In addition to your checking account that you use for your regular spending, you’ve probably considered opening a savings account as well. A savings account accrues a trickle of interest and is more accessible and stable than an investment account, and allows you to keep your money stored away more than a checking account can.

Naturally, you’ll want to open a savings account with the highest possible interest rate. FitnessBank offers the nation’s highest interest rates, but they make you hustle for it. Literally.

So how does FitnessBank work, and is it worth it? Let’s investigate.

What is FitnessBank?

FitnessBank rewards account holders who average 12,500 steps per day with the nation’s highest interest rates (peaking at 3.0% in 2019). The fewer steps you get the lower your rates, bottoming out at 0.25%.

Naturally, the idea is to motivate account holders to stay active. But why? Your health insurance company has a clear motivation to keep you off the couch – if you’re healthier, they spend less on claims. But why would your bank care how fit you are?

Interestingly, FitnessBank’s motivation is largely intrinsic. America’s first “Active Lifestyle Bank” is the brainchild of Ed Cooney, former president of Atlanta-based Affinity Bank. The 51-year-old industry vet loves baseball and Tough Mudders, and wants his account holders to work for their interest, giving new meaning to the term “sweat equity.”

How does FitnessBank work?

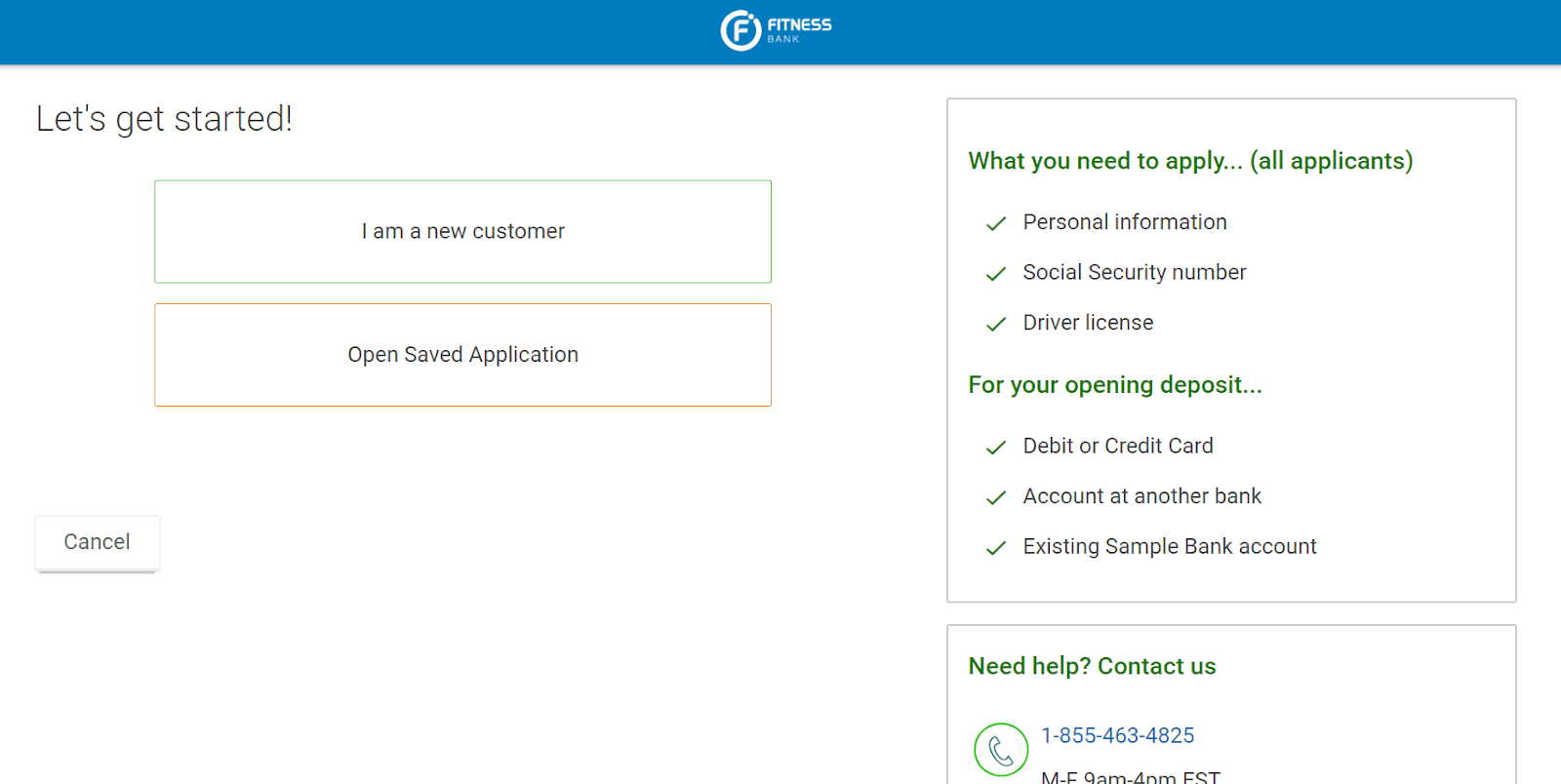

FitnessBank is online-only, but its site is robust and well-optimized. Opening an account is impressively quick and painless, and can be done here.

Note that their hours of live support aren’t 24/7, but the account holders I’ve spoken to have never had issues with wait times.

