloads the purchase history from your linked credit and debit cards, tallies the spare change from purchases, and once the change exceeds the $5 threshold, withdraws that amount from your checking account and invests it.

Using the Round-Ups® feature isn’t necessary to invest, but it’s a nice touch that’s in line with my belief that the best way to save and invest is to find ways to automatically set aside money before you even miss it. The Round-Ups® feature does just that with $3,000,000,000 invested in spare change and counting among users according to Acorns. That’s a big number!

Smart Deposit

Another great feature of a checking account with Acorns Checking is Smart Deposit. After setting it up, you can have a portion of your paycheck or other regularly-scheduled deposits automatically deposited in your investment or retirement accounts.

With Smart Deposit, you are paying yourself first. Your money is invested for you before it ever hits your checking account.

Bonus investments

Using Acorns Earn, you can earn bonus investments when you shop at participating merchants via a linked credit or debit card or the Chrome browser app. Bonus rates vary by merchant. Acorns will automatically add the bonus to your investment account between 60 and 120 days following your purchase.

Sustainable investing

When you invest using Acorns, you aren’t just putting money toward your own future. You can invest using Acorns’ ESG (Environmental, Social, and Governance) portfolios to add sustainable companies to your portfolio and invest in companies you truly believe in.

No hidden fees

Acorns’ simple monthly pricing is all-inclusive.

With Acorns Invest, there are no trading fees or commissions.

With Acorns Checking, there are no overdraft fees, maintenance fees, or ATM fees at ATMs within the Allpoint network (over 55,000 ATMs nationwide).

Bank fee recovery

If you’ve been charged for insufficient funds or purchase interest, Acorns can help. Acorns will identify unnecessary banking fees and, thanks to built-in technology from Harvest by Acorns, you’ll have the tools necessary to dispute them.

My experience using Acorns

Signing up for Acorns is easy and takes just minutes whether you do it online or via their iOS or Android apps.

You will need to select your plan tier when you sign-up. After creating your account, you will need to link a checking or savings account. An exterior checking account is recommended for this. This account will be used for investments and also to pay your monthly membership fee.

To get started with Acorns Invest, you’ll answer a few questions about:

- Your investing goals

- How long you have to achieve those goals

- Your comfort level with risk

Acorns will recommend a portfolio for you based on your age, time horizon, income, goals, and risk tolerance. These ETF portfolios range from aggressive (which is all stocks) to conservative (meaning all bonds), with a mix on the options scaled in-between.

- Conservative

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

You can go with the portfolio Acorns recommends or choose another, but that’s it – there’s five different core Acorns portfolios and four ESG Acorns portfolios. The ESG portfolios from Acorns, depending on which you select, have you invest in a mix of companies, markets, and bonds. That may seem limiting, but remember Custom Portfolios is one tool Acorns offers that provides you the option to add individual stocks and ETFs (included in Premium).

After you have selected your portfolio, you can set up your automatic investment schedule and, optionally, the Round-Ups® feature. That’s it! Acorns will pull your investments from your linked account according to the rules you set up and automatically rebalance your portfolio as the market moves.

To be honest, all robo-advisors make it easy to open an investment account. But Acorns might just have the smoothest onboarding process of the ones I’ve seen. You can go from no account to set-up for automated investing in less than 15 minutes. You could probably even do it in less than 10. And again, no account min. and just $5 to start investing.

My experience with Acorns is limited to the Invest product. As much as I’d like to personally try every app that offers a checking account, I’ve simply tired of opening (and later closing) dozens of new bank accounts to test them all. Establishing new accounts is also costly to the banks if I’m not intending to use them for years.

But as you can imagine, a checking account is a checking account. A checking account with Acorns offers mobile check deposit, no minimum deposit requirements, and a Visa debit card. You have access to over 55,000 free ATMs in the Allpoint network. There is a $500 daily withdrawal limit on the account.

The one thing to note about checking is that it’s not free – you’re paying monthly fee to have access to Acorns Checking and Acorns Later. Although the cheapest $3 a month is cheaper than many checking accounts at national banks, there are many competitive online checking accounts that are entirely free.

The primary benefit (other than an arguably cool matte green metal debit card) is the Smart Deposit feature that can automatically divert a portion of your direct deposits into your investment account. Is that worth a couple of bucks a month? Honestly, I think so. It’s pretty cheap if it helps you get in the investing habit.

Who is Acorns best for?

I think Acorns is an excellent product if you:

- Could use some help sticking to a savings plan

- Don’t know a lot about investing and don’t have a lot of money to invest, but want to start putting something into the market

- Just want a really simple investing app or combination investing and savings app

Here’s the thing: Acorns could be a beautifully simple total money management tool. By offering investment, checking, and retirement accounts in one app, you don’t need much else.

