J. P. Morgan Self-Directed Investing from Chase Bank invites new users in with a crisp, intuitive platform and unlimited commission-free online stock, ETF and options trades. All backed by powerful tools and robust customer service that existing Chase customers are already familiar with.

With over 500 financial service reviews published since 2006, our editorial team has decades of experience researching the best personal finance products. When evaluating investing platforms, like J.P. Morgan Self-Directed Investing, we look at ease of use for beginning, investment tools, investments offered, app interface, relevant fees, and end-to-end experience.

J.P. Morgan Self-Directed Investing offers Chase clients tremendous convenience and new investors an intuitive investing platform with unlimited commission-free online stock, ETF and options trades.

It's ideal for those who are interested in learning the market with no investment minimums attached.

- Exceptional customer support

- Simple, intuitive interface

- Easy integration for existing Chase customers

- Advanced traders may want additional functionality

- Portfolio Builder requires $2,500 min.

What is J.P. Morgan Self-Directed Investing?

J.P. Morgan Self-Directed Investing is Chase Bank’s stock market trading platform. J.P. Morgan Self-Directed Investing (SDI) allows you to buy, sell, and trade the following investment products:

- Stocks

- ETFs

- Options

- Mutual funds

- Bonds

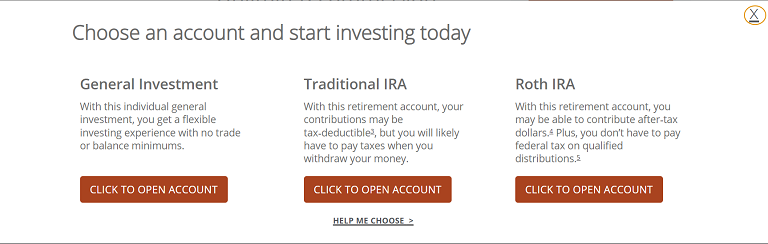

And offers the following account types:

- General investment

- Traditional IRA

- Roth IRA

J.P. Morgan Self-Directed Investing pros & cons

Pros

- Chase customer support — J.P. Morgan Self-Directed Investing stands out from other brokerage apps by offering a knowledgeable and accessible customer support team.

- Simple, intuitive interface — Chase’s trading platform is lean and clean, letting new investors get up and running without being overwhelmed by charts of data.

- Portfolio Builder — With the complimentary Portfolio Builder tool, J.P. Morgan Self-Directed Investing assists new investors by helping them gauge their risk tolerance and investing goals.

- Integration for Chase customers — For existing Chase customers, adding a J.P. Morgan Self-Directed Investing account to your dashboard is quick and seamless – and consolidating your trading platform into your banking app lends beaucoup convenience over time.

Cons

- Basic functionality — Aspiring day traders may find investment vehicles and research tools from J.P. Morgan Self-Directed Investing to be limiting.

- Portfolio Builder requires $2,500 min. — Even the automated Portfolio Builder requires you to have $2,500 in your account, excluding many young investors who may need it most.

- No crypto support — Unlike Robinhood, J.P. Morgan Self-Directed Investing doesn’t allow for crypto trading, and considering the big banks aren’t the biggest fans of unsecured currencies, it probably never will.

How does J.P. Morgan Self-Directed Investing work?

J.P. Morgan Self-Directed Investing lets you make unlimited commission-free online stock, ETF and options trades with no account minimums. This is self-directed, meaning you pick and choose what you buy and sell without automation (though there’s tools like watchlists and screeners to help build a diversified portfolio).

Signing up for J.P. Morgan Self-Directed Investing is easy. To open an account, sign up using our J.P. Morgan Self-Directed Investing link and select “click to open an account.” You’ll notice Chase has a crisp, inviting site design. Calm, user-centric language and layout will be a theme throughout your SDI experience.

You’ll first be asked to choose an account type so you can get started investing. If you don’t know what account you would like to open, there’s also a button that helps you choose. This opens up a comparison between each account type and answers some frequently asked questions, like how much you can contribute. There are no limits on how much you can contribute in a general investment account, for instance, regardless of age, income, or any other factors.

Following that, you’ll enter a workflow for creating an account. This includes review, for providing details like your Social Security Number and date of birth, choosing an account type (Individual or Joint) and letting them know if you’re an existing Chase customer.

Hiding on this page is another one of J.P. Morgan Self-Directed Investing’s key competitive advantages. See it? Top left. Chase is so dedicated to customer service that you can call them just for help filling out your application.

Moving on with the workflow, you’ll enter a beneficiary, read over some forms, and E-Sign a few documents.

Once that’s done, Chase will prompt you for a source of funds for your account.