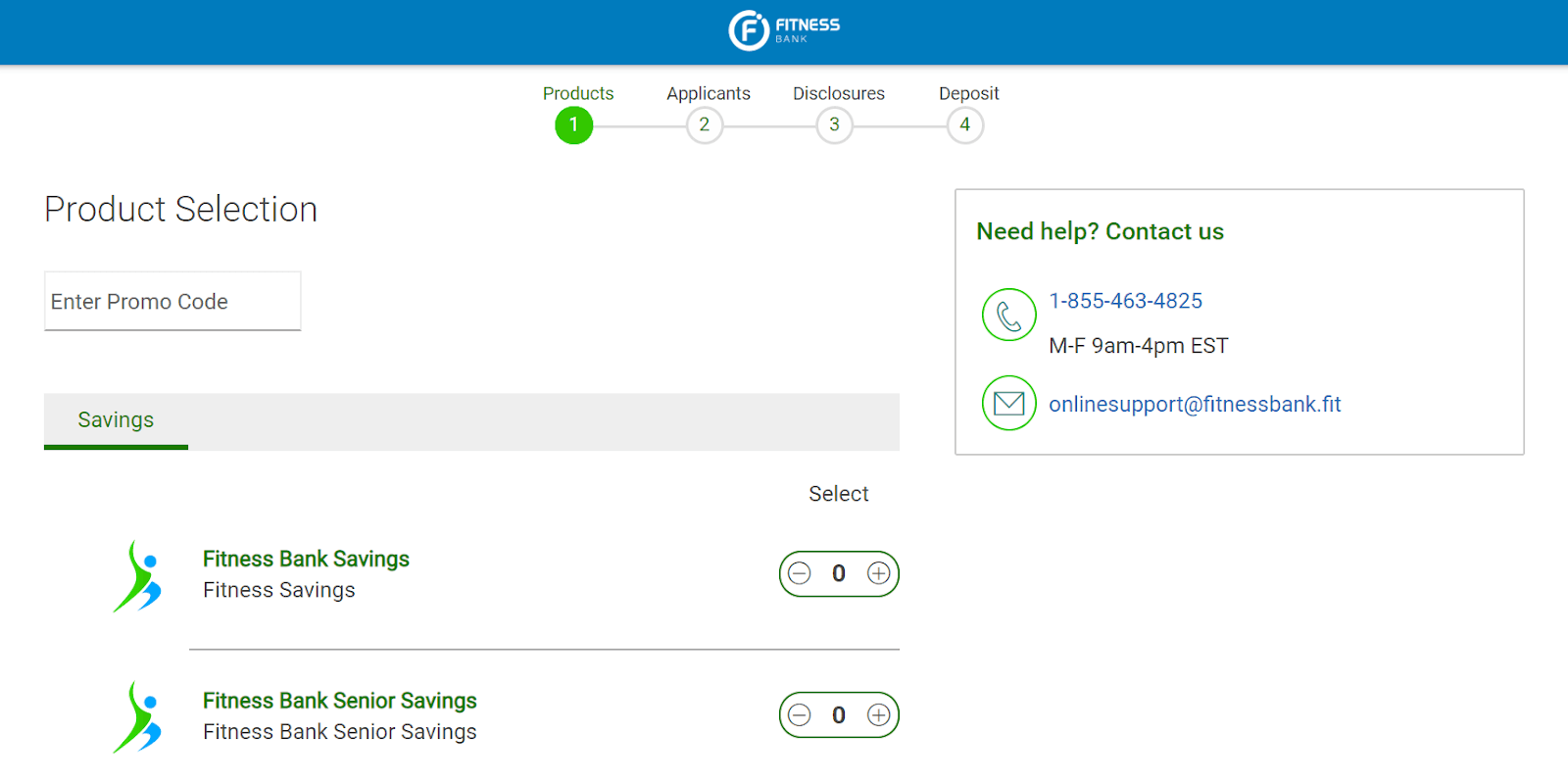

The next page feels more Amazon than Chase Bank. You’re prompted for a promo code, and use (+) and (-) buttons to add accounts to your “shopping cart.”

Note that the screenshot isn’t cut off at the bottom; there really are just two types of accounts. Fitness Bank Savings is for everyone under 65 – Fitness Bank Senior Savings just has a lower step threshold for upper-tier interest rates.

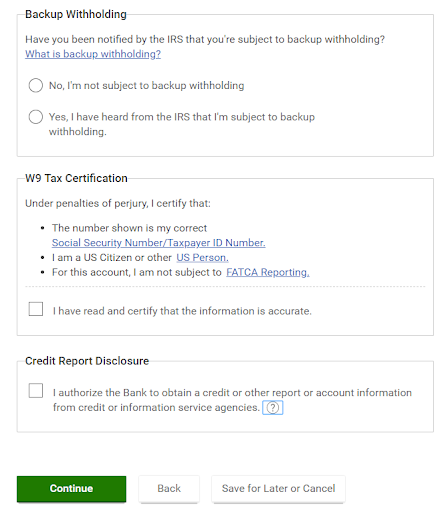

As expected, FitnessBank then prompts you for your basic personal information (name, contact info, address, employment status, etc.) and some financial info.

