I designed our free monthly budget spreadsheet to be as simple as possible to use.

This spreadsheet incorporates the 50/30/20 budgeting rule (explained below). It’s also loosely based upon the Kakeibo budgeting method, an elegant technique from Japan. Here’s what it looks like.

Read on to understand the philosophy behind this spreadsheet and get instructions for use. Download link is below.

50/30/20 monthly budget template

Our Google Sheets budget template lets you plug in your income and expenses to automatically calculate how much you have left to spend each month. It helps you see exactly what your income is going toward and shows you if you’re under or over budget as you track your spending.

50/30/20 budgeting explained

This template includes guidance for the 50/30/20 budgeting method. This is a widely used strategy that’s easy to apply and remember.

Basically, it helps you set priorities in your budget and categorize expenses by breaking your spending into three types: needs, wants, and savings. Then, it gives a different percentage of your income to each of these expense categories.

Here’s how the 50/30/20 budget works:

- 50% is for needs. This includes household expenses that may fluctuate (think: groceries and utilities) as well as fixed costs, like insurance premiums or car payments, and other non-negotiables.

- 30% is for wants. This includes the things you do for fun, such as going to concerts or dining out, and other things that are important to you, like updating your seasonal wardrobe or donating to charity.

- 20% is for saving. This includes putting money into your emergency fund, investing in retirement accounts, and saving for big financial goals — like the down payment on a car or house.

You can think of your budget as a spending plan. By breaking your total income down into categories, you’re telling yourself how much you can spend in each category — not focusing on what you shouldn’t spend. This can be a helpful perspective if you’ve ever found budgeting to be too restrictive.

Now that you know how a 50/30/20 budget works, the next step is to personalize the budget template.

How to create your personal monthly budget template

Using the budget template is easy. Follow these steps to make it your own:

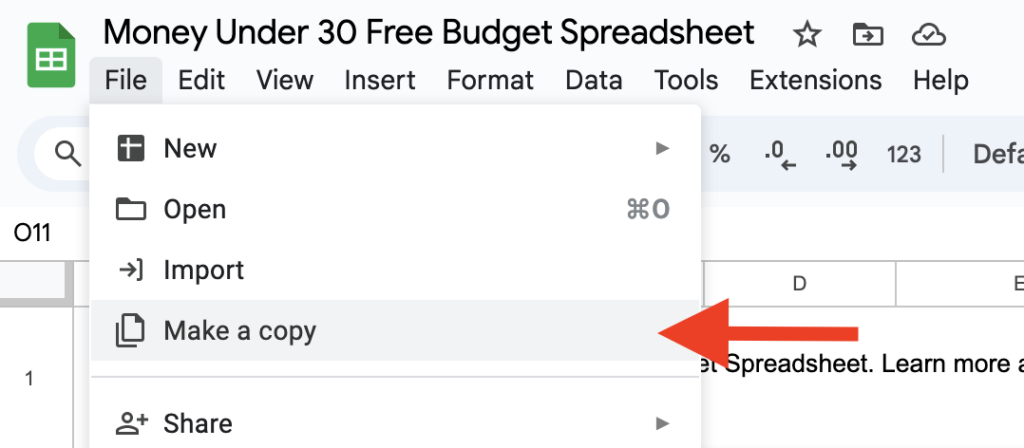

Make a copy of the spreadsheet

You cannot edit the public version of the spreadsheet. Go to File -> Make a copy to save your own copy of the budget spreadsheet. You can also download the spreadsheet to use in other applications like Microsoft Excel.

2. Enter your planned income, expenses and savings goals

- Fill in the blanks for your monthly expenses by putting your typical costs in the “Planned” column for each category.

- Check the “Need?” box for necessary expenses like groceries, rent and loan payments. Leave the box unchecked for discretionary expenses like dining, shopping and entertainment.

3. Enter your actual spending at the end of the month

Use the “actual” column to keep track of what you actually earn, spend and save throughout the month. You’ll see the difference field automatically populate to show whether you are under or over your budget.

4. See how your budget lines up with the 50/30/20 rule

After you have entered an entire month’s income, savings and expenses, you’ll see the percentage of your income that you spent on necessities, “wants”, and savings in the “Totals” box.