Once your application is approved, Chase will prompt you to download the Chase Mobile® app, where you’ll basically be treated as a regular Chase customer if you aren’t one already with only one account type listed: J.P. Morgan Self-Directed Investing.

From here, you’ll open your brokerage account and enter J.P. Morgan Self-Directed Investing’s dashboard for buying, selling, and trading. You can also trade using the online dashboard from your computer.

Pricing for J.P. Morgan Self-Directed Investing

Like most modern trading platforms, J.P. Morgan Self-Directed Investing offers $0 commission trades; you can buy and sell stocks all day without Chase taking a cut. Commission-free brokerages have become the industry standard, but you shouldn’t take them for granted – just ask anyone who yelled at their greedy Wall Street broker in the 80s!

The three fees you’re most likely to run into are (others may apply):

- $0.65 per options contract.

- $25 broker-assisted trades fee on stocks and ETFs.

- $75 transfer and termination fee applies when assets are distributed or transferred out of account.

Transfer fees suck, especially if you plan to take brokers for a test drive for a few months. That being said, it’s unfair to pick on Chase for charging $75 to close or move your account since companies like Robinhood and Webull do the same.

Overall, however, Chase’s fees are still lower and fewer than most, so it’s an overall win for the platform.

J.P. Morgan Self-Directed Investing features

Whether you’re new to trading platforms or you’re considering a switch, what can J.P. Morgan Self-Directed Investing offer you?

Sign-up bonus for J.P. Morgan Self-Directed Investing

Get up to $700 when you open and fund a J.P. Morgan Self-Directed Investing account (retirement or general) with qualifying new money when you sign up with our link by 10/11/2024*. Be sure to read through the relevant offer terms and conditions to make sure you don’t miss out on this welcome bonus.

You can receive your bonus when you open and fund your account with $5,000 or more by moving eligible cash, transferring securities, or rolling over existing retirement assets from another institution within 45 days of coupon enrollment date. Assets from J.P. Morgan Chase & Co. or its affiliates are not eligible, only qualifying new money. Maintain your new funds 90 days from enrollment and enjoy your bonus thereafter – J.P. Morgan Self-Directed Investing will add it directly into your account within 15 days.

- Get $50 when you transfer or roll over $5,000-$24,999

- Get $150 when you transfer or roll over $25,000-$99,999

- Get $325 when you transfer or roll over $100,000-$249,999

- Get $700 When you transfer or roll over $250,000 or more

» Get up to $700 with J.P. Morgan Self-Directed Investing

$0 commission, $0 account minimum

As mentioned, J.P. Morgan Self-Directed Investing doesn’t charge commissions on trades (with the exception of a fee on options contracts) and doesn’t require an account deposit of any size on day one to open an account.

The latter is a nice perk for anyone looking to open an online brokerage account to have on hand, but can’t afford to fund it quite yet.

Portfolio Builder

Once your account clears and you drop in some funds, you’re immediately granted access to the entire stock market. If that seems a little overwhelming, Chase has your back with Portfolio Builder (for those with an account balance >$2,500).

The Portfolio Builder starts with a quiz to help you determine a) your risk tolerance and b) your investing goals. It then guides towards stocks, ETFs, and overall asset allocation based on your answers.

For example, if you have a high risk tolerance and short-term goals, Portfolio Builder may guide you towards some more high-performing stocks. If you’re more conservative with your money and plan to buy a house in five years, PB may instead guide you towards Blue Chip-based ETFs or dividend stocks.

The Portfolio builder doesn’t serve as a robo-advisor over a brokerage account, but if investing is bowling, Portfolio Builder is like the bumpers on the side, guiding you towards a strike.

Integration with Chase apps

As mentioned, a huge draw of J.P. Morgan Self-Directed Investing is its smooth integration with Chase online and Chase Mobile® app. If you’re already familiar with the Chase ecosystem, you’ll love how J.P. Morgan Self-Directed Investing will:

- Pull your existing account info to greatly accelerate the signup and approval process.

- Seamlessly drop your investing account into your existing dashboard for easy access.

- Allow you to quickly move funds in and out of your Chase accounts.

For Chase users, keeping everything within the family may lend a sense of security, comfort, and convenience.

Simple desktop and mobile app

J.P. Morgan Self-Directed Investing edges out the competition by offering both a mobile and a desktop app that are well-designed and easy to manage.

Trading platforms tend to follow one of two philosophies to dashboard design: clean and simple, or dense and chaotic. Classical music or speed metal. Both have their pros and cons, and clearly attract different types of investors. Chase went for the former approach.

Chase customer service

Last but certainly not least, investing through J.P. Morgan Self-Directed Investing gives you access to Chase’s renowned customer support team. Average connection times are quick, and staff are generally considered to be experienced and knowledgeable.