At this stage, FitnessBank will make a soft pull of your credit to determine your specific interest rates (since it’s not clear from the site copy, I verified with FB’s customer service team that it is indeed a SOFT pull).

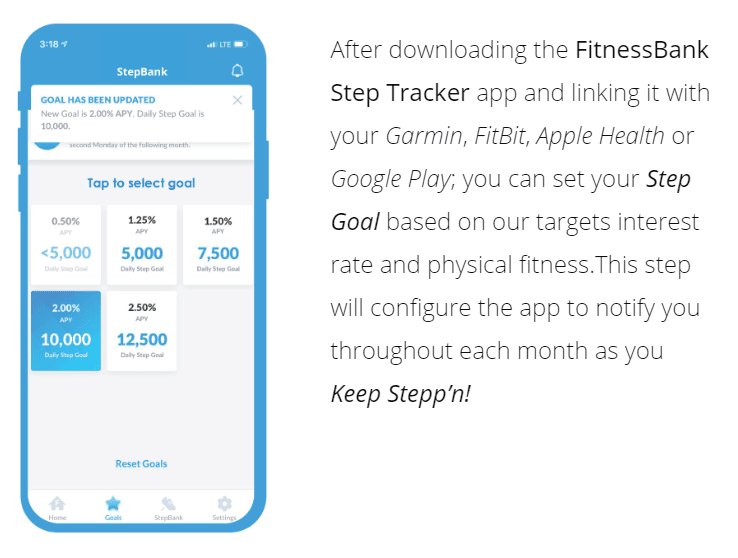

As the very last step, FitnessBank will ask for a deposit and direct you to download the FitnessBank App, which will report your daily steps (the monthly average dictates your rates). Their site copy actually does a pretty good job of explaining how the App works:

How are FitnessBank’s rates?

