Everyone knows credit scores are important in the mortgage borrowing process. There are different mortgage types, and each has a minimum credit score requirement just to get your loan approved.

But even apart from loan approval, the level of your credit score can affect the interest rate you’ll pay, and therefore the monthly payment. If you’re on the lower end of the credit score range, you can pay thousands of dollars per year more in interest than you will if you are in the highest credit score range.

For that reason, you need to know what your FICO® Score before you apply is.

Different mortgage types, different minimum credit scores

Let’s start this discussion with a table of the minimum credit score requirements by loan type:

| Mortgage type | Minimum FICO Score required |

|---|---|

| Conventional | 620 |

| FHA with 3.5% down payments | 580 |

| FHA with 10% down payments | 500 |

| VA mortgage | No minimum, but approval is unlikely below 580 |

| Jumbo mortgage | Varies by loan program and lender, but unlikely below 680 |

Conventional

Conventional mortgages are loans that are ultimately purchased by Fannie Mae and Freddie Mac, who also set the parameters for the program. They’re considered to be conventional because, unlike FHA and VA mortgages, they use private mortgage insurance companies (PMI) instead of government agencies to insure the loans against default. However, PMI is only required when the down payment on a purchase or the equity in a refinanced home is less than 20%.

With the exception of jumbo mortgages, conventional mortgages are the most credit score sensitive mortgage types. They have a set minimum FICO Score requirement of 620. However, lenders may impose a somewhat higher credit score if your loan application contains other risk factors. That may include a minimum down payment, a cash-out refinance, or a high debt-to-income ratio (DTI).

But what may be even more relevant when it comes to credit scores and conventional mortgages is the impact your credit score will have on the interest rate you’ll pay on your loan.

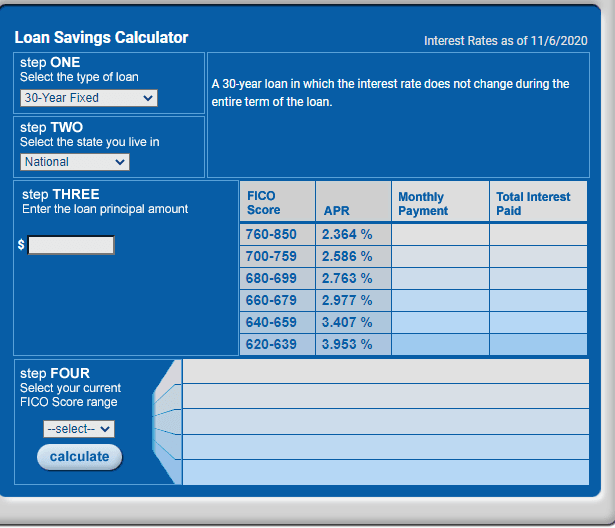

The effect of your credit score on the interest rate you’ll pay on a conventional mortgage is demonstrated by the data provided through the myFICO Loan Savings Calculator (These rates are current as of November 7th, 2020).

As you can see from the screenshot above, a credit score above 760 will get you an interest rate of 2.672% and a monthly payment of $1,212 on a $300,000 loan. At the opposite end of the credit score scale, if your credit score is below 640, your interest rate will jump to 4.261%, and a monthly payment of $1,478.

The difference between the highest credit score range and the lowest credit score range translates into $266 per month, or $3,192 per year. On a 30-year mortgage, that comes to an incredible $95,760 over the life of the loan.

If a conventional loan sounds like what you’re looking for, Reali Loans is a completely online lender that can help you see what loan rates you qualify for. In fact, they say that their average customer saves $20,000!

To see what other mortgage rates you qualify for, check out the table below.

FHA with 3.5% down payment

FHA loans are so called because they are insured by the Federal Housing Administration, a US government agency operating under Housing and Urban Development (HUD). Because they’re subject to government-provided mortgage insurance, credit score requirements are more relaxed. And for that reason, FHA mortgages are more popular among borrowers with fair credit.

Under standard terms, you’re required to make a minimum down payment of 3.5% on the purchase of a home. That will require a minimum credit score of 580.

That doesn’t guarantee all lenders will accept a credit score as low as 580 on all loans. If your loan is considered a higher risk, the lender may impose a minimum score of 620. Even though loans operate under FHA guidelines, the private lenders who originate them have considerable latitude in underwriting them.

FHA with 10% down payment

This isn’t a special program. Instead, it’s a standard FHA loan that provides more credit flexibility with a larger down payment. FHA will accept a credit score as low as 500 with a minimum down payment of 10%. The larger down payment makes the loan less risky, and therefore less likely to go into default.

This is the closest thing there is to a mortgage for bad credit. Credit scores as low as 500 often have major derogatory information, like a recent bankruptcy, a pattern of consistently late payments, or even a series of collection accounts.

However, once again just because FHA will accept a credit score as low as 500 with the larger down payment doesn’t mean all lenders will. If they consider your loan profile to be too risky, including your credit history, they may still reject the loan.

Also be aware that even if your loan is approved with a 10% down payment, the lender may still require you to pay off any past due balances, collection accounts, judgments, or liens.