Why you should budget your whole income

Budgeting all of your income is a strategy known as zero-based budgeting and it’s a good way to use your money more efficiently.

If you split 100% of your income across your categories — 50% for needs, 30% for wants, and 20% for saving/debt repayment — you’ll know exactly what happens to every dollar at the end of the month so you can feel confident you’ve put all your money to good use. You won’t have to worry about ending up with “leftover” cash and having to decide what to do with it.

What if you’ve budgeted for your wants and needs and don’t know how to use the rest of your money? Try adding it to your emergency fund, investing it, or repaying more of your debt.

Figuring out your wants vs. needs

All of our wants and needs are different, and you might have to tweak the template to make it work for you.

For example, maybe travel expenses are actually a “need” for you because you travel for work or a gym membership is non-negotiable. Feel free to play around with the categories and make sure to update them regularly as your personal and financial needs change.

Tips for making the most of your monthly budget template

Once you have your spreadsheet set up, it’s important to make the most of it all year long. Here are a few tips to help you apply your spending plan every month.

Review your budget on a monthly basis

At the beginning of the month, review the money you have for each category and adjust your spending accordingly. If a recurring expense changes or you need to update your income, do it right away.

Track your spending

Log your spending every time you pay a bill or make a purchase. Checking the spreadsheet often is a good way to avoid overspending and save money.

Check in each week

Check in with your remaining totals at the start of each week and identify areas where you might need to cut back. Your budget will only work if your income and expenses are accurate.

Adjust as needed

If your actual costs turn out to regularly be more or less than you estimated, update your budget accordingly. And if something comes up that you didn’t budget for, like an unexpected repair or medical bill, make adjustments to your spending. For example, if you overspend in one category for one month, try to spend less in another.

Stay positive

If you do go over budget one month, don’t let it discourage you. Just do what you can to balance your spending and start fresh next month. Sticking to a budget is hard, but you’ve got this. Remember, it’s about progress not perfection.

Get our free monthly budget spreadsheet

» Get our free monthly budget spreadsheet here.

Prefer something a bit simpler? I also created a really simple budget worksheet that’s available as a spreadsheet or a printable PDF.

Don’t like using a spreadsheet? Try these apps instead

If you already know budget templates just don’t work for you, you can try an app instead.

There are a number of excellent budgeting apps to help you create a budget, track expenses, and see your cash flow. Many connect directly to your bank accounts to automate your budgeting and categorize your transactions, so there’s very little setup required.

Here are three of our favorite best budgeting apps.

Empower

Empower, formerly Personal Capital, is *Larry David voice* pretty, pretty straightforward: link up your bank account and the app tracks your spending. Your results are displayed on this budgeting app in easy-to-read charts.

Other options include a multitude of calculators, a fee analyzer to see how your retirement account fees are impacting your retirement date, the ability to monitor your net worth, and even a retirement planner all for free. This dashboard is pretty comprehensive and you’ll get the most out of it if you revisit it often.

» MORE: Learn more in our full Empower review.

PocketSmith

PocketSmith is a beginner-friendly budgeting app and money management tool. It makes it easy to look at your spending habits and think “big picture” about your money.

One way PocketSmith helps you do this is with future forecasting. As you set up your next month’s budget, you can take a look at how small decisions impact your finances six months down the road. Then you can play around with budget categories and read reports to understand how you’re really spending rather than just how you want to be using your money.

» MORE: Read our experience in our full PocketSmith review.

You Need A Budget (YNAB)

YNAB is a more extensive solution that helps you create a zero-based budget. Zero-based budgeting requires you to give every dollar a job and take tracking your spending to the next level.

To use this app, you’ll set some goals and log your transactions throughout the month. Then, YNAB‘s reporting tools will help you monitor how you’re doing and show you your full financial picture. This is an especially great option for anyone focused on reducing their debt.

» MORE: Check out our full YNAB review.

The bottom line

Budgeting can be as simple — or as complicated — as you want to make it. Our free monthly budget template is designed to be as easy to use as possible and to take the guesswork out of creating a budget. Get out of debt, understand your habits, and meet your savings goals by taking care of your budgeting.