Here are their current rates and associated step requirements:

| Rates | Daily average steps required |

|---|---|

| 0.65% | 12,500+ |

| 0.55% | 10,000-12,499 |

| 0.45% | 7,500-9,999 |

| 0.35% | 5,000-7,499 |

| 0.25% | 0-4,999 |

So yes, you can earn some decent interest rates on your savings account, but you really have to work for it. 12,500 steps is roughly 6.25 miles of walking or running per day: more than double the national average of around 5,000.

Of course, banking with FitnessBank is an easier recommendation if you’re already getting over 12,500 steps per day. If you’re on your feet for work, and including days off still average well over 12,500 steps, FitnessBank might be the right bank for you.

What are FitnessBank’s best features?

The nation’s highest interest rates

Since launching in Q2 2019, FitnessBank has consistently offered the nation’s highest interest rates for savings accounts.

FDIC-Insured

As a subsidiary of Affinity Bank, FitnessBank is a “legit” bank with FDIC insurance, meaning your deposits are protected.

Gamification

FitnessBank is pretty hands-on with its customers, gamifying the saving process through personal goal tracking, leaderboards, and the FitnessBank Step Challenge of the Month.

Prizes include high-end running shoes and signed paraphernalia by famous runners.

Ease of use

FitnessBank’s website and app function exceptionally well together as both a fitness tracker and a fully-featured online banking portal.

No hidden fees

The only time FitnessBank will charge you a fee is if your account balance falls below $100 or you make more than six debit withdrawals in a single month.

My personal impressions of FitnessBank

When I learned that FitnessBank offered America’s highest interest rates by a wide margin, my first question was: how? FitnessBank doesn’t make more money the more you step, so how can they offer higher interest rates than banks that have been in business for a century?

My theory was that only a certain percentage of account holders actually make the highest tier interest, and everyone else earns substantially less. All in all, their APY averages out to something more reasonable and sustainable.

Using a friend’s account, I was able to test and verify that yes, this is indeed the case. Fewer than half of FitnessBank’s account holders are achieving above 10,000 steps per day, meaning that the other half are getting 0.45% APY or less.

So, if you open an account and consistently achieve 12,500 steps or higher, you will get the industry’s highest interest rate… for now. The problem is (if my theory is correct), for FitnessBank to maintain this balance they need a roughly equal number of active and inactive clients. And in the long term, how many inactive or lazy people are going to open a “Fitness Savings Account” and accept below-average interest?

I hugely applaud FitnessBank’s innovation, technology, and further gamification of an active lifestyle (especially for seniors). I just have doubts about their ability to sustain such high interest rates as the scales tip and more account holders vie for the upper tiers. Either the interest rates will have to lower or the step limits will have to rise.

FitnessBank is best for

Anyone already averaging 12,500+ steps per day

If you work in retail, the medical field, or otherwise have a job or lifestyle that ends with you averaging 12,500+ miles per day (including weekends), it’s almost a no-brainer to open a savings account with FitnessBank. You’ll earn interest quickly and won’t be penalized for making fewer than six debit withdrawals per month. It’s free money.

Anyone seeking motivation for an active lifestyle

Struggling with self-motivation to stay active? Maybe a little extra cash is the carrot you need on the end of your stick. There are other apps available that offer cash rewards for daily step thresholds, but typically at a fraction of the rate you could earn through FitnessBank.

FitnessBank is not ideal for

Anyone who doesn’t consistently achieve 10,000+ steps per day

In order to accrue more interest with FitnessBank than with any other bank, you need to average 10,000 or more steps per day. If you average fewer than 10k steps, you’ll actually earn less interest than you would with another bank.

