Anybody can—and should—be an investor. You don’t need to study every issue of the Wall Street Journal, be glued to CNBC, or even be a “math person” to put your money to work for you in the stock market and secure your financial future.

There are, however, a few important concepts every investor needs to know.

Today, we’re going to talk about one — asset allocation.

First: What’s an asset?

An asset is anything of value: Cash, real estate, or even vintage cases of scotch. In investing, there are different asset classes (groups of similar investments).

The three main asset classes:

- Cash

- Stocks

- Bonds

Others include real estate, private equity, natural resources, foreign currencies, and more. For the purposes of this article we’ll focus on cash, stocks, and bonds, and lump all the other assets into “alternatives.”

What does asset allocation mean?

Asset allocation refers to the mix of investments you hold. A sound asset allocation strategy ensures your investment portfolio is diversified and aggressive enough to meet your savings goals without unnecessary risk.

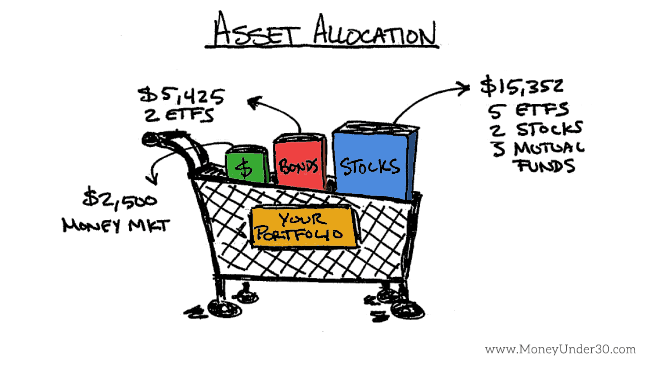

The grocery basket analogy

Here is an analogy that explains exactly how asset allocation works:

When you go to your local grocery store, you grab a shopping basket. The basket is like your total investing portfolio; it’s where you place all the items you’re going to purchase (or all of the assets you buy).

When you go to your local grocery store, you grab a shopping basket. The basket is like your total investing portfolio; it’s where you place all the items you’re going to purchase (or all of the assets you buy).

The point of asset allocation is to broadly diversify your investment portfolio, just like you probably diversify your diet. (Even if you love cheeseburgers, you don’t want to eat them all the time because you’ll miss out on nutrients in other foods.) So you fill your cart with a variety of foods.

As you shop, you don’t organize your groceries yet — you just throw it all in there. But you can easily categorize your purchases by food group: milk and eggs into one bag, meat in another, and fruits and veggies in another.

Each of these food groups is akin to an asset class in your portfolio. You may hold dozens of different investments and within each of them are stocks, bonds, and cash. You can’t quickly tell by glancing at your grocery basket how many veggies versus how many sweets you have, but you can (and likely do) separate it out in your head to know you’re buying food for a balanced diet.

Just as it’s not healthy to eat only hamburgers, in investing it’s not healthy to be overly invested in one asset class. The goal of proper asset allocation is to create an ideal mix of investments that gets you the greatest long-term gains for a tolerable amount of risk.

Why asset allocation matters

The goal of asset allocation is to get a return on your money while managing risk.

There will, of course, always be market risk—the risk that an entire market will decline. We saw a good example of market risk from the fall of 2008 to the spring of 2009. Every asset class declined across the board. Stocks, bonds, mutual funds, and real estate all took a nose dive. Money market funds—considered the safest of safe investments—even lost money. The bottom line is you can’t eliminate risk entirely. (And leaving your money is a savings account isn’t the answer. Over time, inflation will outpace the measly interest rates savings accounts offer and leave you with a negative return on your money.)

The good news is that with smart asset allocation, you can reduce some investing risks, specifically unsystematic risk (the risk that lies within one particular investment).

Investing in any individual stock or bond leaves you vulnerable to the risk that the particular investment could go down in value. Diversification eliminates this risk and gives you the opportunity to make money with one asset class even while another declines.

Asset allocation strategy 101

Choosing an appropriate asset allocation depends on two things:

- How long you have to invest

- How much risk you can tolerate

In terms of retirement, your asset allocation will look very different at age 25 than it will at age 75. When you’re in your 20s, you likely have 30 or 40 years to invest before you need that money back, so you can choose aggressive investments that have high growth potential but also higher risk. In retirement, you no longer have decades for your money to grow and you will need to withdraw money every year. You can’t afford for your portfolio to have a bad year in which it loses 20%, so you’ll choose more conservative investments that don’t return as much but are less risky.

A simple starting point

There’s a common formula (and many variations) out there to find your target asset allocation for retirement savings:

100 – age = percentage of stocks

So if you’re 20, you would invest 80% in stocks and 20% in bonds. If you’re 60, you would invest 40% in stocks and 60% in bonds.

This formula is an oversimplification, but I like it because it gives you the idea of how your asset allocation should change as you age. Some young, aggressive investors will want to invest in 90 or even 100% stocks, whereas many conservative investors will never own 70% stocks at age 30, and that’s OK.

