Ten percent? Twenty percent? More?

I’ve written a lot about the benefits of both 401(k)s and IRAs. We’ve also looked at the emerging Roth 401(k) option and when it makes sense for young investors.

But everybody’s next question is: “Okay, okay, but how much should I put into my 401(k)?”

There’s no one-size-fits-all answer

One of the most popular posts in this blog’s ten-year archives is “How Much Should Be In Your 401(k) At 30?”

I was 25 when I wrote it, trying to decide how much to contribute to my own 401(k).

But what I learned from over 200 (sometimes nasty) comments is that setting a savings benchmark by age alone is silly; no two savers are the same. You can’t compare the engineer who graduated at 22 into a $65,000-a-year job with no student loan debt to a doctor who starts practicing at 29 and has $200,000 in loans. Or the social worker earning $35,000 a year and needing all of it just to eat.

You can use this basic 401(k) calculator to estimate how much you will save on your 401(k) based on your personal status:

Today I want to provide slightly more tactical advice. As a percentage of your income, how much should you contribute to your 401(k)?

- If you’re in debt?

- If you can also do a Roth IRA?

- If your employer does not match funds?

The two fundamental rules of retirement savings

Here are two rules that will apply to almost everyone:

- If your employer matches 401(k) funds, contribute enough to get the full match. Do this first. Even if you’re in debt. Even if you don’t put in a penny more. It’s free money, and you should take it.

- Next, if you can contribute to a Roth IRA, work on contributing the full annual limit a year to that account before you contribute any extra to your 401(k) (aside from what’s necessary to get the employer match). This will give you a nice cushion of tax-free cash in retirement.

Figure out the ratio you’re the most comfortable with—but keep upping your savings

There are lots of ratios out there recommending how to divide up your income. Some are as simple as spend 50%, save 50%. Although an admirable goal, most people will have a hard time with this. Especially in your twenties. I like 75/20/5.

- Spend 75%

- Save 20%

- Give 5%

But figure out the ratio you’re comfortable with. You may want to defer charitable giving until you’re debt-free. If you need most of your income to eat, it might be spend 90, save 10 or even 95/5. That’s okay. But you should reevaluate this as your financial situation changes and aim to get to at least 80/20.

In this example (75/20/5), if you earn $40,000, you would spend $30,000 or $2,500 a month, save $8,000 a year, or $667 a month, and—if you want—set aside $2,000 a year for your chosen causes. Note that we’re working off of before-tax income, so that $2,500 a month for spending might be more like $2,000 after taxes).

Working backwards from this, let’s say your employer will match up to half of a 6% contribution to your 401(k). So 6% of your pre-tax income is $3,000. Your employer throws in $1,500. You put that in, and you have $3,500 left in your savings budget.

If you don’t have a fully funded emergency fund, this comes next. Open a simple online savings account—they’re boring, but safe—and load it with cash.

If you have plenty for a rainy day, then you return to your retirement options. If you qualify for a Roth IRA, that’s probably where the $3,500 should go. If you don’t qualify or have more than that max left to spend, return to your 401(k) and up your contributions.

The four levels of retirement savings

The lesson is: Figure out what percentage of your income you can save in total, and allocate it appropriately:

Level 1: Max out your employer match in your 401(k). (Free money!)

Level 2: Max out your emergency savings (about six months’ living expenses).

Level 3: Max out your Roth IRA (up to the annual cap).

Level 4: Max out your 401(k) (up to a total limit for employee contributions).

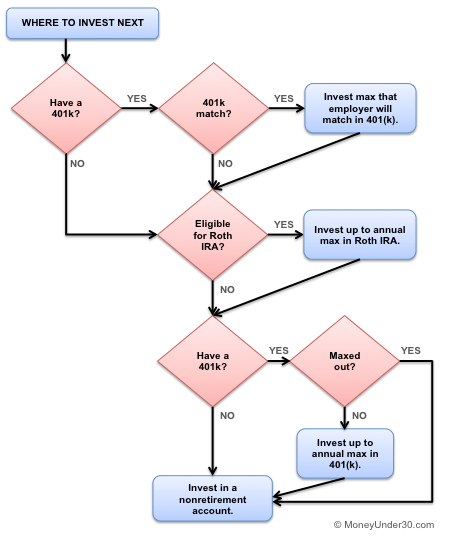

This flowchart will also help.

If you’re in debt, focus on high-interest balances while you save

If your employer matches 401(k) contributions, put in enough to get that match, even if you’re in debt.

Next, if you’re in credit card debt, stop. Put your extra money towards paying that off before making additional retirement contributions. Focus first on getting out of credit card debt and then come back.

Got student loans? Follow the above schedule anyway. Unless your private loans have double-digit interest rates, I don’t recommend repaying student loans early.

It never hurts to save more

Twenty percent is a great goal, but some retirement experts actually suggest saving more like 25% or even 30. Why?

You know that saying, “Past returns are no guarantee of future performance”? That’s why. It’s true that the annual average return of the S&P 500 between 1928 and 2014 was 10%, for example. But that doesn’t mean anything for future returns.

We have no way of knowing what future returns will be—they could be 8%, they could be 4%. But the only way to hedge against an uncertain future is to save more money. The more you have, the less you need jaw-dropping returns to meet your goals.

Get help with your 401(k)

Already have a 401(k)? While you’re researching contributions, take a minute to analyze your current holdings too—there could be big savings to be found.

Check out Empower for a free app that creates easy-to-understand visuals of the investments you own in your 401(k), IRA, and other investment accounts. There’s also Wealthfront for a great all-in-one financial app that allows account holders to take control over their finances, automate saving and investing, and manage their accounts all in one place.

Summary

Everyone’s financial situation is different, and thus everyone’s retirement contributions will also be different. The key is to find a ratio you’re comfortable with, but that also encourages you to save a little extra than you might otherwise. We suggest aiming for a ratio of 80/20 to start with, and upping as you can.