Anyone who doesn’t need a savings account

Again, the value of a savings account is in access. It accrues interest unlike a checking account, and it’s easier to withdraw from than a retirement or investment account.

However, if you can afford to invest your savings for a higher yield, you may not need or want a savings account. And because FitnessBank currently only offers savings accounts, they may not be for you.

Pros & cons

Pros

- Free money for the active and fit — If you’re already consistently achieving 12,500 steps per day (including weekends), you might as well switch your savings account to FitnessBank to accrue higher interest.

- A stable, FDIC-insured investment — Unlike your stocks or mutual funds, your FitnessBank account is FDIC-insured for the maximum of $250,000. So a FitnessBank account, like most savings accounts, is a safe way to accrue trickling interest with negligible risk.

- Solid technology — Despite being on the younger side, FitnessBank is backed by a solid website and application with few user complaints.

Cons

- Intense daily requirements — To achieve interest rates above industry average, you need to consistently achieve 10,000 steps per day. If you fall below that, you’ll accrue less interest than you would with other banks.

- Requires a step counter at all times — Though FitnessBank has no account opening fees, you’ll need to invest ~$100 in a compatible step counter from FitBit or Garmin or have your phone on you at all times to track your steps through Apple Health or Google Fit.

- Uncertain future — Fitness-driven banking is a novel and unproven concept. Presumably, FitnessBank can offer high-steppers industry-leading interest because enough account holders fall below the average to balance it out. I’m personally uncertain this will be a sustainable concept.

The competition

FitnessBank vs CIT Bank

CIT Bank is a division of First-Citizens Bank & Trust Company, a member of the Federal Deposit Insurance Corporation (FDIC). Above all, they’re known for their high-yield CDs and savings accounts.

Our most recommended option is the CIT Bank Platinum Savings account.

With no account opening or monthly service fees, the CIT Platinum Savings Account is a premier option that offers a competitive 5.00% APY with a balance of $5,000 or more.

With an initial deposit minimum of just $100 to open an account and no minimum balance required after, this is an easy high-yield savings account to open. See site for details.

- Earn up to 5.00% APY

- No monthly service fees

- Unlimited transfers and withdrawals

- Fast, easy account opening

- Balance requirement for max APY

- Lack of ATM access

CIT Platinum Savings offers up to an impressive 5.00% APY. See site for details.

The APY is combined with quick sign-up process, a helpful mobile app from CIT Bank that supports free mobile check deposits and external transfers, and a lack of maintenance fees eating into your balance.

» MORE: Read our full CIT Bank Platinum Savings Account review

FitnessBank vs nbkc bank

Visiting nbkc’s slick website might give you the impression that the bank is a hip new disruptor in the space, but nothing could be further from the truth. National Bank of Commerce was first chartered at the tail end of the Civil War, and carries on a 155-year tradition of honesty, integrity, and customer-centric banking.

Nbkc’s brand is “no gotchas” and they take pride in transparency and simplicity. There are zero hidden fees, and you can debit from your Personal Money Market Savings Account (phew) from 32,000 ATMs worldwide for no fee. Even if you manage to find an ATM that charges you a fee, nbkc will refund it, making it a solid choice for travelers. nbkc’s current APY isn’t as competitive as FitnessBank’s but they offer better access to your funds, even if you can still only withdraw 6x per month without penalties.

Summary

FitnessBank is a highly innovative, FDIC-insured bank offering savings account holders the nation’s highest interest rates as long as they average 12,500+ steps per day. The bank also offers a strong website and app, and receives strongly positive consumer scores.

I recommend FitnessBank to anyone who already has a savings account and is consistently averaging 12,500 steps per day. At that point, moving your savings over to a FitnessBank account is just free money. If you average 10,000 steps or more, you’ll likely still make more interest than you would with another bank, but the slimmer margin may not be worth the inconvenience of step tracking.