VA mortgages

Much like FHA mortgages, VA mortgages are also insured by a government agency – the Veterans Administration. One of the big advantages of VA mortgages is that they offer 100% financing for either purchases or refinances. That means zero down payment if you’re a buyer, and zero equity if you’re a homeowner doing a refinance.

The VA doesn’t have specific minimum credit score requirements. However, most lenders will impose an in-house limit. With most lenders, expect that minimum to be 620. That said, some lenders might go a little below – but probably not lower than 580 – if you are otherwise a strong borrower.

Jumbo mortgages

The maximum loan limit for conventional mortgages is $510,400 for single-family homes in most counties across the US. (The loan limits are higher for multifamily properties and in certain counties designated to be high-cost areas).

If a borrower needs a mortgage that will be larger than the conventional loan limit, the loan is referred to as a Jumbo mortgage. These loans are not in any way provided by Fannie Mae, Freddie Mac, or any government agency. Instead, they’re provided by private banks and other lending sources. That means the specific requirements for each loan type will be unique to that particular program.

Jumbo mortgages are even more credit score sensitive than conventional mortgages. Not only will they adjust your interest rate based on your credit score at the time of mortgage application, but the threshold for loan approval is much higher than it is for other loan types.

For example, a bank can set a minimum credit score limit of 700 or 720. They may require a minimum of 740 for a loan in excess of $1 million, or one with less than 20% down. The point is, there’s little standardization with credit scores when it comes to jumbo mortgages. Because of the much higher loan amounts, credit requirements, as well as all other guidelines, are more strict than they are other loan types.

As a general rule, you should not expect to qualify for a Jumbo mortgage with a credit score of less than 680. And even then, it will likely only be possible if you are an otherwise strong borrower.

No matter what loan you take out – you need to consider the cost of insurance as well

If you have any sort of financing for your home, you need homeowners insurance. It’ll be required by the lender that’s funding your purchase. While homeowners insurance definitely won’t be as large of an expense as the mortgage itself, it’s important to factor in the price when considering how much you can afford for monthly mortgage payments.

Searching for the best homeowners insurance rates used to be a pain because you had to call up each company individually, but now, thanks to the internet, you can shop for your rates all in one place. Policygenius should be your go-tos when it comes to rate shopping.

Can you get a mortgage with bad credit?

Your best chance of getting a mortgage if you have bad credit is to use an FHA mortgage with a 10% down payment. Once again, even if you do it’s likely you’ll be required to pay off any past due balances.

Prior to the Mortgage Meltdown that began in 2008, subprime mortgages were common that would make loans available to borrowers with virtually any type of credit. But since those loans were the root cause of the Meltdown itself, they largely disappeared. There are constant rumors that they are making a comeback, but it seems to be on a limited basis if it’s happening at all.

Stay on Top of Your Credit

It’s not just about getting approval either – as you’ve seen with conventional and jumbo mortgages, the interest rate you’ll pay on your loan is closely tied to your FICO® Score.

Your FICO Score is determined by a few key factors, here are a few things to keep in mind.

From now on, pay all bills on time

That includes loans, credit cards, utility bills, and especially your rent or current mortgage payment.

Pay off any past due balances

That won’t make the negative information disappear from your credit report, but a paid past-due account is always better than an open one.

Pay down your credit card balances

One of the biggest factors affecting your credit score is what’s known as your credit utilization ratio. That’s the amount you owe on your credit cards, divided by your total credit limits. For example, if you owe $5,000 on your credit cards, and the total of your credit limits is $10,000, your credit utilization ratio is 50%. The credit bureaus like a ratio below 30%, and the closer you can get to that the better your credit score will be. At 80% and above, the effect is very negative, and even predictive of default.

Check your credit report for errors

If you find any, dispute them and have them removed.

Monitor your credit closely

The only way to know if your credit is moving in the right direction is to monitor it on a regular basis. In that way, you’ll know if you’re on track, or if you need to take extra steps to accelerate the process.

The best credit score monitoring program you can choose is myFICO’s FICO®Advanced FICO.

That statement isn’t close to being an exaggeration. With FICO Advanced, you can get the credit score most home lenders actually use plus 25 other commonly used FICO Scores. And, in addition to credit monitoring, you’ll get $1M in identity theft insurance.

But what’s even more significant is that myFICO is part of the organization that produces FICO Scores. That means you’ll be getting your scores directly from the original source. And just as important, they provide you with three-bureau credit monitoring and FICO Score alerts from all three major credit bureaus, Experian, Equifax, and TransUnion.

That last benefit is more important than most consumers realize. A negative credit entry can appear on one or two credit reports, but not all three. Only by monitoring all three on a regular basis will you know exactly what’s going on with your credit scores, in the same way that mortgage lenders will see it. myFICO’s FICO® Advanced FICO is the best way to do that.

Summary

As you can see, your credit score will have a material effect on the interest rate and monthly payments on your new mortgage, or if you’ll even be approved for the loan at all. You owe it to yourself to do whatever is necessary to make sure your credit is in shape to get a loan approved but also provide you with the best interest rate you deserve.