The big thing that’s missing is an interest-bearing FDIC-insured savings account. I’m actually quite surprised Acorns doesn’t offer this.

If Acorns were to add a savings account component, I could easily see someone needing only an Acorns account and, perhaps a credit card, to manage their money. It would be beautiful in its simplicity.

Even when I was 25 years old, I had checking, savings, and investment accounts at three different financial institutions. Today, I have accounts at more than a half dozen different financial institutions (not counting probably a dozen more I’ve opened for review purposes). How wonderful it would be to have one app and be done with it!

» Get your $20 bonus with Acorns

Who shouldn’t use Acorns?

Acorns is not the app for investors who want a high level of control over their portfolios. You may prefer one of the best brokerage accounts instead.

Additionally, Acorns is not a replacement for an emergency fund held within an FDIC-insured savings account. If you have the Acorns Personal plan, your money will be stored in one of two places: a checking account that doesn’t earn interest or an investment portfolio comprised of stock and bond exchange-traded funds (ETFs).

Unlike cash in a savings account, investment accounts can lose value. They are the best way to grow your money over years and years, but they are volatile in the short-run. You want your emergency savings to be there for you when you need it (at a moment’s notice).

An investment account is a great way to save for goals that are many years in the future. But you should always keep some cash in an interest-bearing savings account in case you need it in a hurry.

Finally, you should think carefully about choosing Acorns Invest over a different robo-advisor if it will take you a long time before you invest $5,000 or more invested. Why is that?

Most robo-advisors charge an annual fee as a percentage of the money you have invested. Many companies charge 0.25%. On a $1,000 investment account, that works out to just $2.50 a year compared to the $12 you’d pay with Acorns. The breakeven amount is $4,800. Now, the interesting thing is that as your investment balance grows, Acorns Invest starts to become an incredible deal. If your balance grows to $100,000, you’re still just paying $12 a year with Acorns but you’d be paying $250 a year with the other guys. For retirement accounts, you need to have an account balance of $14,400 before Acorns Later becomes cheaper than some of the competition.

The competition

There are a lot of great robo-advisors and we’d rank Acorns near the top (check that list, it’s there), but Acorns isn’t trying to directly compete with most of them. Acorns is squarely focused on helping new investors get in the investing habit. However, if you did want to compare two directly, here’s how Acorns stacks up.

Acorns vs Wealthfront

Wealthfront is a popular robo-advisor that’s geared more towards long-term investors with sizeable balances, offering both investing and checking accounts. I don’t consider it a direct competitor to Acorns, but I think a comparison is useful.

Wealthfront is designed for young professionals, anyone from passive investors who want expert digital guidance, to people who want to be smarter with money.

With low fees and multiple tax perks, automated investment management tuned in to your individual risk level make Wealthfront worth a look.

- Passive investing with automated management

- Tax-loss harvesting

- Ability to customize portfolios

- No fractional shares of ETFs in automated accounts

- No human advisors

A Wealthfront investing account requires a $500 minimum investment and costs 0.25% of your invested assets per year. That works out to $2.08 per month for every $10,000 invested. This makes Wealthfront’s investing accounts considerably more expensive than Acorns. But you also get more for your money.

For example, all accounts at Wealthfront benefit from tax-loss harvesting, a feature that strategically sells underperforming investments to reduce your annual capital gains taxes. Accounts with $100,000 or more unlock more powerful tax-loss harvesting at the stock level and Risk Parity, an enhanced asset allocation strategy. Accounts with $500k or more unlock the Smart Beta feature which uses AI to future fine-tune your stock allocation.

Wealthfront’s checking account is free and actually pays interest – 5.00% APY currently. All it requires is a $1 opening deposit. Wealthfront’s Self-Driving Money™ feature can use AI to automatically pay your bills and divert money to other savings and investment accounts. You can also organize your money into specific savings buckets, like an emergency fund and vacation fund.

Investors with higher balances may benefit from increased returns thanks to Wealthfront’s advanced investing features – potentially offsetting the increased fee as it’s a percentage rather than flat like Acorns.

» MORE: Read our full Wealthfront review

Summary

Acorns has competitors that both cost (a little bit) less or offer (a little bit) more. But I don’t know of any other product that makes it easier to start investing and develop the investing habit.

You don’t need to know anything about the stock market. And with this micro-investing app you can invest as little as $5 at a time – literally the spare change that’s leftover after a few debit card purchases. You’ll also earn bonus investments while you shop, with your spending tracked in the background.

Acorns isn’t for everybody. Investors who want to trade stocks, for example. As your balance grows, you may consider paying more for features that might increase your returns. But I think Acorns is an excellent product for anyone looking to invest for the first time or find a painless way of investing a few more dollars each month. It could also be a great way to simplify your finances and use one app for your everyday checking account, IRA, and investment account.