But…asset allocation is about more than stocks and bonds

If you’re new to investing, finding a comfortable allocation between stocks and bonds is a good start. For example, if you don’t hold any bonds at all, you might buy a bond index fund to offset your stock holdings.

To become a more skillful investor, however, you’ll want to look beyond these broad classes and consider the kinds of stocks and bonds you’re holding. You might own 80% stocks but find that all of your stocks are domestic companies. As a young aggressive investor, think of the big wide world outside of the United States. International stocks include economies that are younger than ours and growing at a faster pace. This presents an incredible opportunity for investors to earn huge returns over the coming decades, but foreign stocks may be more reactive to international politics and events, making them riskier.

Choosing your ideal asset allocation

Only you can decide which asset allocation you’re comfortable with. And, if you are investing for different goals, you should maintain different target allocations for each goal. For example, you’ll want a more aggressive allocation for retirement and a more conservative allocation for a new house fund that you plan to use in the next five years.

Here are some questions to help you decide on the best allocation for you:

How soon will you need the money?

If you’ll be investing for more than 20 years, choose an aggressive (mostly stock) allocation. If you’ll need the money sooner than that, invest in a mix of bonds and stocks. If you need the money in between two and five years, stick with mostly bonds. If you might need the money within a year, stick with a cash savings account.

How comfortable would you be with losing 30% of your money in a year?

Although rare, the worst years in the stock market could mean a loss of up to a third of your money. That’s tough for anybody—but aggressive investors see it as a bump in the road that will be overcome by future gains. If, however, you know you would freak out over such a loss, consider weighting your portfolio with more bonds, which can soften the blow of the stock market’s more volatile up and downs.

Are you on track with your retirement savings?

Contributing enough money to your retirement account can reduce the need to be overly aggressive with your investments. If you make regular retirement contributions, you can feel good about choosing a moderate allocation that avoids wild ups and downs.

If, however, you’re behind in contributing to your retirement and playing catch up, a more aggressive strategy may be necessary. In this case I’d recommend speaking with a financial advisor to create a solid plan for how you can reach your retirement goals through a combination of saving and aggressive investing (so you avoid making any costly mistakes on your own).

How to calculate your current asset allocation

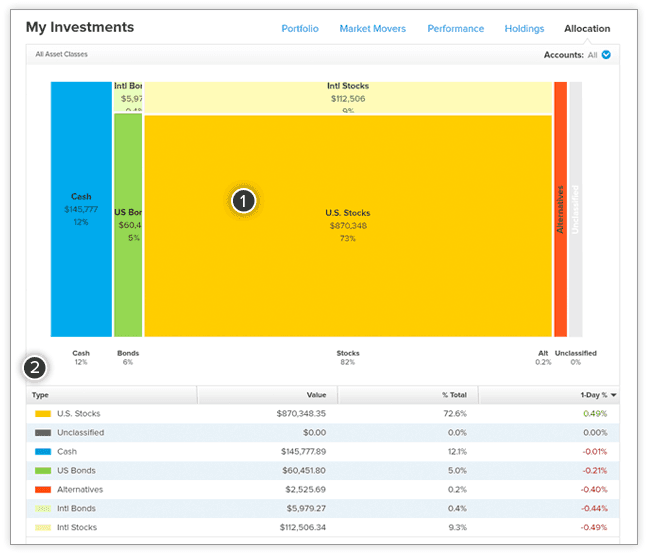

Your investment portfolio likely contains one or more mutual funds or exchange-traded funds (ETFs), each of which owns hundreds of different investments. Some of these funds, such as an index fund that tracks the S&P 500, may contain only one asset class (stocks). But others may be managed funds that hold stocks, bonds, cash, and other asset classes. Fortunately, technology makes it easy to “x-ray” all of your investments and find your current asset allocation.

The first place to check is in your brokerage online account, as most provide a snapshot of your current asset mix. The other tool that I’ve fallen in love with is Empower. It’s a free investment management app that aggregates all of your investing accounts from multiple brokers. Empower provides a beautiful graph of your asset classes including: domestic and foreign stocks, foreign and domestic bonds, cash and alternatives. Check out our full Empower review here.

What you can do now

It’s a good time to check up on your asset allocation to see if your portfolio is where you want to be.

If you notice, for example, that your portfolio is too heavily weighted in one asset class, you should consider adding investments of another class. You can simply buy more of an asset class or exchange one investment for another until you achieve your desired allocation.

You can learn more about asset allocation in your 401(k). If you want to make a change, you may have to speak with your HR or benefits manager and fill out a form to request a different investing strategy.

Another great move, while you’re checking into your asset allocation, is to consider diversifying. The more diverse your investments, the less likely you are to lose big if a certain sector tanks. One way to diversify is to learn about investing in art, especially if you share a passion for fine art, or considering a top real estate investment app if that’s more of interest.

Need 1-on-1 advice? Learn how to find the best financial advisors.