Chase’s customer support team can’t offer investing advice, but they’re super helpful to have around if you have technical questions or would like clarification on any fees or functionality.

My experience researching J.P. Morgan Self-Directed Investing

I appreciate that Chase offers a “safe space” for new and/or casual investors to buy stocks, ETFs, and bonds.

It may be basic, but investing should be boring.

With Portfolio Manager guiding you along and your bank account balance staring you right in the face, SDI discourages impulsive or emotion-based trading – and that’s what you want. The inability to set up recurring crypto buys, for example, is honestly more of a perk than a missing feature.

What I’d like to see is for Chase to do a better job at attracting young, new investors to the platform. Many novices are seeking a safe platform that’s still attractive (like alternatives for Robinhood), and little things like an expanded learning center would leave the porch light on for them.

Until then, however, SDI still offers a compelling package as it exists today.

Who is J.P. Morgan Self-Directed Investing best for?

All things considered, who is Chase’s investing platform best geared for?

Existing Chase customers

If you’re already tapped into the Chase ecosystem, you’ll love how simple and seamless adding a J.P. Morgan Self-Directed Investing account to your dashboard will be.

On paper, it may seem like consolidating your banking and investing apps into one may just save a little RAM, but having your brokerage and bank accounts in the same dashboard saves time and can help guide your investing choices. It’s also one less app download.

New investors

J.P. Morgan Self-Directed Investing offers plenty to help beginners learning how to invest ease into trading, from a clean and simple interface to Portfolio Builder to a dedicated customer support line in case anything goes awry.

I wish Chase could offer a little more in the form of EDU materials and a learning center, but it’s not too hard to find those resources elsewhere.

» Open an account with J.P. Morgan Self-Directed and get up to $700.

Who shouldn’t use J.P. Morgan Self-Directed Investing?

J.P. Morgan Self-Directed Investing is an all-around solid trading platform, but it’s not for everyone. Which traders should look elsewhere?

Advanced investors and day traders

If you’re an experienced investor looking for a trading platform with all the options, J.P. Morgan Self-Directed Investing simply isn’t a fit. Even if you’re just a new investor looking to grow your day trading skills, you’ll quickly outgrow the limited functionality from J.P. Morgan Self-Directed Investing.

The platform is designed to be simple and streamlined for the casual investor to make simple trades. Specifically, here are some advanced features it’s missing:

- Pre-/post-hours trading.

- Fractional shares.

- Penny stocks.

- Cryptocurrency trading.

- International investment vehicles.

- Detailed chart analytics.

- Third-party data integration.

If you’re a new investor or in the Chase ecosystem already and none of those sound like you’ll need them, then you belong in the first group that J.P. Morgan Self-Directed Investing is best for.

The competition

These are some alternative top investment account options if you’re not a existing Chase customer or you’re a beginner investor who wants to dip a toe in with fractional investing.

J.P. Morgan Self-Directed Investing vs Robinhood

Robinhood is a mobile-friendly and easy-to-use trading app that’s great for beginners with just $1 to get started investing.

Robinhood is a popular stock trading and investing app that offers zero-commission trades on thousands of investments, including stocks, starting with as little as $1.

With beginner-friendly features and easy-to-read charts, Robinhood is great for new investors and there's advanced features even more seasoned investors can appreciate.

- Commission-free trading

- Easy to use, well-displayed dashboard

- No obligation or minimum account balance

- No bonds or mutual funds

Robinhood offers zero-commission trades on thousands of investments, including fractional shares, all in a simplified trading experience. You can trade partial portions of stocks and ETFs both by dollar amount and share amount, something SDI doesn’t offer.

The website for Robinhood has an in-depth section to help you learn about investing basics, the markets, and trading lingo. Robinhood, however, doesn’t give you the full suite of investment options you’ll get with J.P. Morgan Self-Directed Investing, but if you’re just starting out or a casual trader you may not be looking for them.

J.P. Morgan Self-Direct Investing vs E*TRADE

If you’re an experienced investor looking for a new platform to grow into, you may find your forever home at E*TRADE.

If you’re an experienced investor looking for a new platform to grow into, you may find your forever home at E*TRADE.

E*TRADE’s platform has attracted an army of day traders by offering a wide assortment of investment tools, research, and analytics. Even more passive investors will be intrigued by E*TRADE‘s compelling Smart Beta and Socially Responsible ETFs, which are designed to outperform the market and support conscious capitalism, respectively.

Summary

J.P. Morgan Self-Directed Investing offers a smooth and convenient way for existing Chase customers to add investing to their account dashboard.

Non-Chase customers may still be drawn in by SDI’s clean interface and robust customer service, but advanced investors and day traders will likely find the platform’s basic toolkit too limited to grow into.

» Open an account with J.P. Morgan Self-Directed and get up to $700.